Updated November 22, 2023

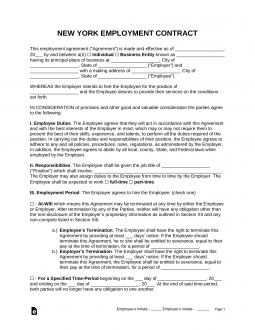

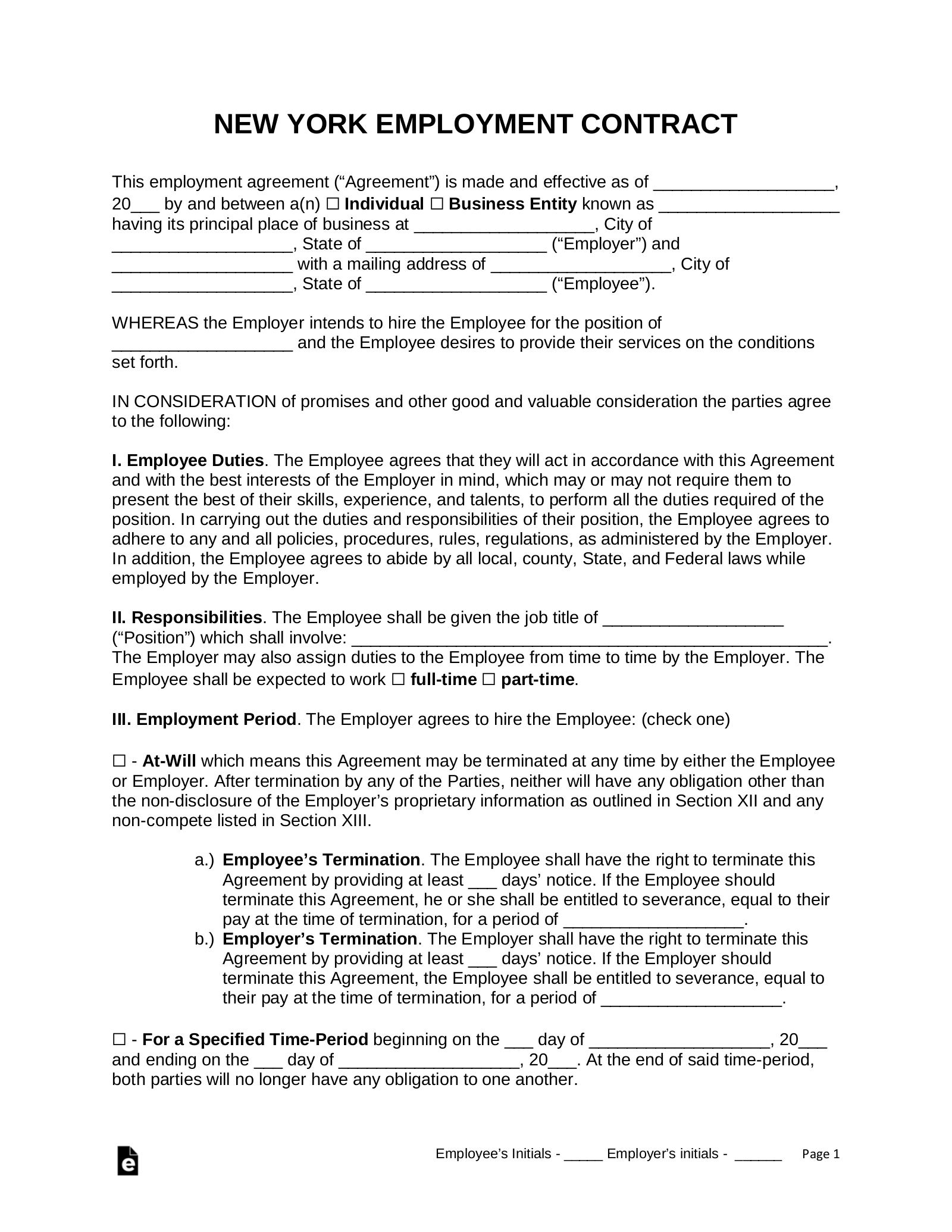

A New York employment contract agreement is implemented by employers in order to establish the terms of employment for a new employee. By having the subject sign the agreement, the employer can protect themselves from certain liabilities. For example, the employer can stipulate on the form that the employee can be terminated if they are unable to work due to a physical or mental disability. For the employee, a contract ensures that their wages and period of employment will be guaranteed, in addition to assuring that they will be provided with any employee benefits described in the document.

