Updated June 02, 2022

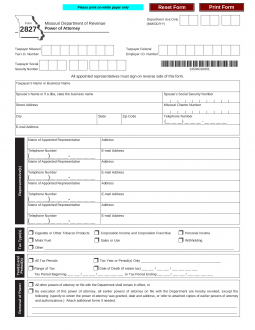

A Missouri tax power of attorney (Form 2827), otherwise known as the “Missouri Department of Revenue Power of Attorney,” can be used to assign power to a tax professional or qualified agent to make filings on your behalf, obtain your tax information, and resolve any tax-related issues you may have. This form is useful when there are questions raised by the Department of Revenue as it allows you to appoint someone who is more knowledgeable about taxes to research and resolve the matter on your behalf.

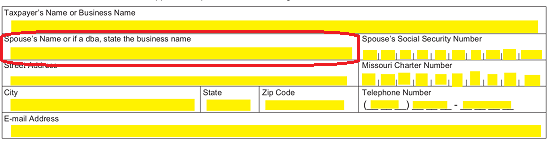

How to Write

1 – The Tax Authority Form Is Available To Open And/or Download On This Page

Open this form as a PDF by clicking on the button below the image. You may use a PDF editor to enter information directly onto this form or you may print it then fill in the information manually.

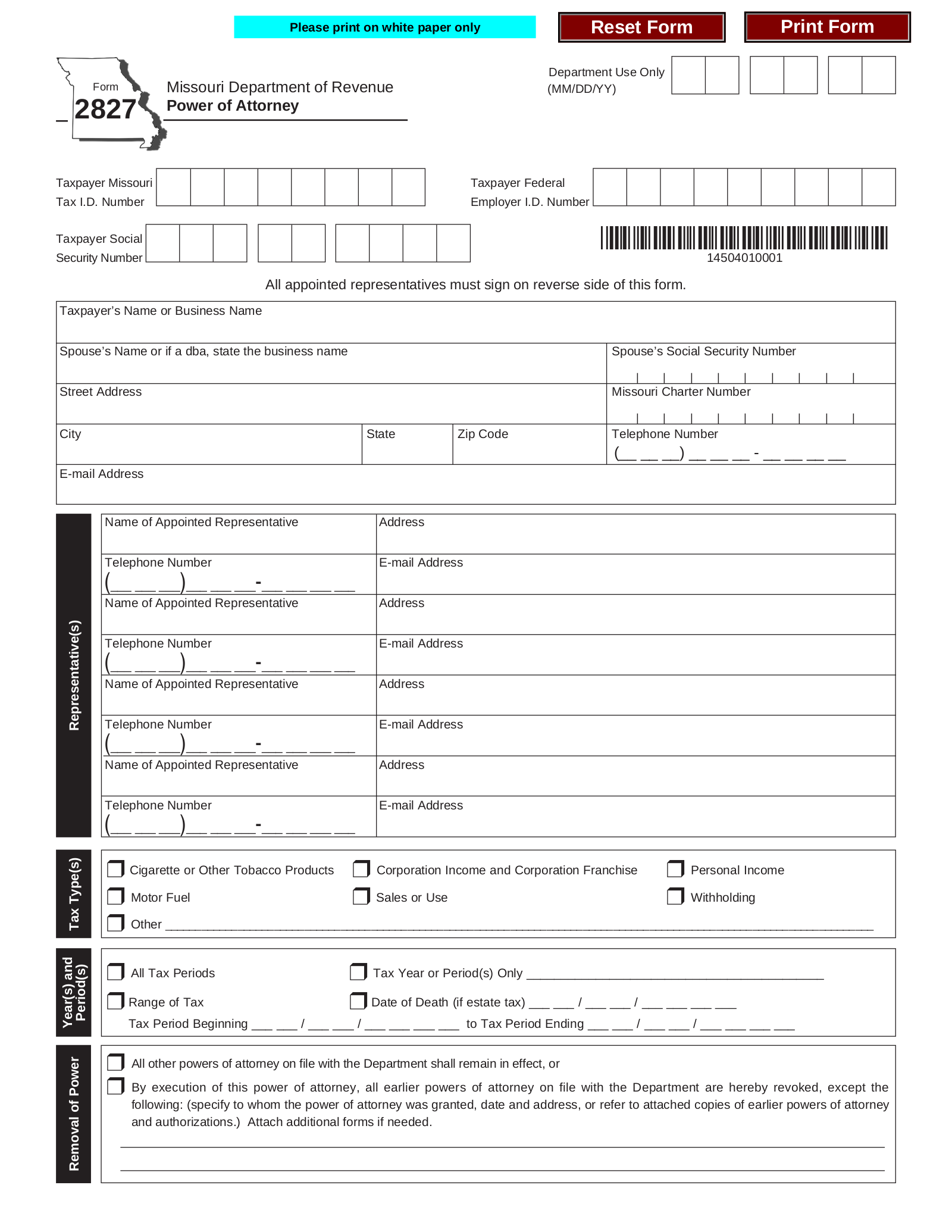

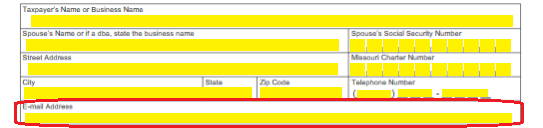

2 – Provide The Identity Of The Principal Taxpayer

The Principal Taxpayer, appointing Power through this form, must be properly identified. There will be three sets of boxes at the top of the page. At least one must be filled in, depending on the Taxpayer’s status. Use these boxes to record the Principal “Taxpayer Missouri Tax I.D. Number,” the Principal “Taxpayer Social Security Number,” or the Principal “Taxpayer Federal Employer I.D. Number.” Below these sets of boxes will be a Table where you may provide additional information regarding the Principal’s Identity. Use the first row to document the “Taxpayer’s Name or Business Name.” If the Principal