Updated March 21, 2024

A Connecticut LLC operating agreement allows the member(s) to adopt rules and establish who the owners are of the company. The members can agree to include any terms on how to run the day-to-day operations of the company and appoint officers. An operating agreement can be altered at any time by making an amendment and attaching it to the original document.

After its execution, an operating agreement should be kept by each member and is not filed with a government agency.

Is an Operating Agreement REQUIRED in Connecticut?

No. Businesses are not legally obligated to implement an operating agreement in Connecticut.

By Type (2)

Single-Member LLC Operating Agreement – To be used by an entity that shall be run by a sole proprietor. This document will offer all of the benefits that are afforded to larger companies to the owner.

Single-Member LLC Operating Agreement – To be used by an entity that shall be run by a sole proprietor. This document will offer all of the benefits that are afforded to larger companies to the owner.

Download: PDF, MS Word (.docx), OpenDocument

Multi-Member LLC Operating Agreement – To be used by any company that will have more than one (1) member, managing the business and sharing ownership.

Multi-Member LLC Operating Agreement – To be used by any company that will have more than one (1) member, managing the business and sharing ownership.

Download: PDF, MS Word (.docx), OpenDocument

Table of Contents |

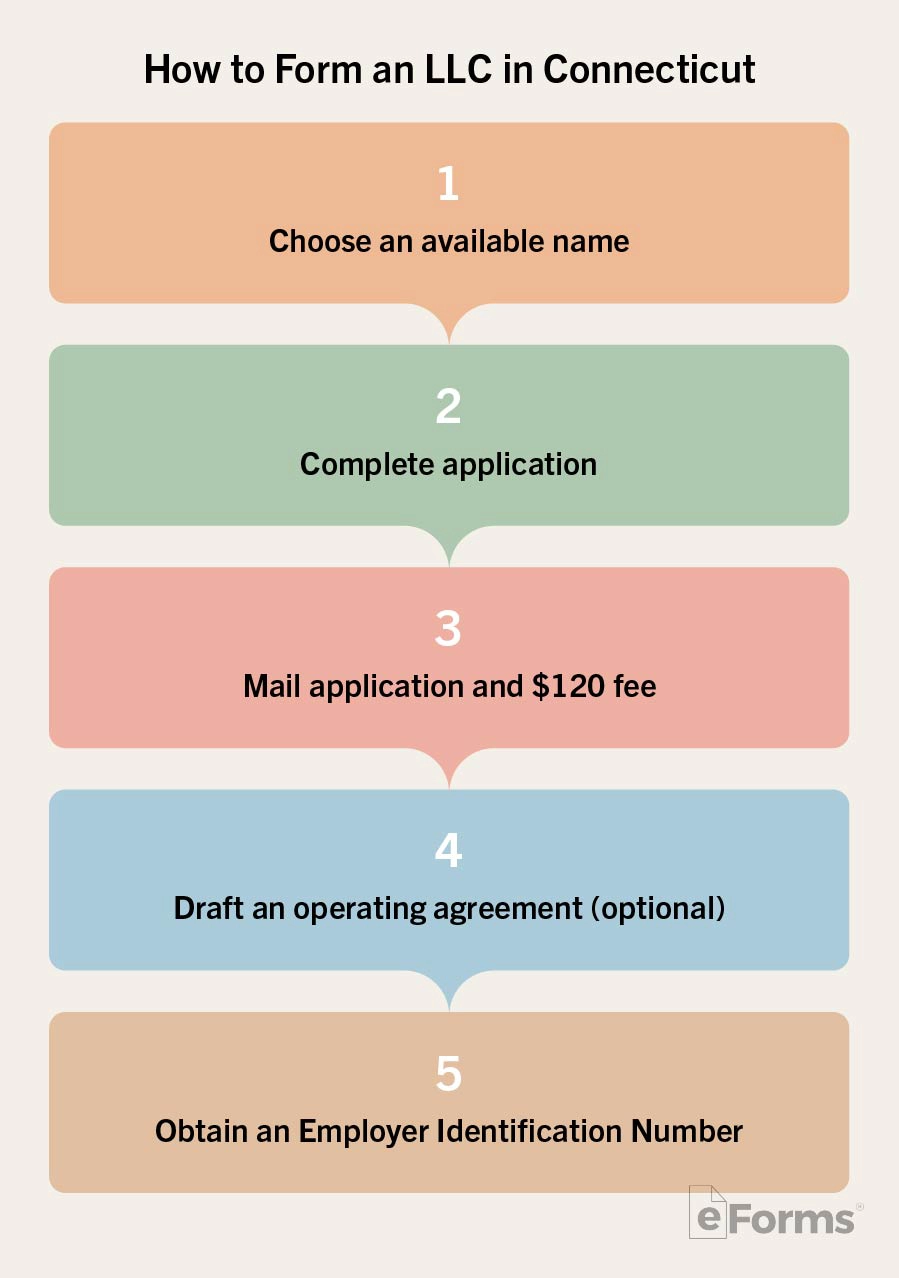

How to Form an LLC in Connecticut (4 steps)

- Download the Application

- Attach the Filing Fee

- Operating Agreement

- Employer Identification Number (EIN)

When filing an LLC in the State of Connecticut it is extremely important to verify the availability of your proposed business name before attempting to file. The Secretary of State will not accept applications with names similar to any other business currently in their records. Conducting a Business Inquiry will allow you to ensure that your desired name is indeed available for use in the State.

2. Attach the Filing Fee

COMMERCIAL RECORDING DIVISION, CONNECTICUT SECRETARY OF THE STATE, P.O. BOX 150470, HARTFORD, CT 06115-0470

or

COMMERCIAL RECORDING DIVISION, CONNECTICUT SECRETARY OF THE STATE, 30 TRINITY STREET, HARTFORD, CT 06106

3. Operating Agreement

It is highly advisable that you draft an LLC operating agreement after successfully filing in Connecticut. The legal document states the way in which the LLC’s internal affairs are to be managed and it defines the duties, rights, and position of the ownership. Filing the form isn’t mandatory though it is still recommended nonetheless.

4. Employer Identification Number (EIN)

Obtaining an Employer Identification Number (EIN) is necessary for any business that plans on performing financial transactions under the company name. An EIN allows the LLC to legally pay employees, apply for company credit cards, and register for bank accounts. Once your filings with the Secretary of State have been approved, we recommend applying for an EIN right away by either filing in the Online Application or by completing Form SS-4.

Laws

- Connecticut Uniform Limited Liability Company Act – Chapter 613a

- Operating Agreement Statutes

- Sec. 34-243d (Operating agreement: Scope, function and limitations)

- Sec. 34-243e (Operating agreement: Effect on limited liability company and person becoming member; formation of agreement that becomes operating agreement)

- Sec. 34-243f (Operating agreement: Effect on third parties and relationship to records effective on behalf of limited liability company)

“Operating Agreement” Definition

“Operating agreement” means the agreement, whether or not referred to as an operating agreement and whether oral, implied, in a record or in any combination thereof, of all the members of a limited liability company, including a sole member, concerning the matters described in subsection (a) of section 34-243d. “Operating agreement” includes the agreement as amended or restated.

Video