Updated March 05, 2024

A commercial lease letter of intent is a document that summarizes the leasing terms for commercial property, which is reviewed prior to the execution of a formal agreement. The principal function of the letter is to prove that the tenant is a serious renter and to inform each party of the major details of the rental arrangement.

Table of Contents |

What is a Commercial Lease?

A commercial lease is a rental agreement between a landlord and a tenant who wishes to lease a commercial space for retail, industrial, or office use. The lease consists of terms and conditions that determine the responsibilities of each party during the contract term.

Landlords often fit the rental space to accommodate the tenant’s business needs. As a result, the landlord will typically require a longer contract term to ensure a return on their investment (3 to 5 years is standard).

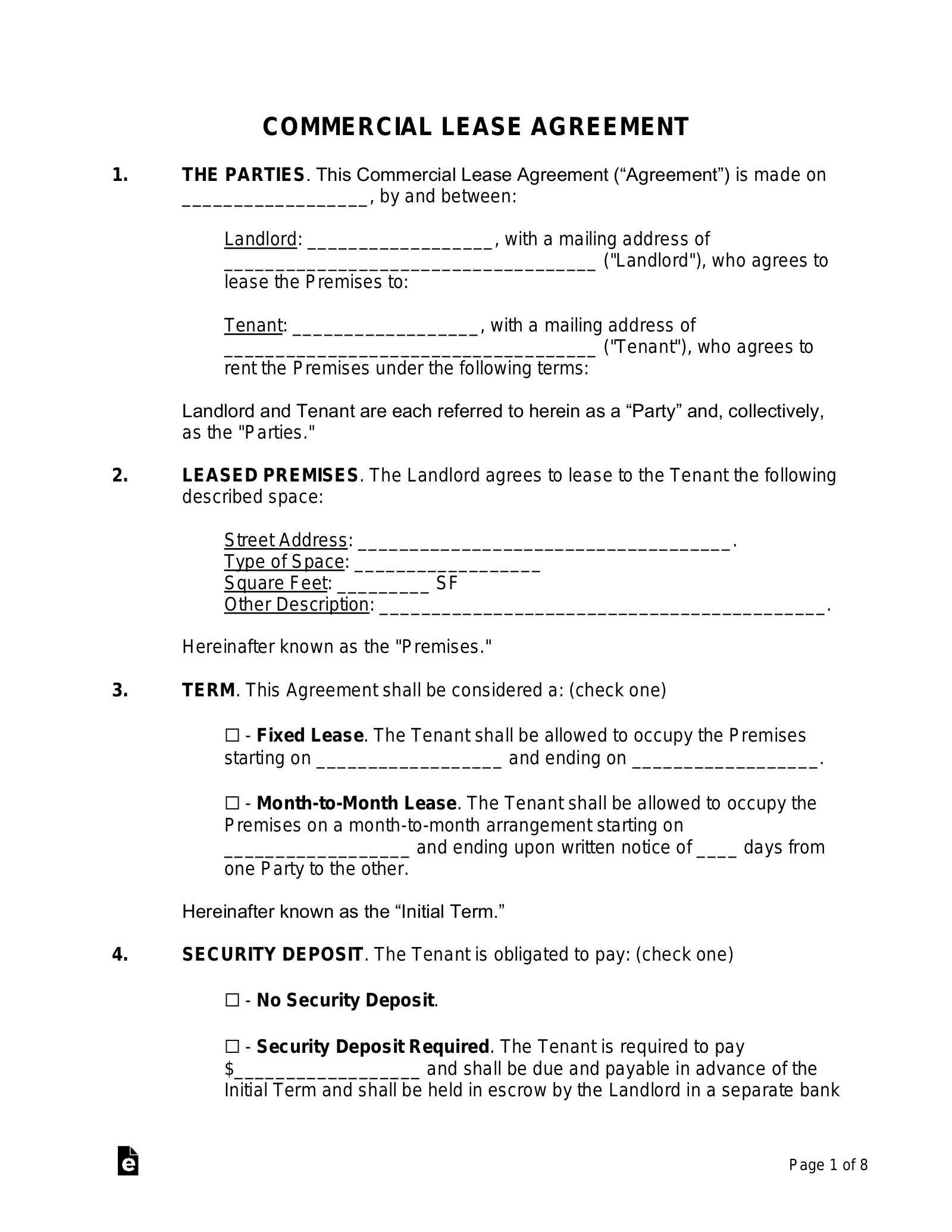

Commercial Lease Agreement – A legally binding rental contract between a landlord and a business tenant.

Commercial Lease Agreement – A legally binding rental contract between a landlord and a business tenant.

