Updated June 02, 2022

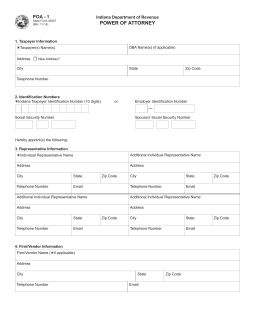

An Indiana tax power of attorney (Form 49357), otherwise known as Indiana Department of Revenue Power of Attorney, is a type of hardcopy appointment that allows a person to delegate to another person the handling of your tax matters with the Department of Revenue. This form, when properly executed will allow your representative to make filings and obtain your tax information, and communicate with the Department of Revenue on your behalf.

How to Write

1 – The Required Indiana Form Is Accessible Directly From This Page

It is imperative that all the information reported on this form be one hundred percent accurate, so take a moment to gather the appropriate materials. When you are ready, select the form to open or download using the button on below the image.

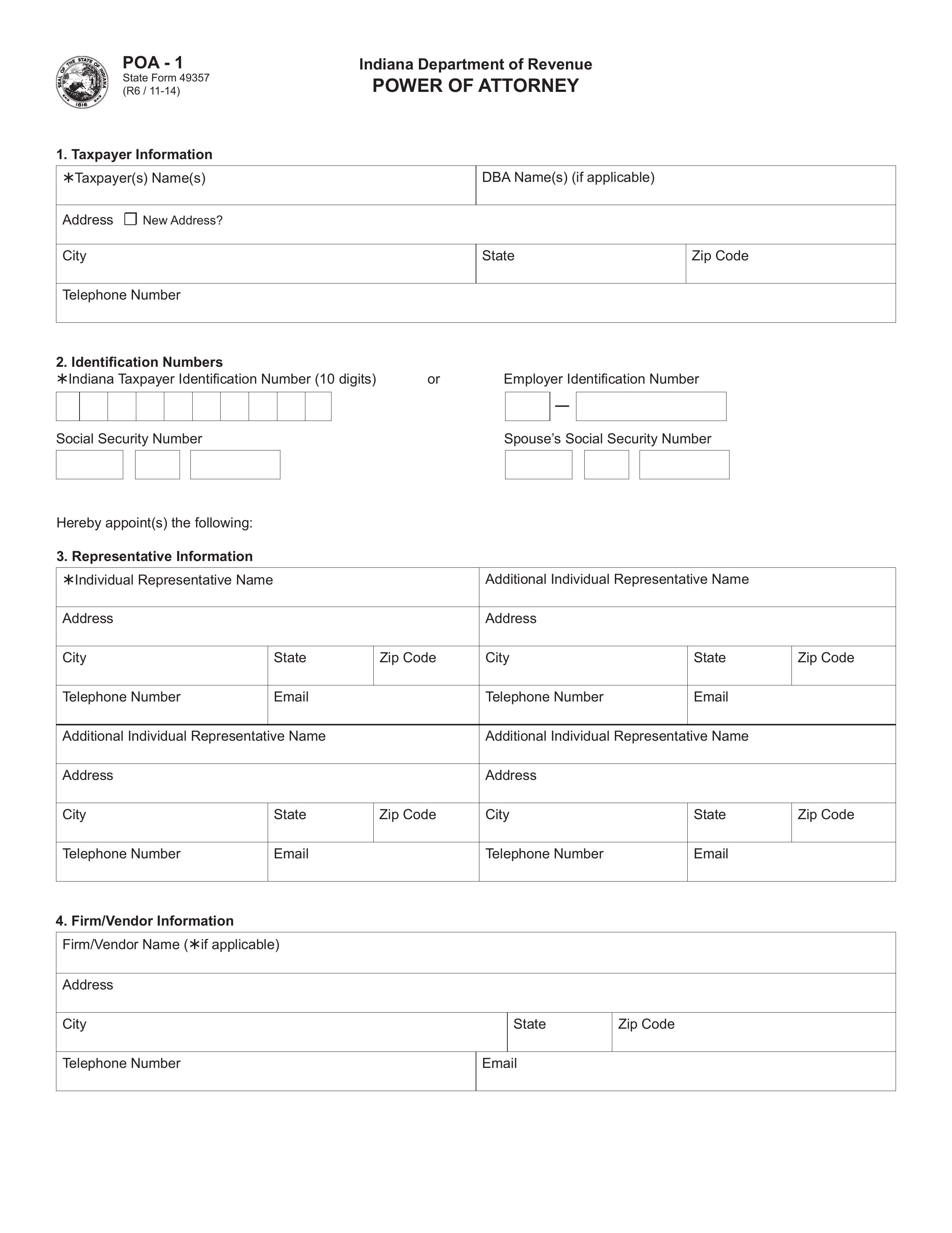

2 – The Indiana Taxpayer’s Information Should Be Recorded

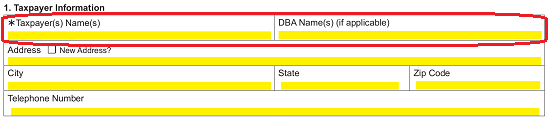

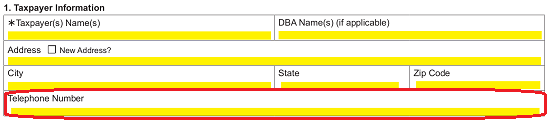

Locate Item 1, “Taxpayer Information.” This is the first table on the page and will require some definitive information regarding the Taxpayer acting as a Principal or Grantor of Power through this form. On the first line of this table, report the Indiana Taxpayer’s Full Name in the first cell. If the Taxpayer does business as another entity, then enter the Name of that entity in the second cell on the first row (below the words “DBA Name(s)”).  