Updated July 21, 2023

Or use ContractsCounsel to hire an attorney!

A stock purchase letter of intent is used to establish an agreement for the purchase of shares in a business, such as a corporation, company (LLC), or partnership. The agreement may be used for public and privately traded companies.

If shares of a privately-owned company are being purchased, the buyer may need to view the business’s corporate bylaws, operating agreement, or partnership agreement (depending on the entity type), as the official ownership interest is located in these documents.

Table of Contents |

What is a Stock Purchase LOI?

A stock purchase letter of intent is used for the purchase of a limited number of stocks in a company or corporation from an individual or entity that owns the desired shares. A letter of intent is often non-binding and is instead a preliminary offer prior to the signing of a purchase agreement. However, the letter may be made binding and, furthermore, may promise the payment of a deposit to the seller upon the signing of a formal agreement.

The document covers the purchase price and transaction arrangement, as well as a variety of stipulations that assure confidentiality and exclusivity. If all interested parties sign the letter, a purchase agreement must be sent to the seller within the timeframe indicated by the buyer in the document.

Stock Purchase LOI – Sample

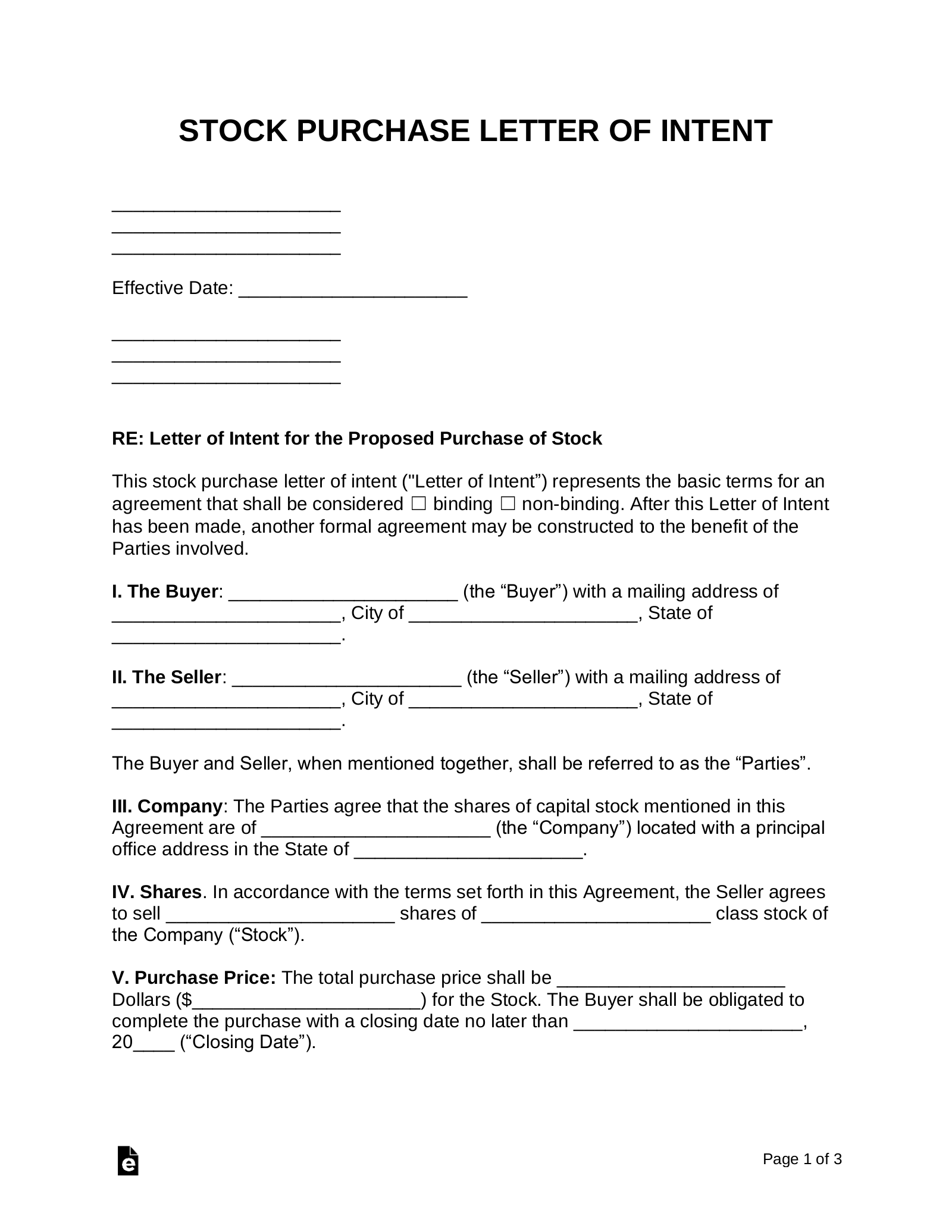

STOCK PURCHASE LETTER OF INTENT

Denise Van Raalte

216 Fraser Road

Detroit, Michigan 48026

Effective Date: March 1st, 2020

Charles Henderson

4730 Crestwood Drive

Detroit, Michigan 49518

RE: Letter of Intent for the Proposed Purchase of Stock

This stock purchase letter of intent (“Letter of Intent”) represents the basic terms for an agreement that shall be considered non-binding. After this Letter of Intent has been made, another formal agreement may be constructed to the benefit of the Parties involved.

I. The Buyer: Denise Van Raalte (the “Buyer”) with a mailing address of 216 Fraser Road, City of Detroit, State of Michigan.

II. The Seller: Charles Henderson (the “Seller”) with a mailing address of 4730 Crestwood Drive, City of Detroit, State of Michigan.

The Buyer and Seller, when mentioned together, shall be referred to as the “Parties”.

III. Company: The Parties agree that the shares of capital stock mentioned in this Agreement are of Henderson Printing LLC (the “Company”) located with a principal office address in the State of Michigan.

IV. Shares. In accordance with the terms set forth in this Agreement, the Seller agrees to sell One Thousand (1,000) shares of A-class stock of the Company (“Stock”).

V. Purchase Price: The total purchase price shall be Four Thousand Eight-Hundred Fifty-Eight Dollars ($4,858.00) for the Stock. The Buyer shall be obligated to complete the purchase with a closing date no later than June 1st, 2020 (“Closing Date”).

VI. Deposit: With the signing of this Letter of Intent, the Parties agree that:

Deposit is NOT Required: The Buyer shall not be required to make payment at the time of signing this Letter of Intent.

VII. Formal Agreement: After the signing of this Letter of Intent:

