Updated September 13, 2023

A subcontractor agreement is used by a contractor when hiring a subcontractor to assist in the completion of a project or service. The independent contractor will usually hold a contract for services with a client, most commonly in construction, and will choose to hire a subcontractor to finish a part or all of the services. The agreement should outline all duties, liabilities, and responsibilities of the subcontractor along with any other conditions.

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

By Type (14)

Table of Contents |

How to Hire a Subcontractor (5 steps)

- Define the Scope of Work

- Find the Subcontractor

- Begin the Bidding Process*

- Write the Agreement

- Finalize the Agreement and Pay

A subcontractor is sought when an individual or company, known as the “independent contractor,” cannot perform the duties necessary to complete a project. This is common in construction when specialty tasks are needed to be completed in order for the entire project to be finalized. The agreement is between the independent contractor and subcontractor only.

1. Define the Scope of Work

The scope of work is a term that is used to describe the exact specifications for a task that is to be completed by a subcontractor. This description will be needed when trying to find a subcontractor for a specific job.

The scope of work is a term that is used to describe the exact specifications for a task that is to be completed by a subcontractor. This description will be needed when trying to find a subcontractor for a specific job.

For example, if a roofer is needed the exact type, square feet, materials needed, and the due date must be outlined in the scope of work.

2. Find the Subcontractor

After the scope of work is specified, it’s now time for the independent contractor to find a qualified subcontractor to fulfill the job. The best way is to ask around or go on websites, such as Yelp, to find reviews. Once a select number of potential candidates have been found, it’s time to contact them and see if they are interested in the work.

After the scope of work is specified, it’s now time for the independent contractor to find a qualified subcontractor to fulfill the job. The best way is to ask around or go on websites, such as Yelp, to find reviews. Once a select number of potential candidates have been found, it’s time to contact them and see if they are interested in the work.

3. Begin the Bidding Process*

*If the independent contractor has already selected a subcontractor, they can skip this step.

*If the independent contractor has already selected a subcontractor, they can skip this step.

The bidding process is when all potential candidates for the job are given the scope of work and are allowed to submit proposals on how much they will charge if they are given the work. This can take anywhere from days, weeks, or months depending on the scope of work involved (such as materials needed, number of employees, etc.).

