Updated March 20, 2024

A Washington LLC operating agreement—also known as a “limited liability company agreement”—governs the conduct of the everyday affairs of the company related to its activities and members. It is the only recorded document that mentions the ownership of the company. Therefore, it should be kept in a safe and accessible place by each member.

Is an Operating Agreement REQUIRED in Washington?

No. Washington state law does not mandate the adoption of an operating agreement for LLCs.

By Type (2)

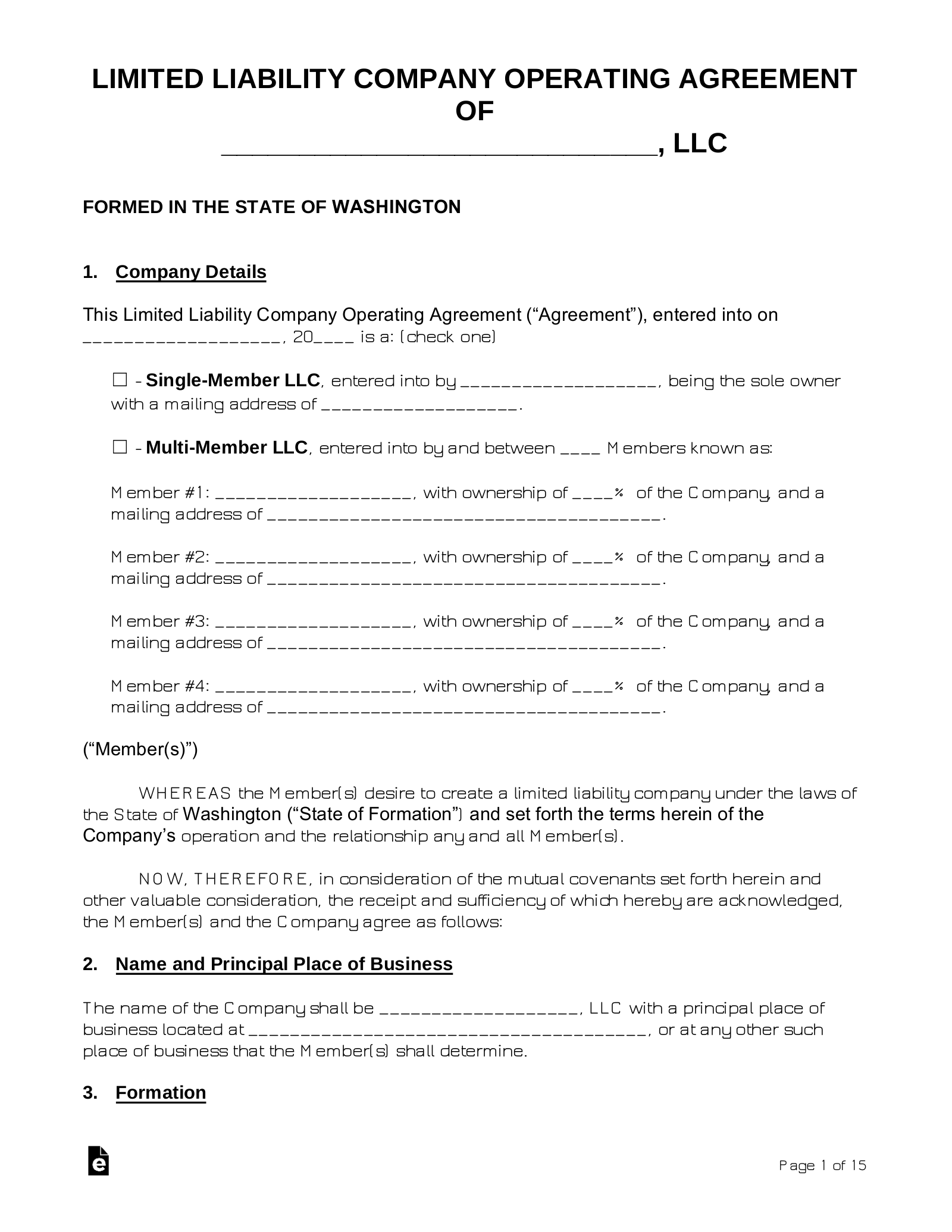

Single-Member LLC Operating Agreement – For use by a sole proprietor and sole manager of a business.

Single-Member LLC Operating Agreement – For use by a sole proprietor and sole manager of a business.

Download: PDF, MS Word (.docx), OpenDocument

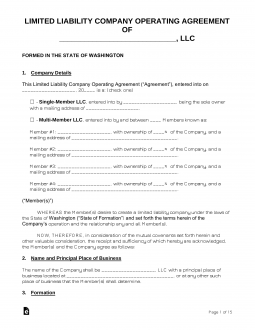

Multi-Member LLC Operating Agreement – For use by contributing members of any company that has more than one (1) member.

Multi-Member LLC Operating Agreement – For use by contributing members of any company that has more than one (1) member.

