Updated March 05, 2024

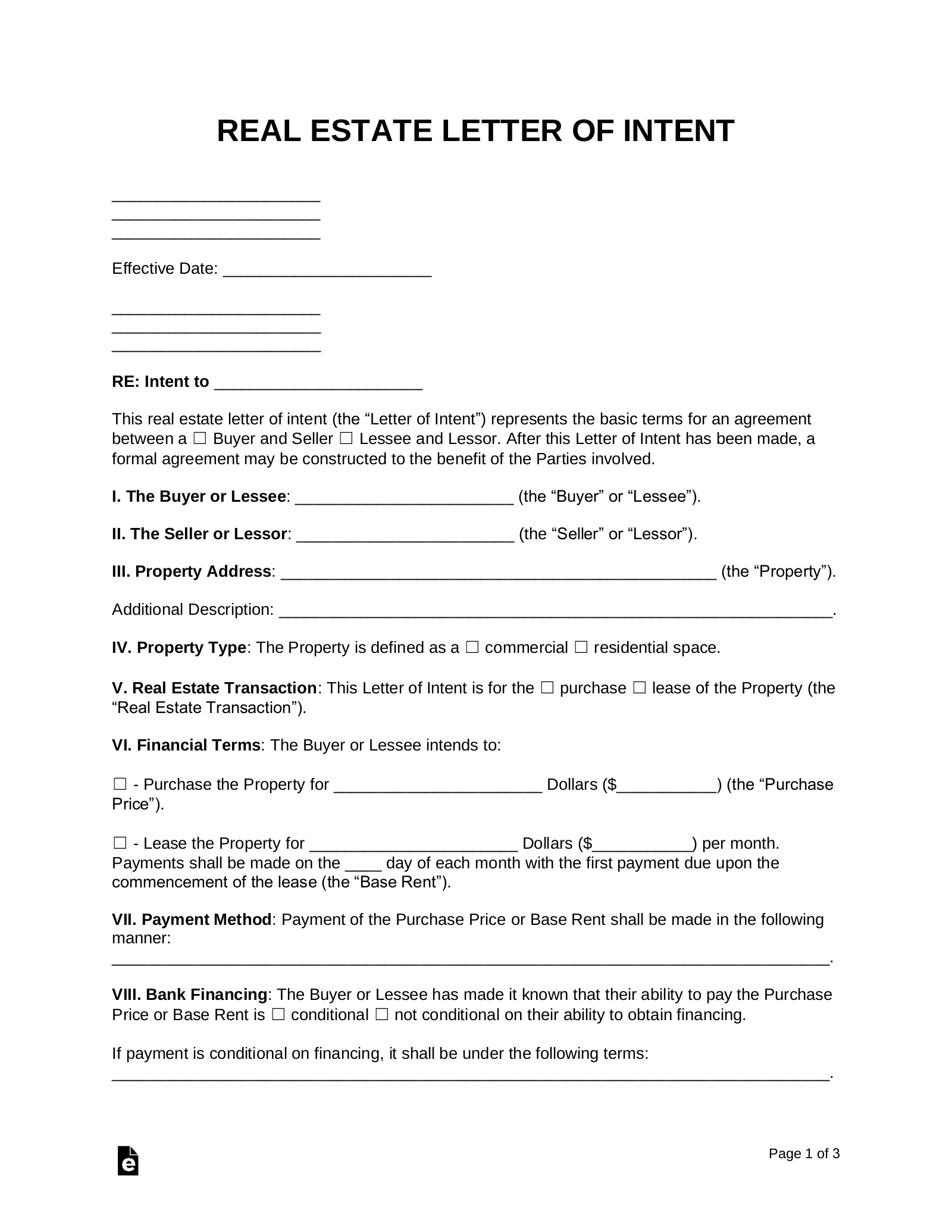

A real estate letter of intent (LOI) is a non-binding agreement that outlines the terms of a sale or lease contract. Once a letter of intent is signed, it becomes a legally binding contract, commonly in the form of a purchase agreement or lease agreement.

By Type (4)

