Updated November 21, 2023

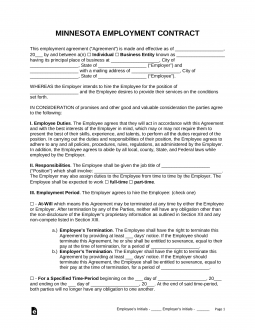

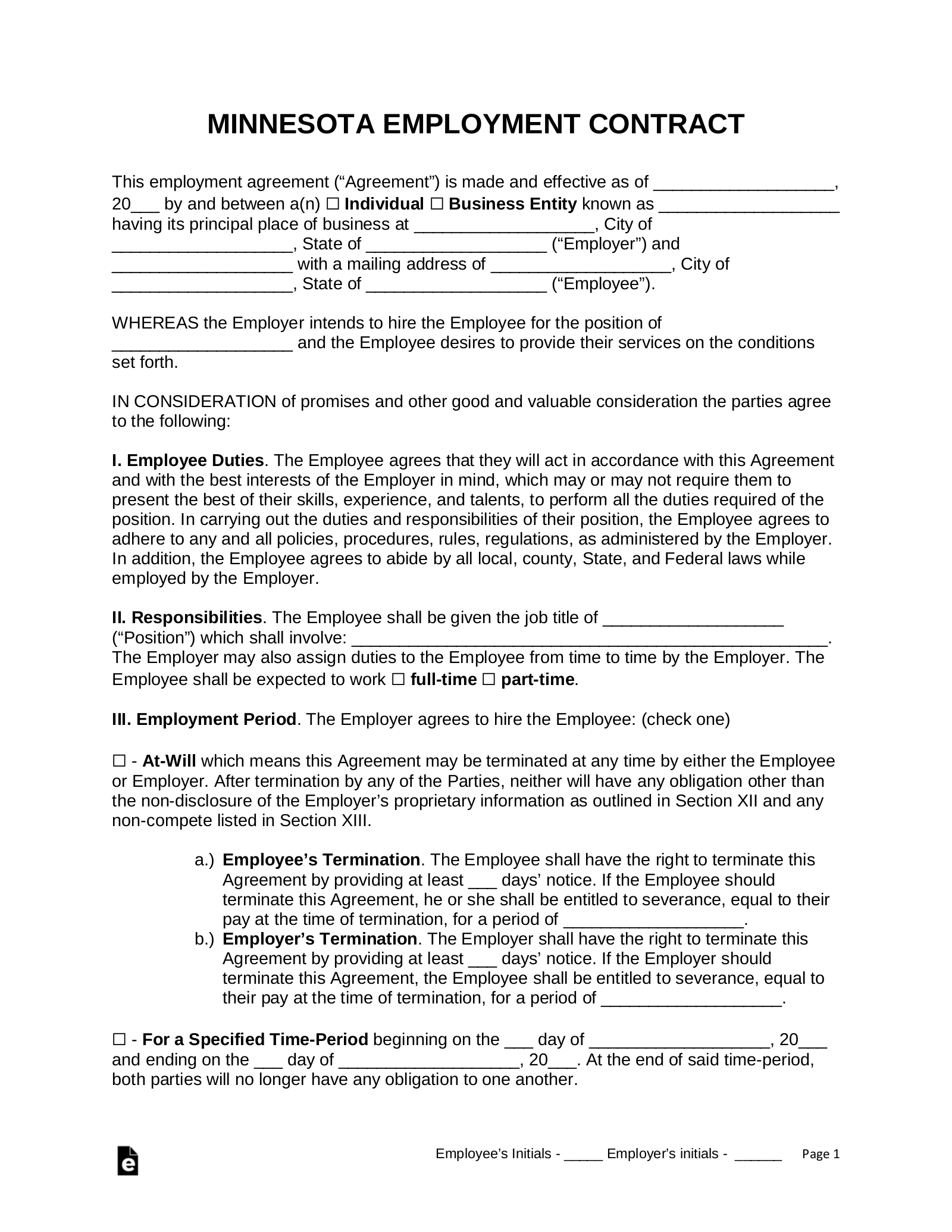

A Minnesota employment contract agreement is used to establish the terms of the professional relationship between an employer and an employee. The employer may use such an agreement for both short term and long term job positions. In the body of the document, the employer will specify the job title, duration of employment, and the amount of compensation, as well as the frequency of the employee’s wage payments. Any employee benefits, such as health benefits, paid leave, bonuses, and commissions should also be included in the form.

