Updated June 02, 2022

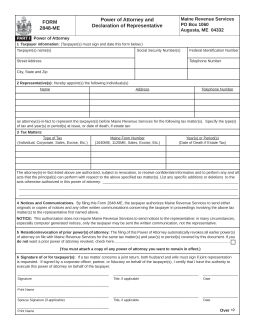

A Maine tax power of attorney (Form ME-2848), otherwise known as the Maine Revenue Services Power of Attorney and Declaration of Representative, is a form used when someone wishes to appoint an accountant, tax attorney, or other financial representatives to handle their tax matters such as filings and inquiries. The agent will be able to obtain information and make filings on the person’s behalf.

How to Write

1 – Form 2848-ME Should Be Accessed through This Web Page

Three choices for the file format you may obtain this file in has been provided through the “PDF,” “ODT,” and “Word” buttons. You may use fill this form out onscreen provided you have the appropriate software or you may print it then fill it out manually.

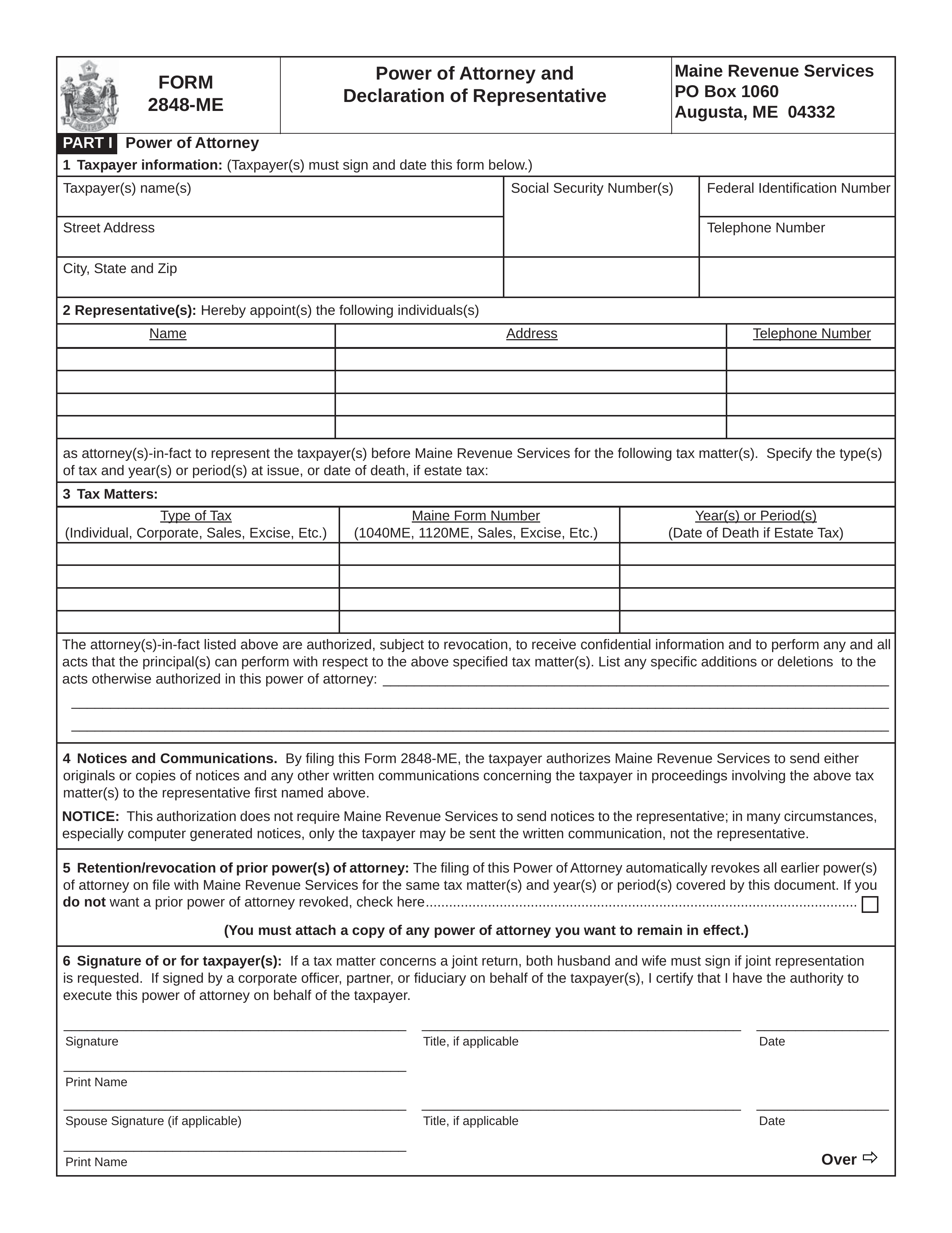

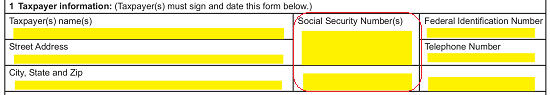

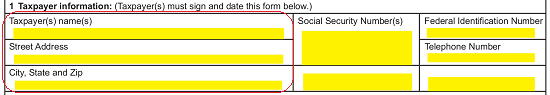

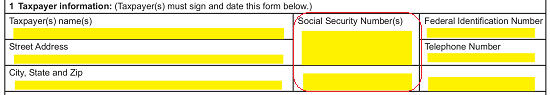

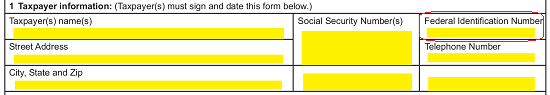

2 – The Taxpayer Granting This Authority Must Be Reported In The First Table

In order to grant a Representative Principal Authority, the Principal Taxpayer’s information will need to be recorded. The first table will provide a well-structured area to provide the required Taxpayer information that must be submitted.

Use the first column, to record the “Taxpayer(s) Name(s),” “Street Address,” and “City, State, and Zip” in the first, second, and third rows. If the Principal has filed jointly in any of the Tax Matters the Representative or Attorney-in-Fact with a Spouse, then enter the same information for the Spouse in this table as you do for the Principal Taxpayer.

Use the second column to report each Principal Taxpayer’s Social Security Number.

If the Principal Taxpayer is a business entity, use the third column to report the Principal Taxpayer’s “Federal Identification Number.” Finally, regardless of the Principal Taxpayer’s entity type, record each Principal Taxpayer’s Telephone Number in the last two boxes of the third column.

Finally, regardless of the Principal Taxpayer’s entity type, record each Principal Taxpayer’s Telephone Number in the last two boxes of the third column.

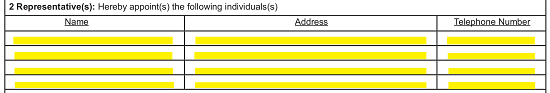

3 – Report At Least One Attorney-in-Fact Or Representative Being Granted Authority In The Second Table

