Updated December 11, 2023

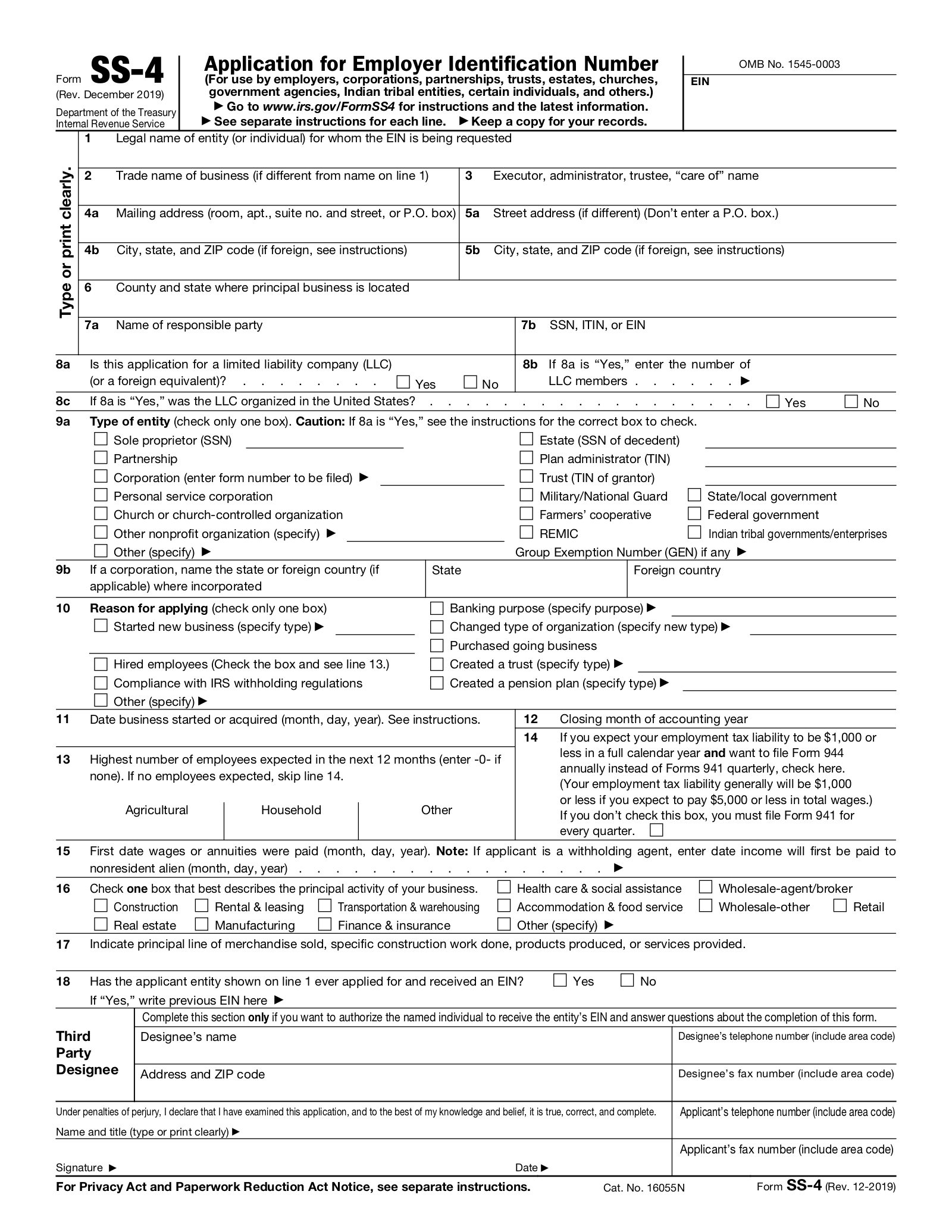

Form SS-4 is an application for an Employer Identification Number (EIN), also known as a Federal Tax Identification Number, from the IRS. The IRS assigns a unique nine-digit number to businesses, other entities, and certain individuals for tax and legal purposes. A single responsible party must submit the form or apply online to obtain an EIN.

Responsible Party

Unless the EIN application is for a government entity, the individual who owns or is in charge of the entity must personally apply. They must provide a valid Taxpayer Identification Number, such as a Social Security Number.

Table of Contents |

Who Needs an EIN?

Most companies and organizations doing business in the U.S. are required to have an EIN for tax reporting, banking, and other purposes. Businesses, non-profits, government agencies, estates, trusts, and other entities may be issued an EIN.

EIN Required

An EIN is required for the following types of entities:[1]

- Businesses with employees: If a business employs workers, it needs an EIN for paying wages, accounting, and taxes.

- Corporations and partnerships: Entities that operate as a corporation or partnership are required to have an EIN.

- Entities filing certain tax returns: Any entity that files Employment, Excise, Fiduciary, or Alcohol, Tobacco, and Firearms tax returns must have an EIN.

- Self-employed retirement plan holders: An EIN is required for self-employed individuals who have a Keogh pension plan.

EIN Not Required

The following types of entities generally do not need an EIN:[2]

- Sole proprietors: Sole proprietors with no employees can use their personal TIN instead of applying for an EIN.

- Independent contractors: Similarly to sole proprietors, those working as independent contractors do not need an EIN and can use their TIN instead.

- Non-income generating trusts and estates: Many trusts and estates are required to have an EIN, but those that do not generate any income are not included in this requirement.