Formal Agreement Required: A formal agreement shall be constructed by April 30th, 2020 based off the terms in this Letter of Intent (“Formal Agreement”). If there is no Formal Agreement created, or the Parties could not agree to the details by the Closing Date, this Letter of Intent shall be considered null and void.

VIII. Confidentiality: All negotiations regarding the Business between the Buyer and Seller shall be confidential and shall not to be disclosed with anyone other than respective advisors and internal staff of the Parties and necessary third (3rd) parties. No press or other public releases will be issued to the general public concerning the Business without the mutual consent of the Parties or as required by law, and then only upon prior written notice to the other party unless otherwise not allowed.

IX. Good Faith Negotiations: The Buyer agrees to act in an honest and diligent manner to enter into “good faith” negotiations in order to execute a formal agreement and/or close the transaction.

X. Exclusive Opportunity: Following the execution of this Letter of Intent, the Parties agree not to negotiate or enter into discussions with any other party unless there are any existing agreements in place (e.g. option to purchase, first right of refusal, etc.).

XI. No Public Announcement: The Parties agree not to make any public announcement with regard to the transaction contemplated by this Letter without the prior written consent of the other. Additionally, each of the Parties shall bear their own costs and expenses related to the transaction contemplated by this Letter, including, but not limited to, fees and expenses of legal counsel and accountants.

XII. Currency: All mentions of currency or the usage of the “$” icon shall be known as referring to the US Dollar.

XIII. Governing Law: This Letter of Intent shall be governed under the laws by the State of Michigan.

XIV. Counterparts and Electronic Means: This Letter of Intent may be executed in several counterparts, each of which will be deemed to be an original and all of which will together constitute one and the same instrument. Delivery to us of an executed copy of this Letter of Intent by electronic facsimile transmission or other means of electronic communication capable of producing a printed copy will be deemed to be execution and delivery to us of this Letter of Intent as of the date of successful transmission to us.

XV. Severability. In case any provision or wording in this Letter of Intent shall be held invalid, illegal, or unenforceable, the validity, legality, and enforceability of the remaining provisions shall not in any way be affected or impaired thereby.

XVI. Acceptance: If the Parties are agreeable to the aforementioned terms, this Letter of Intent must be authorized by no later than April 1st, 2020.

IN WITNESS WHEREOF, the Parties have executed this Letter of Intent on the day and year written below.

BUYER

Buyer’s Signature ______________________ Date ______________________

Print Name ______________________

SELLER

Seller’s Signature ______________________ Date ______________________

Print Name ______________________