Updated March 21, 2024

A New Jersey LLC operating agreement is a legal document that includes the structural components of a company such as daily operations and ownership. The members will need to unanimously agree to the terms of the agreement for it to become effective. Should any terms change and the members would need to add an amendment to the original agreement.

Is an Operating Agreement REQUIRED in New Jersey?

No. LLCs in New Jersey are not legally required to adopt an operating agreement.

By Type (2)

Single-Member LLC Operating Agreement – This document is designed for LLCs with only one (1) owner. The document will allow for the recording of daily business practices and the ability to maintain a separate legal status between personal and business purposes.

Single-Member LLC Operating Agreement – This document is designed for LLCs with only one (1) owner. The document will allow for the recording of daily business practices and the ability to maintain a separate legal status between personal and business purposes.

Download: PDF, MS Word (.docx), OpenDocument

Multi-Member LLC Operating Agreement – This document should be selected for LLCs that have more than one (1) owner. The document would establish all ownership, as well, it would establish the various financial relationships between the managers and partners.

Multi-Member LLC Operating Agreement – This document should be selected for LLCs that have more than one (1) owner. The document would establish all ownership, as well, it would establish the various financial relationships between the managers and partners.

Download: PDF, MS Word (.docx), OpenDocument

Table of Contents |

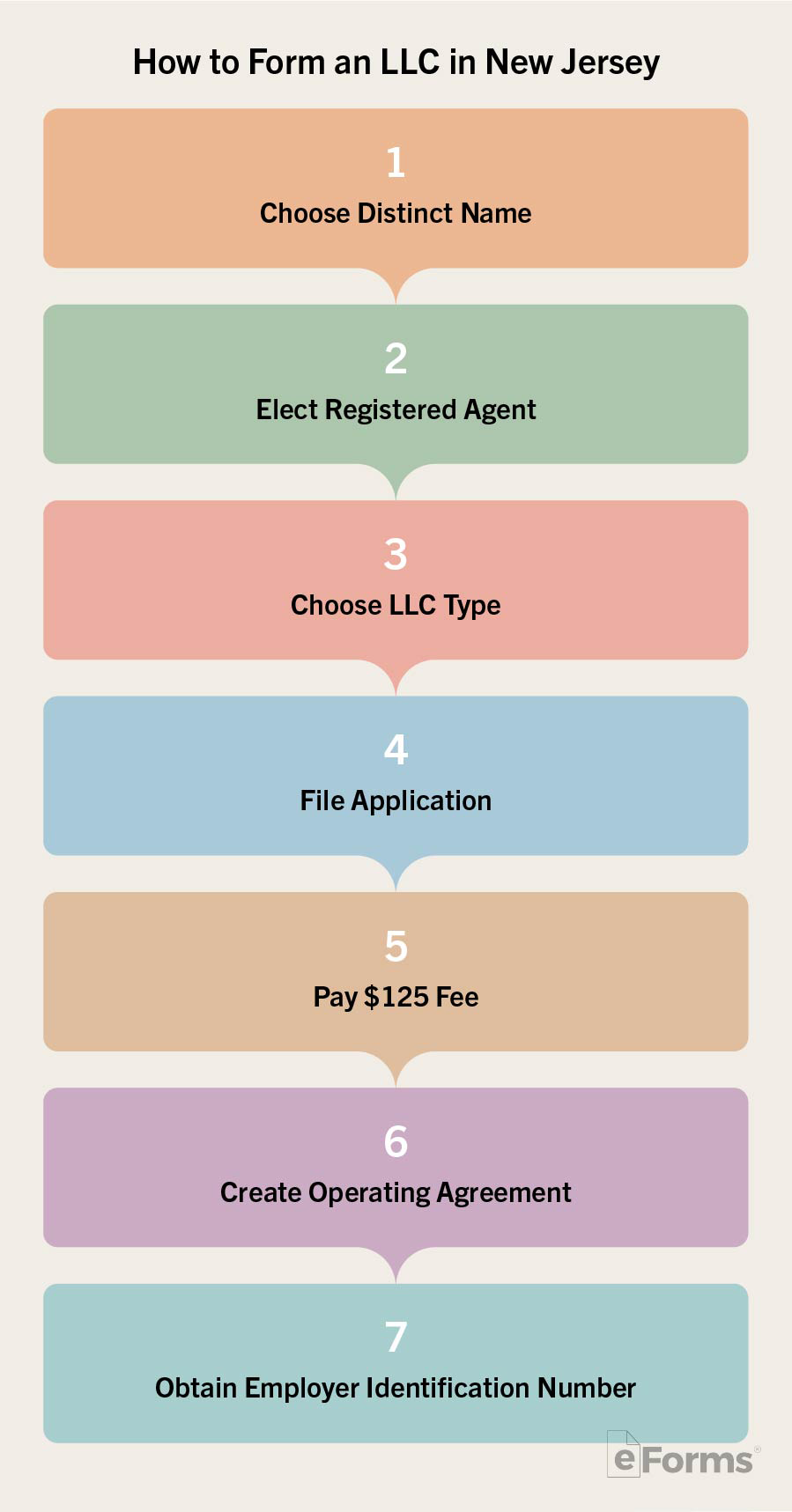

How to Form an LLC in New Jersey (6 steps)

- Registered Agent

- Choose your LLC Type

- File the Application

- Pay the Fee

- LLC Operating Agreement

- Employer Identification Number (EIN)

Business filings in the State of New Jersey are handled by the Division of Revenue, and it is with their offices that you will be submitting your LLC forms. However, before filing, you are encouraged to search for your business name in the State’s Records to ensure that no other business has filed with, or reserved, the same name or one that is distinctly similar.

1. Registered Agent

Managing members of the LLC must elect a Registered Agent before filing in the State. A Registered Agent is an individual that the LLC grants permission to accept State filings on the company’s behalf, such as service of process and annual reports. The agent may be one of the following:

- Individual resident of the State

- Individual with the authority to transact business in the State

2. Choose your LLC Type