Download: PDF, MS Word, OpenDocument

Download: PDF, MS Word, OpenDocument

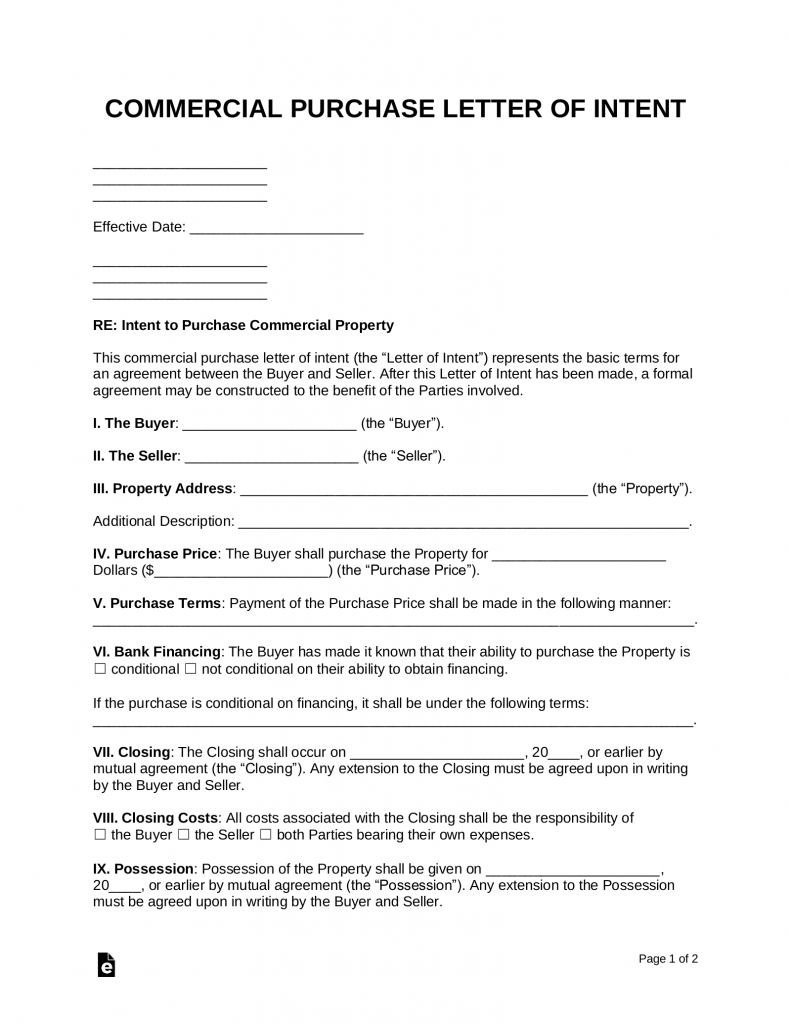

Purchase – Commercial Property

Purchase – Commercial Property

Download: PDF, MS Word, OpenDocument

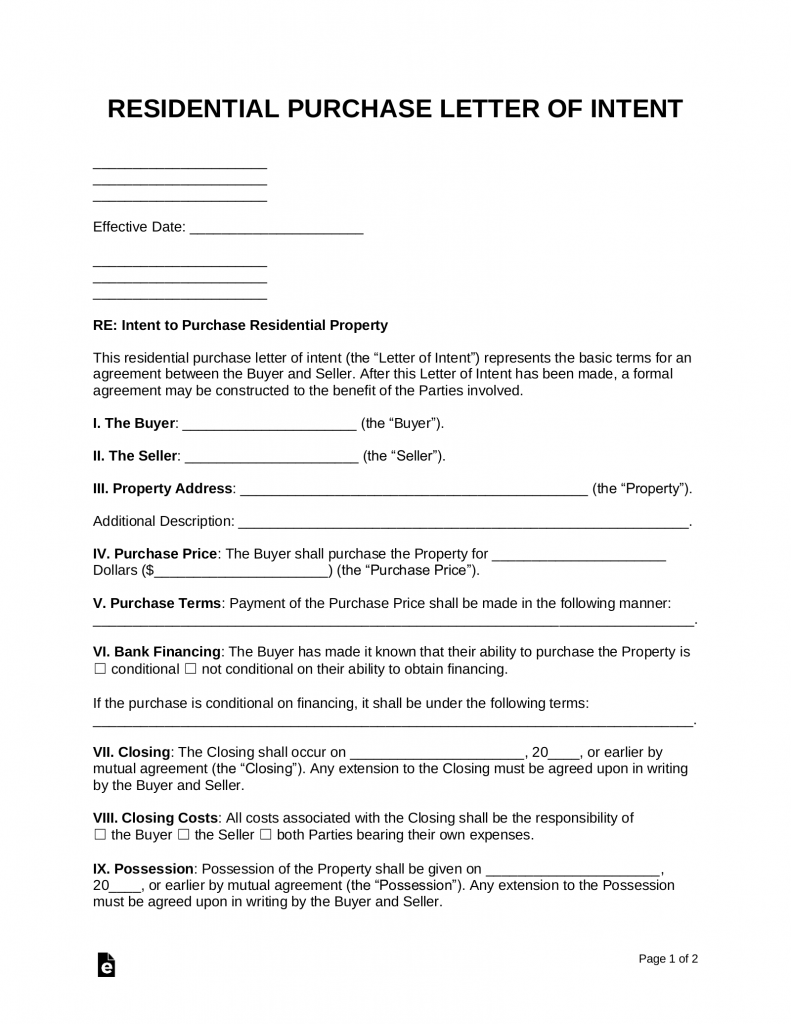

Purchase – Residential Property

Purchase – Residential Property

Download: PDF, MS Word, OpenDocument

Table of Contents |

Is a Letter of Intent Binding?

It is up to the parties to determine whether the letter of intent will be legally binding. After this decision is made, a statement indicating the binding status of the document should be incorporated into the language of the form. It is far more challenging to enforce the agreement without this written declaration.

How a Letter of Intent Works (5 steps)

- Buyer/Tenant Views the Property

- The Parties Negotiate

- Binding Arrangement is Made

- Inspection Period

- The Closing

2. The Parties Negotiate

If the buyer or tenant chooses to proceed with the transaction after assessing the property, they should complete a letter of intent and present it to the owner for review. This letter offers a general description of the proposed transaction, including the desired financial terms and completion dates. Negotiations between the parties will likely continue if the owner is unsatisfied with the initial offer.

