Updated June 02, 2022

A Montana Tax Power of Attorney Form (Dept. of Revenue), otherwise known as the “Montana Department of Revenue Authorization to Disclose Tax Information Form,” is a document you can use to designate someone, usually a tax professional, to act on your behalf at the Department of Revenue. You can authorize that he or she receives information, represents you or makes decisions on your behalf, or all three.

How to Write

1 – Organize The Information Required For This Submission Then Open This Document

The official paperwork required to assign Principal Tax Powers to an Attorney-in-Fact is attainable through one of the three buttons beneath the preview picture on this form. In order to fill in this form, you will need information regarding the Taxpayer and Attorney-in-Fact’s Identity and Location, the Tax Matters involved, the Time Periods involved, and the status of any previously issued Tax Authorities.

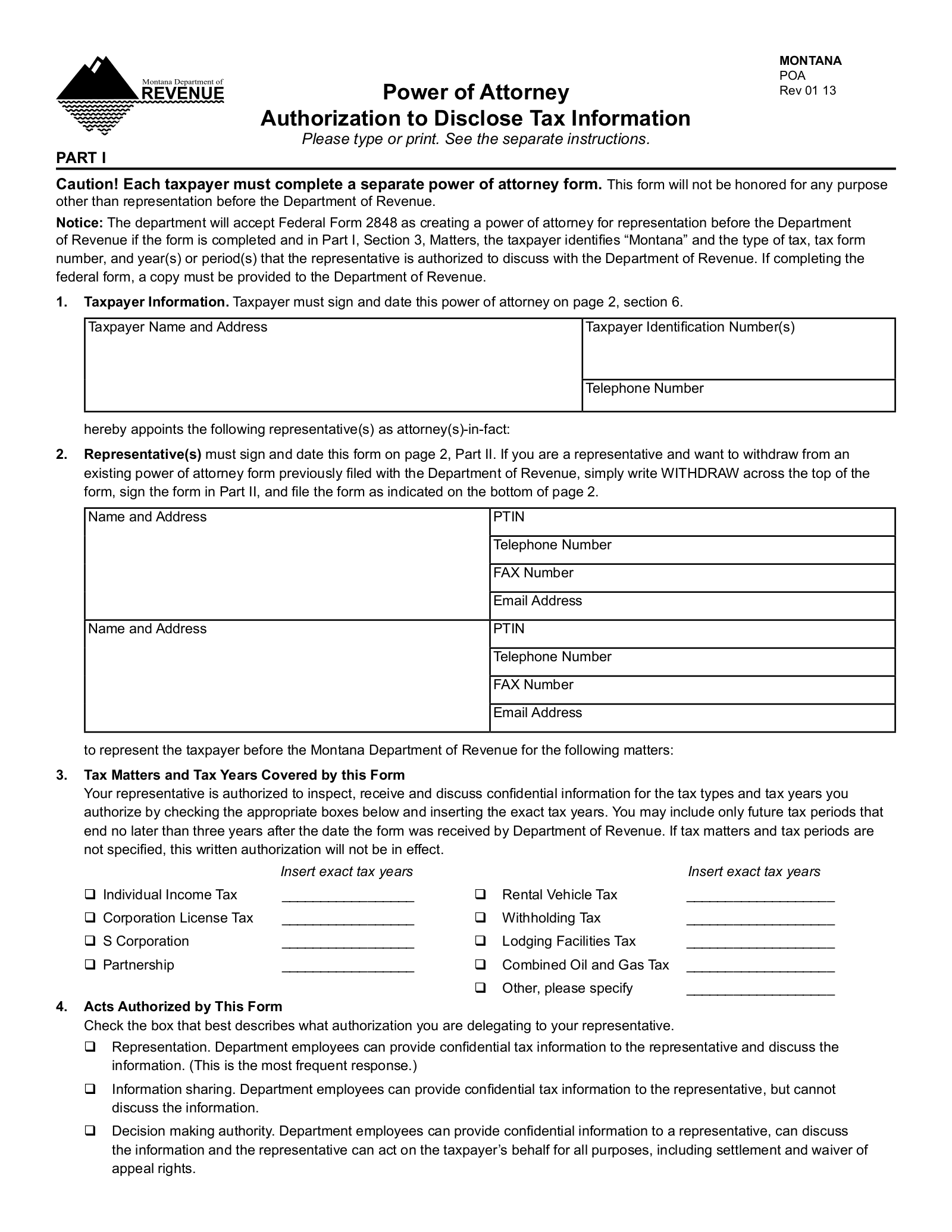

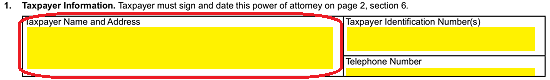

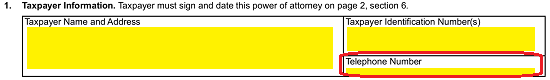

2 – Document The Full Name And Complete Address Of The Principal Taxpayer

Locate the first article (“Taxpayer Information”). In the box labeled “Taxpayer Name and Address,” enter the First Name, Middle Name, and Last Name of the Principal Taxpayer. This is the entity who is delegating his or her Tax Powers to the Attorney-in-Fact. Directly below the Principal Taxpayer’s Name, in the same box, record the Complete Address where the Principal Taxpayer lives.

Next, in the box labeled “Taxpayer Identification Number(s),” record the Principal Taxpayer’s Social Security Number. If the Principal Taxpayer is a business entity, record the entity’s Federal Employer Identification Number in this box.  In the final box of this section, enter the Principal Taxpayer’s contact “Telephone Number.” Make sure this phone number is an up-to-date and well-maintained Telephone Number.

In the final box of this section, enter the Principal Taxpayer’s contact “Telephone Number.” Make sure this phone number is an up-to-date and well-maintained Telephone Number.