Download: PDF, MS Word (.docx), OpenDocument

Table of Contents |

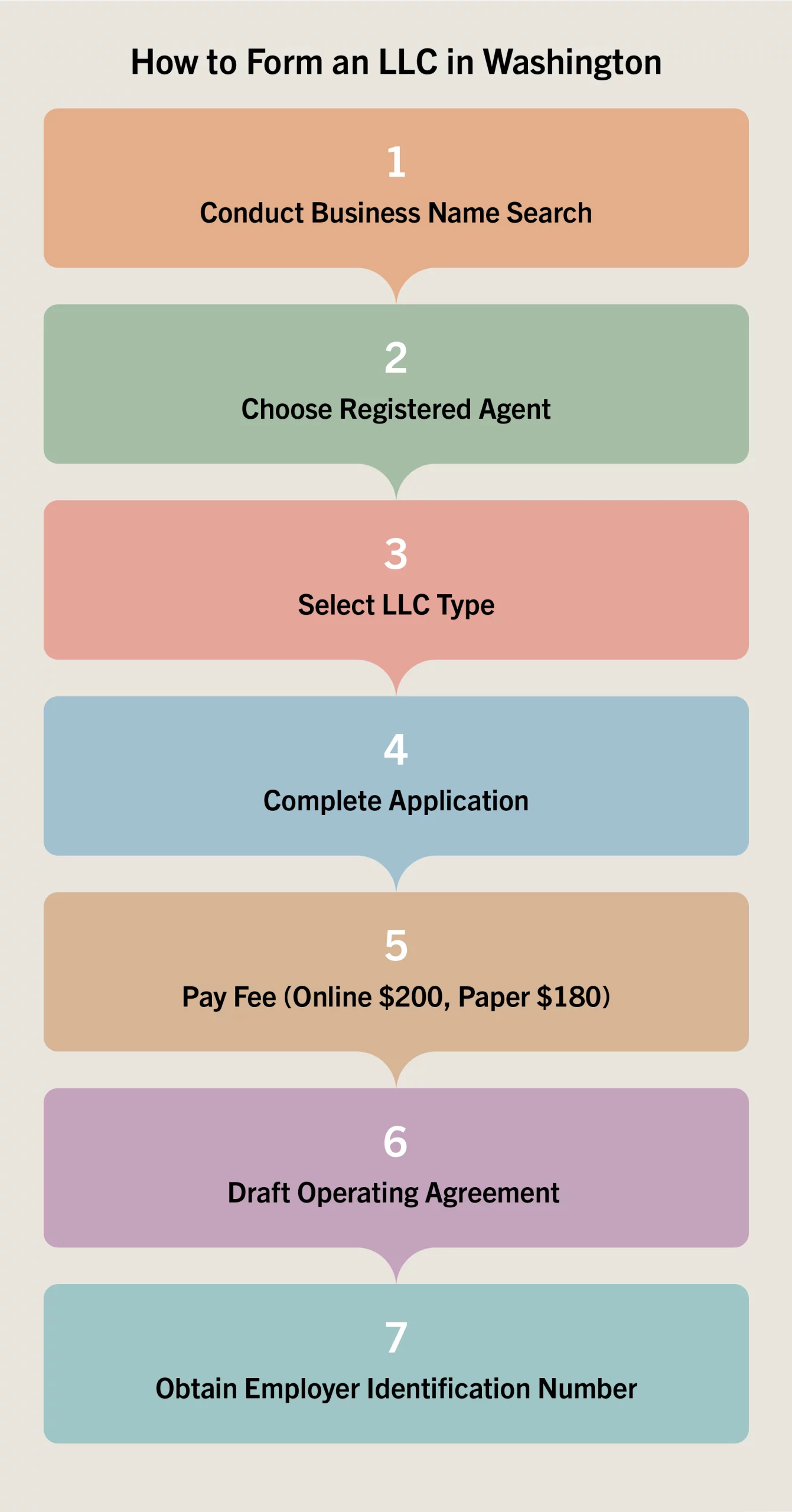

How to Form an LLC in Washington (5 steps)

- Choose Your Registered Agent

- Which LLC Type

- Processing Fee

- Operating Agreement

- Employer Identification Number (EIN)

One of the more important steps of the LLC filing process is the choice of a business name that has not already been taken or reserved by another business; any duplicate or like names will be rejected by the State. To verify the availability of your business name, search for it in the Washington Department of Revenue’s records.

2. Which LLC Type

Choose your LLC type and fill in the subsequent application.

- Domestic LLC – Form a new company within Washington

- *Foreign LLC – Expand an existing company (formed in an outside jurisdiction)

*Foreign applicants will need to include a Certificate of Existence in PDF or JPEG format.

Washington State has modified its registration process so that only online filing is available. To get started filing online, create a user account here.

4. Operating Agreement

An operating agreement allows LLC owners to create a suitable operating structure for the company by establishing the rights, duties, and financial investments of each member. There is no State law requiring the form, though it is highly recommended that one be implemented once the LLC has been filed with the Secretary of State.

5. Employer Identification Number (EIN)

An Employer Identification Number (EIN) must be acquired if your LLC plans to hire/pay employees or conduct major financial transactions under the company name. It is free to obtain an EIN on the IRS Website as well as through the submission of a PDF of Form SS-4.

Laws

- Limited Liability Companies – Chapter 25.15 RCW

- Operating Agreement Statutes

- RCW 25.15.018 (Effect of limited liability company agreements—nonwaivable provisions)

- RCW 25.15.141 (Remedies for breach of limited liability company agreement by member)

- RCW 25.15.171 (Remedies for breach of limited liability company agreement by manager)

- RCW 25.15.801 (Construction and application of chapter and limited liability company agreement)

“Limited Liability Company Agreement” Definition

“Limited liability company agreement” means the agreement, including the agreement as amended or restated, whether oral, implied, in a record, or in any combination, of the member or members of a limited liability company concerning the affairs of the limited liability company and the conduct of its business.