By Type (4)

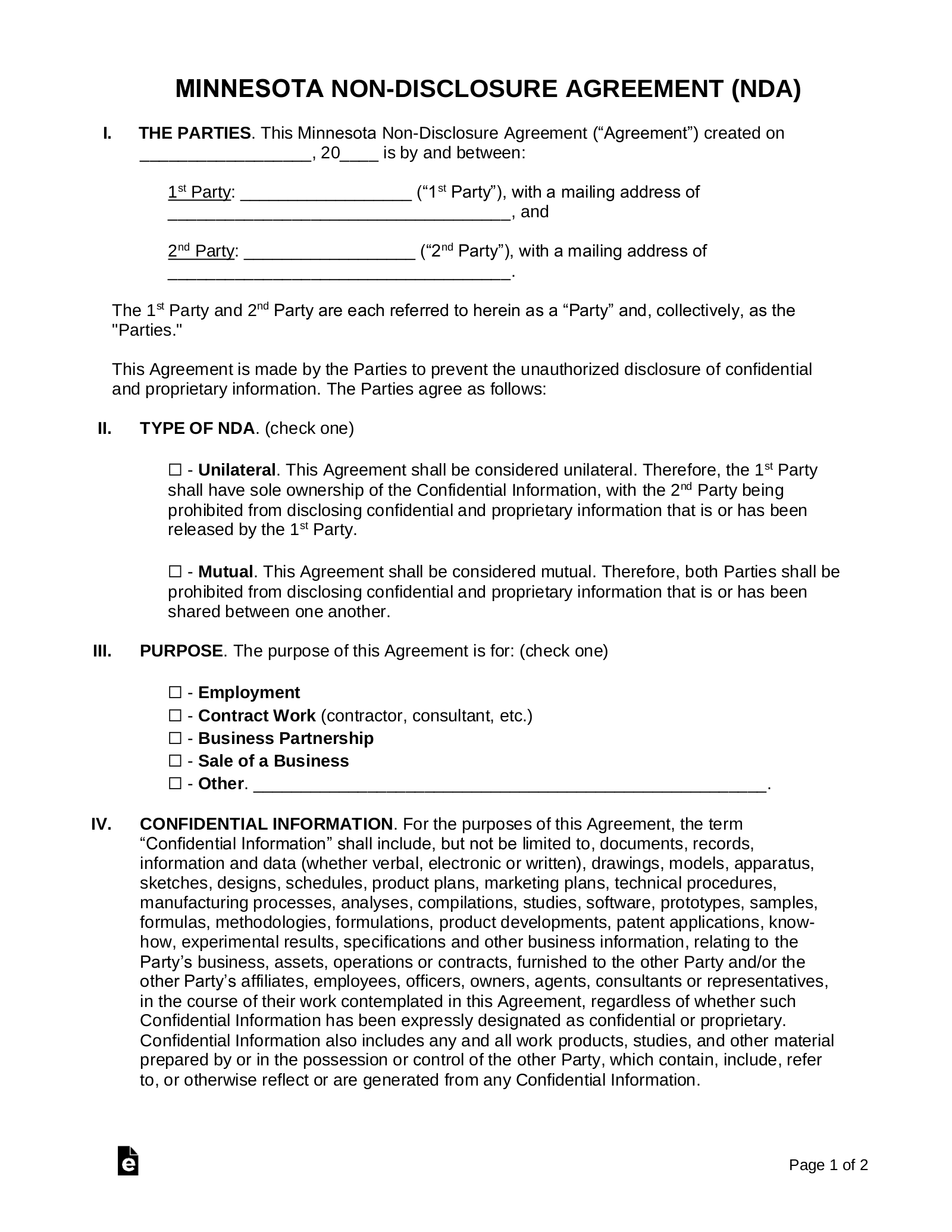

Employee Non-Disclosure Agreement – Employees that sign this contract must agree not to share any confidential information or trade secrets with third-party competitors.

