Updated February 21, 2022

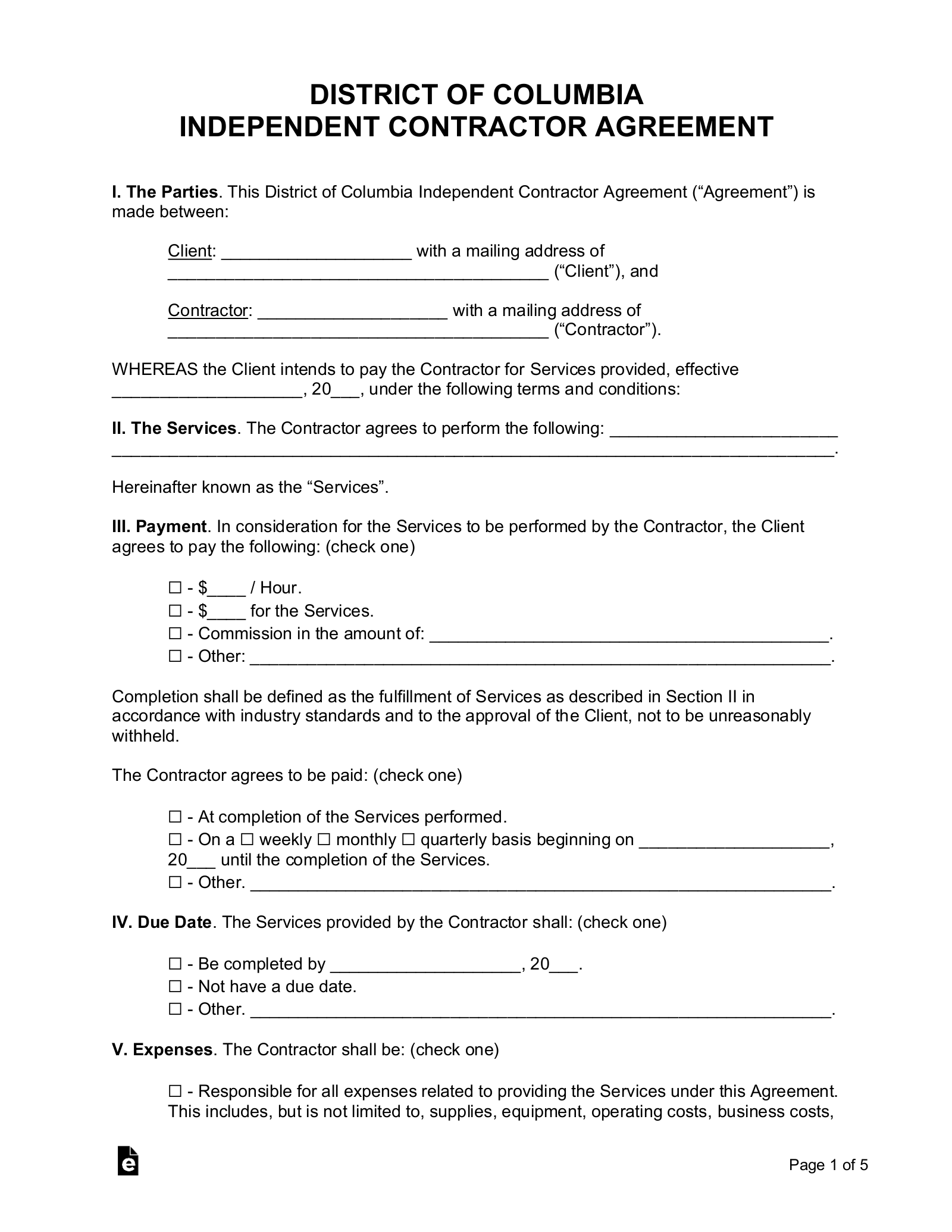

A Washington D.C. independent contractor agreement sets the terms for work that will be done outside of the employer-employee relationship. Instead, one (1) party, called a client, hires another party, the contractor, to do a set of discrete tasks, and the relationship concludes once the tasks are completed and payment is provided. The agreement will set out what work is expected, and how much the contractor is to be paid. It may also specify that the worker is an independent contractor, but in the event that this is later disputed, describing someone as an independent contractor in an agreement does not guarantee that a court will agree.

Washington D.C. has its own legal interpretation for whether someone is an independent contractor, but independent contractors generally have more control over how the work is completed and are thought to be in business for themselves, rather than the person or company hiring them. The determination is significant because it significantly changes the employer’s obligations, including taxes to withhold and contributions to the worker’s compensation system.