Taxpayer is a person make sure you record the First, Middle, and Last Name plus any additional suffixes or prefixes attached to that Name. If the Principal Taxpayer is a Business, then record the Full Legal Name of the Business along with any applicable business suffixes (i.e. Corp., Ltd, Co., etc.). If this is a person or entity doing business under a different Name in the State of Missouri, then enter the registered Name of the filing entity, not the d.b.a. Name.

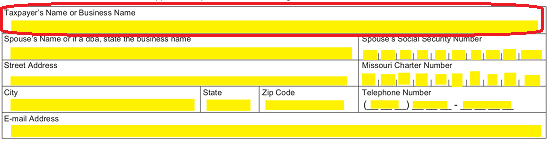

Below these sets of boxes will be a Table where you may provide additional information regarding the Principal’s Identity. Use the first row to document the “Taxpayer’s Name or Business Name.” If the Principal Taxpayer is a person make sure you record the First, Middle, and Last Name plus any additional suffixes or prefixes attached to that Name. If the Principal Taxpayer is a Business, then record the Full Legal Name of the Business along with any applicable business suffixes (i.e. Corp., Ltd, Co., etc.). If this is a person or entity doing business under a different Name in the State of Missouri, then enter the registered Name of the filing entity, not the d.b.a. Name.  The next three rows will be divided into two columns. For the moment, we will focus on the left-hand column. If the Principal Taxpayer has/had a Spouse that he or she filed jointly with then or is a Business operating a Name other than its Official Name, then you must satisfy the item in the second row titled “Spouse’s Name Or If A dba, State The Business Name.” If this box applies then supply the Name it requires. Otherwise, you may leave it blank.

