Updated June 02, 2022

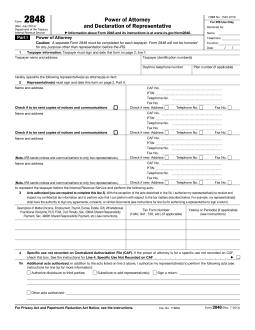

A Delaware tax power of attorney (Form 2848) is a paper submission that can be used to designate an agent to represent the principal in front of the Delaware Division of Revenue. Even though it is a U.S. Internal Revenue Service form, Delaware has specified that it may be used for people seeking to designate someone to represent them before the Delaware DOR. Usually, the designee is a tax accountant or attorney who will have access to the principal’s personal information and be able to make filings on their behalf.

How to Write

1 – Open Or Download Form 2848

You may access the appropriate form (beneath the file image on this page) utilizing the PDF, OTD, or Word buttons. Make sure to have all the relevant information organized for easy reference.

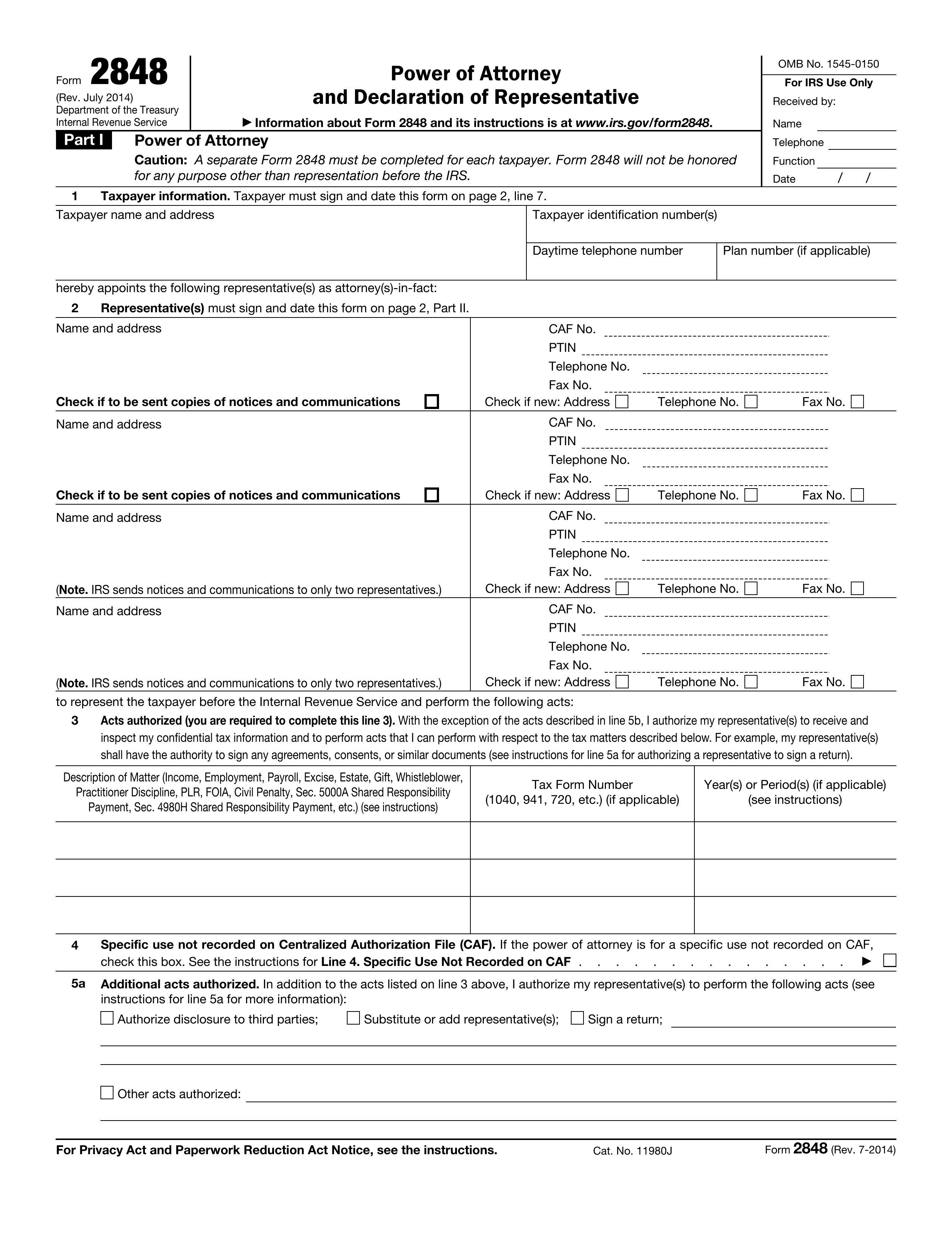

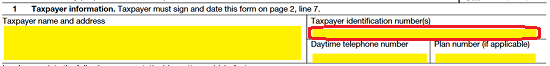

2 – Record The Principal Taxpayer’s Identity and Residential Address

The first row will require that Taxpayer Information is clearly presented in specific areas. The first pieces of information to be displayed will be the Principal Taxpayer’s Full Name and Complete Address. This must be entered under the words “Taxpayer name and address”

The Taxpayer Identification Number the I.R.S. knows the Principal as must be reported in the box labeled “Taxpayer identification number(s).” A good example of such a number would be the Principal’s Social Security Number.