Entities that meet the criteria should apply for an EIN when starting or acquiring a new business, changing the legal structure of a business, hiring employees, creating a trust or pension plan, obtaining a loan, or opening a bank account.[3]

EIN vs. TIN

The term Taxpayer Identification Number (TIN) is a category of numbers assigned to individuals and entities by the government. An EIN, also known as a Federal Tax Identification Number (FTIN), is one kind of TIN.[4] Other kinds of TINs include Social Security numbers and Individual Taxpayer Identification Numbers, which are assigned to people who cannot get a Social Security number.

Who Can Apply For an EIN?

The IRS requires a specific person, known as the “responsible party,” to be named on an EIN application. This is the person who controls, owns, or manages the entity applying, specifically its assets and funds. The responsible party must be an individual person, not an entity, unless the application for an EIN is for a government agency.

The responsible party is usually the owner, general partner, grantor, trustor, or true principal officer of the organization or entity. If there are two people who qualify, the entity can choose either one to serve as the responsible party.[5]

If the responsible party changes, the entity must report this change to the IRS within 60 days by filing Form 8822-B.

Responsible Party vs. Nominee

Sometimes, entities assign a nominee to act on the entity’s behalf during its formation or for a longer period of time. A nominee has limited authority and is not qualified to serve as the responsible party on an EIN application. The IRS may reject applications that name a nominee instead of a legitimate responsible party.

Third-Party Designees

Form SS-4 includes a section for designating a third party to receive the entity’s EIN and correspond with the IRS. A designee can be assigned if the responsible party does not want to directly handle matters related to the EIN beyond being named on the application.

How to Apply

There are multiple ways to apply for an EIN. The IRS issues an EIN instantly to those who apply online, whereas mailed and faxed applications carry longer processing times.[6]

- Online: Use the EIN Assistant offered by the IRS (processing time: instant)

- Fax: Send Form SS-4 to the appropriate number (processing time: four days)

- Mail: Submit Form SS-4 to the relevant address (processing time: up to four weeks)

Foreign individuals without an ITIN can apply for an EIN by calling the IRS International Tax Line at +1 (267) 941-1099.

How to Fill Out Form SS-4

The Application for an Employer Identification Number is a short document with only one page to be filled out. However, the person filling it out will need to have specific information on hand about the entity’s legal status, accounting information, and employees. The responsible party must provide their information and sign the form.

Line 1. Legal Name of Entity

Provide the full legal name of the individual or entity requesting the EIN. For individuals, enter the first name, middle initial, and last name (e.g. “Mary C. Smith”).

Line 2. Trade Name of Business

If the business uses a different trade name or DBA (“Doing Business As”) name, present that name here.

Line 3. Executor, Administrator, or “Care Of” Name

If the entity has designated a person to receive tax information on its behalf, enter that person’s name here. For trusts or estates, enter the name of the fiduciary.

Lines 4a – 5b. Address

Provide the entity’s mailing address and, if separate, its physical address. For addresses outside the United States, provide the city, province or state, postal code, and the full country name.

Line 6. Business Location

List the county and state of the entity’s primary physical location.

Lines 7a – 7b. Responsible Party

Enter the full legal name of the responsible party (first name, middle initial, and last name) and their Taxpayer Identification Number (typically a Social Security Number).

Lines 8a – 8c. LLC Status

Check the appropriate boxes to indicate the entity’s LLC status and, if the entity is an LLC, whether it was organized in the United States. Enter the number of LLC members in Line 8b.

Line 9a. Type of Entity

Select the type of entity that is requesting the EIN. See the Instructions for Form SS-4 for detailed descriptions of each category.

Line 9b. Place Incorporated

If the entity type is a corporation, enter the state or foreign country in which it is incorporated.

Line 10. Reason For Applying

Check the box that best describes the entity’s reason for requesting an EIN (typically starting or acquiring a new business, changing the organization type, or hiring employees).

Line 11. Date Business Started

Indicate the date on which the business was started or acquired. Foreign applicants should enter the date they began or acquired a business in the United States. For estates, enter the date of the decedent’s death. For trusts, enter the date the trust was funded or the date it was required by law to obtain an EIN.

Line 12. Accounting Year

Indicate the last month of the entity’s tax or accounting year, typically based on the calendar year or fiscal year. Certain types of entities are required to abide by specific accounting years.

Line 13. Employees

Enter the number of agricultural, household, and all other employees employed by the entity. Enter “0” for any category in which there are no employees.

Line 14. Form 944

By checking this box, businesses who expect their employment tax liability to be $1,000 or less in a full calendar year can elect to file Form 944 annually instead of filing Form 941 every three months.

Line 15. First Date Wages Paid

For businesses that have employees, enter the first date on which it started paying wages or annuities. Enter N/A if the business does not plan to have employees.

Lines 16 – 17. Principal Business Activity

Select the option that best describes the applicant’s principal business activity on Line 16, or select “Other” and provide your own description. In Line 17, provide detail about the line of business, such as the principal line of merchandise sold, specific construction work done, products produced, or services provided.

Line 18. Prior EIN

If the business previously applied for an EIN, list the old EIN here.

Third-Party Designee

Provide the name, address, and contact information of the third-party designee if one is being assigned.

Applicant’s Contact and Signature

The responsible party must sign and date the form to attest that the application is true, correct, and complete to the best of their knowledge. Their title and contact information must be listed.

FAQs

Where can I find my EIN?

If you have lost your EIN, you can locate it on the original notice from the IRS, statements from a bank or licensing agency you used your EIN with, or past tax returns. You can also contact the IRS Business & Specialty Tax Line at (800) 829-4933.[7]

Can Form SS-4 be filed online?

Those who wish to apply for an EIN online can do so using the IRS EIN Assistant portal. Form SS-4 is not needed for online applicants.

How do I update the information on Form SS-4?

If the business address or responsible party changes, the entity must report this change to the IRS within 60 days by filing Form 8822-B.