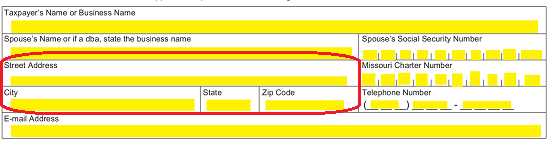

The next three rows will be divided into two columns. For the moment, we will focus on the left-hand column. If the Principal Taxpayer has/had a Spouse that he or she filed jointly with then or is a Business operating a Name other than its Official Name, then you must satisfy the item in the second row titled “Spouse’s Name Or If A dba, State The Business Name.” If this box applies then supply the Name it requires. Otherwise, you may leave it blank.  The next two rows will require the Principal Taxpayer’s Home Address (or Official Executive Office Address) supplied in the cells labeled “Street Address,” “City,” “State,” and “Zip Code.”

The next two rows will require the Principal Taxpayer’s Home Address (or Official Executive Office Address) supplied in the cells labeled “Street Address,” “City,” “State,” and “Zip Code.”

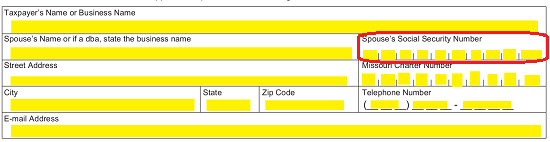

The column on the right will require some odds and ends. If a Spouse exists, his or her Social Security Number must be supplied in the cell labeled “Spouse’s Social Security Number.”

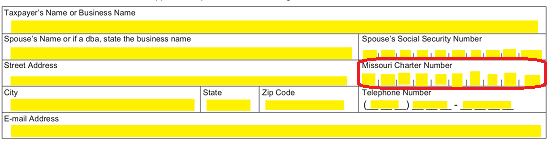

If the Principal Taxpayer is a Business Entity operating in Missouri then, enter the entity’s “Missouri Charter Number” in the appropriately labeled cell.

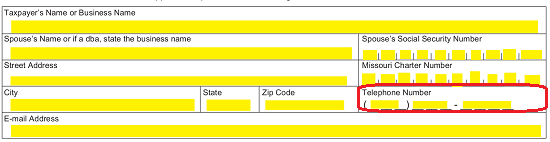

Regardless of the entity type, the Principal Taxpayer may be defined as, enter his, her, or its Contact Phone Number in the cell labeled “Telephone Number.”

Supply the Principal Taxpayer’s “E-Mail Address” in the last row of this table.

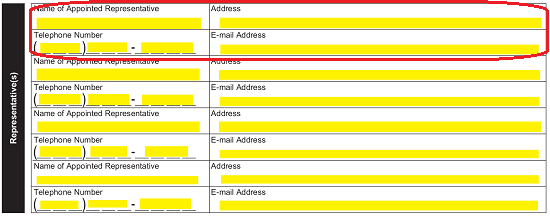

3 – Identify The Appointed Representative(s)

The next task will be to clearly document the Identity and Contact Information of each Principal Taxpayer Representative being appointed with Principal Power, otherwise known as the Appointed Representative. The table labeled “Representative(s)” will provide an organized area to supply this information in an organized fashion. Use this table to list the Full “Name of Appointed Representative,” his or her Physical “Address,” his or her “Telephone Number,” and his or her “E-Mail Address.” There will be enough room on this form to declare Four Representatives, though if necessary, you may include an attachment naming more. Only the Principal Appointed Representative(s) listed in this table will be granted the Principal Power to act as the Principal Taxpayer in the matters we will list in the next sections.