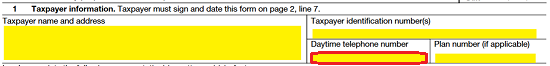

Below this, the Principal Taxpayer’s Daytime Telephone Number must be entered into the appropriate box.

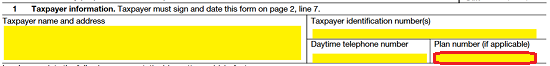

If the Principal Taxpayer also has an applicable Plan Number, it must be entered in the last box of the Taxpayer Information section.

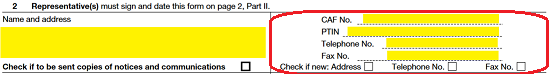

3 – Representative Information

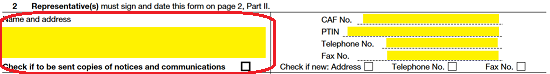

Each Representative the Principal Taxpayer wishes to grant power to when representing him or her to the I.R.S. must have his or her information recorded on this document. There will be a table in Section “2. Representative(s),” where this may be accomplished. The column on the left will allow for a definition as to the Identity and Location of the Agent being Named. Enter the Full Name and Complete Address of each Agent on a separate row. There will enough room to name four Agents, though it should be mentioned the Internal Revenue Service will only forward Principal Taxpayer Communication to a maximum of two Agents.

The column on the right will be broken into several corresponding rows where one Agent’s information may be reported. Each Agent must have his or her CAF No., PTIN Number, Daytime Telephone No., and Fax No. must be presented on the blank spaces labeled CAF No, PTIN, Telephone No, and Fax No (respectively). The last piece of information required will be a report on the status of the Agent’s Contact Information. If this Agent’s Address, Telephone No., and/or Fax No. differs from that previously reported to the Internal Revenue Service mark the box labeled “Address,” “Telephone No.,” and “Fax No.,” after the words “Check if new.”

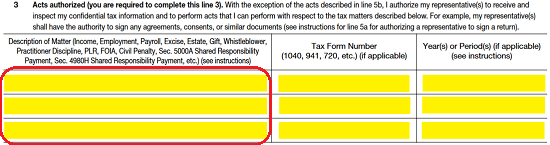

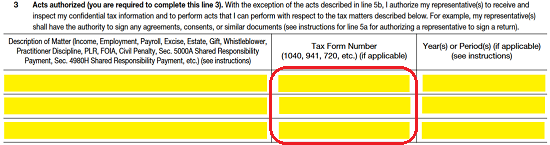

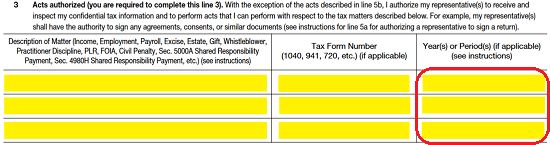

The third section “Acts Authorized,” will provide the area required to grant the Agents listed above with the Power to receive, inspect, and perform acts regarding the Tax Matters the Agent has Principal Power in. To begin, refer to the first column, then enter the Description of the Tax Matter the Principal Taxpayer grants Power to the Agent over (i.e. Income, Employment, Excise, Practitioner Disciple, etc.). Each Matter Description should be listed on a separate row.

The second column should list any forms the Taxpayer’s Agent should have access and power over reported.

The third column will provide an area to specify the Tax Years or Tax Periods in which the Agent may exert Principal representation and power.

4 – Define The Tax Matters and Agent Power

The fourth section will refer to Centralized Authorization File the I.R.S stores for efficiency purposes. If the powers granted are specific powers, the checkbox in Item 4 must be marked. If this is the case, the Agent should mail or fax the specific power of attorney to the IRS office handling this matter as well as keep a copy present at all times. This sort of document will not revoke prior powers recorded on the CAF with an unrelated matter.![]()

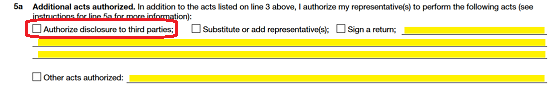

Next, in section 5a, the Principal Taxpayer has the opportunity to authorize specific acts by defining them. If the Principal authorizes the Agent to Disclose information to a third party, then mark the first checkbox.

