Updated June 02, 2022

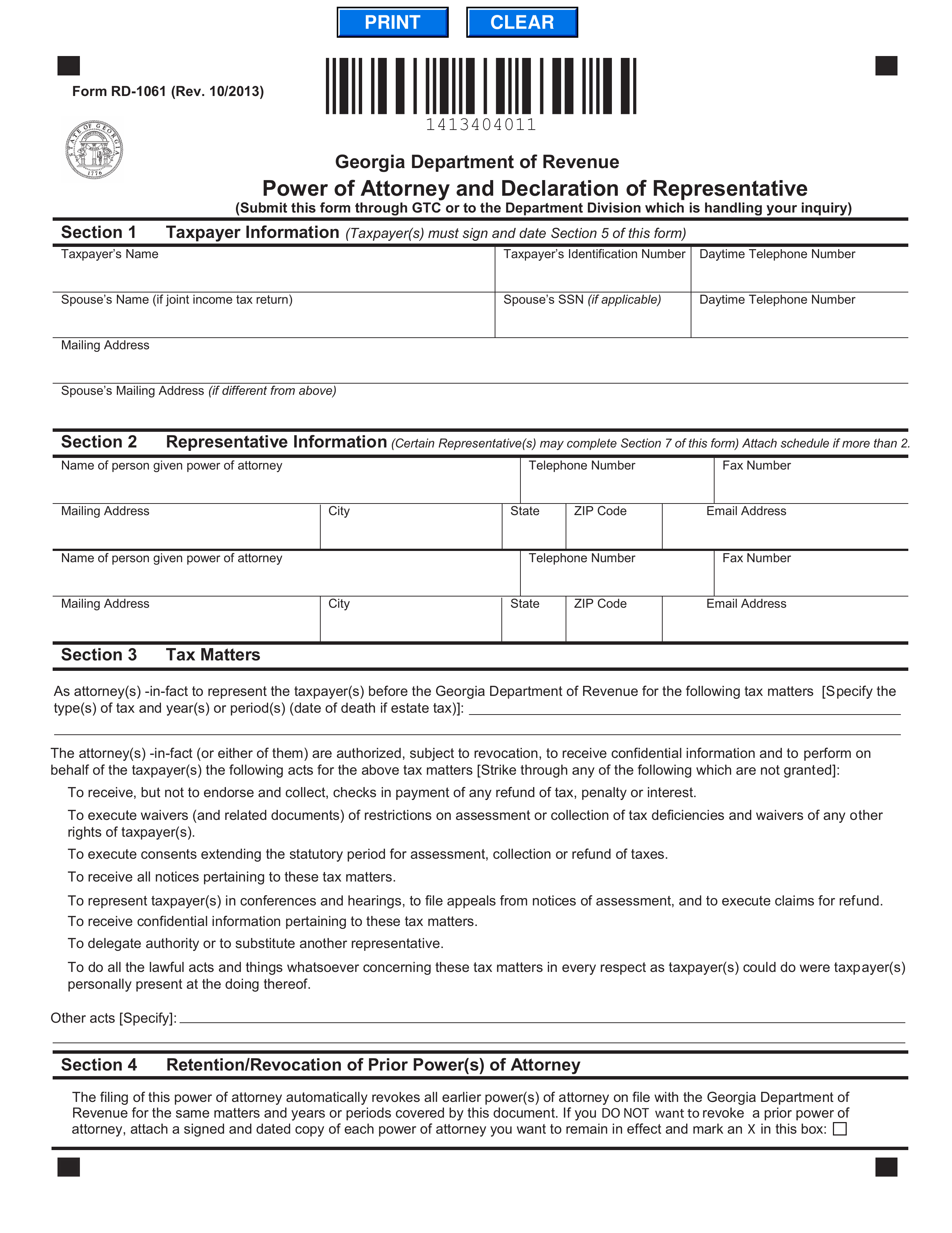

A Georgia tax power of attorney (Form RD-1061), often referred to as the Georgia Department of Revenue Power of Attorney and Declaration of Representative, allows a principal to designate an agent, usually a trusted tax advisor or attorney, to represent them in front of the Department of Revenue. Once this document is properly executed and submitted, the agent named within it can proceed with filings or obtain information on the principal’s behalf.

