Updated April 24, 2024

IRS Form 1310 is used by an executor, administrator, or representative in order to claim a refund on behalf of a deceased taxpayer. A surviving spouse or court-appointed representative uses this form only as required.

Important

A representative or executor that has been appointed by a will uses this form to claim the deceased taxpayer’s refund. The IRS does not need a copy of the will.

Table of Contents |

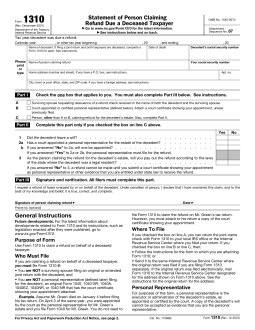

When is Form 1310 Required?

- Executors/Representatives: If a refund is claimed, the person responsible for filing tax returns on behalf of a deceased taxpayer must generally include Form 1310.

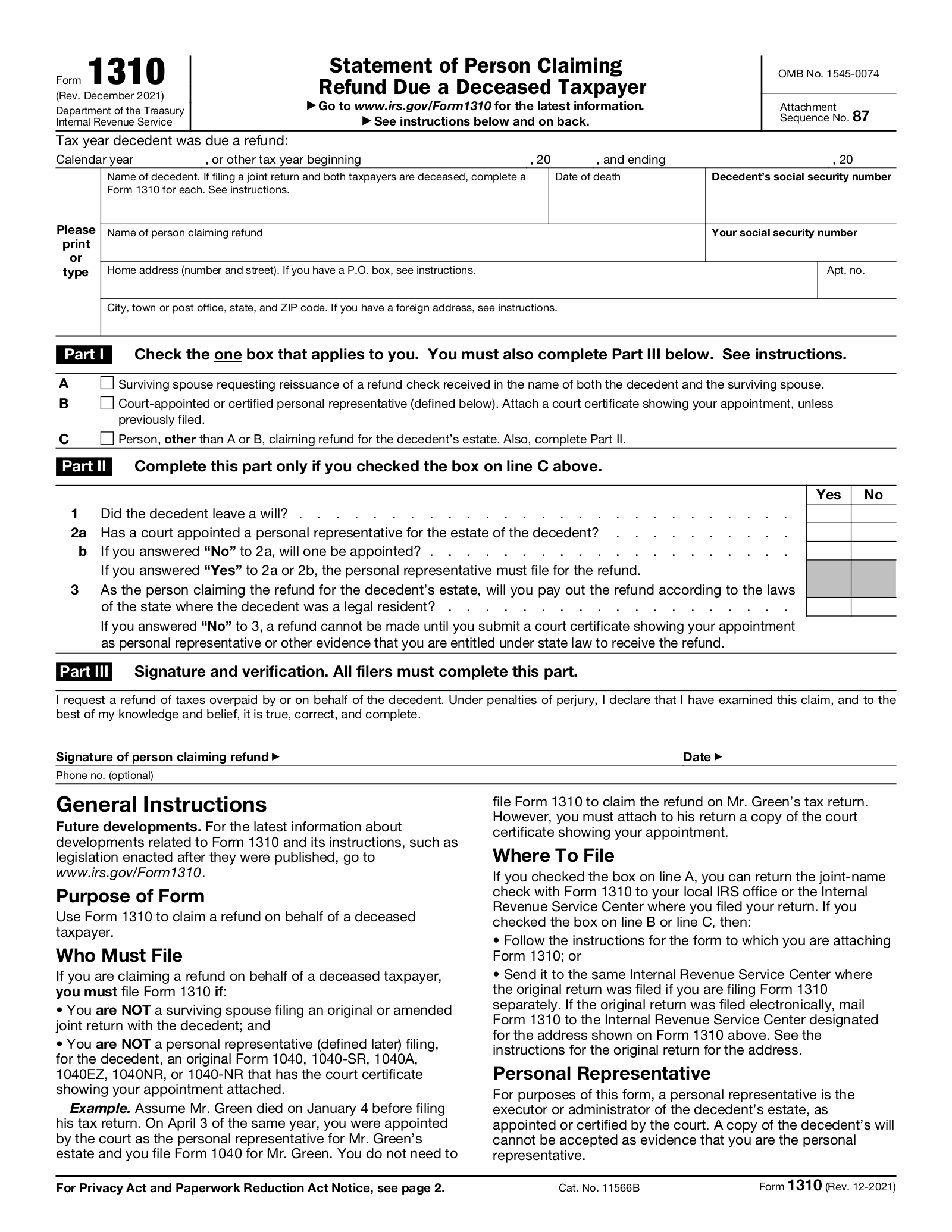

- Joint-Named Refund: If a surviving spouse receives a refund check that includes the deceased spouse’s name, the check can be reissued in the surviving spouse’s name. The surviving spouse must return the check marked “VOID” along with a completed Form 1310 and a written request that the check be reissued. Documents should be mailed to the local IRS office or the service center where the return was mailed.[1]

