Updated July 19, 2023

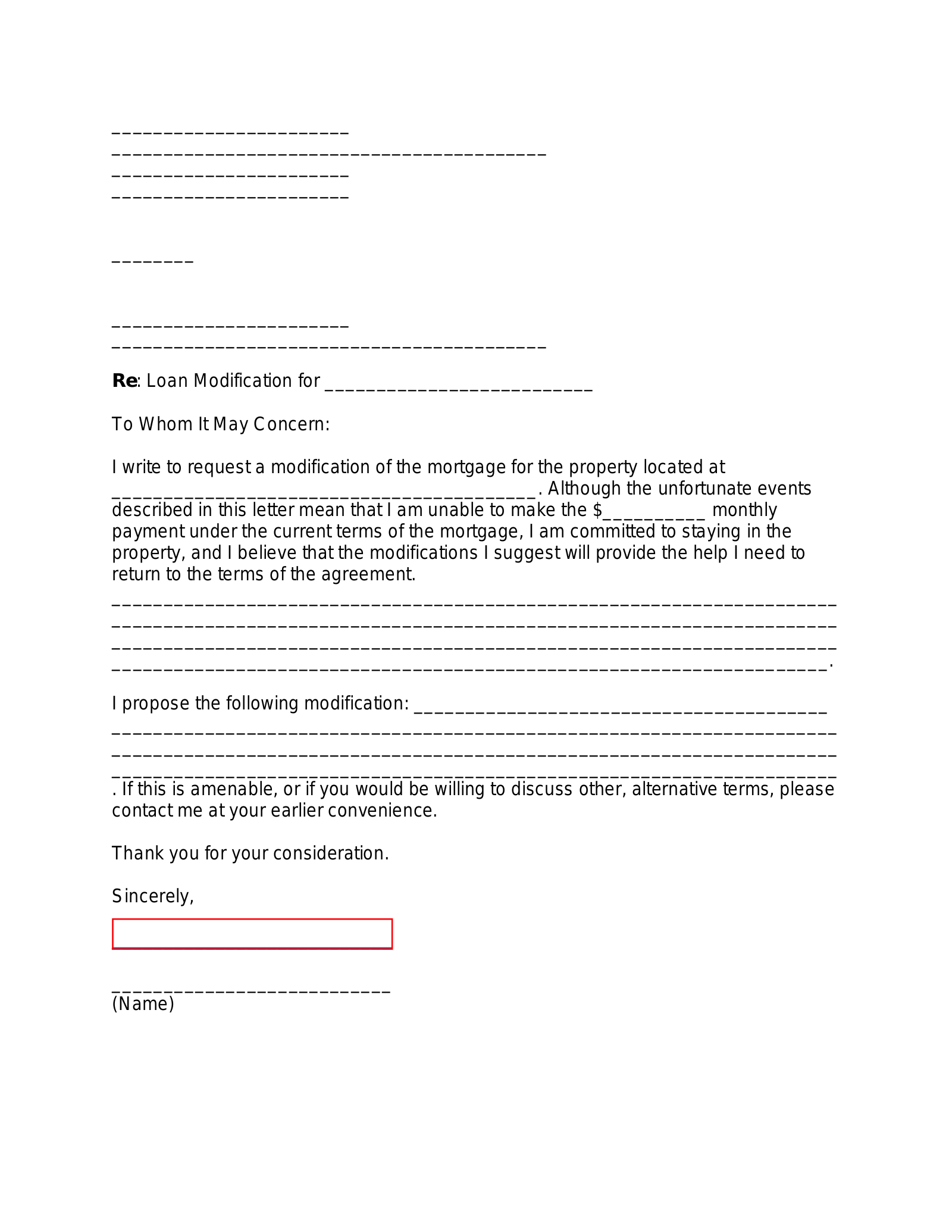

A mortgage financial hardship letter requests a lender for loss mitigation on a mortgage loan — such as a loan modification for a reduction in payments or a short sale — due to extenuating financial circumstances. The borrower must provide this letter to their lender along with any additionally required forms and supporting documents to prove that they are unable to make payments under the existing terms of the mortgage.

Sample

Jennifer Coolridge

123 Neighborhood Way

Los Angeles, CA 90021

Nov. 3, 2022

Brick Mortgage Co.

321 Reese St.

Los Angeles, CA 90012

To Whom It May Concern:

I am writing this letter to request a loan modification to help me get my mortgage payments back on track and avoid foreclosure during this time of unforeseen financial duress for my family.

Five months ago, I lost my job as a manager at the Cheesecake Factory. As a single mother and sole earner for my family, losing this source of income has had a drastic impact on our financial situation. After many unsuccessful attempts at securing another job, I’ve maxed out my credit cards to support my three children, who are all under the age of 13. At this point, I’m unsure I can continue meeting the most basic necessities for them, such as putting food on the table.

For the next six months, until I am able to secure another source of income, I am requesting that my monthly payment amount is reduced from $800 to $300. This reduction would allow me to continue making my payments as a show of good faith. Since being approved for this mortgage in 2014, I did not miss a single payment until I lost my job five months ago.

I am attaching my bank statements, tax return, a letter from my former employer, and utility bills. I sincerely hope that we can work out a solution together. Thank you for your time and consideration, and please let me know if you need anything else from me.

Sincerely,

Jennifer Coolridge