Updated June 05, 2023

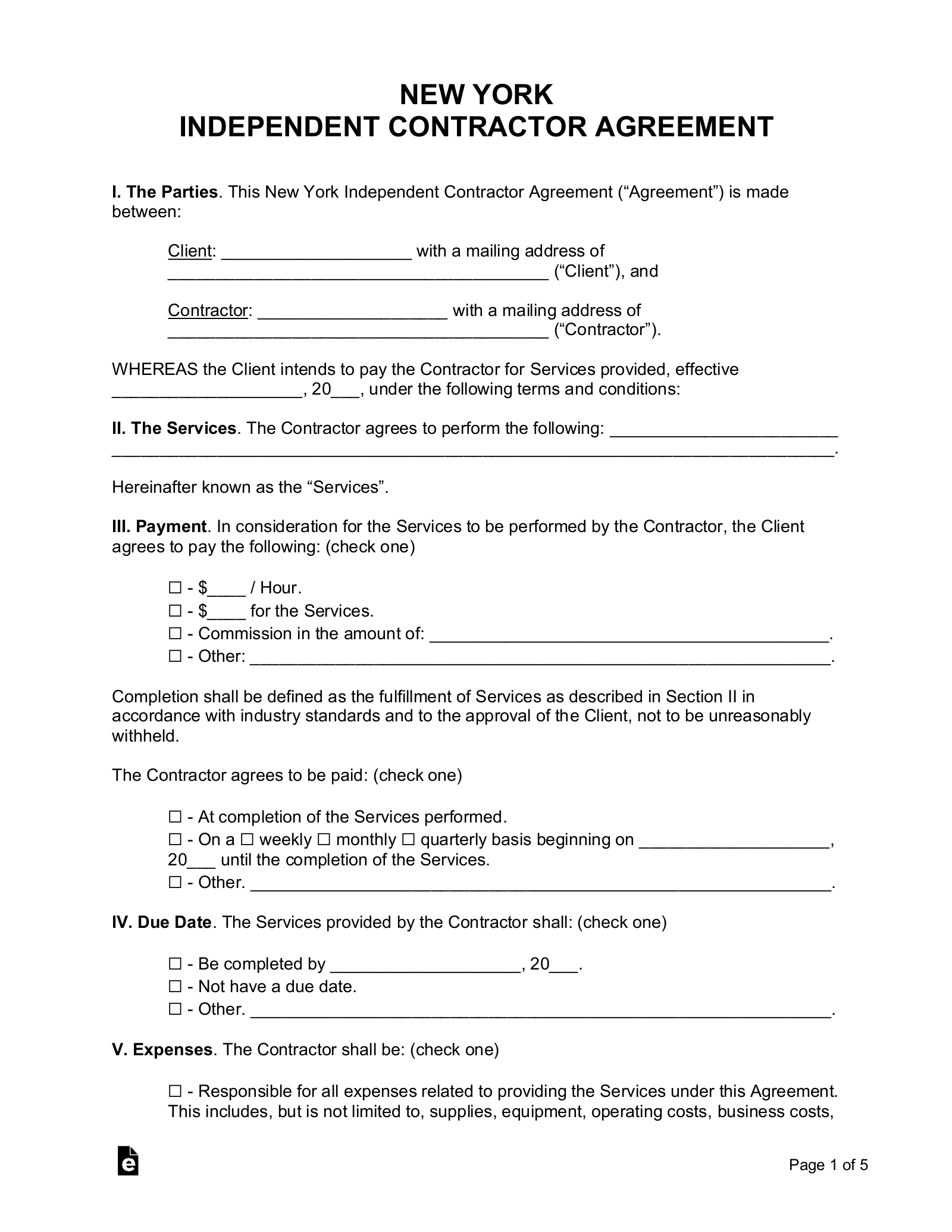

A New York independent contractor agreement is a document that outlines the scope of the work and payment for a contractor hired by a client. Any business or worker who is engaged to work independently and outside of normal business operations is considered an independent contractor. Unlike employees, a contractor is required to pay their own income tax and liability insurance. Independent contractors and clients should always have all of their agreed-upon terms written into the contract to avoid unnecessary expenditures and ensure that the other party will uphold the agreement. The contract should be signed by both parties and kept in their records for future reference.

Assessing Independent Contractor Status

On December 2, 2003, the Court of Appeals of the State of New York established a five-factor test to determine whether an employer-employee relationship exists. The framework assesses the degree of control exercised by the employer/client over the employee/independent contractor’s work process and product based on:

1 – Whether the worker is able to determine their own workflow;

2 – Whether the worker can take on other jobs;

3 – Whether benefits are awarded to the worker;

4 – Whether the worker is on the employer’s payroll; and

5 – Whether the worker is free to determine their own schedule.