Updated March 20, 2024

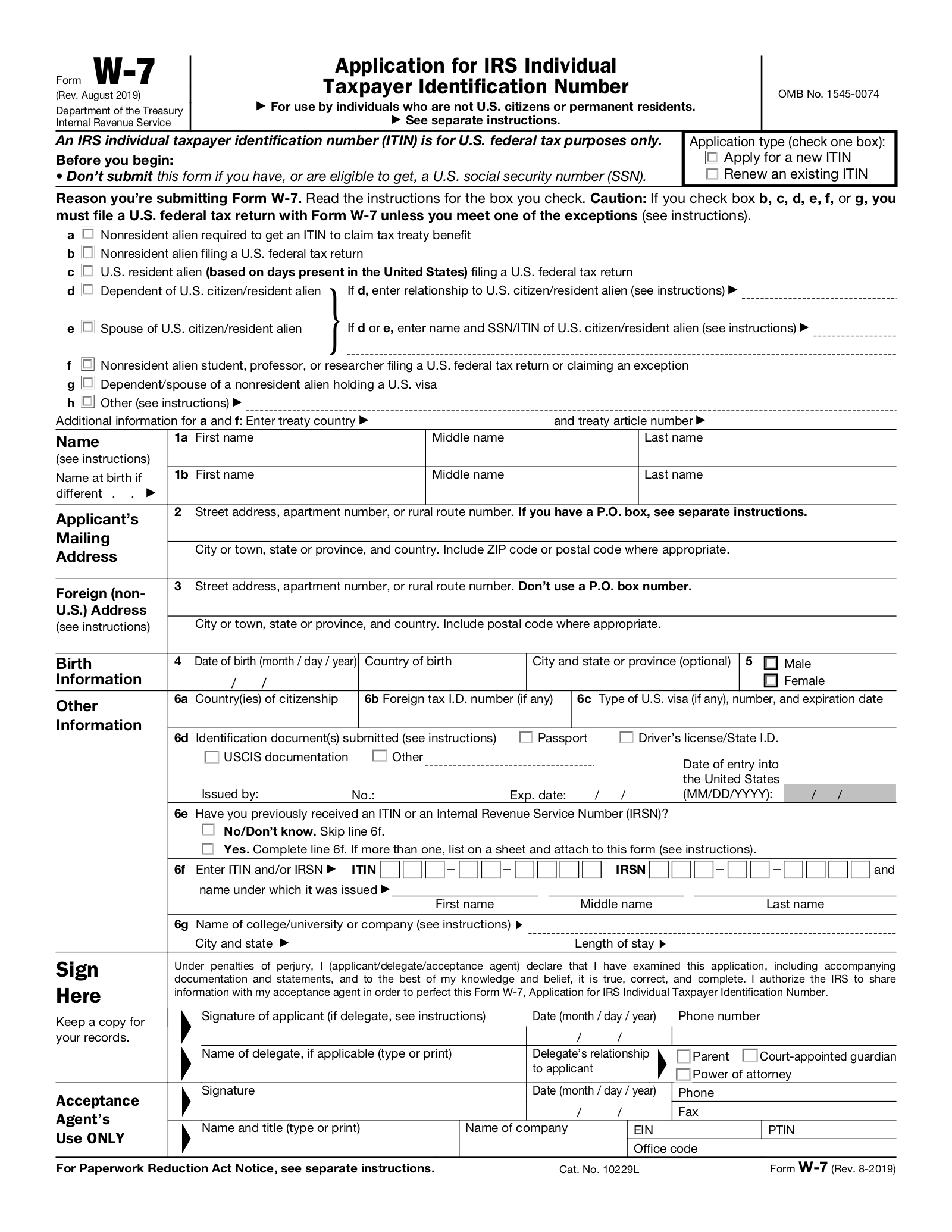

An IRS Form W-7, also called an “Application for IRS Individual Taxpayer Identification Number,” is a form used by individuals who are ineligible for a Social Security Number but still need to file taxes in the United States. If the applicant is approved, a 9-digit Individual Taxpayer Identification Number (ITIN) is issued and is used as a tax processing identifier.

