Updated March 25, 2024

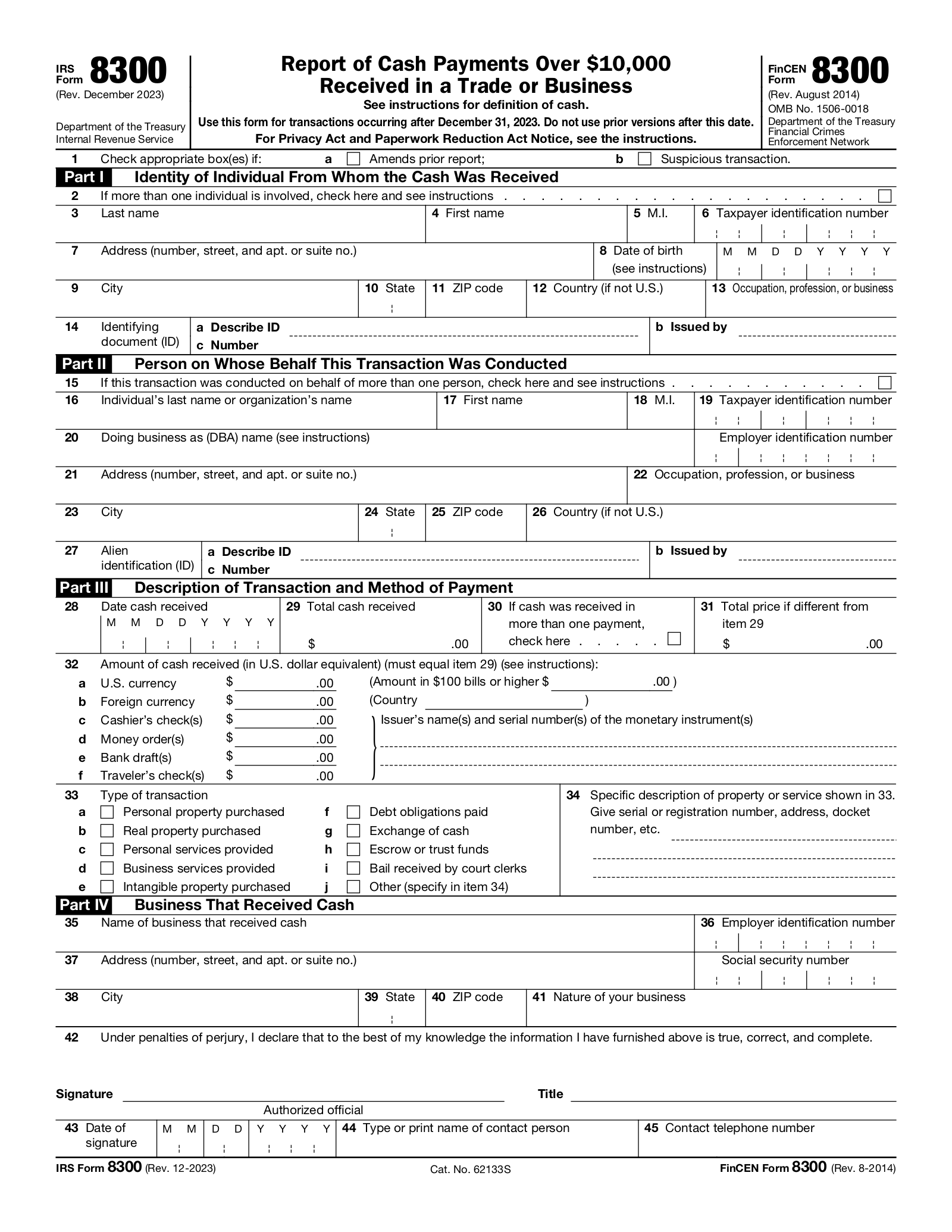

Trades and businesses use IRS Form 8300 to report cash payments of more than $10,000 to the IRS and the Financial Crimes Enforcement Network, as required by the US Patriot Act of 2001. The information provided in the form helps law enforcement combat money laundering, drug trafficking, terrorist financing, and other illegal activity by creating an audit trail used in criminal investigations.

Table of Contents |

Who Must File

Trades and businesses must report cash payments over $10,000 received in the ordinary course of business by the same agent or buyer, whether the payment is made in a single transaction or in related transactions. A report must also be made if multiple payments are made and the total cash received within a 12-month period exceeds $10,000.[1]

When to File

Businesses must file form 8300 within 15 days of receiving the cash. If the 15th day falls on a weekend or holiday, the report must be filed on the next business day.

How to File

Form 8300 must be filed with the IRS or with the United States Treasury, Financial Crimes Enforcement Network (FinCEN).

When filing with the IRS, this form must be filed electronically if the preparer is required to eFile any 1099. If the preparer is submitting fewer than 10 copies, or if eFiling is inconsistent with their religious beliefs, completed paper copies may be mailed to:

The Detroit Federal Building

P.O. Box 32621

Detroit, MI 48232

When filing with FinCEN, preparers are encouraged to file electronically by using FinCEN’s BSA E-Filing System.

Frequently Asked Questions (FAQs)

What is Cash?

Cash includes US and foreign coins and currency. Cash may also include cashier’s checks, traveler’s checks, and money orders with a value of less than $10,000 if the payment is received in a designated reporting transaction or any transaction when the business knows the customer is trying to avoid reporting of the transaction.[2]

Cash does not include: 1) personal checks from the customer’s account, or 2) cashier’s checks, travelers checks, or money orders with a value of more than $10,000

What is a Related Transaction?

Related transactions are transactions between a customer and the recipient of the payment occurring within a 24 hour period. When multiple payments are made totaling more than $10,000 in a 24 hour period, the transaction must be reported.[3]

What is a Designated Reporting Transaction?

A designated reporting transaction is the retail sale of: 1) consumer durables like automobiles or boats, 2) collectible items like art, antiques, jewelry, and coins, or 3) travel or entertainment.

Can I voluntarily report suspicious transactions?

Businesses can voluntarily file Form 8300 in connection with a transaction of less than $10,000 if it appears that the customer is trying to prevent the business from filing form 8300 or trying to cause the business to file a false or incomplete from 8300.[4]

When a business voluntarily reports a transaction of less than $10,000, there is no requirement to notify the payer.

Does the customer have to be notified?

Whenever a business is required to file form 8300, the business must provide a written statement to each person identified within the form that contains all of the following information:[5]

- Name and address of the business

- Name and phone number of a contact at the business

- Total amount of reportable cash

- A statement that the business is reporting the transaction to the IRS

Are there penalties for failing to file?

Failing to file Form 8300 when required or manipulating a transaction so that reporting appears unnecessary can lead to severe civil and criminal penalties that may include imprisonment for up to five years.[6]

Do I need to keep copies of Form 8300?

Businesses and trades are required to keep a copy of each Form 8300 it files for five years from the filing date. Any supporting documentation and the required statement it sends to customers must also be kept.[7]

Sources

- Form 8300 Reference Guide: Type of Payments to Report

- Form 8300 Reference Guide: Cash Includes

- Form 8300 Reference Guide: Definition of a Related Transaction

- Form 8300 Reference Guide: Reporting Suspicious Transacrtions

- Form 8300 Reference Guide: Required Written Statement for Customers

- Form 8300 Reference Guide: Penalties

- Form 8300 Reference Guide: Recordkeeping