Updated March 20, 2024

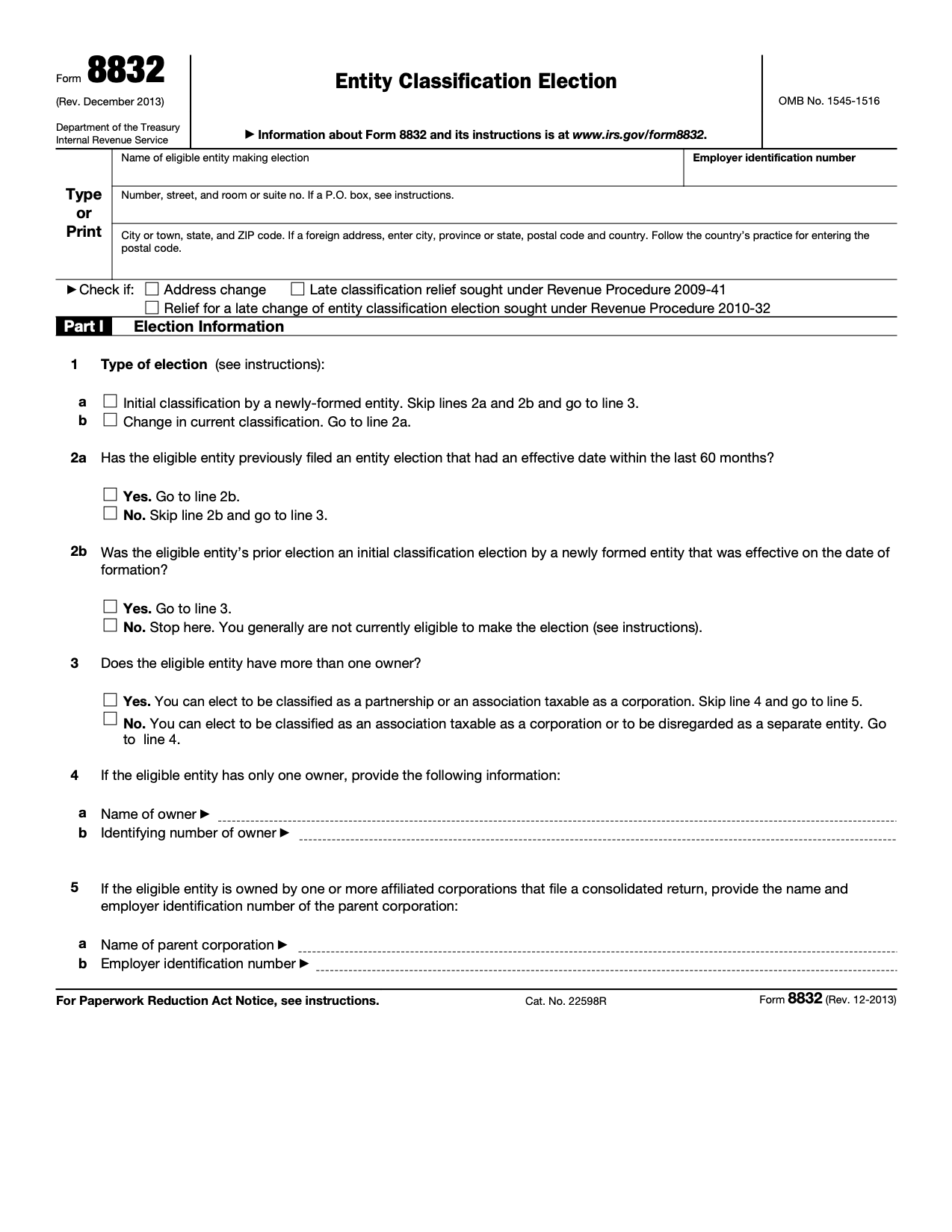

Form 8832 is an IRS tax document used by a business to choose how it will be classified for federal tax purposes. Businesses can elect to be classified as a corporation, a partnership, or a disregarded entity using this form. The IRS uses the information to determine reporting requirements.

Default Rules

If a business does not file an entity classification, the default rules apply:[1]

- Businesses with two or more members are considered partnerships

- Businesses with a single owner are considered disregarded entities

Table of Contents |

Who Can File?

The following entities can elect their tax classification by filing Form 8832:[2]

- LLCs

- Partnerships

- Entities that previously became a corporation by filing Form 8832

- Foreign entities that became a corporation under the foreign default rule

This form is not for:

- Most corporations

- 501(a) tax-exempt organizations

- Real estate investment trusts

- Entities electing to be an S-Corp (use Form 2553 instead)

Tax Implications

The classification selected will change the way an entity and its members file taxes. Eligible entities can elect to be taxed in the following ways using this form:

- Association taxable as a corporation: the business will become a C corporation for federal tax purposes, eliminating “flow-through taxes” that members must pay on their personal income.[3]

- Partnership: entities classified as as partnerships report information to the IRS, but do not pay income taxes. Instead, partners report gains and losses on their individual tax returns.[4]

- Disregarded entity: the default classification for single-member LLCs, a disregarded entity generally files under the owner’s Social Security number (or EIN if the business has employees). The owner is liable for self-employment taxes.[5]

When Does the Election Take Effect?

A new classification elected using Form 8832 cannot apply retroactively more than 75 days before the date of filing, nor can the date effective be delayed more than 12 months after the filing date.[6]

Businesses can request an exception to these rules in the Late Election Relief section of the form. The IRS may grant such relief to businesses that had a valid reason for missing the standard filing deadlines.

Filing Process (8 Steps)

- Verify eligibility

- Choose the appropriate entity type

- Complete Form 8832

- Mail the form to the IRS Service Center for your state (see below)

- Retain proof of filing (certified mail receipt, stamped copy, or IRS confirmation)

- Look for notice of acceptance from the IRS within 60 days

- Attach the form to the entity’s federal tax return or information return for that year

- Ensure the entity’s members file their taxes accordingly

IRS Service Center Mailing Addresses

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201

For: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Tennessee, Texas, Utah, Washington, Wyoming, Foreign Countries, U.S. Possessions

Department of the Treasury

Internal Revenue Service

Kansas City, MO 64999

For: Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Vermont, Virginia, West Virginia, Wisconsin

Frequently Asked Questions

Who has to sign?

Any authorized representative under local law or organizational documents can be the signing party. This is usually an officer, manager, or member. If filing for Late Election Relief, all “affected persons” must sign along with an authorized representative.[7]

Can this form be filed electronically?

Form 8832 is not part of the IRS e-file system. Applicants must mail the form to the appropriate IRS service center.

How can a business change its classification?

If a business already filed to elect its classification and was not a new business at the time it became effective, a 60-month waiting period applies before it can be changed. The IRS may grant limited exceptions if more than 50% of ownership is new.[8]

Sources

- Default Rules | IRS Instructions

- Who Must File | IRS Instructions

- LLC Filing as Corporation | IRS.gov

- Partnerships | IRS.gov

- Single Member LLCs | IRS.gov

- When To File | IRS Instructions

- Specific Instructions: Part II (Late Election Relief) | IRS Instructions

- Specific Instructions: Part I (Election Information), Lines 2a and 2b | IRS Instructions