By Type (4)

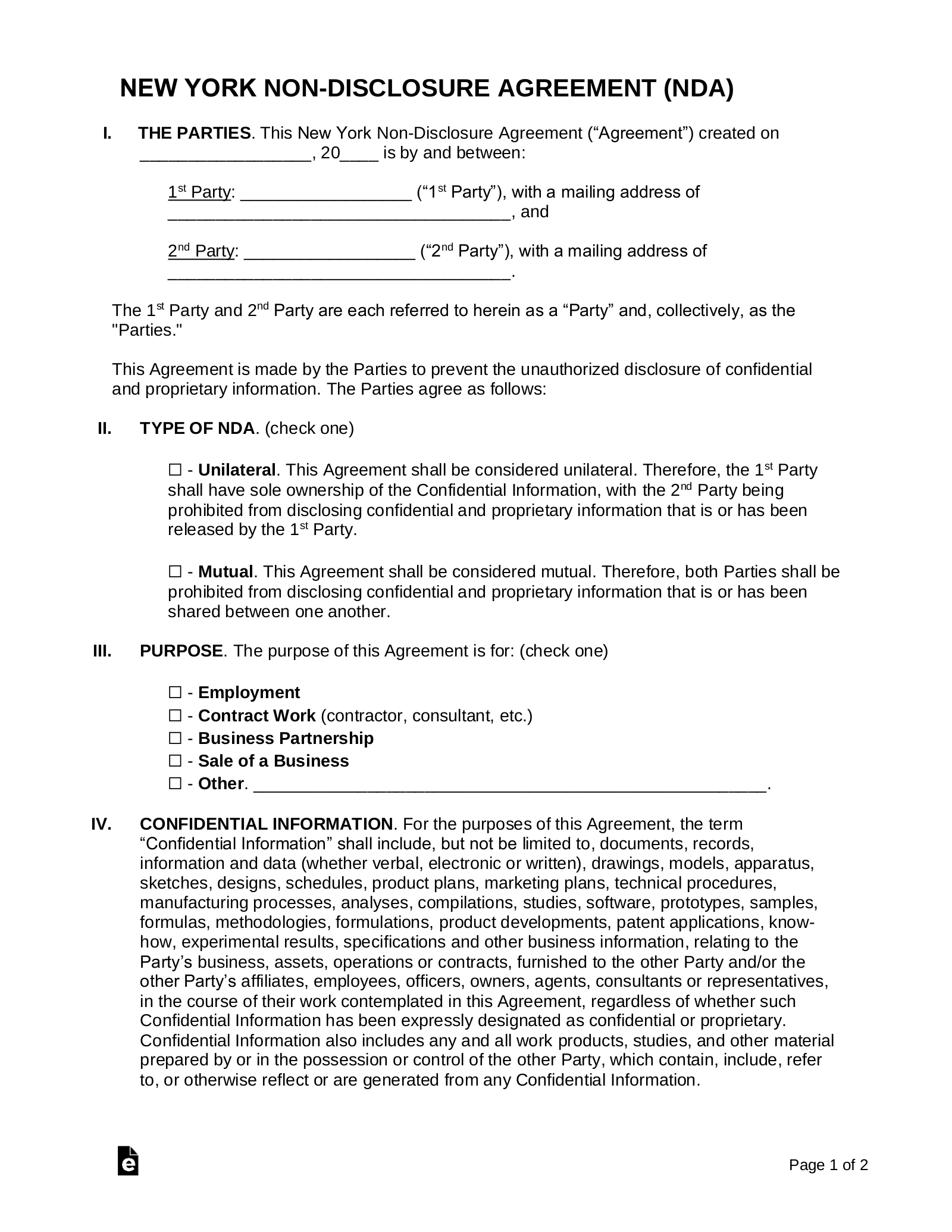

Employee Non-Disclosure Agreement (NDA) – An agreement that is either unilateral or mutual in nature that obligates the signer(s) to withhold confidential information from competitors for a period of time.

