Updated March 27, 2024

IRS Form 2553 is used by eligible corporations and other business entities wishing to be treated as an S corporation for federal tax purposes. Filing this form does not change the structure of a company; instead, it allows the business to file taxes as an S corporation regardless of the default classification assigned by the IRS. Some companies benefit in the form of tax and other savings by doing so.

Table of Contents |

Eligibility

A corporation or other entity may elect to be treated as an S corporation only if it meets a set of criteria that includes the following:[1]

- It is a domestic corporation or entity.

- It has no more than 100 shareholders.

- Its only shareholders are individuals, estates, exempt organizations described in section 401(a) or 501(c)(3).

- It has no nonresident alien shareholders.

- It has only one class of stock.

How an S Corporation is Taxed

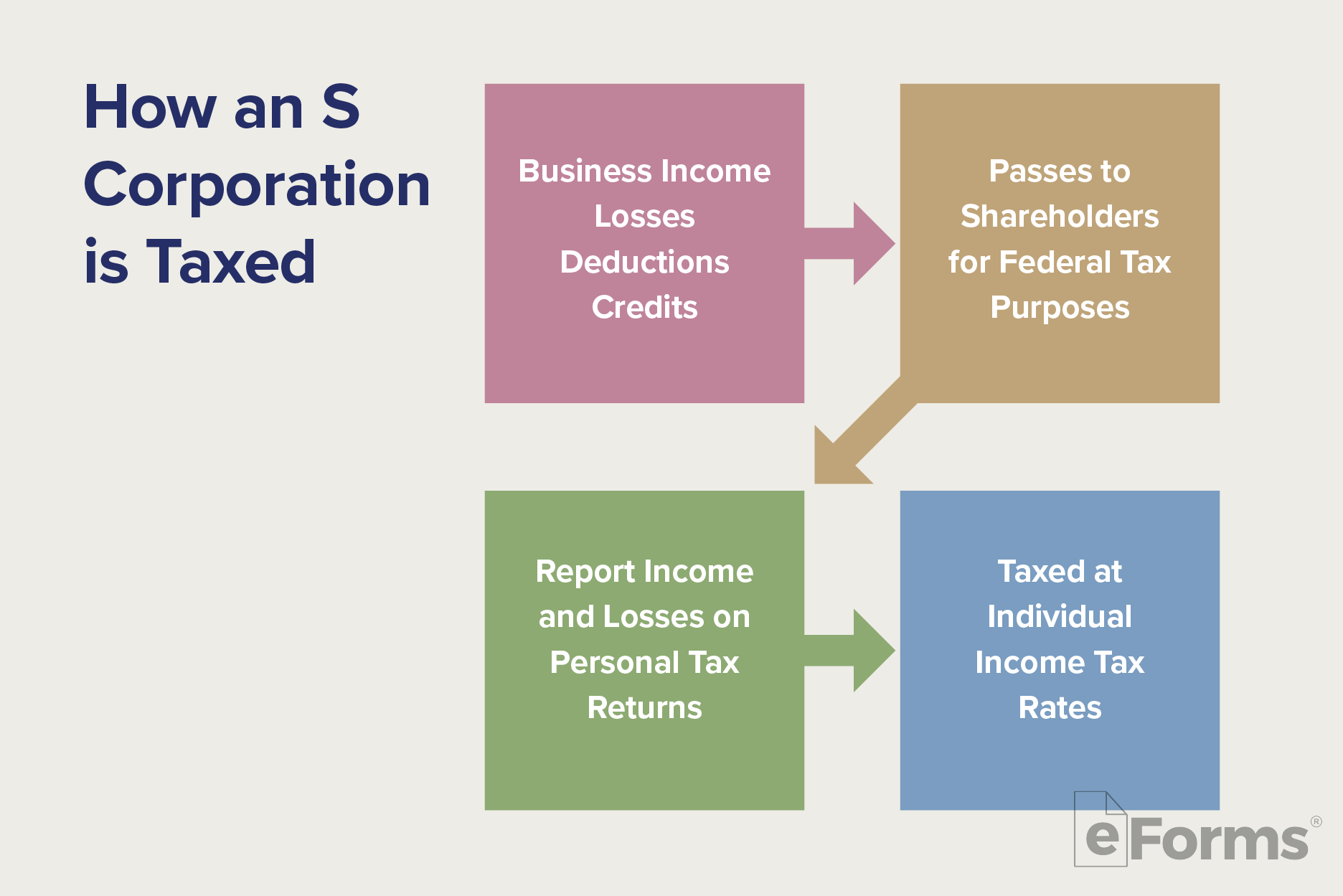

S corporations are a type of corporation that passes business income, losses, deductions, and credits through to its shareholders for federal tax purposes. The business itself is not taxed; instead, shareholders of S corporations report the income and losses on their personal tax returns and are taxed at individual income tax rates.[2]

This allows S corporations to avoid double taxation on corporate income.

C Corporations Taxed as S Corporations

For tax purposes, a C corporation is treated as an entity that exists separately from its owners. As a result, the entity is first taxed on its profits, and then its owners are taxed when dividends are distributed.

A C corporation can avoid this “double taxation” by making the election to be taxed as an S corporation.[3]

LLCs Taxed as S Corporations

Like the S corporation, an LLC is taxed by default as a pass-through entity. The company itself does not pay tax, but the owners do once profits have been distributed.

Although they are treated similarly by default by the IRS, there can be significant advantages for an LLC electing to be taxed as an S corporation:

- When an LLC is taxed as an S corporation, the owners are able to pay themselves as employees before disbursements are made, thereby reducing the company’s overall tax burden.

