Updated August 04, 2023

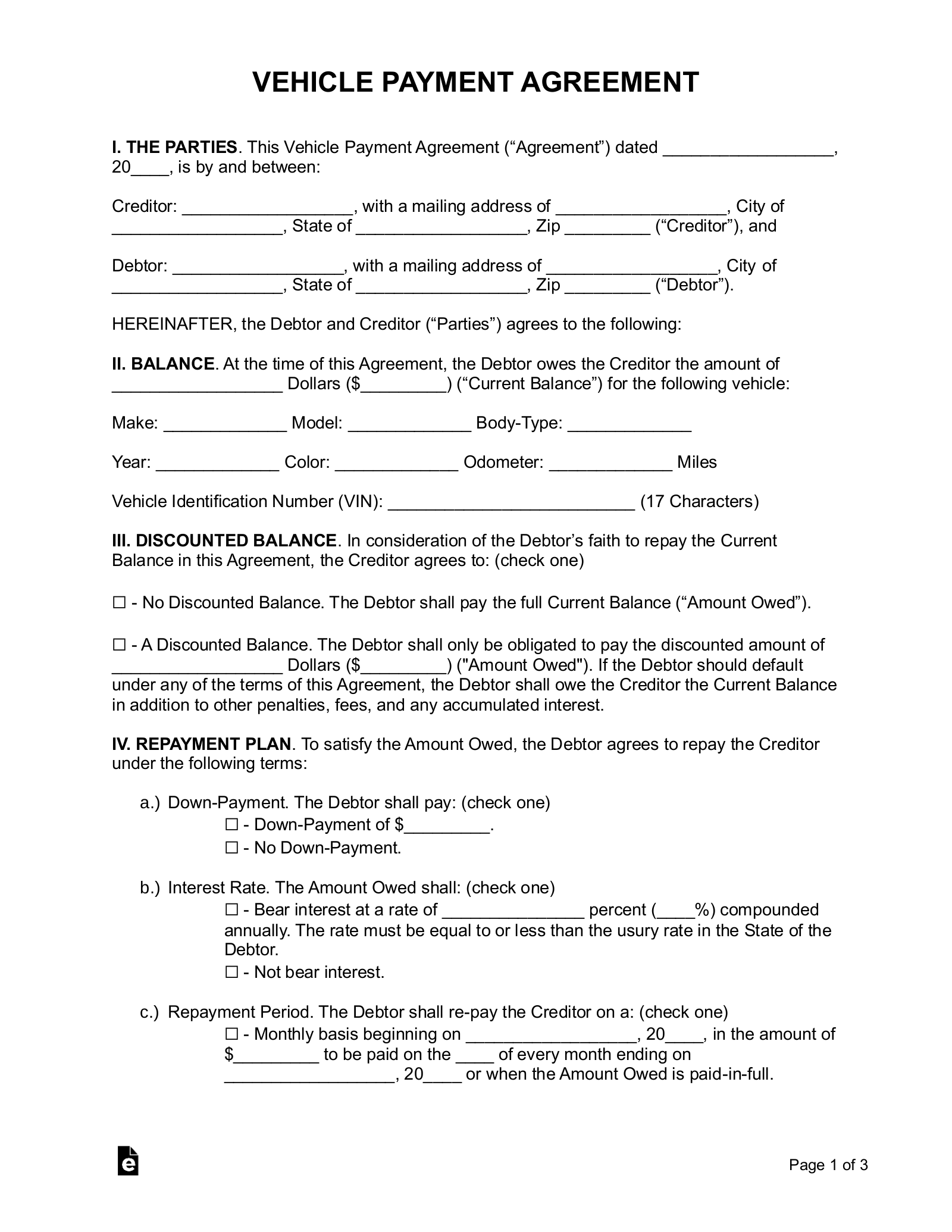

A vehicle payment plan agreement is a contract between a buyer and seller of a vehicle that agrees to installment payments. Since the seller is providing the financing, both parties must agree to the downpayment, interest rate (%), and the payment period.

Common Terms

- Co-Signer – Also known as a “Guarantor” and is someone that guarantees the payment of the loan.

- Downpayment – Deposit paid at the start of the payment agreement. Recommended to be 10% to 20% of the purchase price.

- Monthly Payment – Payment owed by the borrower on a monthly basis.

- Term – Length of the payment period. The average is 36 to 60 Months.

- Interest Rate – The cost of borrowing money. Variable rate that is dependent on the credit score of the borrower (View Current Rates).

Vehicle Bill of Sale – Should be completed when signing the payment plan.

Vehicle Bill of Sale – Should be completed when signing the payment plan.

Download: PDF, MS Word, OpenDocument

Table of Contents |

Vehicle Payment Calculators (3)

Where to Apply for an Auto Loan

The best place to apply is to find the lender willing to give the best rate. This is often online where your profile and terms will be shown to banks nationwide. The rate will be determined by two (2) factors: Borrower’s Credit Score and the Down-Payment. The higher of both items and better the chance of a lower interest rate.

Best Websites to Apply (3)

- NerdWallet – Get a preview of up to 10 other financial institutions and what they offer.

- TheSimpleDollar.com – Breaks down the seven (7) most popular auto loan offers.

- Interest.com – Compares the top six (6) auto loan offers.