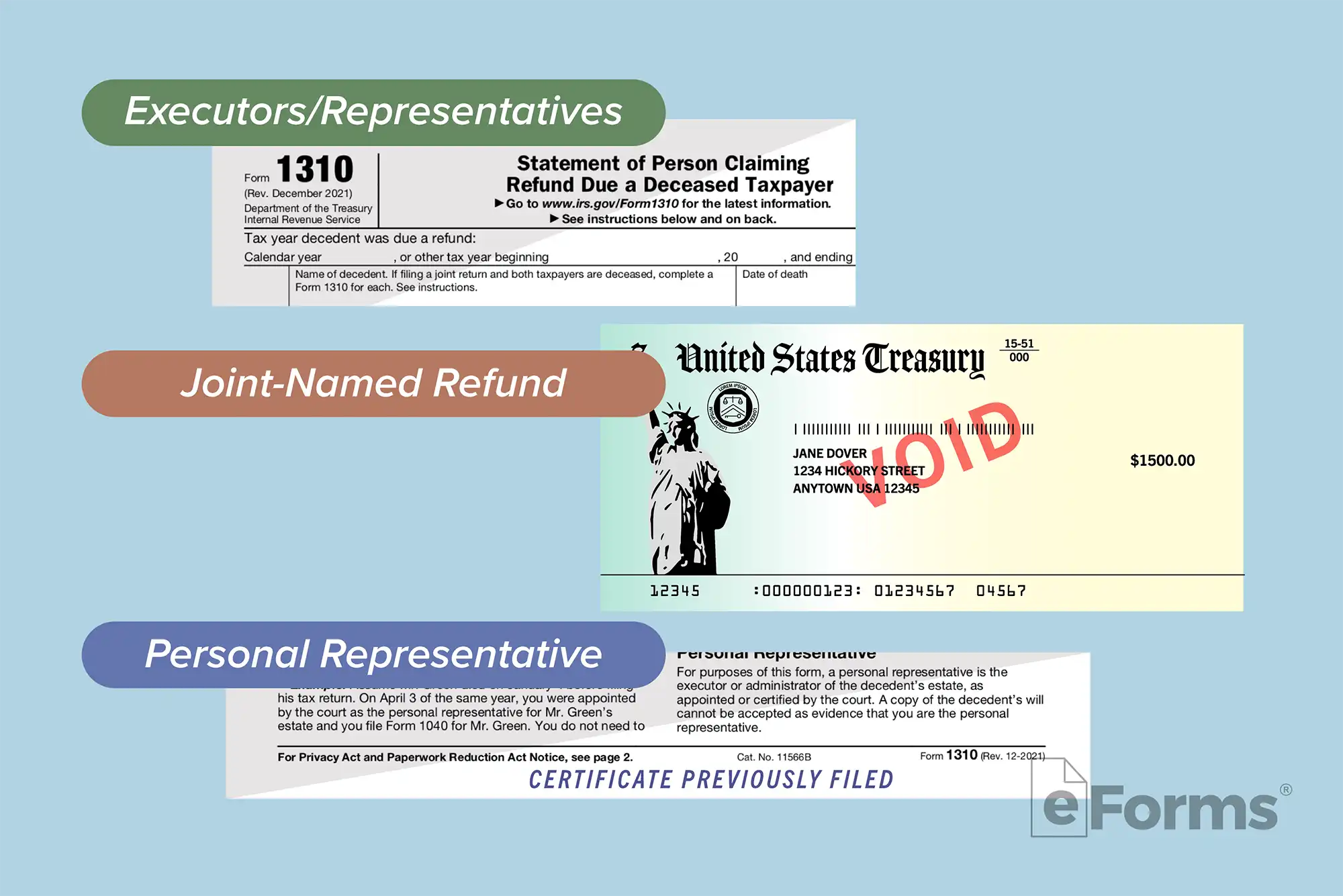

- Personal Representative: If a personal representative claims a refund when filing Form 1040-X or Form 843 and a court order has previously been filed, the personal representative should attach a completed Form 1310 with the words “Certificate Previously Filed” written in the bottom margin.[2]

