Updated March 27, 2023

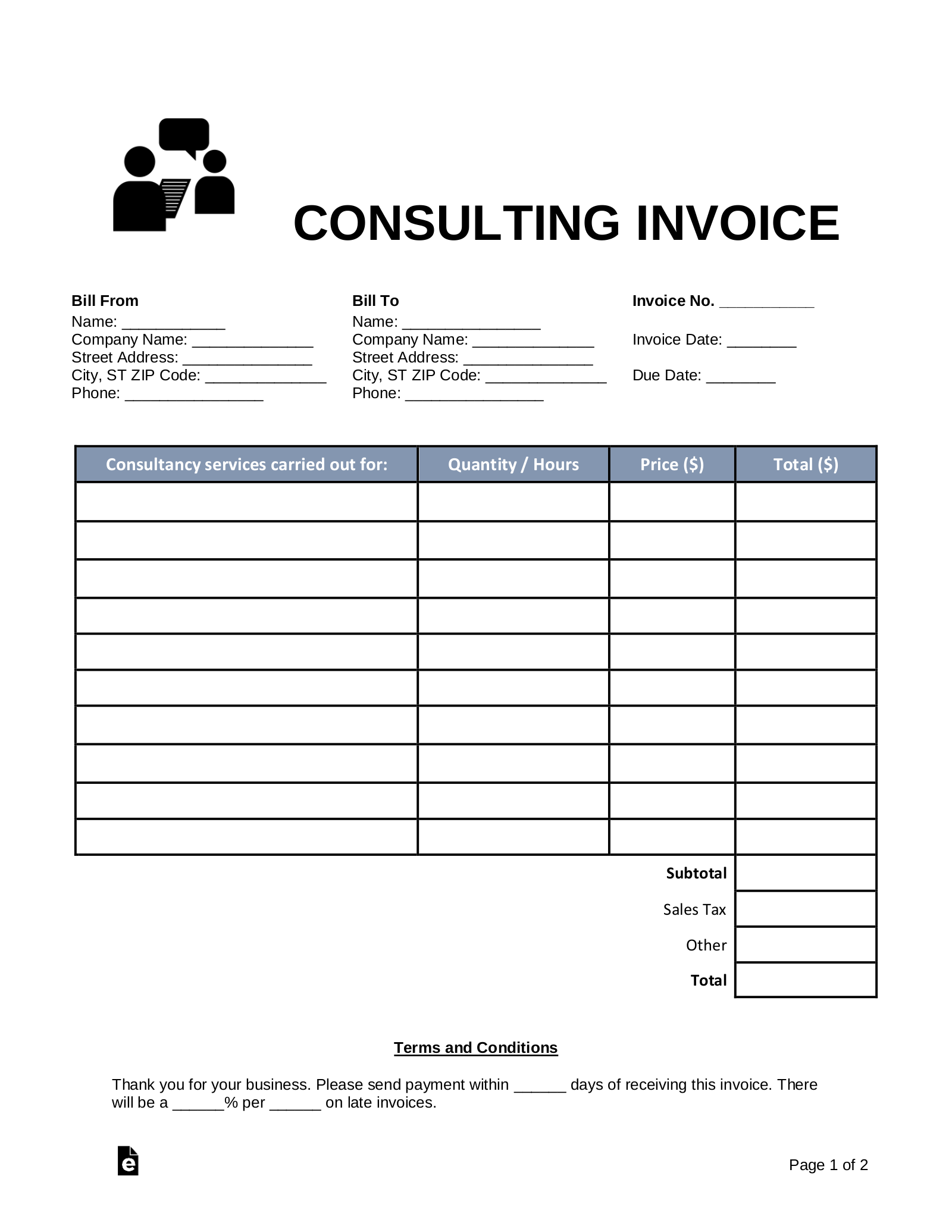

A consulting invoice is a document that allows a professional consultant to provide a client with an itemized statement of services rendered. The document may either be presented at the time of service for payment or the consultant may choose to bill the client at a later date, allowing the client a due date for payment. The consultant will also have the ability to keep a copy of the consultancy itemization for their records.

Elements of a Consulting Invoice

- The date of the invoice and invoice identifier.

- The company name, address and contact information.

- The name, address and contact information of the client.

- The description of the service being provided. To be inclusive of total hours and a breakdown of all charges (i.e., cost of each hour, sales or state tax as applicable, charges for additional services that may be optional, etc.).

- Discounts being provided or available to the customer.

- The date payment is due by and type of payments accepted by the consultant.

- The terms and conditions of the invoice.

Types of Businesses that hire consulting

- Healthcare Companies

- Technology Companies (software and hardware)

- Retail Companies

- Food Industry Companies

- New Companies trying to obtain expertise as they start.

- Existing businesses requiring assistance with changing their culture, sales, products, etc.

How to Charge Consulting Fees

1. Look into Competitor’s Rates

When providing Consulting Fees, the fee may vary and a consultant should provide a competitive rate. In competition with national consulting firms, this provides consultants the opportunity to sell to the client that they can provide a more personal approach or quicker response time, which can address why the consultant may be of lesser price. However, a national firm can have more expertise and experience and therefore a contractor will want to be prepared to address any discrepancies or base rates if they heavily exceed or are incredibly less than national firms or other local competitors.

2. Decide on Fee Model

Dependent on the consulting being provided a model should be assessed. If a contractor feels that their services may take only several hours on a consistent basis then the hourly rate may be for them. However, if the service they offer could take weeks or months to finish, a per project fee may be more appropriate.

3. Use Consulting Invoice to keep records of work

A consultant will want to track all work completed and payments made. This will be critical if the project can take anywhere from weeks to months to finish and the consultant wishes to be paid throughout the project to ensure revenue continues coming in.

4. Bill the client with the Consulting Invoice

To avoid potential issues the client should be billed immediately upon the service being delivered or the project finishing. Any payments that may have been made up to that point should also be included to ensure the final invoice is accurate. Time required to pay should be reiterated to avoid payment delays.

What is a retainer fee?

A retainer fee is a cost incurred upfront by an individual in order to pay for a consultant. This is often utilized for freelancers or lawyers (third parties) who are commonly used by a particular individual. A retainer fee is also a way for a client to provide their commitment and show how serious they are about receiving the service being offered. There can be an “unearned” retainer fee, meaning the work has not been started but an individual is providing money upfront or “earned” retainer fees which means a portion of that money will be left with the consultant after all work is completed.