Updated March 21, 2024

A Michigan LLC operating agreement outlines how a company will function and includes each member’s ownership interest. For an entity with more than 1 member, it is important to have written as there is no other document that records company ownership. Once the document is written it should be signed and kept by each member. If any changes are made to the agreement, an amendment must be signed by all members and attached.

Is an Operating Agreement REQUIRED in Michigan?

No. Michigan state law does not require LLCs to implement an operating agreement.

By Type (2)

Single-Member LLC Operating Agreement – For use by sole proprietors who would like to prepare and file the document within their state to establish procedures, policies, and purpose of their single owner company.

Single-Member LLC Operating Agreement – For use by sole proprietors who would like to prepare and file the document within their state to establish procedures, policies, and purpose of their single owner company.

Download: PDF, MS Word (.docx), OpenDocument

Multi-Member LLC Operating Agreement – For use by companies who have more than one (1) member who would like to collectively establish, by unanimous agreement, full company policies and procedures. They will also have the ability to establish member and financial protections.

Multi-Member LLC Operating Agreement – For use by companies who have more than one (1) member who would like to collectively establish, by unanimous agreement, full company policies and procedures. They will also have the ability to establish member and financial protections.

Download: PDF, MS Word (.docx), OpenDocument

Table of Contents |

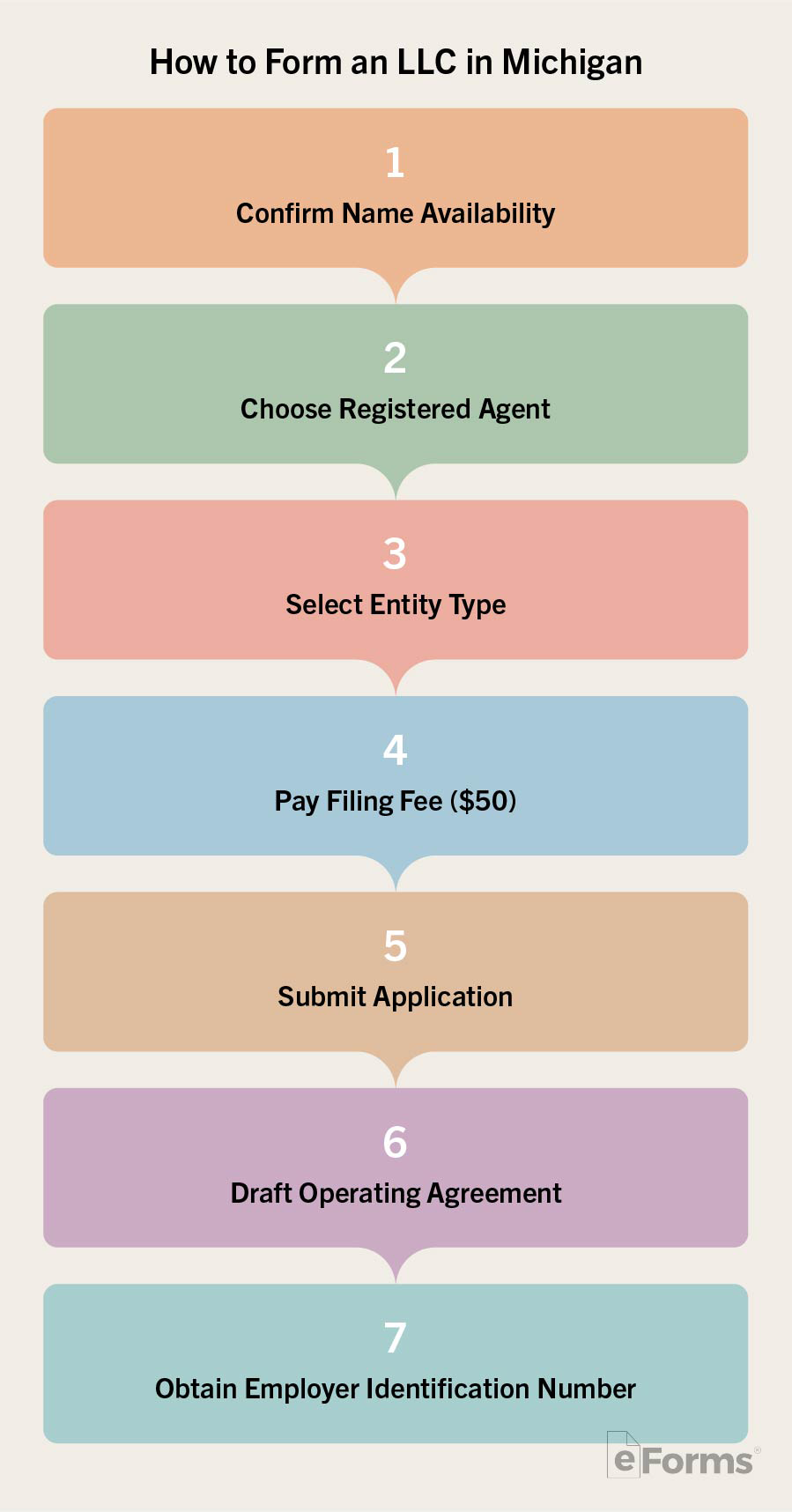

How to Form an LLC in Michigan (6 steps)

- Choose Registered Agent

- Which Type

- Attach the Filing Fee

- Submit your Application

- Operating Agreement (optional)

- Employer Identification Number (EIN)

Individuals filing in the State of Michigan should confirm the availability of their business name before commencing with their LLC registration. The State allows filers to search the Corporations Division’s records to confirm that any name chosen is indeed available and not similar to that of any other name currently registered.

2. Which Type

Choose your entity type from the following options:

- Domestic – Articles of Organization

- *Foreign – Application for Certificate of Authority to Transact Business in Michigan

*Foreign applicants must include with their filings a Certificate of Good Standing to prove the validity of their organization.

4. Submit your Application

You may submit your application to the State by mail or in person. If filing by mail, send your documents to the first address listed below. Otherwise, deliver it by hand to the second address.

Michigan Department of Licensing and Regulatory Affairs Corporations, Securities & Commercial Licensing Bureau, Corporations Division, P.O. Box 30054, Lansing, MI 48909

or

5. Operating Agreement (optional)

An LLC operating agreement is a written document that the managing member(s) may implement upon filing for formation in the State. The agreement provides legal documentation of the financial interest of each member which will be quite useful in the event of litigation or legal disputes between members.

6. Employer Identification Number (EIN)

The Internal Revenue Service, in almost all cases, requires a business to obtain an Employer Identification Number (EIN). This identifier will be necessary if the LLC wishes to pay employees or open bank accounts. To apply for an EIN, complete the Online Application or submit Form SS-4 by mail.

Laws

- Michigan Limited Liability Company Act – Act 23 of 1993

- Operating Agreement Statutes

“Operating Agreement” Definition

“Operating agreement” means a written agreement by the member of a limited liability company that has 1 member, or between all of the members of a limited liability company that has more than 1 member, pertaining to the affairs of the limited liability company and the conduct of its business. The term includes any provision in the articles of organization pertaining to the affairs of the limited liability company and the conduct of its business.