If the buyer or tenant chooses to proceed with the transaction after assessing the property, they should complete a letter of intent and present it to the owner for review. This letter offers a general description of the proposed transaction, including the desired financial terms and completion dates. Negotiations between the parties will likely continue if the owner is unsatisfied with the initial offer.

3. Binding Arrangement is Made

Once the real estate conditions have been successfully negotiated, a binding contract should be drafted and carefully reviewed by each party. The document used at this time will either be a purchase agreement or a lease. For purchase agreements, the parties may wish to have a lawyer examine the contract before entering into an officially binding contract.

Once the real estate conditions have been successfully negotiated, a binding contract should be drafted and carefully reviewed by each party. The document used at this time will either be a purchase agreement or a lease. For purchase agreements, the parties may wish to have a lawyer examine the contract before entering into an officially binding contract.

4. Inspection Period

Purchase agreements typically contain a clause granting the buyer a specified amount of time during which they can inspect the premises. If the property fails to meet their standards, the buyer can usually back out of the agreement or negotiate new terms with the owner. A qualified professional should perform the inspection. If the buyer is satisfied with the inspection results, or if no inspection is performed, the buyer’s offer will be accepted.

Purchase agreements typically contain a clause granting the buyer a specified amount of time during which they can inspect the premises. If the property fails to meet their standards, the buyer can usually back out of the agreement or negotiate new terms with the owner. A qualified professional should perform the inspection. If the buyer is satisfied with the inspection results, or if no inspection is performed, the buyer’s offer will be accepted.

5. The Closing

The closing is a predetermined date when ownership of the property is officially transferred to the buyer. Depending on the state where the property is, the parties may need to meet in person with various entities (e.g., notary, escrow company, titling insurance agent) to complete the transaction. Closing will always involve the parties signing the necessary paperwork and paying associated fees.

The closing is a predetermined date when ownership of the property is officially transferred to the buyer. Depending on the state where the property is, the parties may need to meet in person with various entities (e.g., notary, escrow company, titling insurance agent) to complete the transaction. Closing will always involve the parties signing the necessary paperwork and paying associated fees.

Sample – Real Estate Letter of Intent

Effective Date: June 1, 2019

RE: Intent to Lease a Commercial Property

This real estate letter of intent (the “Letter of Intent”) represents the basic terms for an agreement between a Lessee and Lessor. After this Letter of Intent has been made, a formal agreement may be constructed for the benefit of the Parties involved.

I. The Buyer or Lessee: Salmon Bass (the “Buyer” or “Lessee”).

II. The Seller or Lessor: Mike Schmidt (the “Seller” or “Lessor”).

III. Property Address: 101 Property Way, Samford, Connecticut 06912 (the “Property”).

IV. Property Type: The Property is defined as a commercial space.

V. Real Estate Transaction: This Letter of Intent is for the lease of the Property (the “Real Estate Transaction”).

VI. Financial Terms: The Buyer or Lessee intends to lease the Property for Two Thousand Dollars ($2,000) per month. Payments shall be made on the 1st day of each month with the first payment due upon the commencement of the lease (the “Base Rent”).

VII. Payment Method: Payment of the Purchase Price or Base Rent shall be made in the following manner: Lessee will issue post-dated checks for the entirety of the lease term. All checks will be provided to the Lessor within 5 days of signing a binding lease.

VIII. Bank Financing: The Buyer or Lessee has made it known that their ability to pay the Purchase Price or Base Rent is not conditional on their ability to obtain financing.

If payment is conditional on financing, it shall be under the following terms: N/A.

IX. Purchase Conditions: If the Real Estate Transaction is for the purchase of the Property, the following conditions shall apply:

- Closing. The Closing shall occur on _______________________, 20____, or earlier by mutual agreement (the “Closing”). Any extension to the Closing must be agreed upon in writing by the Buyer and Seller.

- Closing Costs. All costs associated with the Closing shall be the responsibility of ☐ the Buyer ☐ the Seller ☐ both Parties bearing their own expenses.

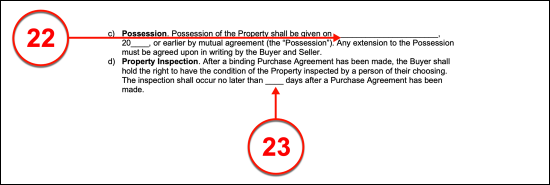

- Possession. Possession of the Property shall be given on _______________________, 20____, or earlier by mutual agreement (the “Possession”). Any extension to the Possession must be agreed upon in writing by the Buyer and Seller.

- Property Inspection. After a binding Purchase Agreement has been made, the Buyer shall hold the right to have the condition of the Property inspected by a person of their choosing. The inspection shall occur no later than ____ days after a Purchase Agreement has been made.

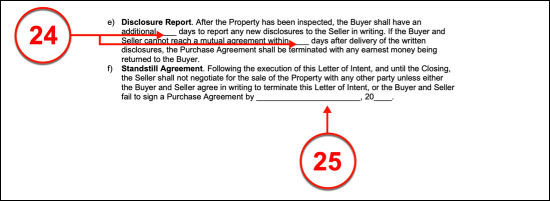

- Disclosure Report. After the Property has been inspected, the Buyer shall have an additional ____ days to report any new disclosures to the Seller in writing. If the Buyer and Seller cannot reach a mutual agreement within ____ days after delivery of the written disclosures, the Purchase Agreement shall be terminated with any earnest money being returned to the Buyer.