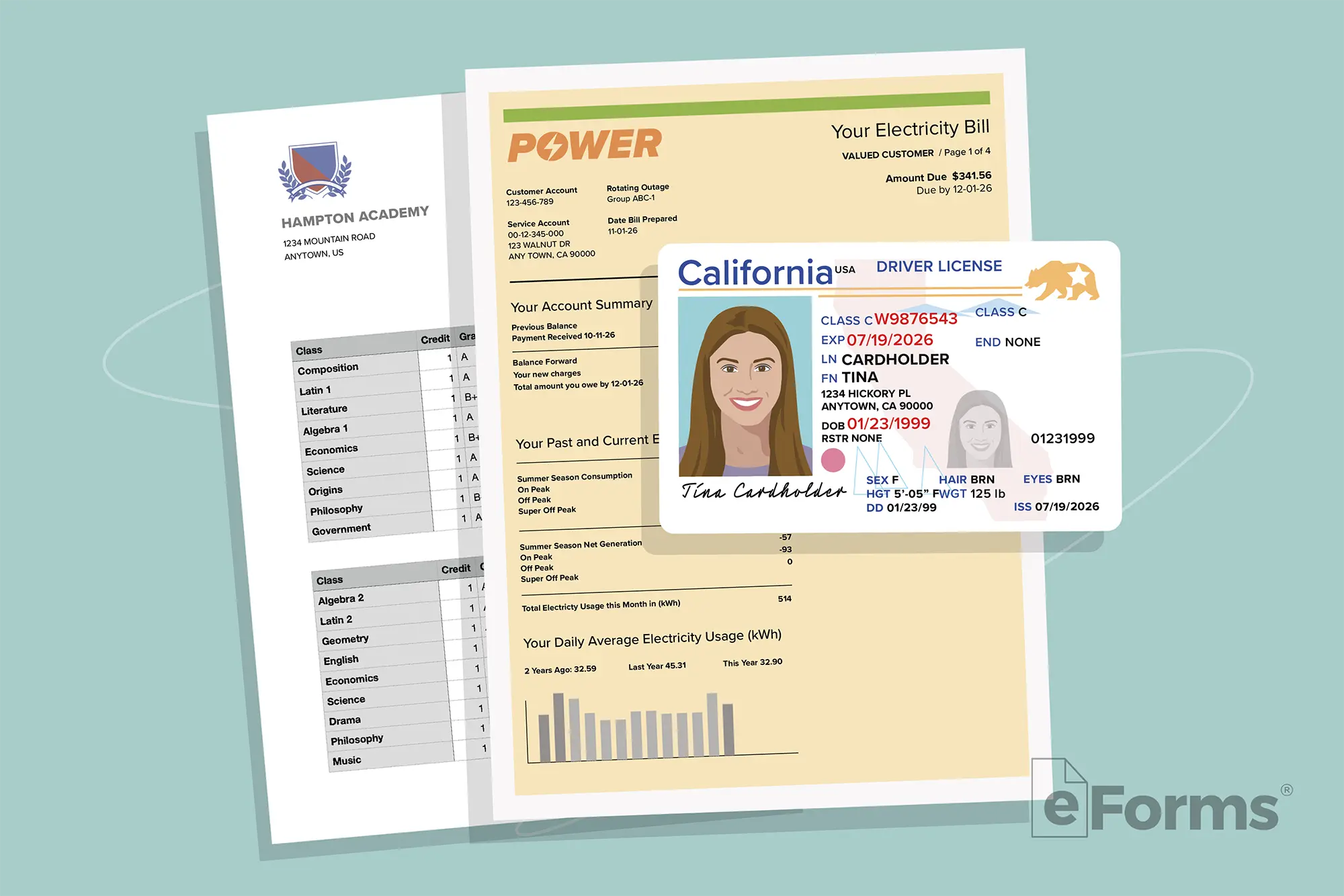

Required Documents:

ITIN applications are required to be submitted as a package with additional documents in order to be approved.

- ITIN Application: Form W7 serves as the application

- Proof of identity and foreign status: most commonly a passport

- Tax return: submit a full return for IRS to process with the application

- Dependents: if W7 is for a dependent, additional documentation required

Table of Contents |

What is an ITIN?

An ITIN is an Individual Taxpayer Identification Number. The federal identifier is only used to process taxes and is for individuals ineligible for a U.S.-issued SSN (Social Security Number) but still needing to file taxes in the United States. ITINs:

- Are in the same format as an SSN (dashes)

- Begin with a “9”

- Expire after a period of inactivity but can be renewed

Example: 9XX-XX-XXXX

Supporting Documents (3)

An ITIN application is required to be sent in with original (or certified copies) supporting documentation that verifies the identity of the applicant. The IRS processes and sends the documents back to the applicant.

Proof of Identity and Foreign Status

Documentation must be submitted that proves both identity and foreign status. Some documentation fulfulls both categories, while some only fulfill each.

BOTH Proof of Identity and Foreign Status:

- Original Passport or certified copy (most highly used and recommended)

- USCIS photo I.D.

- Visa from Department of State

- Foreign military I.D. card

- National I.D. card

- Foreign voter’s registration card

- Civil birth certificate *(only if documents are foreign)

- Medical records *(only for under age 6 and if documents are foreign)

- School records *(only for under age 18 and if documents are foreign)

Identity Only:

- U.S. driver’s license

- U.S. military identification card

- Foreign driver’s license

- U.S. state I.D.

Tax Returns

Applicants must submit a tax return along with the applicant unless they qualify for an exception. The entire return must be included in FULL so the IRS can process the return.

Dependent Documentation

Documentation to prove dependent residency is required for dependent applicants. One of the following would also need to be submitted in addition to a passport if dependent passports do not include a date of entry into the U.S. unless the dependent is from Canada or Mexico or are dependents of overseas U.S. military.

