Updated June 02, 2022

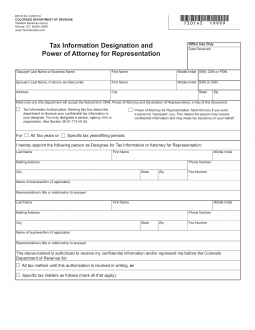

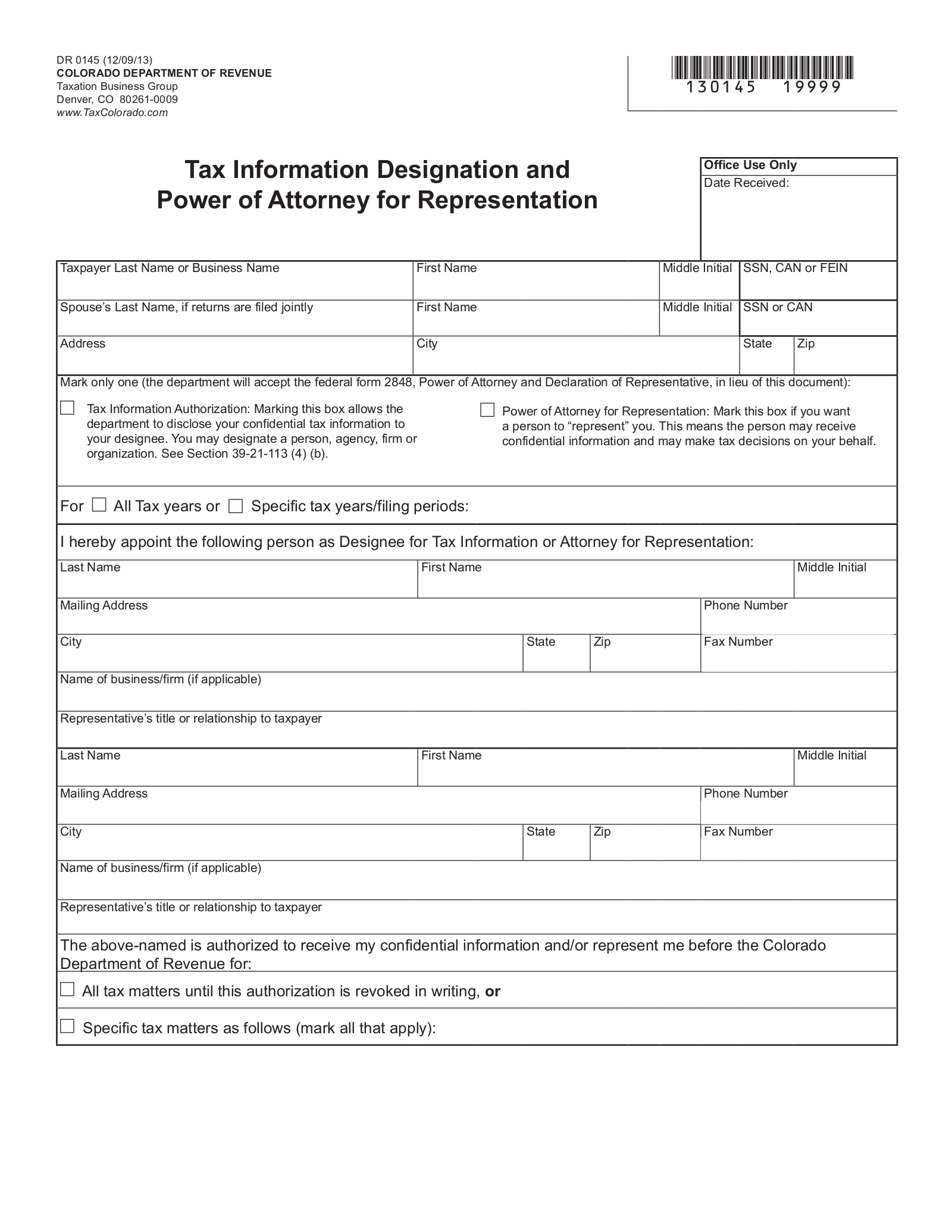

A Colorado tax power of attorney (DR 0145) gives one individual (the agent) the authority to handle another person’s (the principal) tax matters with concerned tax entities. It must be submitted to the Colorado Department of Revenue to be legally binding. The agent takes care of certain filings, speaks on the principal’s behalf, or receives the principal’s tax information in order to determine what decisions and/or actions may need to be engaged.