- Standstill Agreement. Following the execution of this Letter of Intent, and until the Closing, the Seller shall not negotiate for the sale of the Property with any other party unless either the Buyer and Seller agree in writing to terminate this Letter of Intent, or the Buyer and Seller fail to sign a Purchase Agreement by _______________________, 20____.

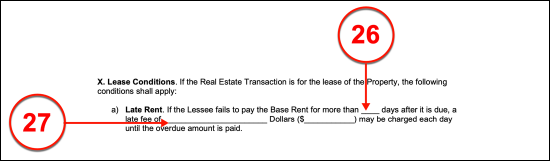

X. Lease Conditions. If the Real Estate Transaction is for the lease of the Property, the following conditions shall apply:

- Late Rent. If the Lessee fails to pay the Base Rent for more than 15 days after it is due, a late fee of Fifteen Dollars ($15) may be charged each day until the overdue amount is paid.

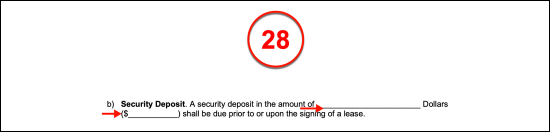

- Security Deposit. A security deposit in the amount of Two Thousand Dollars ($2,000) shall be due prior to or upon the signing of a lease.

- Subletting. The Lessee may not sublet the Premises without first obtaining the prior written consent of the Lessor.

- Appliances and Furniture. The Landlord shall provide the following items for the use of the Lessee: Fridge, stove, washer, dryer.

- Parking. The Lessor shall provide 1 parking space(s) to the Lessee for a fee of Thirty Dollars ($30). This amount shall be paid to the Lessor on a monthly basis in addition to the Base Rent.

- Pets. The Lessee shall have the right to 2 pet(s) on the Premises. The following types of pets are allowed: Cats, dogs.

XI. Expenses: If the Real Estate Transaction is for the lease of the Property, the Lessee shall be required to pay the following monthly expenses in addition to the Base Rent: Heat, electricity.

The Lessor shall be required to pay the following monthly expenses: All other property expenses.

XII. Lease Term: If the Real Estate Transaction is for the lease of the Property, the term of the lease shall be a fixed period commencing on the 1st day of July, 2019, and expiring on the 30th day of June, 2020.

XIII. Lease Termination: If the Real Estate Transaction is for the lease of the Property, the lease may only be terminated under the following conditions: The Lessee shall have the right to terminate the lease by providing at least 90 days’ notice to the Lessor.

XIV. Binding Effect: This Letter of Intent shall be considered non-binding. Therefore, the Parties acknowledge that this Letter of Intent is not enforceable by any Party. The terms outlined herein are solely for the purposes of reaching an agreement in the future, of which the Lessee and Lessor are not bound.

XV. Additional Provisions: The security deposit shall be returned to the Lessee within 30 days of vacating the property. Any deductions to the deposit shall be itemized in writing by the Lessor and reported to the Lessee when the deposit is returned.

XVI. Currency: All mentions of currency or the usage of the “$” icon shall be known as referring to the US Dollar.

XVII. Governing Law: This Letter of Intent shall be governed under the laws of the State of Connecticut.

XVIII. Acceptance: If you are agreeable to the aforementioned terms, please sign and return a duplicate copy of this Letter of Intent by no later than June 15, 2019.

How to Write

Download: PDF, MS Word, OpenDocumen

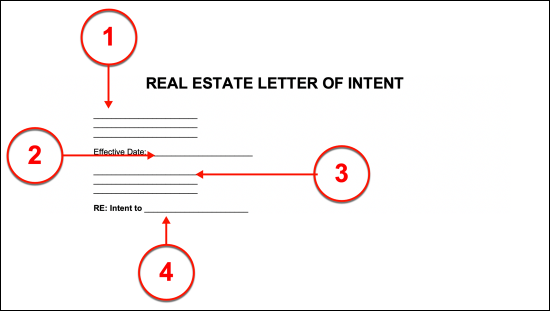

(1) Return Address Of Sender. The full address of this letter’s Sender is required at the top of the page. In most cases, the Sender will be a Property Owner or Property Manager seeking to sell or lease real property however, it can be generated by a prospective Property Buyer or potential Lessee. In any case, the mailing address where the Recipient may send further inquiries or a response should be displayed for easy reference.

(2) Effective Date Of Intent To Enter An Agreement. The filing date for this letter should be produced. This will be the date used to reference the information and intent contained in this document is officially set and made. If desired, it may be the same date both Parties have signed this document.

(3) Recipient Address. The Recipient’s full mailing address is expected before the start of this letter as well. This will aid in solidifying who the Sender is contacting and where he or she can be contacted by mail.

(4) Subject Line. The exact reason why this letter is being sent should be presented. For instance, the intent may be to lease or sell a property to the Recipient. This should be kept brief so merely stating the sale or renting of a specific property (i.e. Lease of Unit A in Building B) will be sufficient.

