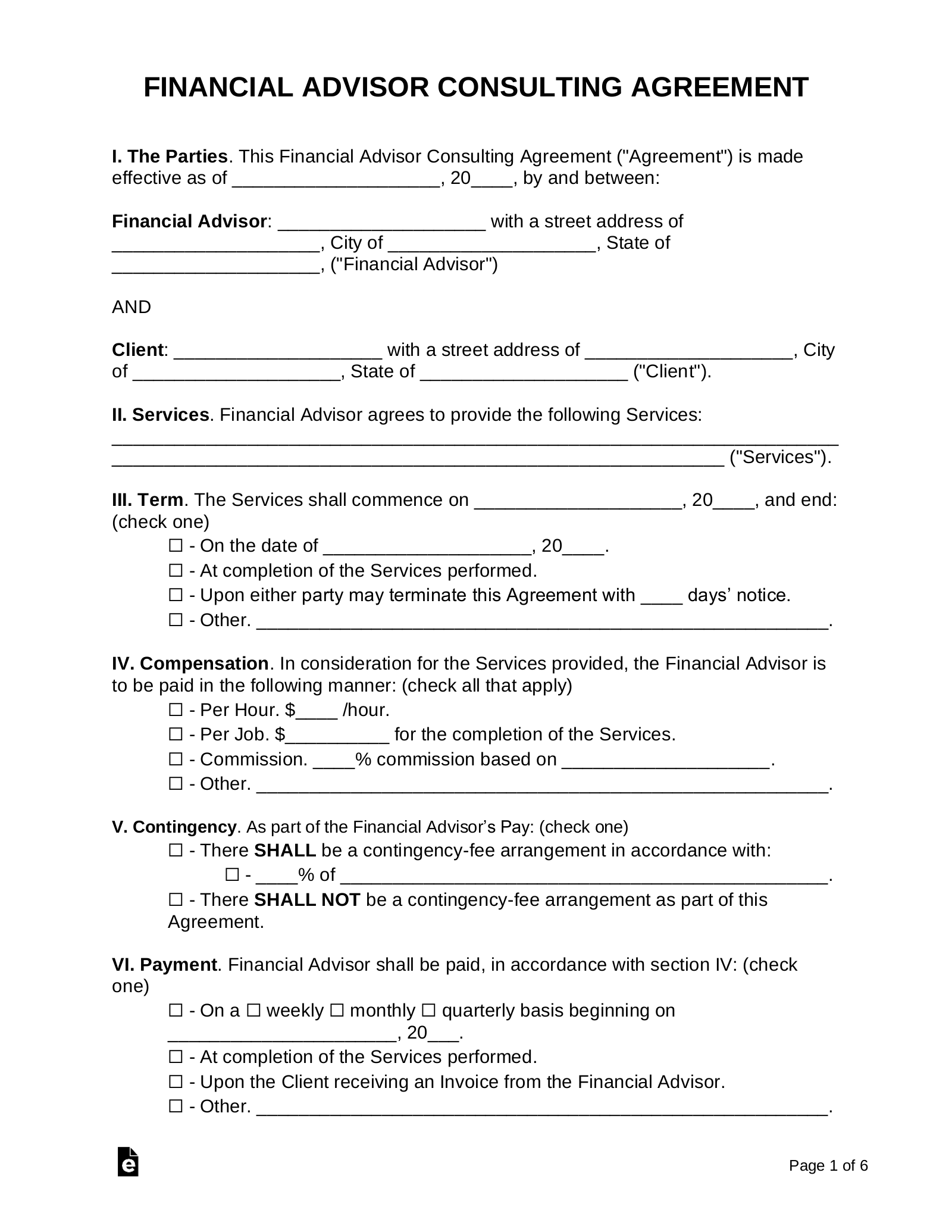

Updated September 27, 2023

A financial consultant agreement details the permissions granted to an advisor by their client for the purposes of creating a legal consulting arrangement. For individuals, the advisor may provide tax planning, investment guidance, and a budget of how much to save monthly. For corporations, the consultant will help create a plan to increase profitability by streamlining the business model. A financial advisor, acting as the consultant, can be a licensed or unlicensed individual.

Series 65 License Search – If a financial advisor holds a Series 65 License they can legally purchase stocks and bonds on another individual’s behalf. Otherwise, a financial advisor may only give advice.

Table of Contents |

What is a Financial Consultant?

A financial consultant, often referred to as a “financial advisor,” offers information and guidance to companies or individuals so they can properly plan their financial futures. The consultant will meet with their client and assess their financial situation so they can plan accordingly. A client may want their advisor to help them make decisions for retirement, education, investments, or simply manage day-to-day expenses. Some consultants are even licensed to buy and sell financial products for their clients (insurance policies, stocks, bonds, etc.).

Primary Roles

- Meet with clients to assess the financial situation;

- Discuss financial goals;

- Create and present a financial plan (retirement, education, expenses, investments, taxes, etc.); and

- Buy and sell financial products (insurance policies, stocks, bonds, etc.).

Does a Financial Consultant Have a Fiduciary Duty?

Yes but only if the consultant is registered with the SEC (Securities and Exchange Commission) or a State securities regulator. To find financial consultants that have a fiduciary duty to their clients, use NAPFA (National Association of Personal Financial Advisors) to find certified financial advisors in your area.

Video

Does a Financial Consultant need to be Licensed?

Financial consultants don’t need a license to provide financial advice; however, they must obtain certain securities licenses if they wish to sell investment products.

Most Common Licenses

- Series 6: Enables a consultant to sell packaged securities such as mutual funds, variable annuities, etc.[1]

- Series 7: Covers basically every type of investment product available to sell (the “gold standard” of financial consultant licenses).[2]

- Series 63: Consultants must obtain this license (in addition to one of the above-mentioned licenses) to sell securities within their state. The Series 63 exam covers the principles of state securities regulations.[3]

- Series 65: Qualifies an investment professional to function as an Investment Adviser Representative in certain states. The Series 65 exam, much like 63, covers laws, regulations, ethics, and fiduciary responsibilities.[4]

How Much Does a Financial Consultant Make?

This type of consulting position has an extremely wide range of salary options depending on the consultant’s experience, what firm they are working for, which city/state, and what specific services they offer. Some consultant salaries can be over $150k, while others can be as low as $23k.