The next three rows will devote themselves to Taxpayer Contact Information. Enter the Physical Street Address of the Taxpayer in the second row. If this Address is not normally associated with the Taxpayer in relation to the Indiana Department of Revenue, then mark the box labeled “New Address?” in this row as well. Use the fields labeled “City,” “State,” and “Zip Code” (in the third row) to complete this address.

The next three rows will devote themselves to Taxpayer Contact Information. Enter the Physical Street Address of the Taxpayer in the second row. If this Address is not normally associated with the Taxpayer in relation to the Indiana Department of Revenue, then mark the box labeled “New Address?” in this row as well. Use the fields labeled “City,” “State,” and “Zip Code” (in the third row) to complete this address.

Enter the Daytime or Cell Phone Number of the Taxpaying Principal in the fourth row.

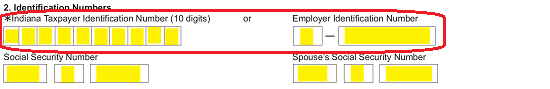

Item 2, “Identification Numbers,” will also focus on the Taxpaying Principal. On the first line, you may either report the Taxpayer’s I.D. Number in the boxes below the words “Indiana Taxpayer Identification Number (10 digits)” or, if this is a business entity, you should report the Taxpaying Entity’s EIN in the space provided below the words “Employer Identification Number.”

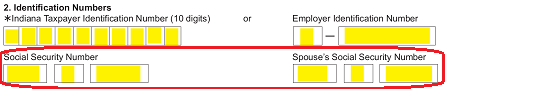

The next line is provided for the Principal Taxpayer’s Social Security Number may be reported. If the Indiana Taxpayer filed jointly, then his or her Spouse’s Social Security Number should be provided below the words “Spouse’s Social Security Number.”

3 – The Taxpayer Representative Accepting This Authority Should Also Be Identified