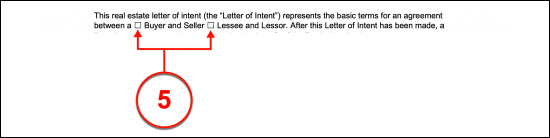

(5) Party Definitions. It is crucial that the type of Parties involved in this letter is defined. Thus, if this document concerns a “Buyer And Seller” select the first checkbox in the opening paragraph by placing an “X” or a checkmark in it. Otherwise, mark the second checkbox to indicate this paperwork will be between a “Lessee and Lessor.” Only one of these options may be selected to properly establish the purpose of this letter.

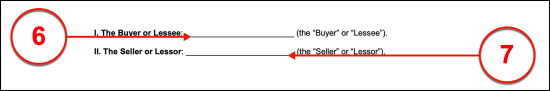

I. The Buyer Or Lessee

(6) Buyer Or Lessee Identity. The role of each Party involved must be presented beginning with the name of the potential Property Buyer or the Lessee. Deliver this Party’s full name to the First Article. This will be the Party who wishes to buy or rent the property this letter will discuss under the conditions that will be explained.

II. Seller Or Lessor

(7) Name Of Seller Or Lessor. Naturally, the Seller or Property Manager/Owner of the concerned property will need to be identified as well. Supply the legal name of the Party or Entity who intends to sell or rent out the property.

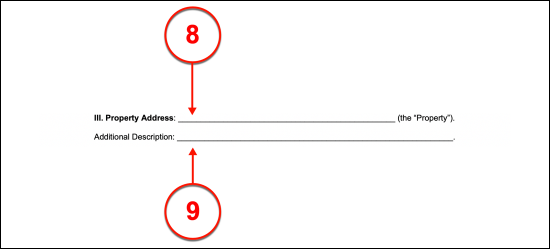

III. Property Address

(8) Address Of Rental Or Property. The physical address will be used to identify the rental property or the property for sale by documenting where one may visit and enter the concerned property.

(9) Additional Description. In some cases, additional information may be required to fully identify a rental property or property for sale. For instance, it may be near specific landmarks or may have structures (i.e. a swimming pool or a parking lot) on it that would aid in its identification. Supply any such information to the space provided in Article III.

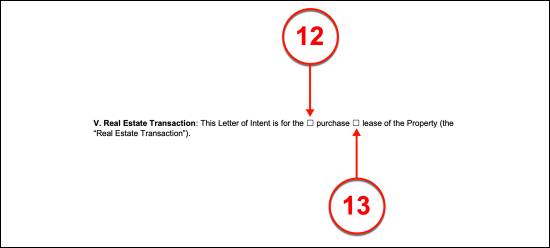

V. Real Estate Transaction

Select Either Item 12 Or Item 13

(12) Purchase. The transaction the Parties will consider engaging in through the content of this letter should be discussed. Therefore, review the options displayed in Article V. If the purpose of this letter is to discuss the purchase of a property (by either the Sender or Recipient) then, choose the first checkbox.

(13) Lease Of Property. If the transaction these Parties may conduct as a result of this letter is the leasing of the defined property, then select the second checkbox.

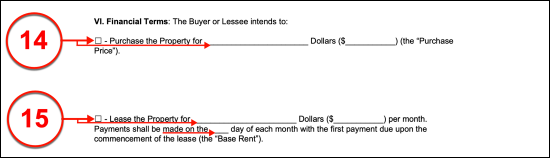

VI. Financial Terms

(14) For Property Purchase. If this document may lead to the purchase of real property, then the price the Seller expects in exchange of the property should be established. For this, select the first checkbox statement on display in Article VI then define the selling price of the property in writing and numerically to the spaces provided.

(15) For Property Leasing. Similarly, if this paperwork concerns a property lease, this should be indicated and the monthly rent defined. In this case, select the second checkbox option from Article VI and define the monthly rent by writing it out to the first available line and displaying it numerically on the second available space. Additionally, produce the calendar day of each month when the rent amount reported above must be paid.

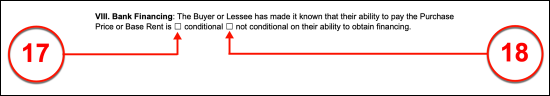

VIII. Bank Financing

(17) Financing Required. A brief discussion on financing will be required if one of the Parties engaged in this paperwork is the Seller of a property. If the Seller will not engage in this transaction unless the Buyer can demonstrate that he or she has already obtained the means to finance this sale through a bank, then place a mark in the checkbox attached to the word “Conditional” found in the Eighth Article.

(18) Financing Not Required. If the Seller will proceed with the next step after this letter regardless of the Buyer’s proof of financing, then select the “Not Conditional” checkbox from the Eighth Article.

(19) Required Financing Conditions. Any financing requirements the Seller places on the proposed transaction should be detailed in the space provided. If needed, additional lines may be inserted in this area or an attachment can be made to accommodate the information needed. Note, if an attachment is made, make sure the title is defined space provided by Article VIII. Notice that several topics will bear discussion on this topic in the next article. If this paperwork concerns a lease, then proceed to Article X.