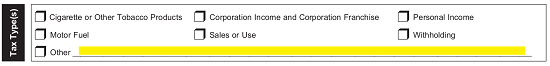

4 – Define The Appointed Representative’s Principal Authority

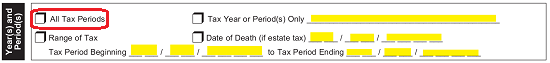

In the section labeled “Tax Type(s),” there will be an opportunity to define the matters the Appointed Representative may use Principal Powers in by marking off the Tax Categories these matters may be classified as. Fill in the corresponding checkbox to all the Tax Types the Appointed Representative is to have Principal Power in: Cigarette Or Other Tobacco Products, Corporation Income and Corporation Franchise, Sales Of Use, Personal Income, Motor Fuel, Sales OR Use, Withholding, or Other. The “Other” category has been provided in the event there is a Tax Matter the Appointed Representative should have Principal Power in that has not been included in this list. If so, then use the blank space after the word “Other” to describe this Authority (making sure to mark the checkbox labeled “Other”).  The next box will be labeled “Year(s) and Period(s).” This will refer to how long the Appointed Representative will have the Principal Authority to act in the Tax Matters defined above. This Period of Effect may be defined in more than one way. If the Appointed Representative will have Principal Power for “All Tax Periods” then, mark the first checkbox in this section.

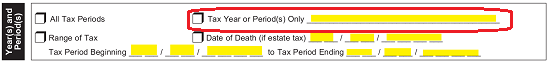

The next box will be labeled “Year(s) and Period(s).” This will refer to how long the Appointed Representative will have the Principal Authority to act in the Tax Matters defined above. This Period of Effect may be defined in more than one way. If the Appointed Representative will have Principal Power for “All Tax Periods” then, mark the first checkbox in this section.  If the Principal only wishes to grant Principal Authority for certain Time Periods (i.e. Tax Year, Tax Quarter, etc.) then mark the second box, labeled “Tax Year or Period(s) Only) and enter the Years or Periods Of Time the Appointed Representative will have Principal Authority.

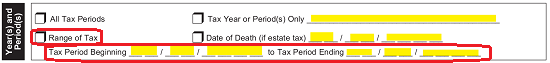

If the Principal only wishes to grant Principal Authority for certain Time Periods (i.e. Tax Year, Tax Quarter, etc.) then mark the second box, labeled “Tax Year or Period(s) Only) and enter the Years or Periods Of Time the Appointed Representative will have Principal Authority.  If the Principal has determined a span of time, then mark the box labeled “Range Of Tax” then use the two blank date lines below it (labeled “Tax Period Beginning” and “Tax Period Ending”) to define this Period of Effect

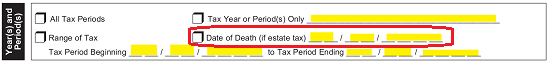

If the Principal has determined a span of time, then mark the box labeled “Range Of Tax” then use the two blank date lines below it (labeled “Tax Period Beginning” and “Tax Period Ending”) to define this Period of Effect  If this is an Estate Tax, then mark the box labeled “Date Of Death” and enter the Date the Deceased Died on the blank space provided.

If this is an Estate Tax, then mark the box labeled “Date Of Death” and enter the Date the Deceased Died on the blank space provided.

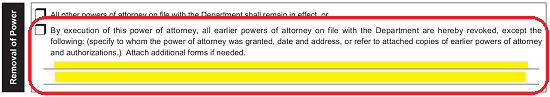

5 – Determine The Status Of Previous Power Documents

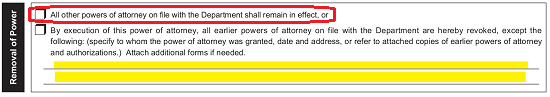

In many cases, there will be previous Authorities issued by the Principal. This document will need to define how it will interact with any such powers in the “Removal Of Power” section. If all the previous Powers designated by the Principal in the past should remain in effect, then mark the first checkbox (labeled “All Other Powers Of Attorney On File With The Department”) If all earlier Powers should be revoked with this form’s execution then, mark the second statement (labeled “By Execution Of This Power Of Attorney…”). If the Principal wishes to revoke some Authorities but not all, then also mark this second statement, then list the previous Authorities that should remain in Effect. If any previous Authorities should not be revoked they must also be attached to this document.

If all earlier Powers should be revoked with this form’s execution then, mark the second statement (labeled “By Execution Of This Power Of Attorney…”). If the Principal wishes to revoke some Authorities but not all, then also mark this second statement, then list the previous Authorities that should remain in Effect. If any previous Authorities should not be revoked they must also be attached to this document.