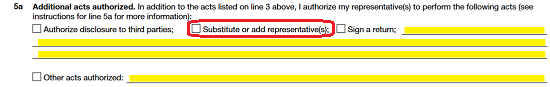

If the Principal grants the Agent the power to Substitute or Add Representatives, the second checkbox should be marked.

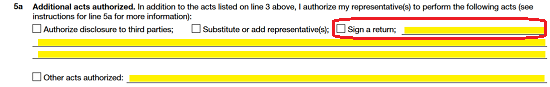

Lastly, if the Principal authorizes the Agent to Sign a Return on his or her behalf, the third checkbox must be marked. Note, this last choice may only be marked if the Principal has a debilitating disease/injury, is not in the country for long periods of time, and/or the IRS has already granted or requested this. If the Agent is being given the power to sign a return, the following statement must be provided on the blank lines provided: “This power of attorney is being filed pursuant to 26 CFR 1.6012-1(a)(5), which requires a power of attorney to be attached to a return if a return is signed by an agent by reason of,” then write in the reason why this power is being assigned (after the word “of”).

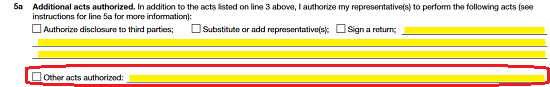

If there are other acts the Agent may perform on behalf of the Principal, then mark the box labeled “Other acts authorized,” and provide a detailed description of the authorized powers on the blank lines provided for this selection.

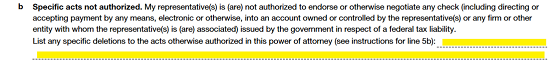

Section 5b will allow the Principal to expressly exclude any power or authority from the Agent’s jurisdiction.

5 – Previously Filed Authorities

Normally, by default, this paperwork will automatically terminate all other powers issued to Agents by the Principal. If the Principal does not want previous Authorities to be revoked, he or she must mark the checkbox in section 6 (“Retention/Revocation of Prior Power(s) of Attorney”).![]()

6 – Supplying Finalization

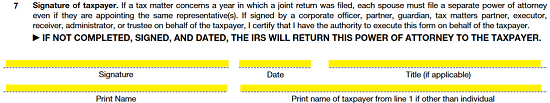

The Principal must provide his or her Signature, Date of Signing, Title, Printed Name, and (if necessary) the Printed Name of the Principal Taxpayer in section 1 – required if the taxpayer is an entity and not an individual. Note: If the Principal Taxpayer filed jointly with a spouse, the spouse must submit a separate Form 2848.

7 – Agent Information

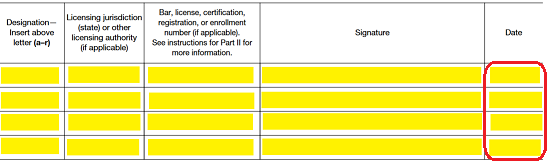

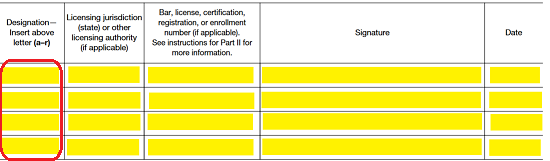

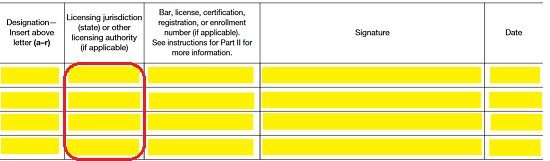

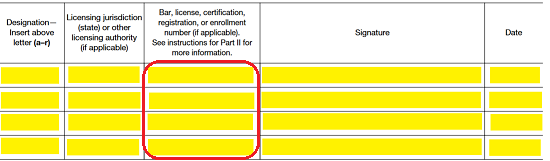

In Part II, “Declaration of Representative,” the Agent being granted power must read the disclosure and description statements. He or she must agree with these statements, then give a self-definition of his or her role using the entity descriptions labeled “a” through “k” and “r.” To begin, the Agent should locate the table with the column labeled “Designation – Insert Above Letter (a-r),” then enter the letter for the entity description that best describes him or her.

In the second column, the Agent must report the Licensing Jurisdiction he or she must answer to.

The third column should have any Identification Number the Agent uses professionally to practice professionally (i.e. Bar Number, Registration Number,etc.)

The fourth column must bear the Signature of the Agent and the fifth column must display the Agent’s Signature Date. There will be enough rows to for four Agents to provide their information and signatures.