How to Write

1 – Consolidate The Required Paperwork

Make sure any additional information or forms that must be included with this filing is available and prepared to be attached. Also, the information recorded here must be accurate. Thus, make sure any reference material needed is available. When it is time to fill out this form, download it using one of the buttons on the right. You may work on it onscreen or you may print it then fill it out. You may open or download any of the available file versions at your discretion.

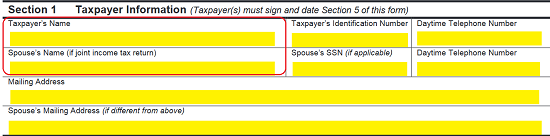

2 – Furnish The Requested Taxpayer Information

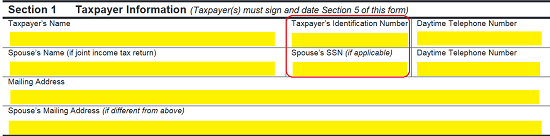

Section 1 of this form will address the Taxpayer Information that must be supplied on this form. First, find the box labeled “Taxpayer’s Name.” Enter the Full Legal Name of the Taxpayer as he or she is known to the Internal Revenue Service. If the Principal Taxpayer, filing this form, files jointly with a spouse, that Spouse must have his or her Name presented in the box labeled “Spouse’s Name.”

Next, the Principal Taxpayer’s Identification Number (i.e. Social Security Number), must be reported in the next box. Below this will be a box to report the Social Security Number of the Spouse if the Principal Taxpayer has filed jointly.

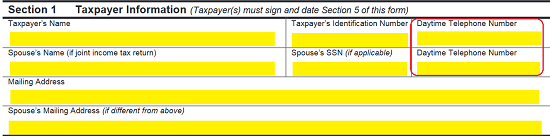

Supply the Daytime Telephone Number of the Principal Taxpayer in the last box on this row. If the Principal Taxpayer filed with his or her Spouse, the Spouse’s Daytime Telephone Number should be reported in the box below this.

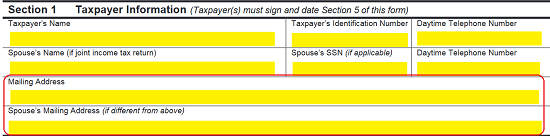

Below this, the Mailing Address of the Principal Taxpayer must be accurately displayed. If the Principal Taxpayer has a spouse, his or her Mailing Address must also be supplied (on the line directly below).

3 – Fill-In the Principal Representative Information

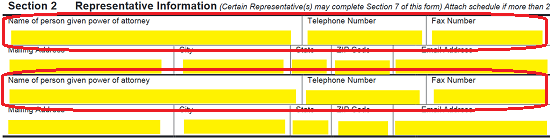

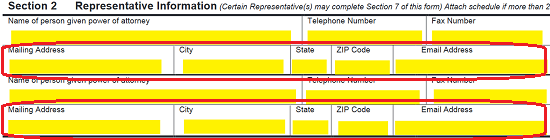

Section 2 will focus on the Representative or Agent who will accept the responsibility of dealing with the I.R.S in the name of the Principal and wield Principal Authority. There will be enough lines to empower two Principal Representatives with Principal Power (two lines per agent).

In order to empower a Principal’s Representative with Principal Authority, the Full Name of the Agent must be declared in the box labeled “Name of person given power of attorney.” Then, in the next two boxes on the same row, report the Principal Representative’s Telephone Number and Fax Number in the boxes labeled “Telephone Number” and “Fax Number” (respectively).

The next line will require the Mailing Address (Building Number, Street, Unit Number, PO Number) of the Principal Representative in the first box. Then supply the Representative’s City, State, and Zip Code in the next three boxes. Finally, fill in the Principal Representative’s E-Mail Address in the last cell of this row.

