Updated April 16, 2024

A stock purchase agreement is between a buyer seeking to buy shares of a company for a set price from a seller. The agreement details the number (#) of shares, price ($) per share, and date of the sale. Any other terms are to be negotiated between the parties, and after signature, the exchange of funds for the shares usually occurs as soon as possible.

Types of Stock (6)

- Corporations;

- Limited Liability Companies (LLCs);

- Partnerships;

- General Partnerships;

- Limited Partnerships; and

- Trusts.

Table of Contents |

What is a Stock Purchase Agreement?

A stock purchase agreement, or ‘SPA‘, allows someone to buy ownership of an entity through its shares of stock (corporation) or as a percentage (%) of the business (LLC). For private entities, the buyer requires to have a due diligence period. For public companies, the buyer is protected under the Securities Act of 1933 and the transaction may occur immediately.

What to Include?

- Buyer’s Name;

- Seller’s Name;

- Description of Shares;

- Purchase Price;

- Closing Date; and

- Due Diligence Period (if any).

Classes of Stock

Classes of stock commonly have different voting rights allowing a group of individuals make the primary decisions of the company.

For example, ABC Company has three (3) different classes of stock:

- Class A Stock: Allows 3 votes per share.

- Class B Stock: Allows 2 votes per share.

- Class C Stock: Allows 1 vote per share.

How to Purchase Stock (Privately) (3 steps)

Purchasing stock can be completed by agreement or online depending on whether the company is publicly traded for not. For private companies, a physical stock certificate is commonly transferred and obtained by the buyer from the seller.

1. Negotiate or Place a Bid

Sign a stock purchase letter of intent or place a bid for a stock on a per-share basis. This starts the negotiating process and allows the seller of the stock to determine whether or not they would like to sell their shares.

Sign a stock purchase letter of intent or place a bid for a stock on a per-share basis. This starts the negotiating process and allows the seller of the stock to determine whether or not they would like to sell their shares.

3. Sign a Stock Purchase Agreement

After the due diligence period, the stock purchase agreement is to be written (see How to Write) and signed amongst the parties. Once signed, the closing should occur immediately with the funds exchanged for the stock certificates. At this time the transaction is closed with the buyer being the official new owner of the stock.

After the due diligence period, the stock purchase agreement is to be written (see How to Write) and signed amongst the parties. Once signed, the closing should occur immediately with the funds exchanged for the stock certificates. At this time the transaction is closed with the buyer being the official new owner of the stock.

Asset Purchase vs. Stock Purchase

The main difference with an asset purchase agreement is the buyer is not obtaining the liabilities of the seller. Whereas, in a stock purchase the buyer is obtaining all obligations of the company in addition to its assets.

