Updated November 21, 2023

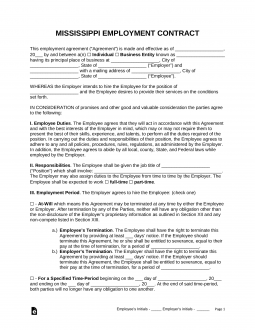

A Mississippi employment contract agreement is a document that establishes the terms and conditions under which an employee agrees to work for an employer. The employer should clearly state the terms of employment, including the pay scale, the duration of employment covered by the contract, and applicable expenses that will be covered by the employer. Any employee benefits should be described in the contract, as well as paid leave and sick days (if applicable).

By Type (4)

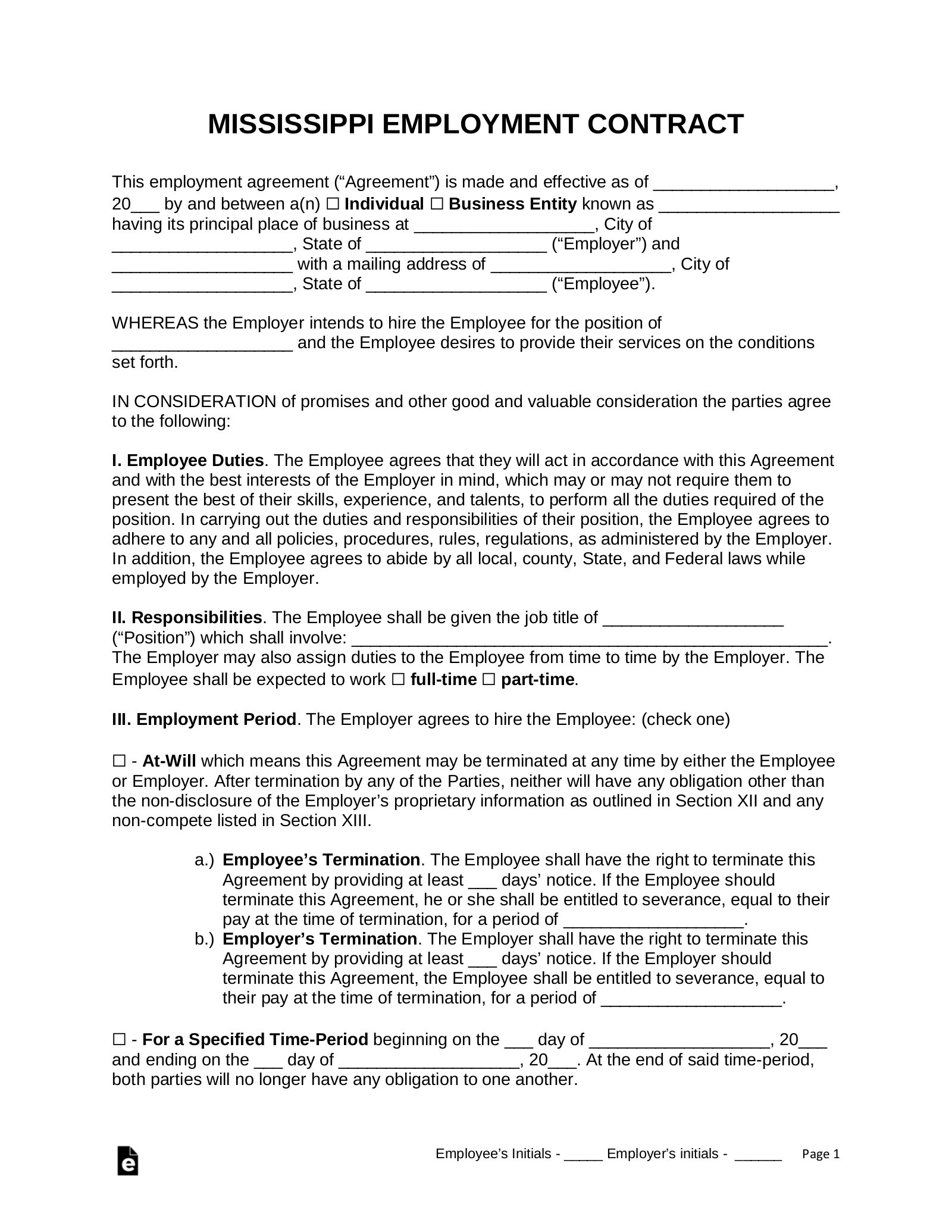

Employee Non-Disclosure Agreement – A written agreement between an employer and an employee that prohibits the employee from revealing trade secrets to competing businesses.