4 – Assign Authority In The Principal’s Tax Matters

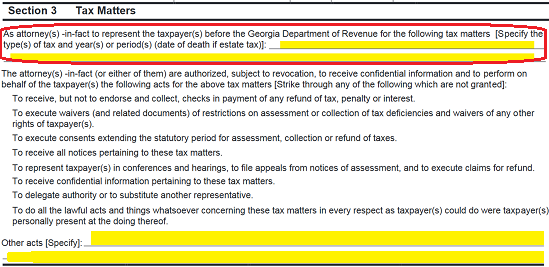

Section 3 will require a report on what areas of the Principal’s Tax Matters the Representative may wield Principal Authority in. To start this report, find the first statement here (beginning with “As attorney(s)-in-fact to represent…” then, list the Tax Matter Type(s), Tax matter Year(s)/Period(s) on the blank lines provided. If this form will concern itself with Estate Tax(es), then make sure to report the Date of Death.

The following information provided will define what actions the Representative may take on behalf of the Principal. These should be considered relatively standard, however, the Principal may restrict the Representative from any of these actions by simply drawing a horizontal line across the statement to be removed, then initialing the margin. If there are any additional Acts the Representative may take on behalf of the Principal, they may be listed on the blank lines, at the end of this statement, just after the words “Other acts[Specify].”

5 – Intent To Revoke

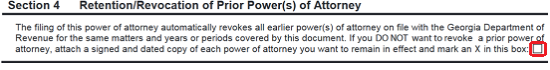

The Principal must define his or her intent to either Revoke any previous authorities on file with the Georgia Dept. of Revenue or, keep them in effect. This document will automatically revoke any previous authorities delivered concerning the same matters and time periods defined in this document. If the Principal does not wish to Revoke such a previously issued Authority, then mark the checkbox in Section 4 and attach the Authority Issuance that should not be revoked by this form’s execution.

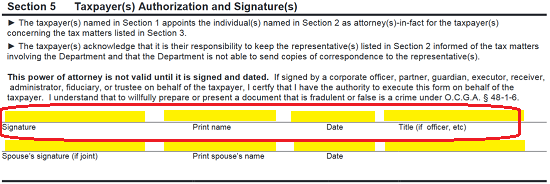

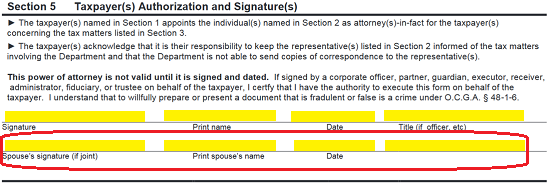

6 – Official Principal Taxpayer Authorization

This form must have the direct approval of the Principal in order for it to be considered a valid representation of the Principal’s intent. Such approval may only be demonstrated when the Principal delivers the Principal’s Signature, Printed Name, Signature Date, and Principal Title (if applicable) in the appropriate areas on the first blank line in Section 5.

If the Principal Taxpayer filed jointly with a Spouse, the Spouse must provide his or her Signature, Printed Name, and Signature Date on the second blank line in this section.

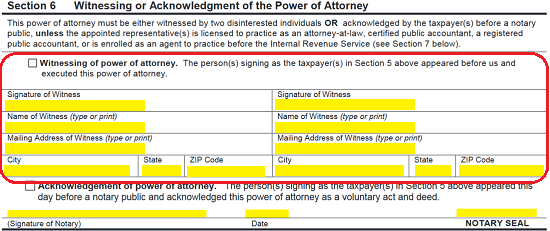

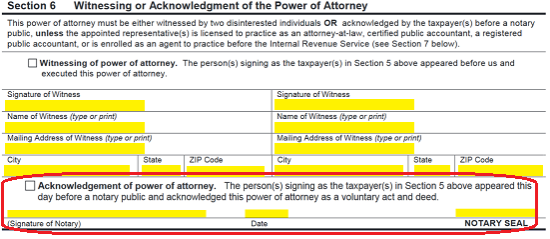

7 – Substantiating This Form’s Principal Intent

There are three ways to substantiate the Principal’s Designation of Power to the Representative(s) named in this document: The Principal Signing must occur before two Witnesses, The Principal Signing must be Notarized, or the Representative has a license to practice as an attorney-at-law, C.P.A., Registered Public Accountant, or enrolled as an Agent to practice before the I.R.S.