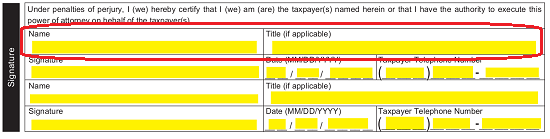

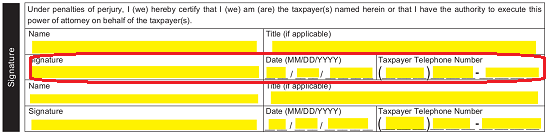

6 – The Principal Taxpayer(s) Will Need To Sign This Tax Power To Execute It

The Taxpayer granting the Appointed Representative Powers of Authority must sign this form. Locate the section labeled “Signature.” Then in the first row make sure the Principal’s Full Name and Title are recorded in their appropriately labeled cells.

The cell labeled ” Signature” must be signed by the principal Taxpayer. Adjacent to this, he or she will need to enter the Date this form was signed. The last cell on this row will require the Principal Taxpayer’s Telephone Number.  There will be enough room for the Principal Taxpayer and his or her Spouse (if filed jointly)

There will be enough room for the Principal Taxpayer and his or her Spouse (if filed jointly)

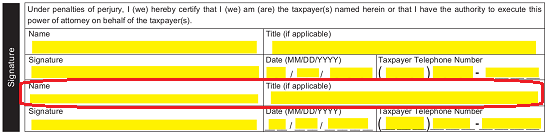

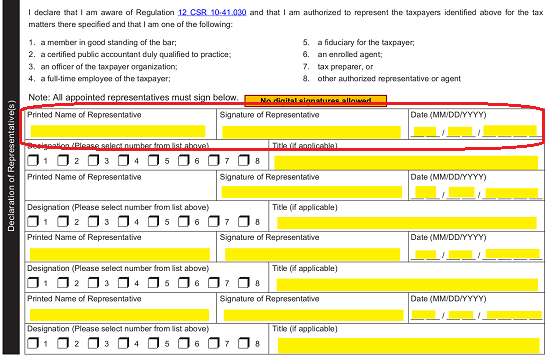

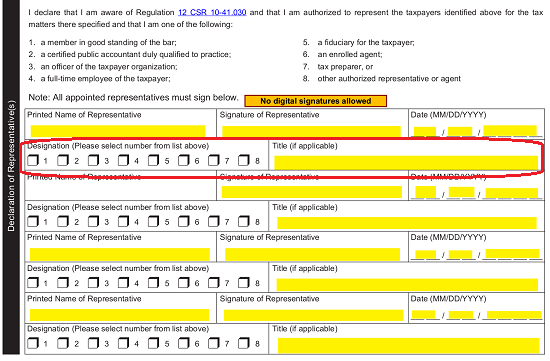

7 – Each Appointed Representative Must Self Identify And Sign This Form

In the section labeled “Declaration Of Representatives,” each Appointed Representative must read the statements provided. He or she should review the list of Titles/Roles and note the one that applies to him or her. Once this is done, each Appointed Representative must Print and Sign his or her Name in the table below. The first row of each Appointed Representative’s section will require the Date of Signature at the end of it.  After providing these items, the Appointed Representative must fill in one of the checkboxes numbered 1 through 8 to indicate which item on the list best defines his or her role. Finally, each Appointed Representative must record any applicable title he or she holds in the cell labeled “Title (if applicable).”

After providing these items, the Appointed Representative must fill in one of the checkboxes numbered 1 through 8 to indicate which item on the list best defines his or her role. Finally, each Appointed Representative must record any applicable title he or she holds in the cell labeled “Title (if applicable).” Once this document has been completed and signed, it may be mailed to the local Missouri Department of Revenue Office.

Once this document has been completed and signed, it may be mailed to the local Missouri Department of Revenue Office.