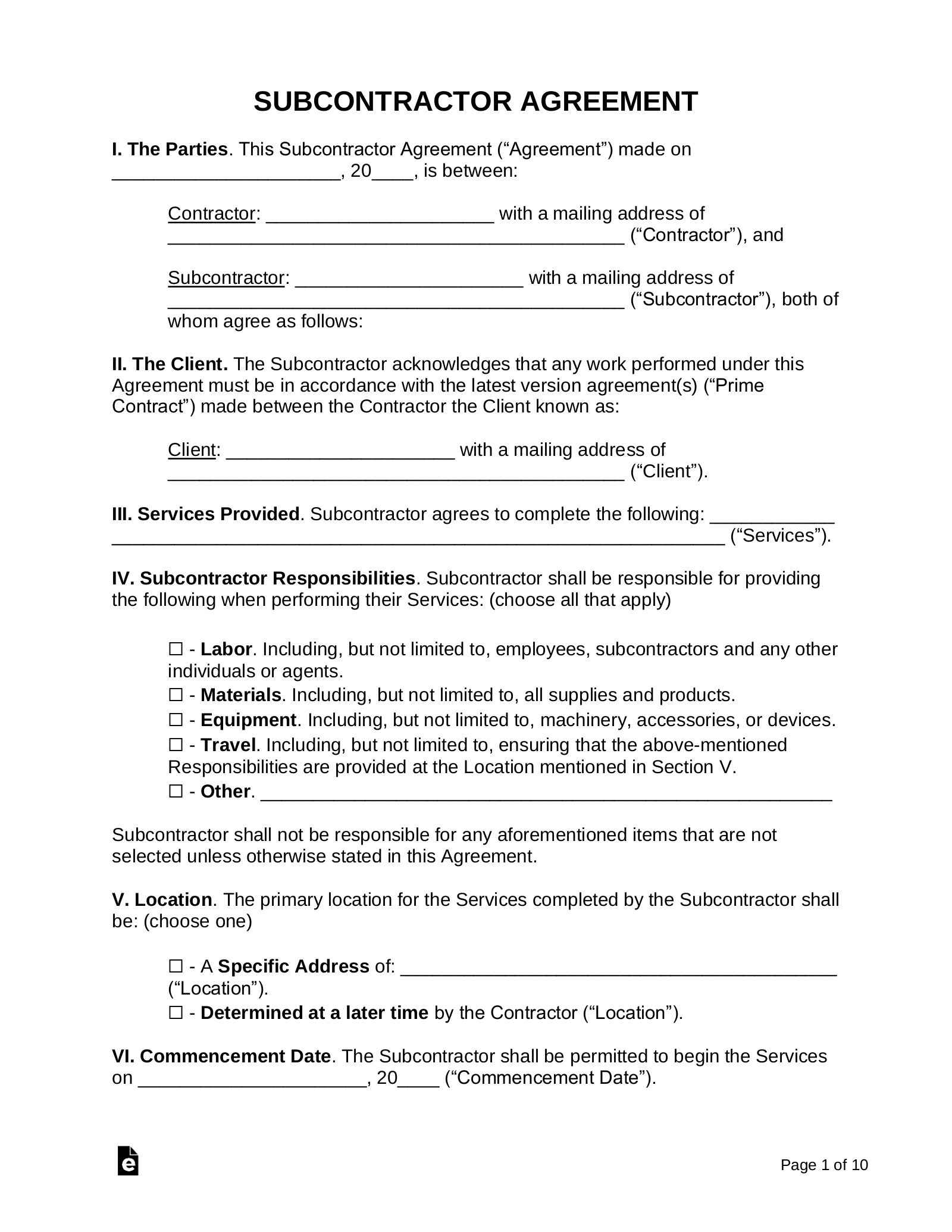

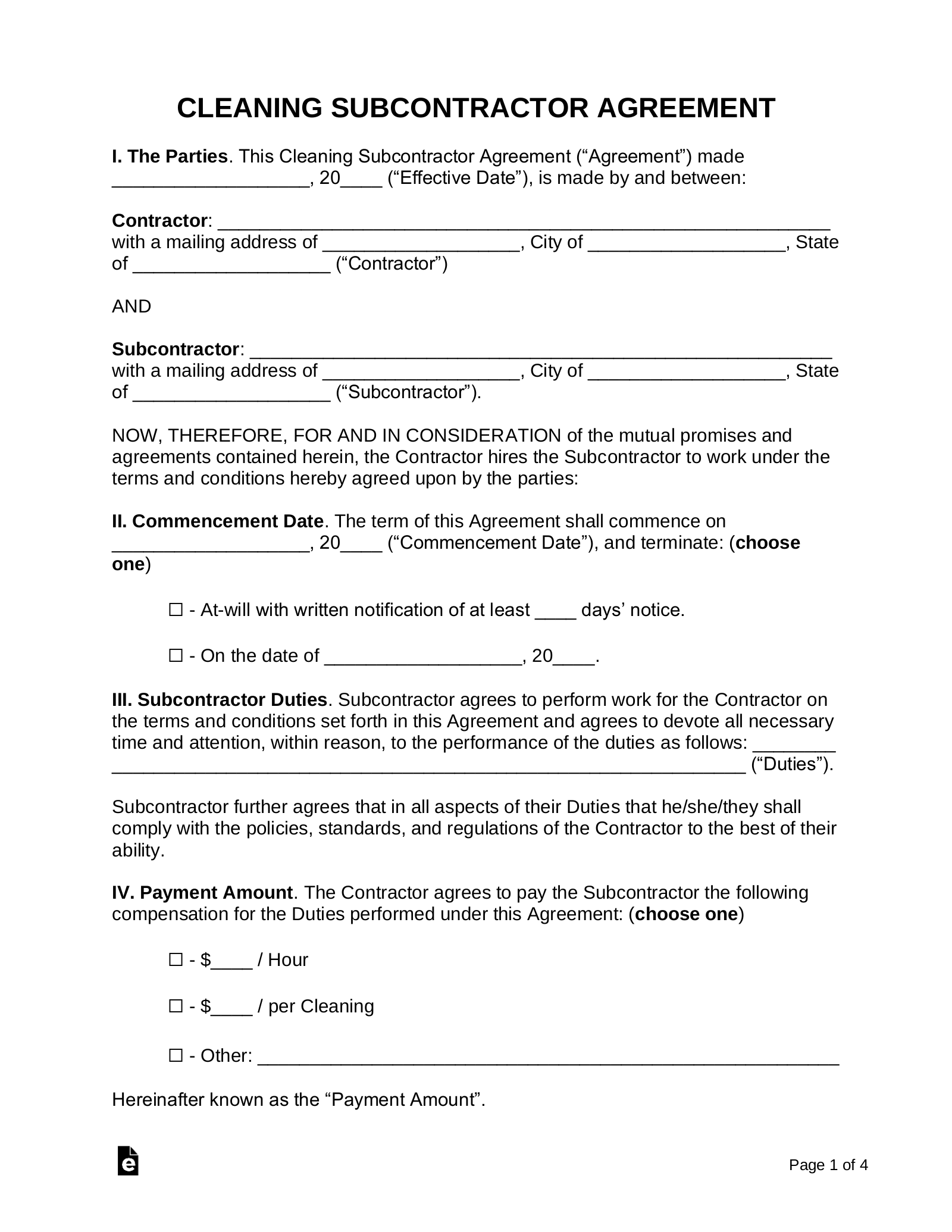

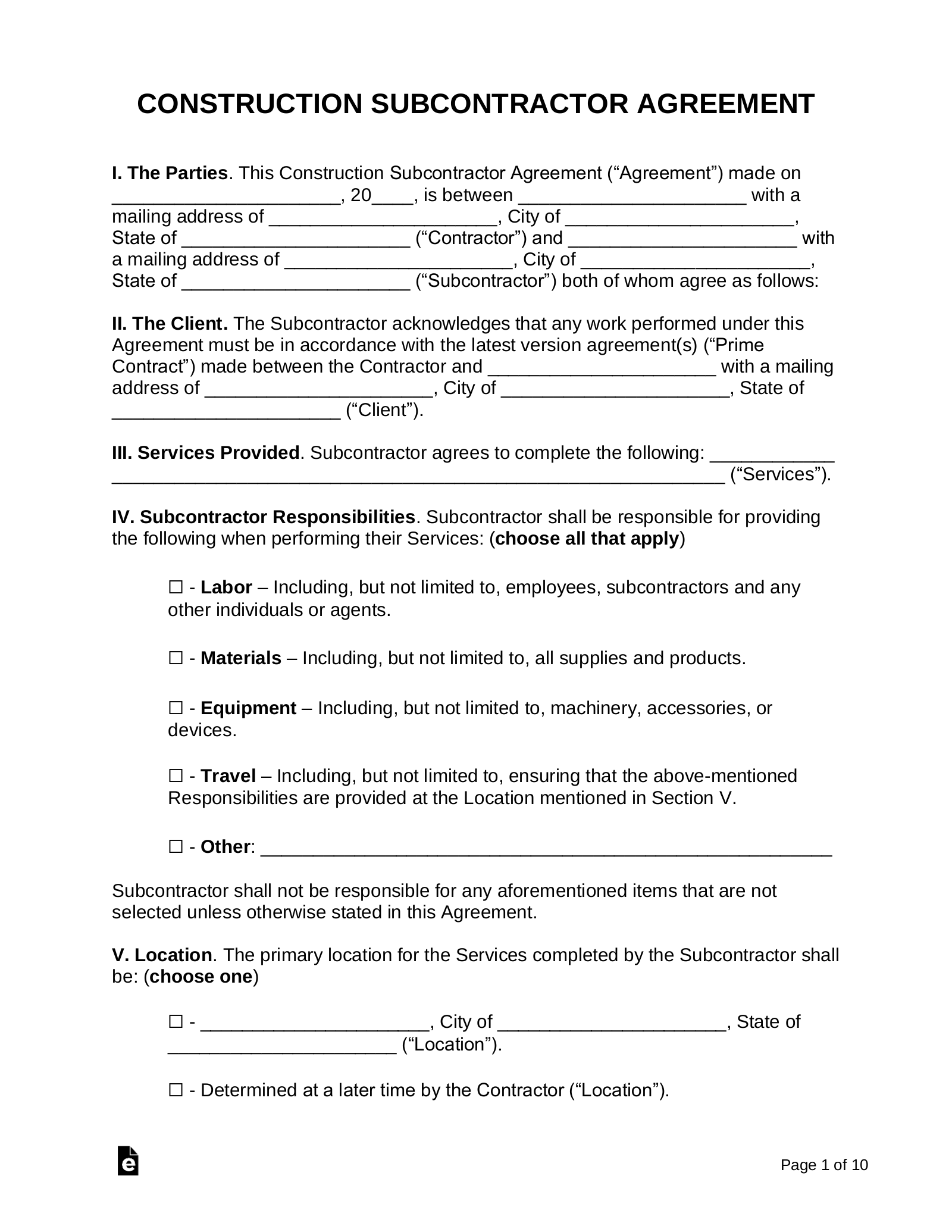

4. Write the Agreement

When writing the agreement, the independent contractor and subcontractor will need to decide who will be responsible for the following items:

When writing the agreement, the independent contractor and subcontractor will need to decide who will be responsible for the following items:

- Payment

- Materials

- Equipment

- Transportation/Travel

- Completion Date

- Insurance (usually General Aggregate)

Before or after the agreement has been signed, the subcontractor may have the right to view the master contract between the independent contractor and the client (the client is the party that hired the independent contractor). This is to confirm that the independent contractor will have the funds for payment at the end of the project.