If the Principal Signing occurs before Witnesses, then mark the box in Section 6, labeled “Witnessing of power of attorney.” Here there will be two separate columns, each with the structure for one unique Witness to satisfy its requirements. Each Witness must sign the “Signature of Witness” line, print his or her name on the “Name of Witness” line, report his or her Mailing Address on the “Mailing Address of Witness” line, then report his or her “City,” “State,” and “Zip Code.”

If the Principal’s designation of power will be verified by a Notary Public at the time of signing, then mark the checkbox labeled “Acknowledgment of power of attorney.” Below this, the Notary Public will Sign, Date, and Stamp the blank line provided.

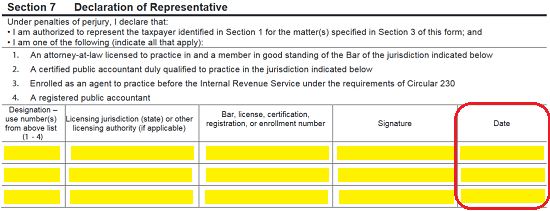

8 – The Principal Representative’s Declaration

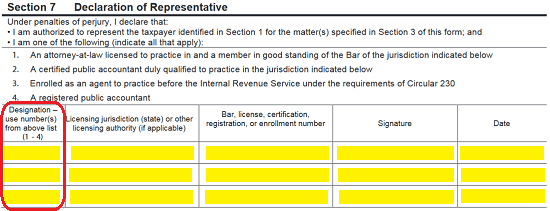

Section 7 has been provided so that the Representative may have an organized method of supplying some necessary information. This section will require the direct attention of the Principal’s Representative. First, each Representative must go through the numbered list defining entity types, then enter the number that defines his or her status in the first column by reporting that number. (Enter 1 if an Attorney-at-Law. Enter 2, if a Certified Public Accountant. enter 3, if an Enrolled Agent, Enter 4 if a Registered Public Accountant).

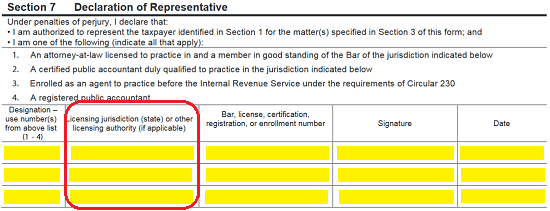

In the second column, each Agent must enter “Licensing Jurisdiction” or “Licensing Authority” that enables the Agent to practice his or her profession.

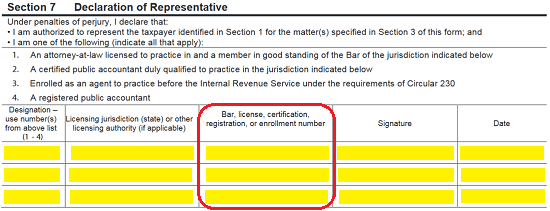

The third column will require the Representative’s Bar, License, Certification, Registration, or Enrollment Number.

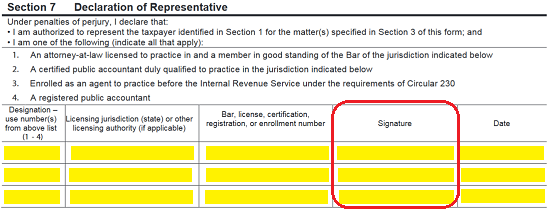

The next column must have the Signature of the Representative supplied.

Finally, in the last column, under “Date,” record the Representative must enter the Date he or she signed this form.