Download: PDF, MS Word, OpenDocument

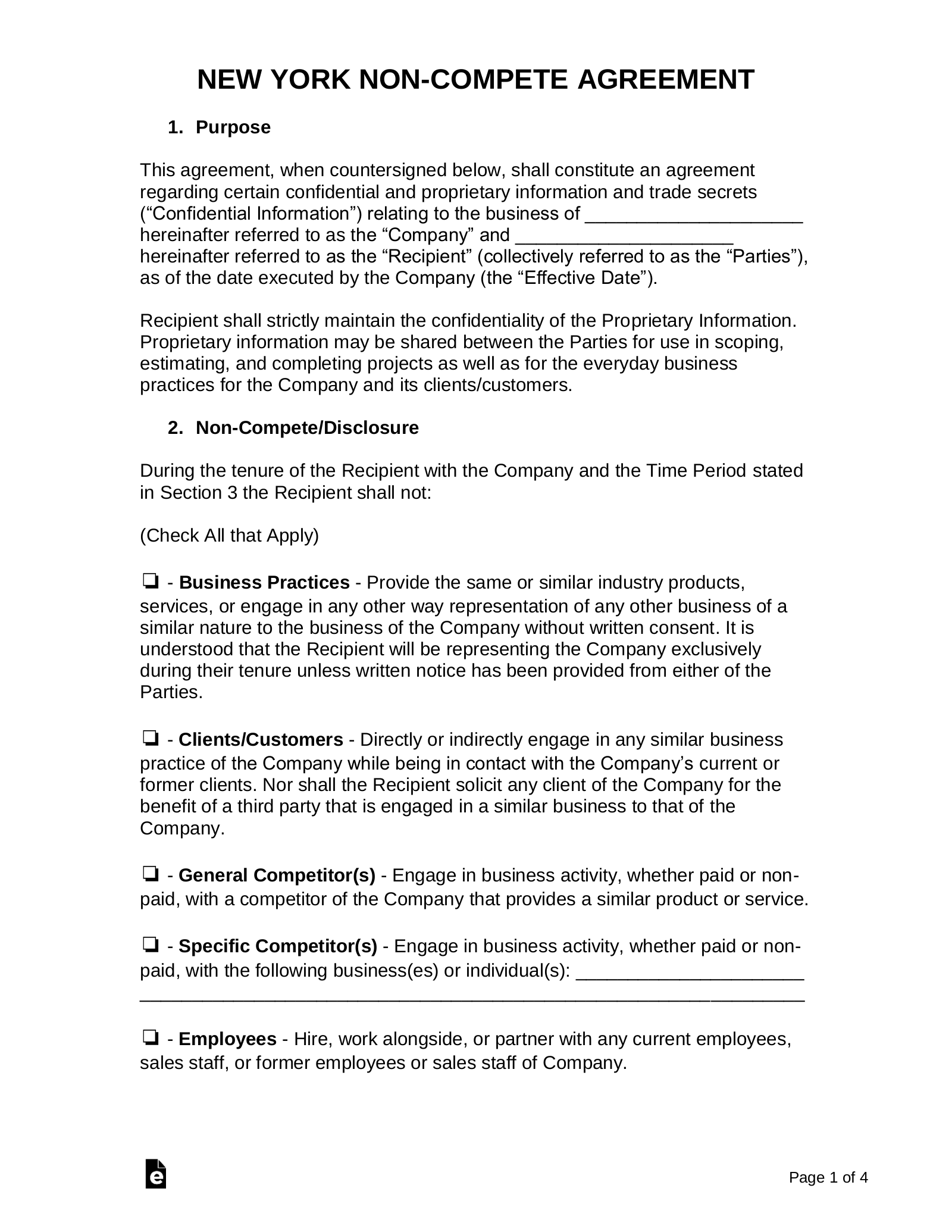

Employee Non-Compete Agreement – Outlines the terms by which an employee agrees not to compete with their employer for a reasonable duration of time from the date the agreement is signed or that their employment is terminated.

Download: PDF, MS Word, OpenDocument

Independent Contractor Agreement – May be used by an individual or a business to draft a written agreement that specifies the terms and conditions under which a contractor is being paid to complete a project.

Download: PDF, MS Word, OpenDocument

Subcontractor Agreement – If a contractor engages additional contractors while completing a project that they have been hired to complete, they will need to use this type of written agreement to establish their terms of employment.

Download: PDF, MS Word, OpenDocument

Table of Contents |

What is an Employee?

“Employee” Definition[1]

At-Will Employment

At-Will Employment – Allowed with the exception of “Implied Contract” understandings.

Income Tax Rate (Individual)

Individual Income Tax Rate – 4% to 8.82%[2]

Minimum Wage ($/hr)

Minimum Wage – $11.80[3]

Local Wages