How to Write

1 – Obtain the Colorado Tax Power of Attorney

You may open this form with a form-friendly browser by selecting one of the buttons presented underneath the preview image of the file.

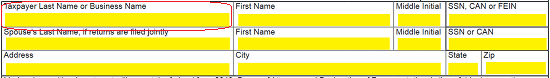

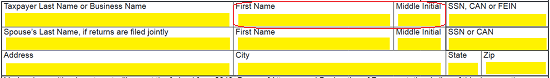

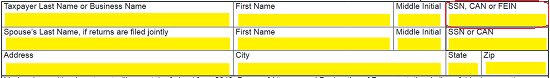

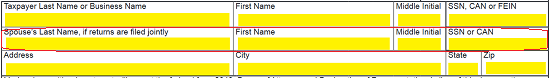

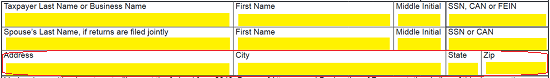

2 – The TaxPayer Granting Authority

Locate the box “Taxpayer Last Name or Business Name.” Fill in the Last Name of the TaxPayer who is granting authority to another party.

The next two boxes must have the “First Name” and “Middle Initial” of the Principal Taxpayer.

In the last box, on this row, report the Principal Taxpayer’s Social Security Number, CAN, or FEIN.

The next row, beginning with the box labeled “Spouse’s Last Name, if returns are filed jointly” is conditional. This row will only be required if the Principal Taxpayer has filed jointly for the Tax Periods when the authority is being granted.

The third row on this page contains four boxes that require Principal Taxpayer’s “Address,” “City,” “State,” and “Zip.”

3 – The Level Of Authority Granted

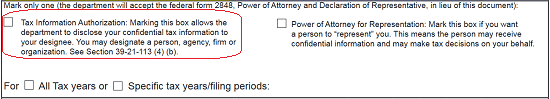

It will be necessary to define the exact level of Principal Power being designated to the Agent. To begin, one of the two checkboxes beneath the Taxpayer Information section must be marked.

If the Colorado Department of Revenue is expected to disclose confidential tax information to the Designee being listed then mark the first box (preceding the words “Tax Information Authorization”).

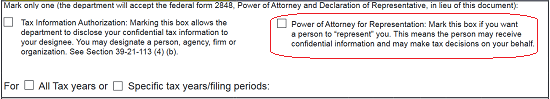

If the Colorado Department of Revenue should disclose confidential information to the Designee and should also accept the Designee’s decision making powers as that of Principal Taxpayers, then mark the second box (preceding the words “Power of Attorney for Representation”).

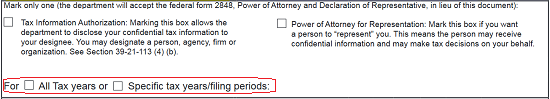

The next step will be to indicate if the power being granted will be in effect for all Tax Years or only for specific years or periods. If the Designee will have the defined Principal Power(s) for all Tax Years then mark the first box, if not, mark the second box and enter the Tax Years/Periods when these powers may be applied in the space provided.