Download: PDF, MS Word, OpenDocument

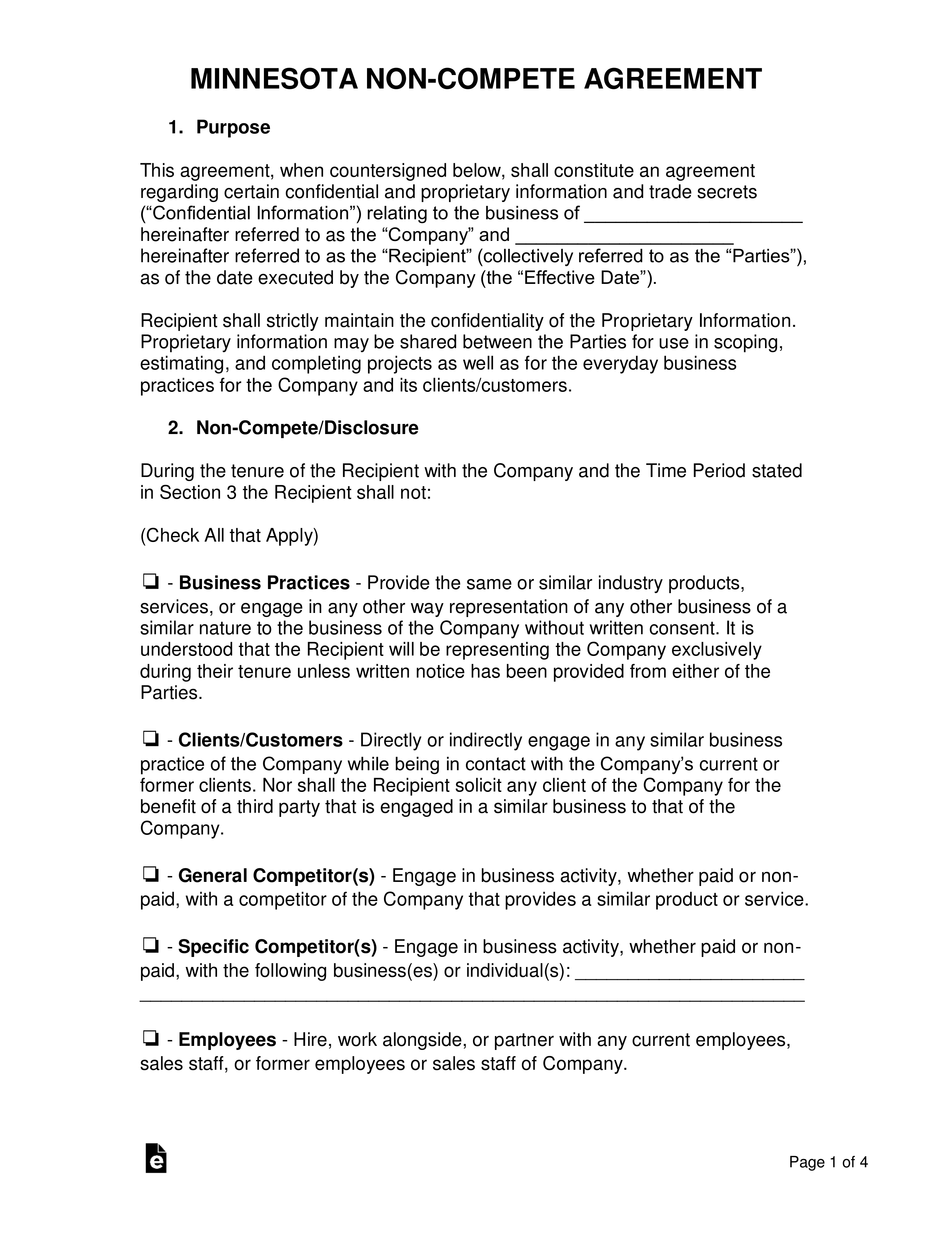

Employee Non-Compete Agreement – Employers may ask their employees to sign this type of contract in order to prohibit them from working in the same field after their professional relationship has been terminated.

Download: PDF, MS Word, OpenDocument

Independent Contractor Agreement – This written agreement may be used by a business or an individual to hire a contractor for the completion of a specific project.

Download: PDF, MS Word, OpenDocument

Subcontractor Agreement – When a contractor hires specialists or workers to contribute to the completion of a project, they will use this type of written agreement.

Subcontractor Agreement – When a contractor hires specialists or workers to contribute to the completion of a project, they will use this type of written agreement.

Download: PDF, MS Word, OpenDocument

Table of Contents |

What is an Employee?

Employee” Definition[1]

“. . . “Employee” means any person who performs services for another for hire including the following . . .”

At-Will Employment

At-Will Employment – Allowed with the exception of “Public Policy” and “Implied Contract” understandings.

Income Tax Rate (Individual)

Individual Income Tax – 5.35% to 9.85%[2]

Minimum Wage ($/hr)

Minimum Wage – $10.00 (employers earning $500,000+/year) / $8.15 (employers earning less than $500,000/year)[3]