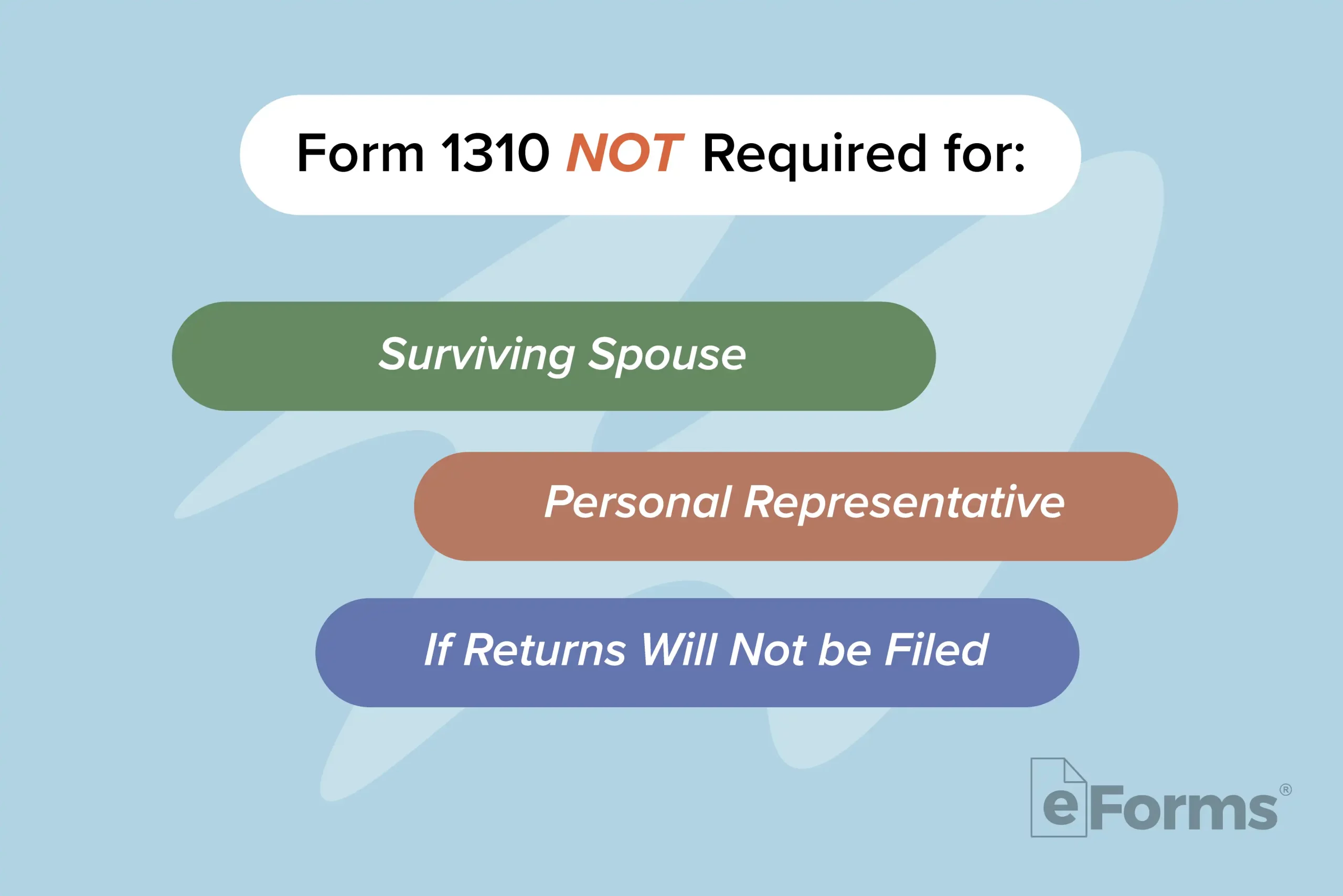

When is Form 1310 NOT Required?

- Surviving Spouse: The surviving spouse of a deceased taxpayer is not required to use this form to claim a refund. The IRS will automatically issue any refund based on the spouse’s filing status.

- Personal Representative: When filing original, final returns on behalf of a deceased taxpayer, a personal representative is not required to use Form 1310. Instead, a copy of the court order or appointment should be attached to the submitted returns.

- If Returns Will Not be Filed: If tax returns will not be submitted, Form 1310 is unnecessary. The IRS provides an online questionnaire to help determine whether or not a person is required to file.

Personal Representative

For purposes of this form, the IRS defines a personal representative as: “the executor or administrator of the decedent’s estate, as appointed or certified by the court.”

Filing a Deceased Taxpayer’s Returns

Typically, final income tax returns must be filed on behalf of the deceased taxpayer for the year of death and for any preceding years that taxes were not filed.[3] The IRS provides a guide for Survivors, Executors, and Administrators to help facilitate the process.

FAQs

Do I need to provide a death certificate?

A death certificate should not be attached to the deceased taxpayer’s return(s). The person filing should retain these records in the event that the IRS requests copies at a later date.[4]

How do I sign the tax return?

For paper returns, IRS signature requirements vary based on the role of the filer.[5] When eFiling, the person filing should follow the instructions provided by the tax software for signature and notation requirements.

What filing status does the surviving spouse use?

The IRS considers the surviving spouse married for the full year that their spouse died unless they remarry during that year. They are eligible to use “married filing jointly” or “married filing separately.”

What is the deadline to file a final tax return?

The same tax deadlines apply for final returns. However, a surviving spouse or a representative may request an extension.

How do I notify the IRS that the taxpayer is deceased?

For paper returns, the person filing should write “deceased,” at the top of the return followed by the deceased person’s name and the date of their death.[6]