4 – The Designee Appointed Authority

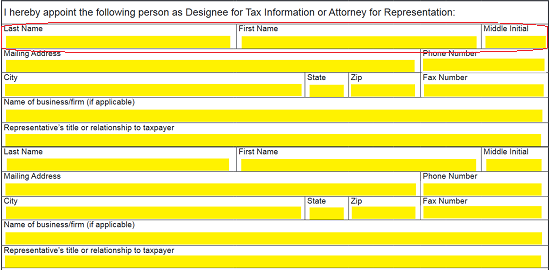

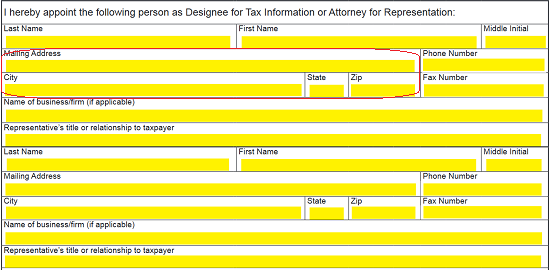

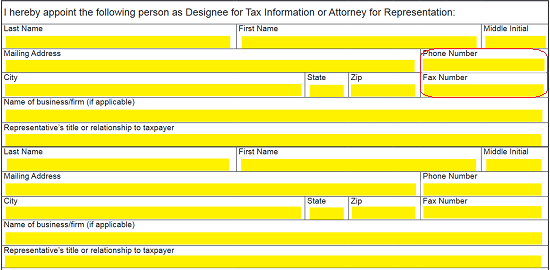

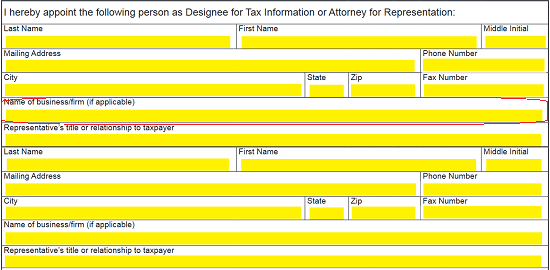

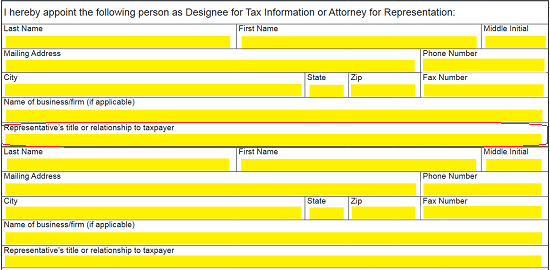

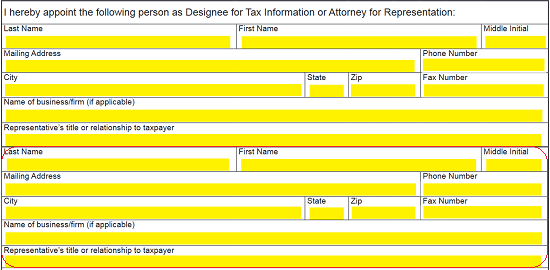

The next area, beneath the words “I hereby appoint…,” will provide a table to report similar information for the Designated Representative and an Alternate Designated Representative.

The first row of this table will be divided into three defined cells. Use this row to enter the Last Name, First Name, and Middle Initial of the Designated Agent being granted Authority.

The second and third rows, divided into two columns, require the Designated Agent’s Address in the left column. Use the spaces provided (“Mailing Address,” “City,” “State,” and “Zip to supply this information.

Use the second and third rows, in the right column, to report the current “Phone Number” and “Fax Number” of the Designee

If the Designee is acting on behalf of a business entity or firm, representing the Principal, then report the Name of the Designee’s Business Entity on the fourth row.

On the last row of the Primary Designated Agent’s area, report the Title or Relationship he or she has with the Taxpayer Principal granting power (i.e. Attorney, Accountant, etc.).

Utilize the next section of this table to record the Alternate Designated Agent’s Full Name, Location, Contact Information, Firm Name, and Relationship to the Granting Taxpayer.

5 – Define the Granted Authority Being Assumed By the Designee

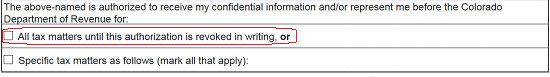

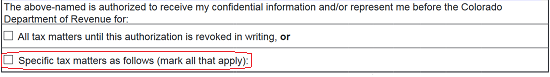

The next area requiring attention will be introduced with the statement “The above-named is authorized to receive my confidential information…” Here, you may define what Tax Matters the Designee will have power in.

If the Designee may assume Principal Power in all Tax Matters then mark the first box and proceed to “4 – Verifying The Designated Agent Principal Power.”

If the Designee may only assume Principal Power for specific Tax Matters, then mark the second box. Note: This will require a report on which Principal Tax Matters the Designee’s Appointed Power applies to.