Similarly, once the Principal Taxpayer’s Information has been provided for submission, it will be necessary to also submit some information to identify the Representative or Attorney-in-Fact the Principal Taxpayer intends to appoint with Authority through this form’s submission. It is worth noting the Maine Revenue Services Department will only send copies of notices (sent to the Principal to the first Agent/Attorney-in-Fact documented).

The table provided will have three columns to declare a Principal Taxpayer’s Attorney-in-Fact Representative. Enter the First, Middle, and Last Name of the Representative in the first column. In the second column, report that Agent’s Address. Finally, in the third column, enter the Agent’s Telephone Number.

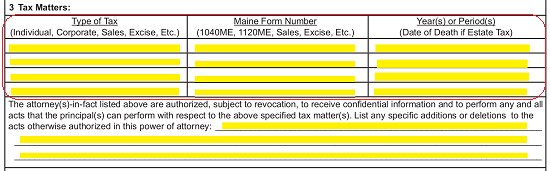

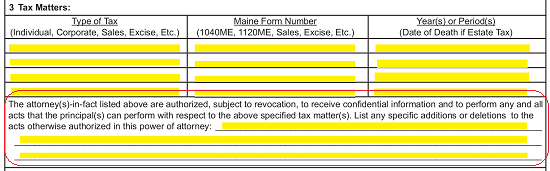

4 – Specify The Tax Matters The Attorney-in-Fact May Act In Using In The Third Table

The Tax Matters the Attorney-in-Fact will be delegated Powers over should be clearly defined. The Maine Revenue Services Department will only allow the Representative to act in the Name of the Principal for the Type of Taxes in the Time Periods defined by the Principal in the table titled “Tax Matters.” This table will have three columns.

Use the first, second, and third column to report the “Type of Tax,” “Maine Form Number,” and “Year(s) or Period(s)” the Attorney-in-Fact will be approved Principal Power in. You may attach a separate document with more information if there is not enough room. Make sure that all Tax Types, Form Numbers/ID, and Time Periods are recorded accurately. In addition to the rows in the “Tax Matters” table will be an area directly below if that are any specific instructions, limitations, extensions, circumstances, additions, deletions, etc. should be applied to any of the Tax Types the Attorney-in-Fact may wield Principal Authority in. If not enough blank lines have been provided for this purpose, then include them in an attachment. Any provisions or instructions the Principal Taxpayer insists on imposing will need to be documented fully by the time of this form’s submission.

In addition to the rows in the “Tax Matters” table will be an area directly below if that are any specific instructions, limitations, extensions, circumstances, additions, deletions, etc. should be applied to any of the Tax Types the Attorney-in-Fact may wield Principal Authority in. If not enough blank lines have been provided for this purpose, then include them in an attachment. Any provisions or instructions the Principal Taxpayer insists on imposing will need to be documented fully by the time of this form’s submission.