Download: PDF, MS Word, OpenDocument

Sample – Commercial Lease Letter of Intent

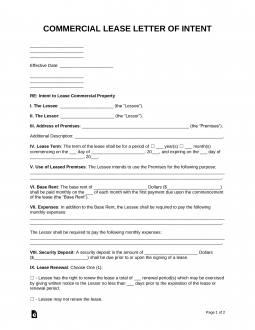

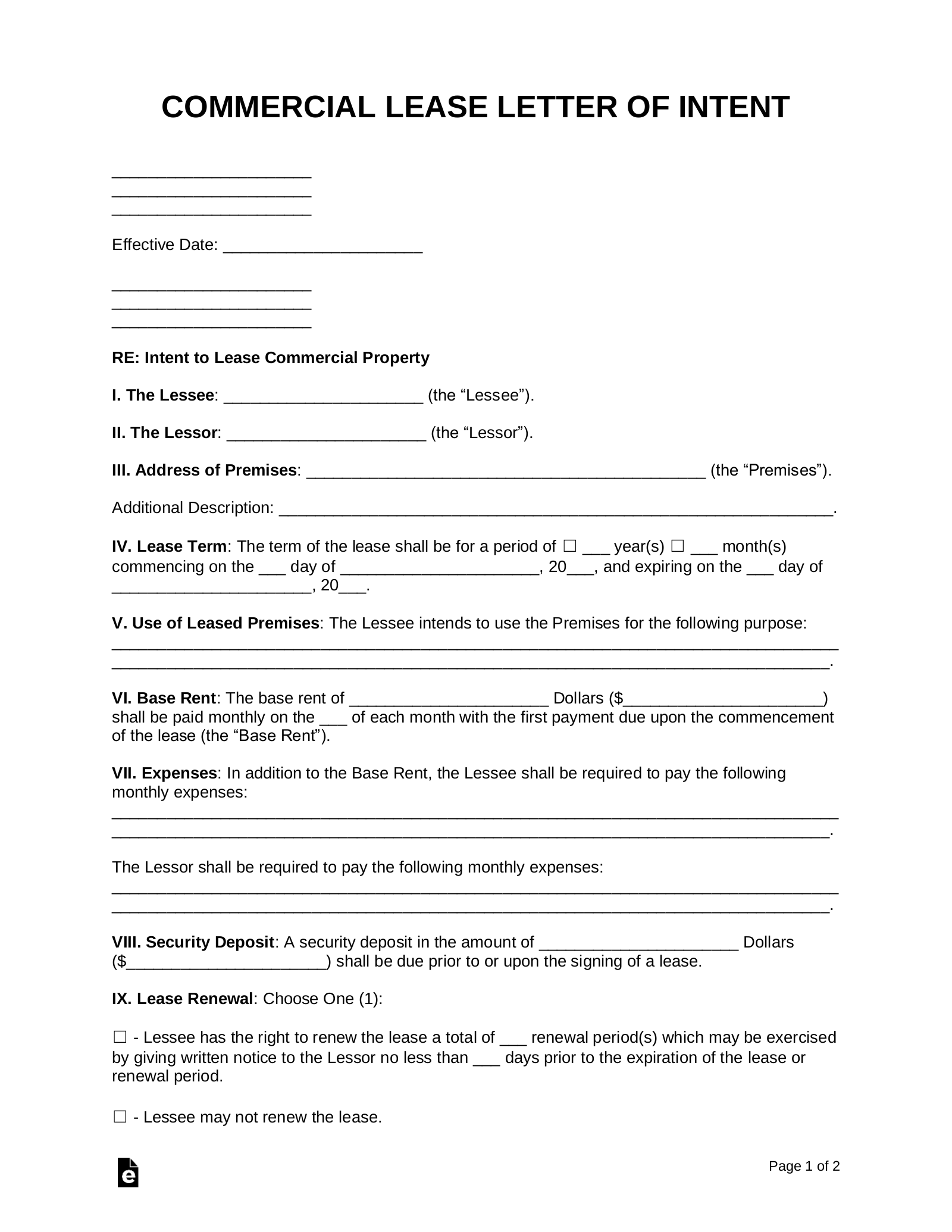

COMMERCIAL LEASE LETTER OF INTENT

Effective Date: November 2, 2019

RE: Intent to Lease Commercial Property

I. The Lessee: First Financial Investments (the “Lessee”).

II. The Lessor: Ruth Simmons (the “Lessor”).

III. Address of Premises: 943 Main St., Capital City, Vermont 05001 (the “Premises”).

Additional Description: None.

IV. Lease Term: The term of the lease shall be for a period of 3 years commencing on the 1st day of January, 2020 and expiring on the 1st day of January, 2023.

V. Use of Leased Premises: The Lessee intends to use the Premises for the following purpose: Office space for the business “First Financial Investments.”

VI. Base Rent: The base rent of Two Thousand Dollars ($2,000) shall be paid monthly on the 1st of each month with the first payment due upon the commencement of the lease (the “Base Rent”).

VII. Expenses: In addition to the Base Rent, the Lessee shall be required to pay the following monthly expenses: Common Area Maintenance (CAM).

The Lessor shall be required to pay the following monthly expenses: All other costs related to the property.

VIII. Security Deposit: A security deposit in the amount of Two Thousand Dollars ($2,000) shall be due prior to or upon the signing of a lease.

IX. Lease Renewal: Lessee has the right to renew the lease a total of 1 renewal period which may be exercised by giving written notice to the Lessor no less than 90 days prior to the expiration of the lease.

X. Rent Increase: Upon a lease renewal, the Base Rent shall increase by Fifty Dollars ($50).

XI. Subletting: The Lessee may not sublet the Premises without first obtaining the prior written consent of the Lessor.

XII. Late Rent: If the Lessee fails to pay the total rent payment for more than 3 days after it is due, the following penalty may be charged: A late fee of Fifteen Dollars ($15) per day until the overdue amount is paid.

XIII. Binding Effect: This Letter of Intent shall be considered non-binding. Therefore, the parties acknowledge that this Letter of Intent is not enforceable by any Party. The terms outlined herein are solely for the purposes of reaching a later agreement in the future, of which, the Lessee and Lessor are not bound.

XIV. Additional Provisions: None.

XV. Governing Law: This Letter of Intent shall be governed under the laws of the State of Vermont.

LESSEE

Lessee’s Signature ______________________ Date ______________________

Print Name ______________________

LESSOR

Lessor’s Signature ______________________ Date ______________________

Print Name ______________________