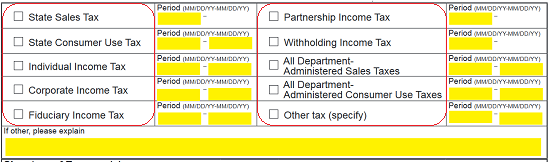

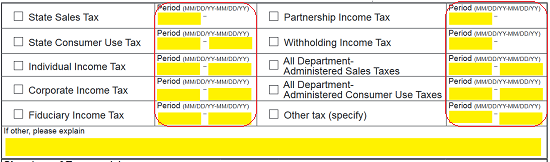

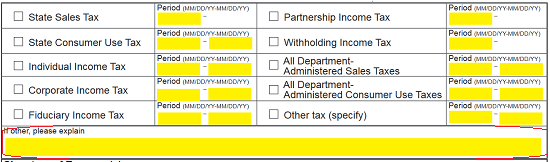

If the Designee may only assume power in certain matters use the next table to define these matters. First, place a mark in the corresponding checkbox to the matters the Designee has Principal Authority in.

Then for each Tax Matter marked, report the starting Month and Year the Designee holds authority and the ending Month and Year the Designee may exhibit this authority. There will be an area provided for this purpose at the end of each statement.

If the “Other tax (specify)” box was marked, use the last row to enter the specifics as to what Tax Matters the Designee effects.

4 – Verifying The Designated Agent Principal Power

The Colorado Department of Revenue will only accept this document and its effect if it is signed by the parties involved. This form will provide a defined area for all these items in the “Signature Taxpayer” section. Before signing this area, the Principal Taxpayer, granting power, should read the bulleted Acknowledgement statements in this are since they will exert power over this document and the Taxpayer’s Signature.

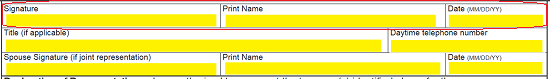

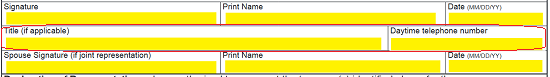

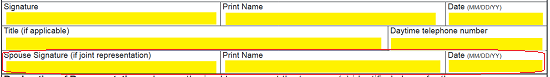

The first row will provide defined areas so the Principal Taxpayer may Sign and Print his or her Name. The last box in this row requires the Signature Date.

The next row requires the Principal Taxpayer’s Title (if applicable) and Daytime Telephone Number to be provided.

The third row has been reserved for the Spouse of the Principal Taxpayer if he or she has been reported in the first section of this form. The Taxpayer’s Spouse will need to Sign and Print his or her name and provide the Signature Date.

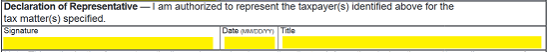

The next row will contain a Declaration of the Representative statement. The Designee will need to sign his or her Name then provide his or her Title and the Date of Signature on the row below this statement. This statement must be verified through the Designee’s Signature.

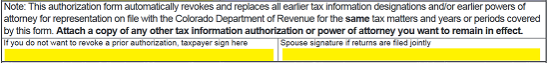

In some cases, previous authorities may be in effect. Any previous authority that is in effect will be automatically terminated by this one unless the Principal Taxpayer attaches a copy of it and signs his or her name under the words “If you do not want to revoke a prior authorization…”. This next signature area will also provide a box for the Spouse to sign his or her name (if applicable).

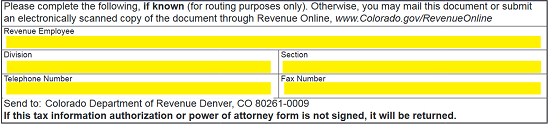

The final table of this form is optional and provided as a matter of routing convenience. If the Principal Taxpayer knows the Name of the Colorado Department of Revenue Employee this document will be received by, then enter that Employee’s Full Name on the blank space labeled “Revenue Employee.” The second row will require the Colorado Dept. of Revenue receiving Employee’s Division and Section. The last row of this table will provide areas for the Colorado Dept. of Revenue receiving Employee’s Telephone Number and Fax Number.