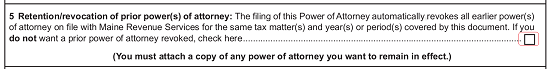

5 – The Option To Prevent Revocation

This Tax Power Delegation Form will automatically revoke all previously issued Authorities the Maine Revenue Services Department views as conflicting. That is, this document will have the final say until the Principal Taxpayer indicates differently. If, however, the Principal wishes to secure the Effect of a previously issued Authority, he or she may do so by marking the box in the numbered bold statement “5. Retention/Revocation Of Prior Power(s) Of Attorney,” then attaching a copy of the previously issued Power that should remain in Effect to this form before completion.

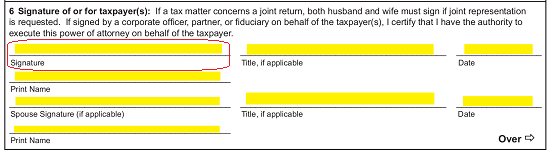

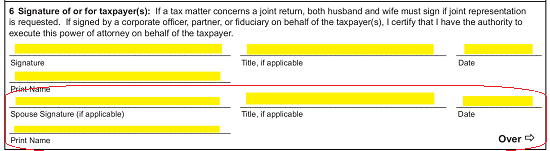

6 – This Form Requires The Principal Taxpayer’s Signature To Go In Effect

The Principal Taxpayer’s Signature will serve as proof to the Maine Revenue Services Department that he or she is intent on delegating this Authority to the Attorney-in-Fact(s) named above.

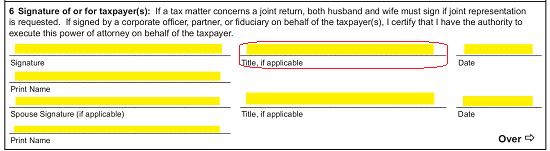

On the first line, in “6. Signature Of Or For Taxpayer(s),” the Principal must sign his or her Name. The next blank space will allow for any Title the Principal may hold to be reported (on the blank space labeled “Title, if applicable”)

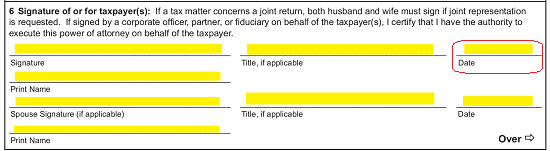

The next blank space will allow for any Title the Principal may hold to be reported (on the blank space labeled “Title, if applicable”) The blank space “Date” refers to the Date the Principal is signing this document. This Date must be reported with the signing of this document.

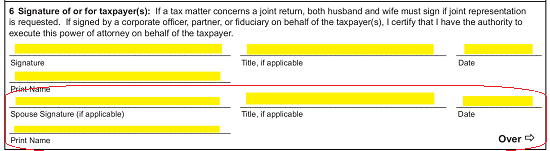

The blank space “Date” refers to the Date the Principal is signing this document. This Date must be reported with the signing of this document. Finally, on the blank line labeled “Print Name,” the Principal must print his or her name.

Finally, on the blank line labeled “Print Name,” the Principal must print his or her name. The next set of lines have been provided if the Principal filed jointly with a Spouse in the Tax Matters defined here and this spouse was listed above. The Spouse must sign his or her Name, report any Title held, record the Date of Signature, and print his or her Name on the blank lines labeled “Spouse Signature (if applicable),” “Title, If Applicable,” “Date,” and “Print Name”

The next set of lines have been provided if the Principal filed jointly with a Spouse in the Tax Matters defined here and this spouse was listed above. The Spouse must sign his or her Name, report any Title held, record the Date of Signature, and print his or her Name on the blank lines labeled “Spouse Signature (if applicable),” “Title, If Applicable,” “Date,” and “Print Name”

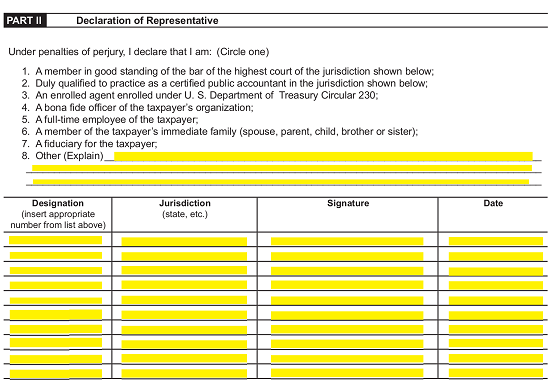

7 – Each Attorney-in-Fact Must Self Report And Sign This Document

It will not be enough to simply report the Name and Contact Information of each Attorney-in-Fact. Each Representative delegated with Principal Power will need to self-report several facts and sign this form. First, the Representative must read the numbered list. Each line will contain a Role or Title Description. If none of these apply, then provide a description of the Role or Title held by a Representative named in this form on the blank lines in item 8. Next, each Attorney-in-Fact will need to fill in the first column with his or her numerical “Designation” in the first column, the “Jurisdiction” where he or she is licensed in the second column, Sign his or her Name in the third column, and the Date of Signature in the fourth column.