Sample

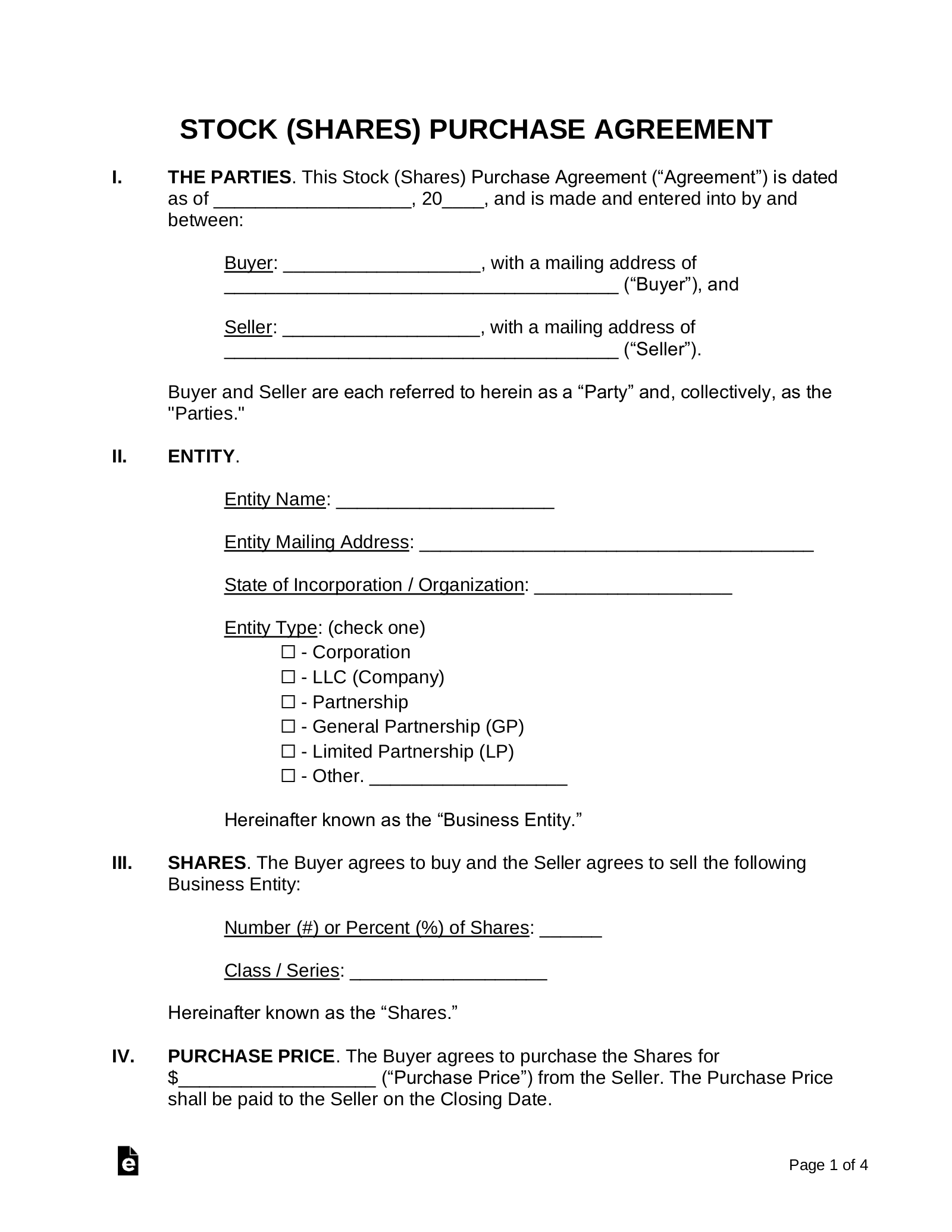

STOCK (SHARES) PURCHASE AGREEMENT

I. THE PARTIES. This Stock (Shares) Purchase Agreement (“Agreement”) is dated as of [DATE], and is made and entered into by and between:

Buyer: [BUYER’S NAME] with a mailing address of [MAILING ADDRESS] (“Buyer”), and

Seller: [SELLER’S NAME] with a mailing address of [MAILING ADDRESS] (“Seller”).

Buyer and Seller are each referred to herein as a “Party” and, collectively, as the “Parties.”

II. ENTITY.

Entity Name: [ENTITY NAME]

Entity Mailing Address: [MAILING ADDRESS]

State of Incorporation / Organization: [STATE]

Entity Type: (check one)

☐ – Corporation

☐ – LLC (Company)

☐ – Partnership

☐ – General Partnership (GP)

☐ – Limited Partnership (LP)

☐ – Other. [OTHER]

Hereinafter known as the “Business Entity.”

III. SHARES. The Buyer agrees to buy and the Seller agrees to sell the following Business Entity:

Number (#) or Percent (%) of Shares: [# OR %]

Class / Series: [CLASS]

Hereinafter known as the “Shares.”

IV. PURCHASE PRICE. The Buyer agrees to purchase the Shares for $[AMOUNT] (“Purchase Price”) from the Seller. The Purchase Price shall be paid to the Seller on the Closing Date.

V. CLOSING DATE. The closing shall occur on or before [DATE] (“Closing Date”) at a time and location agreeable by the Parties.

VI. PAYMENT METHODS. On the Closing Date, the Buyer shall deliver the full amount of the Purchase Price in any of the following methods: (check all that apply)

☐ – Bank Wire

☐ – Cash

☐ – Cashier’s Check

☐ – Other: [OTHER]

VII. DEPOSIT. As part of this Agreement, the Seller: (check one)

☐ – Requires a Deposit. The Seller requires an initial payment in the amount of $[AMOUNT] (“Deposit”). The Deposit must be paid within [#] Calendar Days from the Effective Date of this Agreement.

☐ – Does not require a Deposit. The Buyer’s consideration shall be their full-faith commitment to purchase the Shares of Stock under the terms of this Agreement.