- In some cases, filing taxes as an S corporation will help an LLC qualify for the 20% Qualified Business Income (QBI) deduction permitted under the Tax Cuts and Jobs Act.[4]

When to File

Form 2553 should be completed and filed by the fifteenth day of the third month of the tax year that the election is to take effect, or at any time during the year preceding the tax year that the election is to take effect.[5]

Late Filing

In some cases, the IRS will accept a late filing of Form 2553. However, to do so successfully requires a burden of proof on the part of the filing entity through a rigorous set of steps mandated by the IRS.[6]

Among those steps, the entity must demonstrate that it was eligible during the previous periods, that it had already filed taxes as an S corporation, and that it had reasonable cause for failing to timely file Form 2553.

How to File

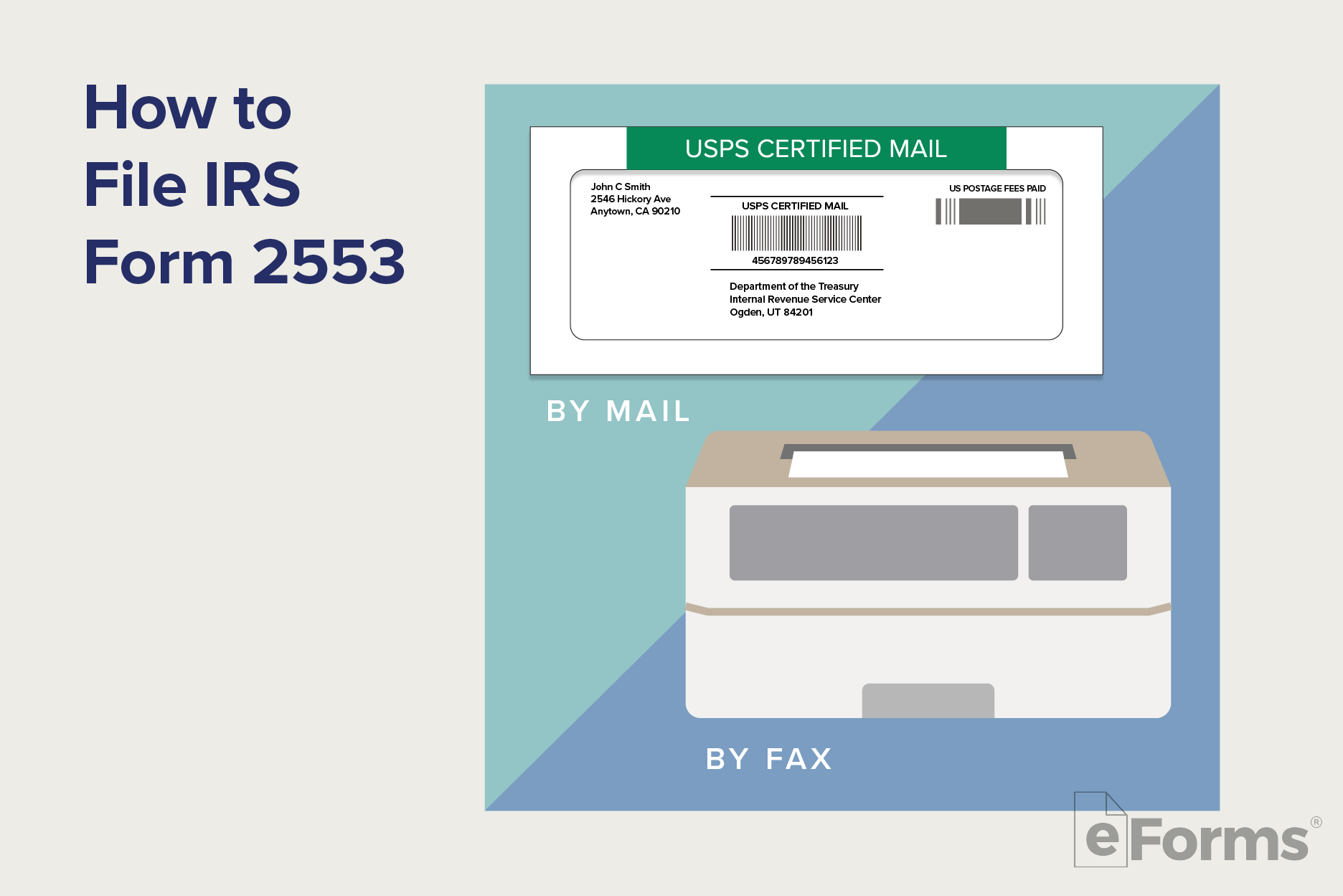

Completed forms can be mailed or faxed to the Internal Revenue Service Center listed below. If the entity files the election by fax, the original should be kept with the entity’s permanent records. If the IRS questions whether Form 2553 was filed, an acceptable proof of filing is:[7]

- A certified or registered mail receipt

- Form 2553 with an accepted stamp

- Form 2553 with a stamped IRS received date

- An IRS letter stating that Form 2553 has been accepted

Care should be taken to ensure that the IRS receives the election. If the entity is not notified within two months of the date of filing (date faxed or mailed), or within five months if box Q1 is checked, follow up by calling 1-800-829-4933.

Where to File

Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin

Use the following address or fax number:

Department of the Treasury

Internal Revenue Service Center

Kansas City, MO 64999

Fax: 855-887-7734

Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming

Use the following address or fax number:

Department of the Treasury

Internal Revenue Service Center

Ogden, UT 84201

Fax: 855-214-7520

Sources

- IRS.gov: Form 2553 Instructions, Who May Elect

- IRS.gov: S Corporations

- IRS.gov: S Corporations

- IRS.gov: Tax Cuts and Jobs Act

- IRS.gov: Form 2553 Instructions, When to Make the Election

- IRS.gov: Form 2553 Instructions, Late Filing

- IRS.gov: Form 2553 Instructions, Acceptance or Nonacceptance of Election