Depending on your filing circumstances, your LLC will be categorized as either a Domestic or Foreign entity. Choose your LLC type based on the following:

- Domestic – You are attempting to file a new LLC within the State

- Foreign – You are attempting to file an existing LLC, initially formed out-of-state

3. File the Application

Domestic and *Foreign LLCs use New Jersey’s Online Filing Portal. For Domestic, choose NJ Domestic Limited Liability Company from the dropdown menu. For Foreign, choose NJ Foreign Limited Liability Company.*A Foreign application must include a Certificate of Existence to prove the validity of the company.

4. Pay the Fee

The Division of Revenue demands a $125 filing fee for LLC applications. Online applicants will be able to supply the fee by credit card or e-check. If submitting a paper application, enclose a check or money order made payable to the ‘Treasurer, State of NJ’ and send your filing package to the following address:

New Jersey Department of the Treasury, Division of Revenue & Enterprise, Services/Corporate Filing Unit P.O. Box 308, Trenton, NJ 08646-0308

5. LLC Operating Agreement

While an LLC operating agreement isn’t required by law in the State, it is highly advisable that one be drafted as it can provide documentation of a number of important details, such as the managerial rights and duties as well as the financial investments of the ownership. Should you choose to draft the form, have each member review it before implementing it officially.

6. Employer Identification Number (EIN)

The Employer Identification Number (EIN) is the corporate equivalent to a Social Security Number in that the Internal Revenue Service issues it to business entities for tax reporting purposes. An EIN is free to obtain and it may be acquired on the IRS Website or through the mail with PDF Form SS-4. Once acquired, the LLC will be able to do the following:

- Open company bank accounts

- Hire employees

- Request credit cards

Laws

- Revised Uniform Limited Liability Company Act – Title 42, Chapter 2C (PDF Version)

- Operating Agreement Statutes

- § 42-2C-11 (Operating agreement; scope, function, and limitations)

- § 42-2C-12 (Operating agreement; effect on limited liability company and persons becoming members; preformation agreement)

- § 42-2C-13 (Operating agreement; effect on third parties and relationship to records effective on behalf of limited liability company)

“Operating Agreement” Definition

“Operating agreement” means the agreement, whether or not referred to as an operating agreement and whether oral, in a record, implied, or in any combination thereof, of all the members of a limited liability company, including a sole member, concerning the matters described in subsection a. of section 11 of this act. The term includes the agreement as amended or restated.