VIII. DUE DILIGENCE PERIOD. The Buyer: (check one)

☐ – Requires a Due Diligence Period. The Buyer requires a due diligence period to inspect the finances and agreements of the Business Entity. The decision as to whether the Shares of Stock is suitable for its intended purposes shall be the sole decision of Buyer, determined in the absolute discretion of Buyer, with Buyer’s decision being final and binding upon the Parties. Buyer shall have until [DATE], at [TIME] ☐ AM ☐ PM to notify Seller of its termination of this Agreement (“Inspection Period”). If the Buyer decides to terminate this Agreement during the Inspection Period, any Deposit made shall be returned to the Buyer.

☐ – Does NOT Require a Due Diligence Period. The Buyer does not require a due diligence period to review the finances, agreements, or any other information of the Business Entity.

IX. DELIVERY. The delivery of the Shares of Stock, along with any stock certificates, shall be transferred to the Buyer at Closing Date upon the funds being received by the Seller in an approved method.

X. AUTHORITY OF SELLER. To induce the Buyer to enter into and perform its obligations under this Agreement, the Seller hereby represents and warrants to Buyer, and covenants with Buyer, as follows:

a.) Capacity. The Seller has all requisite power, authority, and capacity to enter into this Agreement. The execution, delivery, and performance of this Agreement by the Seller does not, and the consummation of the transaction contemplated hereby will not result in a breach of or default under any agreement to which the Seller is a party by which the Seller is bound.

b.) Binding Agreement. This Agreement has been duly and validly executed and delivered by the Seller and constitutes the Seller’s valid and binding agreement, enforceable against the Seller in accordance with and subject to its terms.

c.) Title to Shares of Stock. The Seller is the lawful, record and beneficial owner of all the Shares of Stock, free and clear of any liens, claims, agreements, charges, security interests and encumbrances whatsoever. The sale, conveyance, assignment, and transfer of the Shares of Stock in accordance with the terms of this Agreement transfers to the Buyer legal and valid title to the Shares, free and clear of all liens, security interests, hypothecations or pledges.

XI. AUTHORITY OF BUYER. To induce the Seller to enter into and perform their obligations under this Agreement, the Buyer represents and warrants to the Seller as follows:

a.) Capacity. The Buyer has all requisite power, authority, and capacity to enter into this Agreement. The execution, delivery, and performance of this Agreement by the Buyer does not, and the consummation of the transaction contemplated hereby will not result in a breach of or a default under any agreement to which the Buyer is a party or by which Buyer is bound.

b.) Disclosure. The Buyer is aware of the risks involved in purchasing the Shares of Stock and accepts that its value can change rapidly and unpredictably.

XII. DATE AND TIME. Time is of the essence.

a.) Calendar Days. Calendar days shall represent all days of the year except Saturdays, Sundays, and Federal Holidays (“Calendar Days”).

b.) Effective Date. The effective date of this Agreement shall be the day the Parties authorize this Agreement and acceptance has been given.

XIII. GOVERNING LAW. This Agreement shall be construed, interpreted, and enforced in accordance with, and shall be governed by, the laws in the State of [STATE] without reference to, and regardless of, any applicable choice or conflicts of laws principals.

XIV. COUNTERPARTS. This Agreement may be executed in any number of counterparts and by the several parties hereto in separate counterparts, each of which shall be deemed to be an original, and all of which together shall constitute one and the same Agreement.

XV. ADDITIONAL TERMS & CONDITIONS. [ADDITIONAL TERMS]

XVI. ENTIRE AGREEMENT. This Agreement constitutes the entire understanding and agreement of the Parties relating to the subject matter hereof and supersedes any and all prior understandings, agreements, negotiations and discussions, both written and oral, between the Parties hereto with respect to the subject matter hereof.

Buyer’s Signature: _____________________________ Date: _________________

Print Name: _____________________________

Seller’s Signature: _____________________________ Date: _________________

Print Name: _____________________________

After a letter of intent is signed, the buyer will have the right to obtain all necessary contracts, agreements, and financial reports of the company. This is known as the “due diligence period” to ensure that the seller is not misrepresenting any aspect of the business.

After a letter of intent is signed, the buyer will have the right to obtain all necessary contracts, agreements, and financial reports of the company. This is known as the “due diligence period” to ensure that the seller is not misrepresenting any aspect of the business.