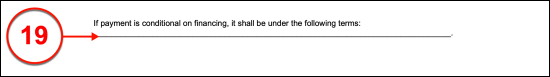

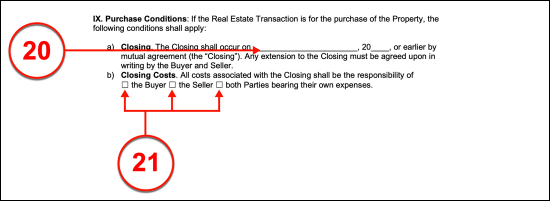

IX. Purchase Conditions

(20) Closing Date. It is mandatory that the closing date both the Buyer and Seller agree to is established. Furnish this date to Statement A under Article IX.

(21) Closing Costs. Since closing a property sale will involve that money be paid to additional Parties (i.e. a Broker or Agent fees), then this letter must solidify who will be responsible for such additional costs. Thus, select “Buyer” or “Seller” from Statement B to assign the appropriate Party as the Payer of the closing costs or elect the third checkbox (“Both Parties”) to indicate that both the Buyer and the Seller will be required to pay their own expenses.

(22) Possession. Document the calendar date when the Seller shall release the possession of the real property to the Seller in Statement C.

(23) Property Inspection. Many Buyers will require that an inspection of the concerned property is conducted within a given period of time after a Purchase Agreement is completed. Furnish the maximum number of days after the potential Purchase Agreement’s execution when an inspection will be considered valid (and required) to the area provided in Statement D.

(24) Disclosure Report. If a property inspection results in additional required content to a disclosure report (i.e. newly discovered water damage), then the Seller must be informed. Document the number of days after the inspection when any such additions to a disclosure report must be recorded with the Seller (in writing) as well as the number of days after receiving such additions that nullify this letter should an agreement not be reached between the Buyer and the Seller regarding additional disclosures.

(25) Standstill Agreement. Naturally, the Seller will not wish to risk losing a sale on this property if an agreement between the Seller and Buyer cannot be reached. Since such a process may be lengthy, a deadline on when the execution of a Purchase Agreement resulting from this letter must be signed lest the conditions, terms, and restrictions in this letter terminate should be imposed. Supply the deadline date for the execution of a Purchase Agreement from this letter to Statement F.

