Updated February 14, 2024

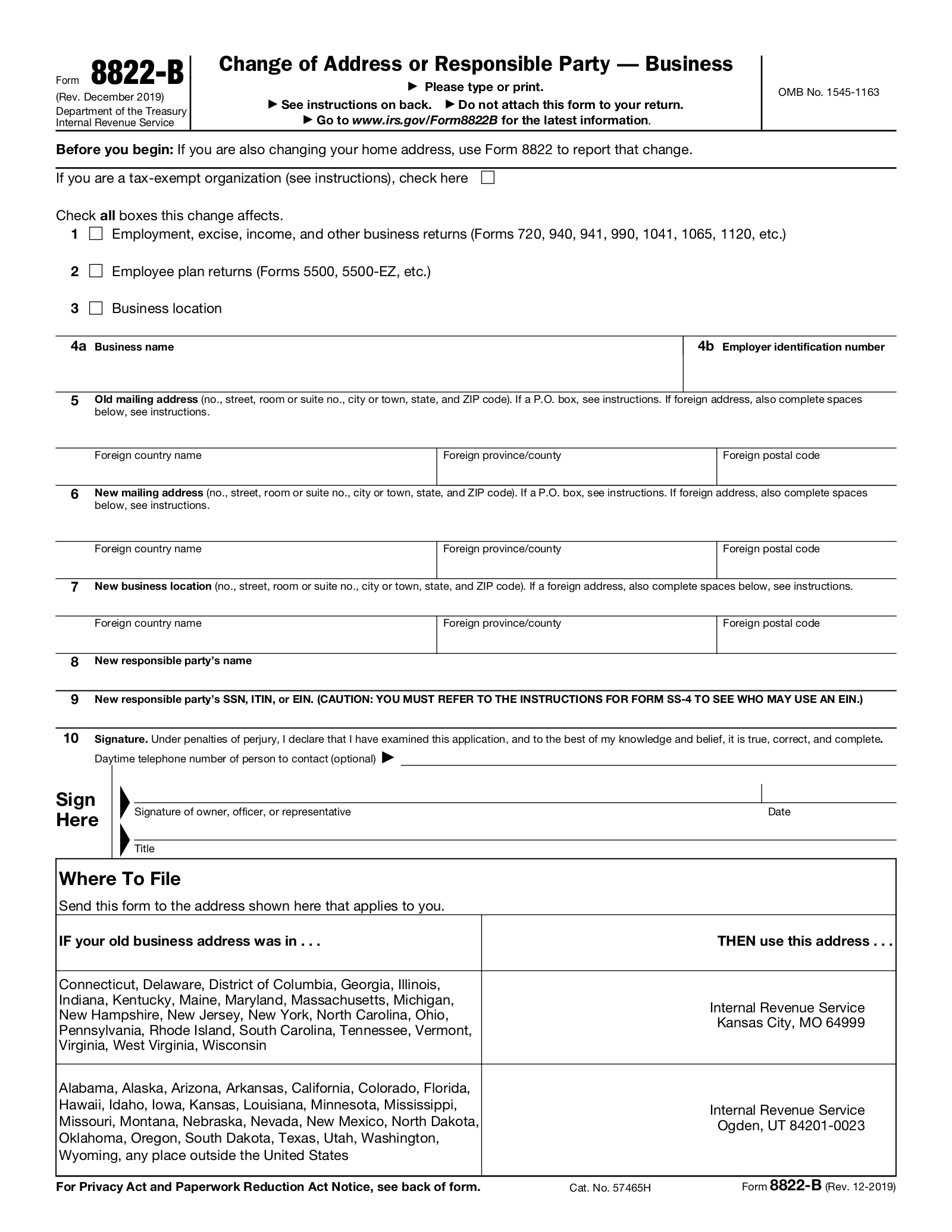

Form 8822-B is used to notify the IRS of a change in a business’s location or mailing address, or a change in that entity’s responsible party. Only businesses and other entities with an Employer Identification Number (EIN) need to submit Form 8822-B.

What is a Responsible Party?

The responsible party is the individual empowered to make decisions about a business’s funds and assets. In most cases, the responsible party must be a natural person, not an entity.

Table of Contents |

Who Must File

A business or entity with an EIN must file 8822-B within 60 days of a change in its responsible party. Form 8822-B is also used to report a change in an entity’s location or mailing address, but it is not mandatory to report this change within a certain timeframe.[1]

How to File

A copy of Form 8822-B can be printed off of the IRS website. The completed form must be signed by an officer, owner, manager, plan administrator, or an authorized representative before being submitted.[2]

The signed form must be mailed or delivered to one of two IRS service centers. Refer to the instructions on the bottom of Form 8822-B to determine where to submit your completed form.

How to Fill Out

Tax-Exempt Organization Checkbox

Check this box if yours is a tax-exempt organization.

Affected Returns Checkboxes

Indicate in these boxes what reportable information will be impacted by the change in your entity’s location, mailing address, or responsible party. Check all boxes that apply.

Boxes 4a and 4b: Business Name and EIN

In these boxes, enter your business’s name and its EIN.

Box 5: Old Mailing Address

In this box, enter your business’s old mailing address, including any applicable apartment, room, or suite number. If entering a foreign address, include the unabbreviated country name, county or province name, and postal code.[3]

Box 6: New Mailing Address

If applicable, enter your business’s new mailing address. Be sure to include the apartment, room, or suite number, if the new address has one. If it is a foreign address, include the unabbreviated country name, county or province name, and postal code.[3]

Box 7: New Business Location

If you are using Form 8822-B to report a change in your business’s location, enter the new location in this box. If this is a foreign location, include the unabbreviated country name, county or province name, and postal code.[4]

Boxes 8 and 9: New Responsible Party Information

If the responsible party has changed, enter the name and SSN, ITIN, or EIN of the new responsible party in these boxes. Refer to the instructions for Form SS-4 to determine which identification number should be included in box 9.[5]

Box 10: Signature

The owner, officer, manager, plan administrator, or authorized representative must sign and date Form 8822-B in this box. Their official title must also be included.

A daytime telephone number where the signer can be contacted may be included, but it is not required.[6]

Frequently Asked Questions (FAQs)

What if I am a representative signing on behalf of the taxpayer?

If you are an authorized representative signing on behalf of the taxpayer, you must attach a copy of your power of attorney to Form 8822-B before submitting it. Form 2848 can be used for this purpose.[2]

Who is able to be a “responsible party”?

For entities with shares or interests traded on a public exchange, the responsible party is the principal officer, a general partner, or the grantor, owner, or trustor. For all other entities, the responsible party is the person who manages the entity’s funds and assets.[7]

Can I file Form 8822-B electronically?

As of 2024, there is no option to submit Form 8822-B online; a physical copy must be mailed or delivered to the appropriate service center.