Download: PDF, MS Word, OpenDocument

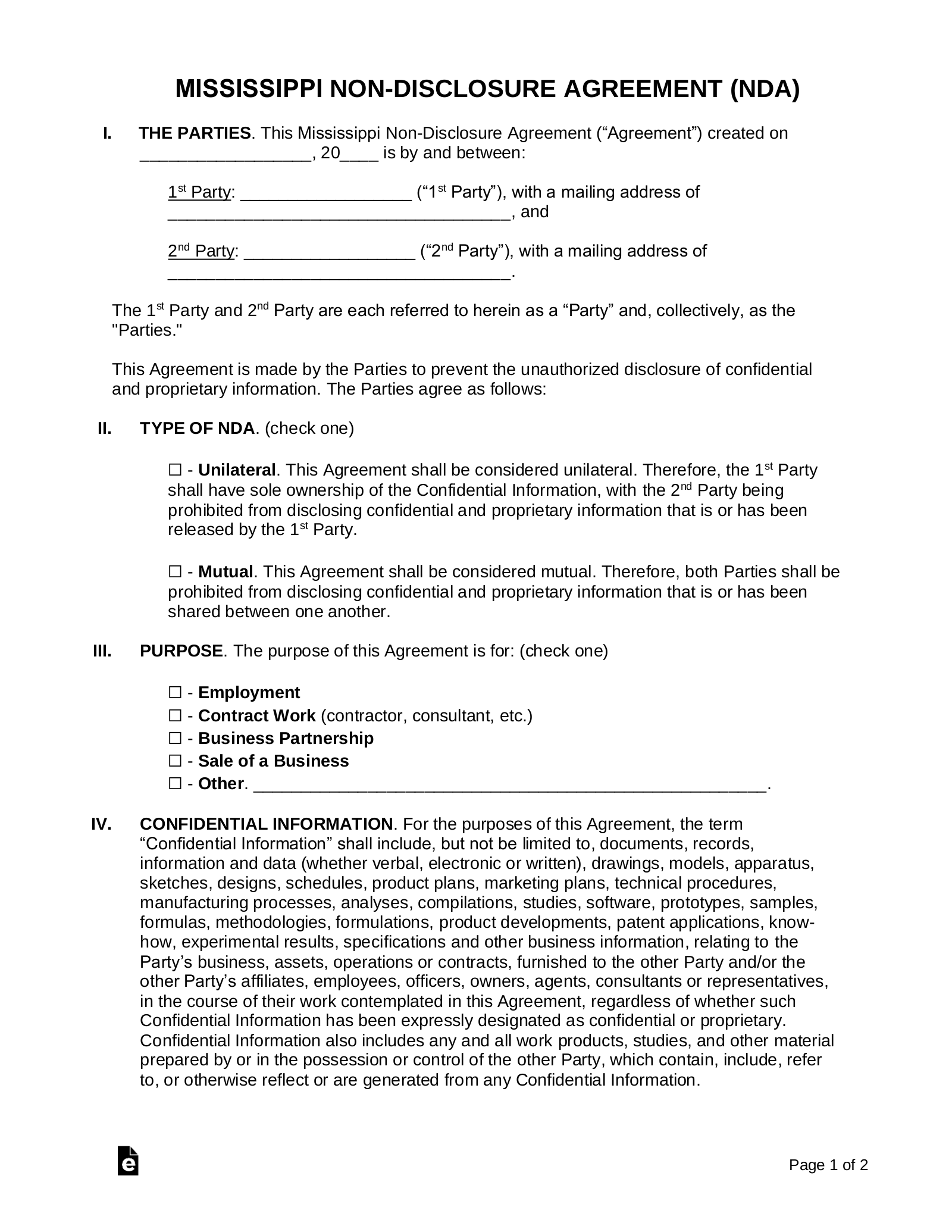

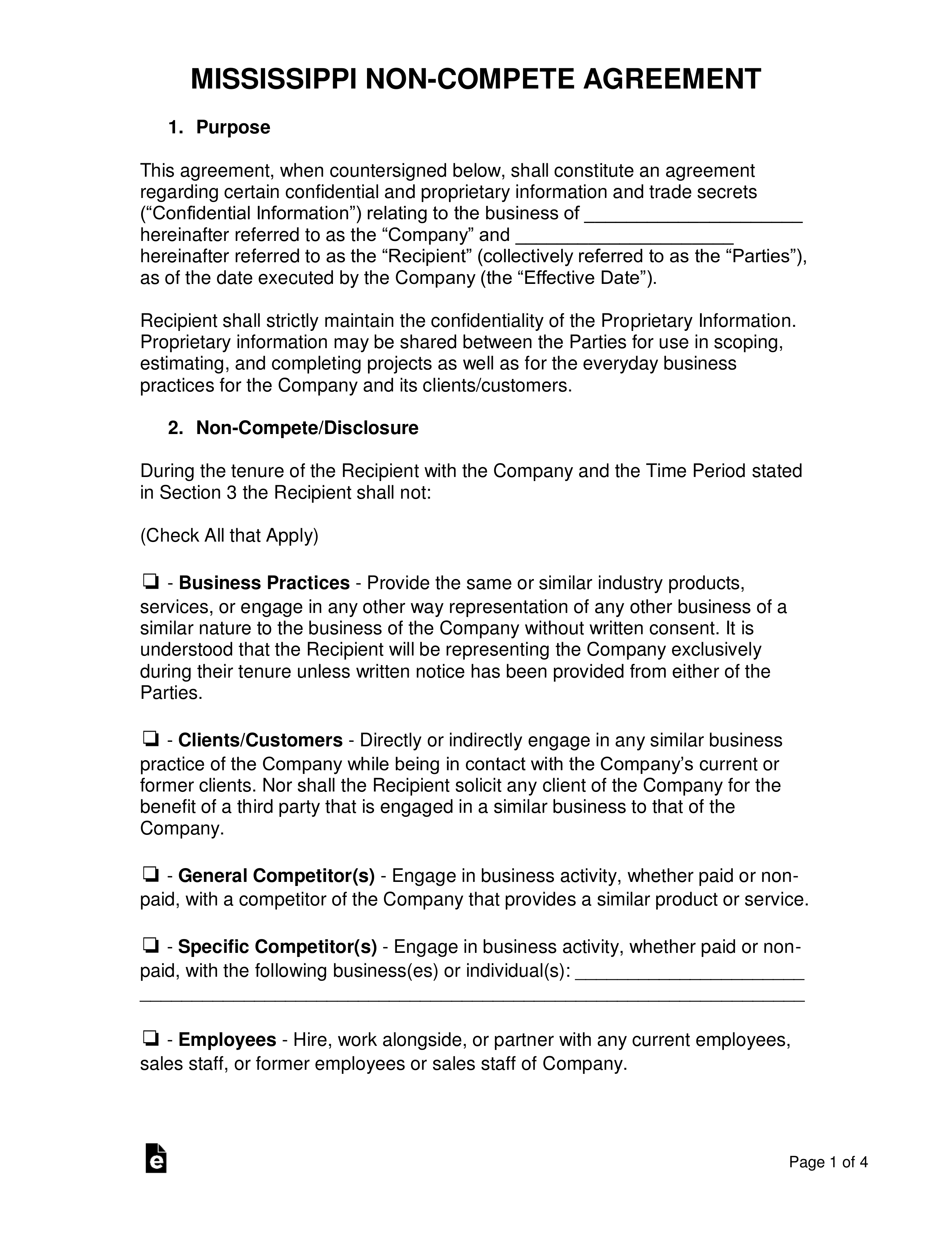

Employee Non-Compete Agreement – Restricts the signing employee from competing in business against the employer for a specified duration of time.

Download: PDF, MS Word, OpenDocument

Independent Contractor Agreement – Details the terms by which a contractor will complete a project for an individual or business.

Download: PDF, MS Word, OpenDocument

Subcontractor Agreement – Used by independent contractors to engage workers or specialists to help in the completion of a project.

Subcontractor Agreement – Used by independent contractors to engage workers or specialists to help in the completion of a project.

Download: PDF, MS Word, OpenDocument

Table of Contents |

What is an Employee?

“Employee” Definition[1]

“. . . is any person or entity that is hired to perform work within the State of Mississippi and to whom a United States Internal Revenue Service Form W-2 or Form 1099 must be issued.”

At-Will Employment

At-Will Employment – Allowed with the exception of “Public Policy” and “Implied Contract” understandings.

Income Tax Rate (Individual)

Individual Income Tax – 3% to 5%[2]

Minimum Wage ($/hr)

Minimum Wage – $7.25 (no State minimum, federal law applies)