- 18 or older: U.S. school record, U.S. property rent statement, U.S. utility bill, U.S. bank statement, U.S. state I.D. or driver’s license, or a U.S. visa.

- Ages 6-17: U.S. school record, U.S. state I.D. or driver’s license, or a U.S. visa.

- Under 6: U.S. medical record, U.S. school record, U.S. state I.D. or driver’s license, or a U.S. visa.

Eligibility

Not everyone is eligible for an ITIN. According to the IRS, the following circumstances are permitted for an ITIN applicant:[1]

- nonresident alien claiming reduced withholding under income tax treaty

- nonresident alien ineligible for SSN that is required to file a tax return

- nonresident alien ineligible for SSN filing a joint return with a resident/citizen spouse

- resident alien ineligible for SSN filing a U.S. tax return

- nonresident alien student, professor, or researcher ineligible for SSN

- alien spouse ineligible for SSN and claimed as an exemption

SSN Eligibility

An ITIN is NOT for individuals eligible for an SSN and is only used for federal tax purposes. An ITIN will not grant any social security benefits.[2] Form SS-5 (Application for Social Security Card) should be used instead to apply for a social security card.

W-7 Form Parts (5)

Part 1 – Application Type

The first part of the W-7 asks if the applicant is applying for a new ITIN or renewing an existing ITIN.

Part 2 – Reason for Submission

The applicant should select the reason for submission. Only reasons the reasons listed fulfill the eligibility requirements for submitting an ITIN application.

Part 3 – Identifying Information

The applicant should be ready to supply:

- Name

- Mailing address (where documents will be returned)

- Foreign address

- Birth information

- Other required identifiers

Part 4 – Signatures

The form must be signed by the applicant in order to be valid.

Part 5 – Acceptance Agent’s Use

The last part of the application must be left blank and will be used by an IRS agent.

Instructions and How to File (6 Steps)

- Determine Eligibility

- Complete Form W-7

- Gather Proof of Identity and Foreign Status

- Gather Supporting Documentation

- Send in the Application

- Wait 7 Weeks

1. Determine Eligibility

3. Gather Proof of Identity and Foreign Status

Original or certified copies that prove your identity and connection to a foreign country are needed. Documentation that can be used to establish BOTH foreign status and identity are:[3]

- Valid passport (with date of entry);

- USCIS photo identification;

- Visa issued by U.S. Department of State;

- Foreign military identification card;

- National ID;

- Foreign voter’s registration card;

- Civil birth certificate;

- Medical records (only for dependents under age 6); or

- School records (only for dependents under 18 if a student)

A U.S. driver’s license, U.S. military identification card, and a foreign driver’s license can only be used for identity, not foreign status. Additional documentation will be required to prove foreign status. All documents submitted must be original documents or certified copies.

4. Gather Supporting Documentation

Additional supporting documentation required depends on the reason for the application.

- Taxes – Attach a federal tax return unless you qualify for an exception

- Applying for Dependent – Supporting documents to establish the relationship (birth certificate, adoption papers)

- Applying for Non-Dependent – Supporting documents to establish the relationship (medical records, lease agreement)

The original tax return for which the ITIN is needed must be attached to the application unless you qualify for an exception. The IRS will then process the tax return and issue an ITIN, which will be used for the tax return. The SSN/ITIN area on the tax return can be left blank when sending in the forms to the IRS.

5. Send in the Application

Mail all documents to:

Internal Revenue Service

ITIN Operation

P.O. Box 149342

Austin, TX 78714-9342

The IRS does not require a return envelope, and all original documents will be returned to the mailing address provided on the W-7.[4]

Spanish (Español) Version

Spanish version of Form W7.

Download: PDF

Frequently Asked Questions (FAQs)

How long does it take to get an ITIN approved?

The IRS states to allow 7 weeks for notification of your application status and 9-11 weeks if submitted during peak processing times.[5]

When do ITINs expire?

An ITIN expires if the number was not used to file taxes for 3 consecutive years.

How can an ITIN be applied for from out of the United States?

Form W-7, along with original documents, can be sent from out of the country. Check the IRS’s instructions for applying from abroad.

What are typical reasons to apply for an ITIN?

Common reasons applicants apply are:

- Filing U.S. taxes

- Claiming tax benefits for dependents/spouse without SSN

- Withholding tax on U.S. income

- Eligible for tax treaty benefits

- Owning/investing in U.S. business

- Real estate transactions

- Receiving scholarships/grants from U.S. institutions

- Some STATE tax filings

Sources

- https://www.irs.gov/help/ita/am-i-eligible-to-apply-for-an-individual-taxpayer-identification-number

- https://www.irs.gov/individuals/international-taxpayers/individual-taxpayer-identification-number-itin-reminders-for-tax-professionals

- https://www.irs.gov/individuals/revised-application-standards-for-itins

- https://www.irs.gov/individuals/international-taxpayers/itin-documentation-frequently-asked-questions-faqs

- https://www.irs.gov/individuals/itin-expiration-faqs#:~:text=A11%3A%20If%20you%20qualify%20for,30)%20or%20from%20abroad).