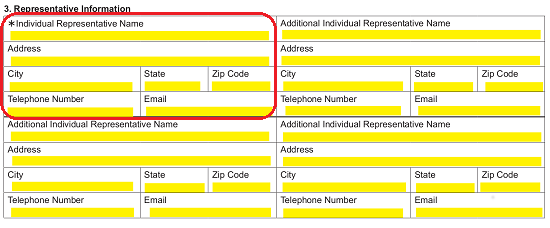

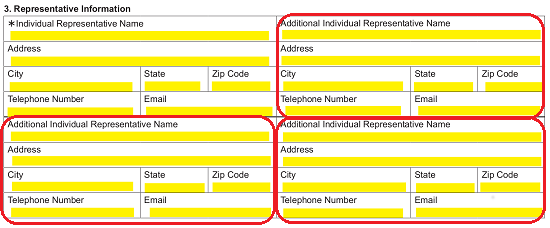

Item 3 will focus on the Representative Agent the Indiana Taxpayer has decided to designate his or her Authority to. The Indiana Taxpayer may choose to name one Primary Representative plus up to three others here. Locate the first cell, titled “Individual Representative Name,” then enter the Name of the Representative chosen by the Principal. Sometimes this entity will be referred to as an Agent or Attorney-in-Fact. The second and third row should present the Street Address (Building Number/Street/Unit or Suite Number) and the City, State, and Zip Code of one Agent. The fourth row will provide an area so the required “Telephone Number” and “Email Address” may be documented.

If the Principal chooses additional agents then locate a section titled “Additional Individual Representative Name” and record the Full Name of this entity. Similarly, you will need to provide the Address, Telephone Number, and Email for this party in the appropriate areas.

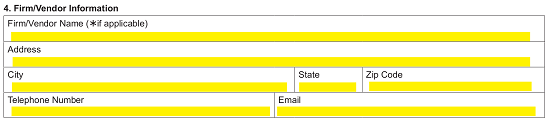

In many cases a named Agent/Attorney-in-Fact may be associated with a business entity or a Business Entity may be the Principal’s Agent, such as an Accounting Firm. In such an instance, the Business Entity’s information must also be documented here. This may be done in Item 4, “Firm/Vendor Information.” If this is applicable, report the “Firm/Vendor Name” in the first row, the Street “Address” in the second row, the City/State/Zip Code in the third row, and “Telephone Number” and “Email” Address in the last row. Each requested item will be appropriately titled.

If the Firm/Vendor table has been filled out accurately then, each Representative in that Firm must have his or her Full Name, Telephone Number, and Email Address reported in the table at the top of the next page. There will be enough room to document four individuals. If more room is required, the Representative Roster may be completed in an attachment that is clearly labeled and dated.

4 – Define What the Agent May Act Upon With Principal

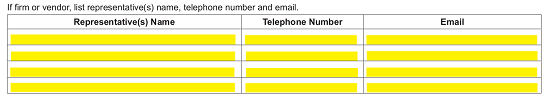

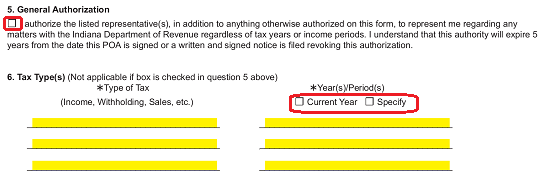

This form will present a choice of items to help define the Tax Matters the Agent may wield Principal Authority in. If the Principal intends to give unlimited access and representational Authority in relation to the Indiana Department of Revenue then check the box in Item 5, “General Authorization.” If, however, the Principal wishes to limit the Agent’s Powers only to certain areas, then skip Item 5 and address Item 6. In Item 6, record the Tax Matters (i.e. Income Taxes) the Principal may affect in the first column (“Tax Types”) and the applicable Years or Time Periods in the second column. If it is the current year, then mark the box labeled “Current Year.” If the Agent may affect these matters for a time period that includes or excludes the Current Year, then mark the check box labeled “Specify,” and use the lines below it to document this time period. If there are multiple Tax Matters and you specify a time period for any, then mark the box labeled “Specify.”

5 – The Indiana Taxpayer’s Verification

The Indiana Taxpayer must sign his or her Name on the “Signature” line in Item 7, “Authorizing Signature.” On the line next to this, the Signature “Date” should be entered.

Below this, the Principal should print his or her Name in the space after “Printed Name” while the space next to it will require (if applicable) the Principal’s Title.

Finally, the Principal must enter his or her Telephone Number and Email Address using the spaces provided on the last line.

When this document is ready for submission, you may:

Fax To:

(317) 615-2605

Or

Mail To:

Indiana Department of Revenue

PO Box 7230

Indianapolis, IN 46207-7230