5. Finalize the Agreement and Pay

After the agreement has been signed, the subcontractor will be able to begin work on the date set forth in the agreement. Depending on the payment schedule outlined, the subcontractor will be paid partially at the start of the job or in full after the work has been completed. After the subcontractor’s work is completed, the agreement is no longer valid unless there are any warranties provided.

Employee vs. Subcontractor

There are several major differences between an employee and a subcontractor. The most important distinctions are outlined below:

1. Taxes

Employees have their taxes (state and federal), Social Security, Medicare, and all other employment-related taxes automatically withheld by their employer.

Subcontractors are solely responsible for filing their taxes. They would need to identify the amount they should withhold on their own and may need to file taxes more frequently than a traditional employee (up to four times per year). This can be done by consulting the Internal Revenue Service (IRS) or a tax accountant.

2. Benefits

Employees are often offered benefits by their employer, which may be inclusive of health benefits, assistance lines, life insurance, etc.

Subcontractors are not typically offered any benefits from the contracting company.

3. Conduct

An employee is bound by the company’s policies and procedures with regard to workplace conduct, responsibilities, etc.

A subcontractor is responsible for behaving professionally and ensuring they bring the appropriate skill sets as needed. They are accountable for creating their own professional guidelines and abiding by them.

Filing Taxes (Form 1099-NEC)

IRS Form 1099-MISC is required to be completed by the contractor if there were payments made to the subcontractor in excess of $600 during the fiscal year. The contractor must provide this form to the subcontractor and the IRS by Jan. 31 of the following year.

The subcontractor is responsible for withholding and/or paying their own state and federal taxes.

What Not to Provide a Subcontractor

Due to the risk of the subcontractor being labeled as an employee of the contractor, it is best to avoid providing a subcontractor with the following:

1. Benefits

Providing benefits to a subcontractor should not be done. Each member of a company’s team should be accountable, which is needed for tax purposes and to ensure the company is abiding by the appropriate healthcare laws. Being that a subcontractor cannot be listed as an employee as well, the company must ensure they are listed as a subcontractor and not offer benefits. Benefits that should not be provided may range from healthcare, 401K, paid time off, sick time and so forth.

2. Tools or Materials

The appropriately qualified subcontractor will not require additional tools and materials to be provided by the company in order to complete the task. They will be able to complete the work required as requested without additions. This would be included and detailed in the subcontractor agreement for full understanding as they would be expected to provide their own materials.

3. Tax Withholding

A subcontractor has the responsibility to file and pay their own taxes. The wages that are made from the job are paid as a lump sum and are not required to have taxes withheld by the contracting firm. The subcontractor will file IRS Form 1099-MISC.

4. Training

A subcontractor will be a fully trained professional with the capability to complete the task or job. The company is responsible for ensuring their employees are trained individuals, however, for work or assignments being sent to a subcontractor, it should require extremely minimal direction. The subcontractor should not require any additional training or be provided full training as their purpose is to provide a specific set of skills.

“Subcontractor” State Definitions

- AL – § 34-8-1(c)

- AK – AS 23.20.526

- AZ – ARS 32-1101(3)(b)

- AR – § 18-44-107(4)

- CA – § 2782.05(i)

- CO – § 24-91-102(4)

- CT – § 4e-1(29)

- DE – § 2501(8)

- FL – § 713.01(28)

- GA – § 13-10-80(a)(5)

- HI – § 444-1

- ID – § 72-102(13)(a)

- IL – 720 ILCS 5/33E-2(k)

- IN – § 5-16-5.5-1

- IA – § 572.1(11)

- KS – § 16-1802(h)

- KY – § 45.560(4)

- LA – R.S. 37:2150.1(13)(a)

- ME – 39-A §105-A(1)(B)

- MD – § 8–101(o)

- MA – MGL c.142A § 1

- MI – § 570.1106(5)

- MN – § 161.321(1)(c)

- MS – 35.IV.10.01(102)

- MO – § 292.675(8)

- MT – § 28-2-2101(9)

- NE – § 45-1202(6)

- NV – NRS 40.630

- NH – § 281-A:2(IV)

- NJ – § 2a-44a-2

- NM – § 60-13-3(A-B)

- NY – § 756(4)

- NC – § 22C-1(6)

- ND – § 35-27-01(7)

- OH – § 1311.01(D)

- OK – § 61-222(7-8)

- OR – § 701.410(1)(d)

- PA – § 1201(5)

- RI – No specific statutory definition.

- SC – § 29-6-10(6)

- SD – § 43-07-01(1)

- TN – § 62-6-102(4)(A)(ii)

- TX – § 28.001(B)(6)

- UT – § 38-1a-102(33)

- VT – § 4001(6)

- VA – VA Code § 2.2-4347

- WA – § RCW 18.27.010(12)

- WV – § 21-11-3(q)

- WI – § 66.0901(1)(d)

- WY – § 39-16-301(vi)