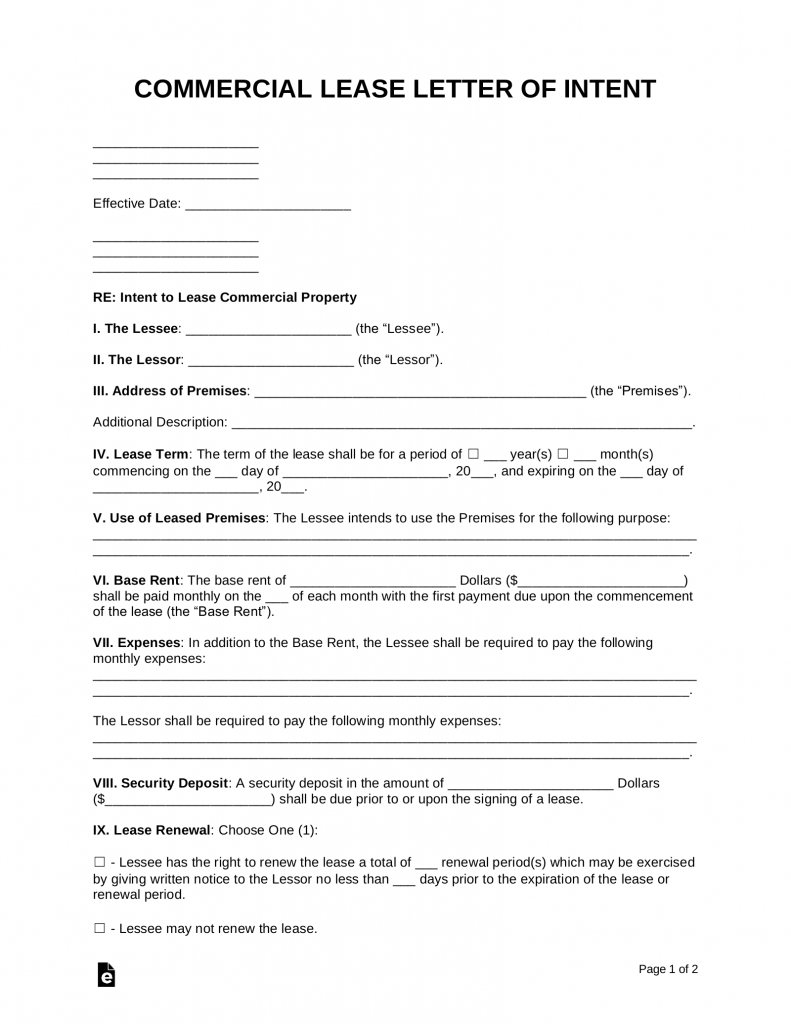

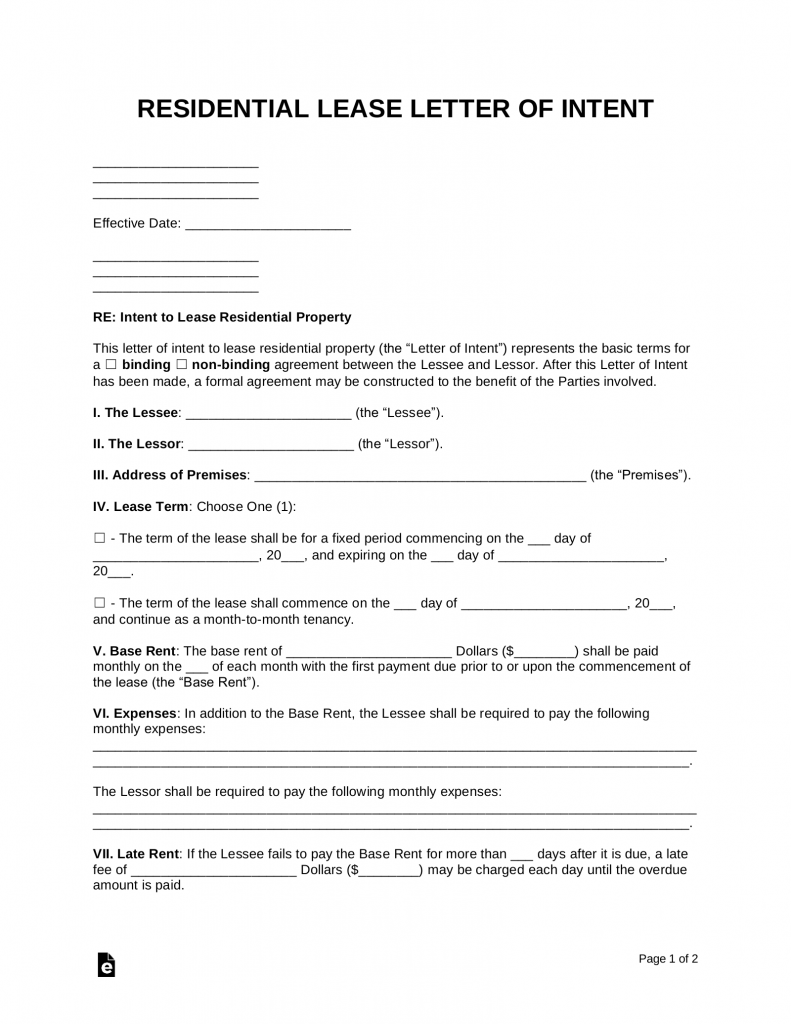

X. Lease Conditions

(26) Late Rent. If the Parties participating in this letter are a Lessor and Lessee then the conditions of the lease that may be offered for execution will need to be discussed. Thus, the first statement in Article X requests a report on the results of a late payment from the potential Tenant. Supply the number of days after the monthly rent’s due date that shall constitute the grace period afforded to the Tenant for payment.

(27) Late Rent Penalty. Notice that Statement A here will also require that the penalty amount that shall be added to a late rent payment is established. Produce this amount as requested.

(28) Security Deposit. In most, (if not all) leases, a dollar amount will need to be submitted from the Tenant for the Lessor to hold in case any damages or violations occur that require a financial solution. The security deposit amount that will be required by a lease that results from this paperwork should be dispensed to Statement B.

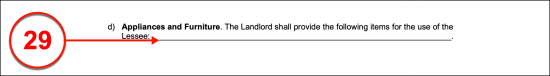

(29) Appliances And Furniture. Some Lessors will provide certain items available to the Tenant during the resulting lease. For instance, short-term or vacation rental property may be furnished with the needs of day-to-day living. Such items (i.e. wifi equipment, refrigerator, etc.) should be identified in this letter using the space provided in Statement E to do so.

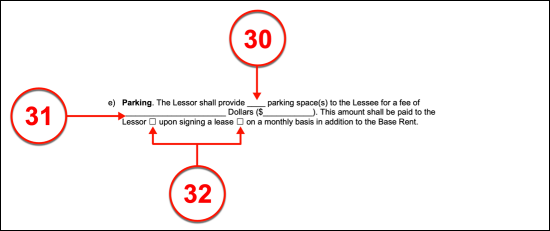

(30) Parking. Furnish the number of parking spaces that will be made available by the potential Lessor during the lease term to the first space available in Statement E.

(31) Parking Payment Amount. If the number of parking spaces that will be available is greater than zero then some additional information will need to be furnished in this statement, beginning with the dollar amount that will be required of the Tenant to access the available parking space(s) during the lease.

(32) Parking Payment Details. This dollar amount must be defined as either a single payment that is due when the lease is signed by marking the first checkbox or, by selecting the second checkbox, as a monthly payment that must be received periodically and on time for the lease term.

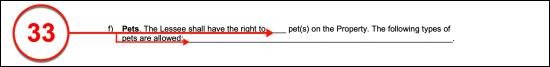

(33) Pets. If the potential lease allows for pets, then document the number of pets the Tenant will be allowed to keep on the premises during the lease as well as a list of the types of pets (i.e. dog under 70 lbs, cats, etc.) allowed.

XI. Expenses

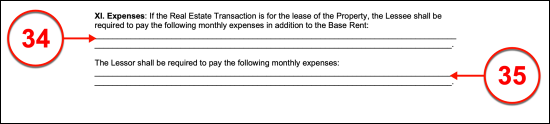

(34) Lessee Expenses. Any additional monthly payment that would be under the responsibility of the Tenant or Lessee for the term of the lease (in addition to the monthly rent) must be recorded in the first area displayed in Article XI. For instance, the Lessee may be required to obtain and maintain renter’s insurance during the lease term.

(35) Lessor Expenses. If the Lessor or Property Manager will be required to pay any monthly expenses to maintain the rental while the potential lease is in effect, then document these expenses in the second area of Article XI.

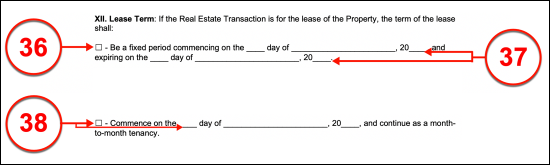

XII. Lease Term

Select Item 36 Or Select Item 38

(36) Fixed Period. Should the purpose of this letter be to discuss a lease agreement then, Article XII should be addressed. One of two choices must be selected from this area to define the lifespan of the potential lease. If the lease will be a fixed-term lease that shall begin and terminate naturally on specific dates then select the first statement’s checkbox.

(37) Fixed Period Details. A lease for a fixed period will require that the first date of the lease term and the final date of the lease term are reported to the contents of the first statement (if selected).

(38) Month-To-Month Tenancy. If the potential lease agreement should be considered in effect at the will of the Parties involved, then select the second checkbox statement. Additionally, dispense the first calendar date that the lease this letter discusses shall commence.

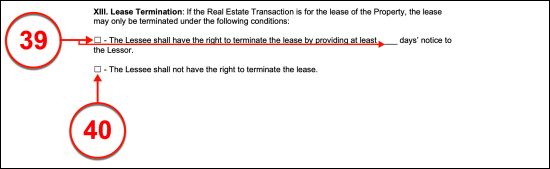

XIII. Lease Termination

Select Item 39 Or Item 40

(39) Lessee Right To Terminate Lease. If a rental agreement is involved then the manner by which the lease this document prepares its Participants to enter will terminate should be discussed. If the Lessee may terminate the resulting lease agreement when desired with a predetermined number of days warning given beforehand then select the first checkbox statement. Additionally, supply the number of days required for such termination notice to the blank space provided.

(40) Termination By Lessee Not Allowed. If the lease this letter focuses on cannot be terminated by the Lessee, then select the second checkbox statement.

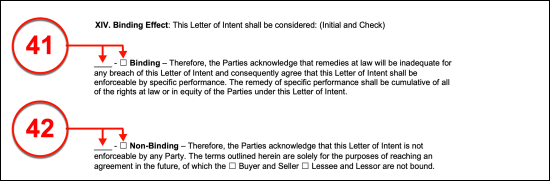

XIV. Binding Effect

Select Item 41 Or Select Item 42

(41) Binding. The Fourteenth Article requires that this paperwork be set as either a binding agreement or a non-binding agreement. If the conditions and terms documented in this letter can be legally enforced in a court of law, then mark the first statement in this section.

(42) Non-Binding. If this letter’s condition or terms will not be considered enforceable in a court of law, then select the second checkbox statement in Article XIV.

XV. Additional Provisions

(43) Remaining Conditions And Terms. Whether this letter concerns a potential property sale or a potential lease, it should be an accurate representation of the resulting transaction. To this end, any topics that have not been discussed thus far but will be part of the potential transaction should be documented in Article XV. Only the conditions and the terms included by this paperwork at the time of signing can be judged as part of this agreement. Any conditions and terms not discussed above and not documented in this area will not be considered part of this letter’s agreement.

XVII. Governing Law

(44) Jurisdiction. As mentioned earlier, this letter may be considered enforceable in a court of law or be considered non-binding. Regardless of this status, the name of the State whose courts would review any misconduct, violations, or misunderstandings resulting from this paperwork should be produced to the space provided in Article XVII.

XVIII. Acceptance

(45) Return Requirement. The deadline that the Sender behind this letter imposes on a response should be furnished to Article XVIII.

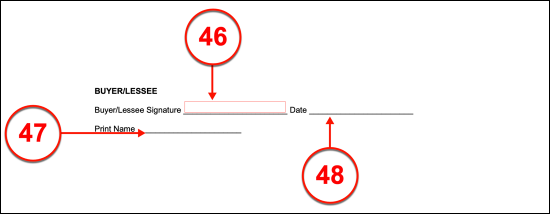

Buyer/Lessee

(46) Buyer/Lessee Signature. The Buyer or the Lessee that is named in the First Article must sign his or her name to benefit from this letter. This action should only be completed if the Buyer or Lessor has reviewed the contents of this document, any attachments provided, and intends to agree to the conditions and terms presented by these items.

(47) Buyer/Lessee Printed Name.

(48) Date Of Signature.

Seller/Lessor

(49) Seller/Lessor Signature. This letter also requires that the Seller or Lessor signs his or her name to show agreement with its content.

(50) Printed Name.

(51) Date Of Signature.

The buyer or tenant visits the property and performs a thorough walkthrough to test appliances, plumbing, window quality, and heating, and to check for visible material and structural defects.

The buyer or tenant visits the property and performs a thorough walkthrough to test appliances, plumbing, window quality, and heating, and to check for visible material and structural defects.