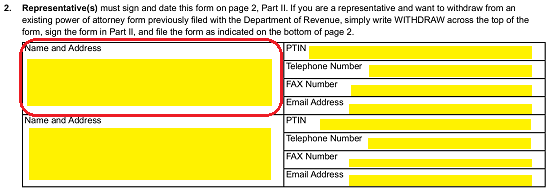

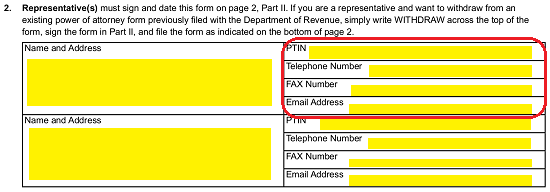

3 – Each Representative’s Identifying Information Must Be Presented

Refer to the second article, “Representative(s),” you will need this section to name each Attorney-in-Fact being appointed with Principal Power. The table provided will have enough room to declare two Appointed Representatives with Principal Authority.

Use the first box, under the words “Name And Address,” to document the Appointed Representative’s First, Middle, and Last Name. Make sure to apply any Titles considered part of his or her Legal Name. In the same box, record the Appointed Representative’s Legal Address.  In the next column, you will need to enter the Appointed Representative’s Preparer Tax Identification Number, current Telephone Number, current Fax Number, and E-Mail Address just below the words “PTIN,” “Telephone Number,” “FAX Number,” and “Email Address.”

In the next column, you will need to enter the Appointed Representative’s Preparer Tax Identification Number, current Telephone Number, current Fax Number, and E-Mail Address just below the words “PTIN,” “Telephone Number,” “FAX Number,” and “Email Address.”

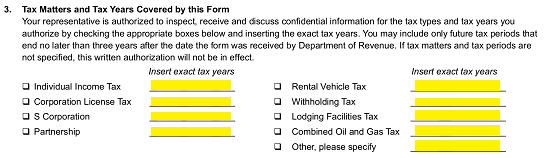

4 – Indicate The Tax Matters The Attorney-in-Fact Will Have Principal Authority In

The Powers granted in this form must be defined so they may be placed within the scope of the Appointed Representative’s Principal Authority. To accomplish this report, we must tend to the third article, “Tax Matters And Tax Years Covered By This Form.” Here, a list of Tax Matters will be provided. Each one will have a corresponding check box and a blank line. If the Principal is designating one of these Powers to the Appointed Representative, the corresponding check box should be marked. In addition, make sure to indicate the “Exact Tax Years” when the Appointed Representative can exert Principal Authority in the selected Tax Matter on the corresponding blank line.

5 – Specify The Principal Approved Actions The Attorney-in-Fact May Take With Principal Power

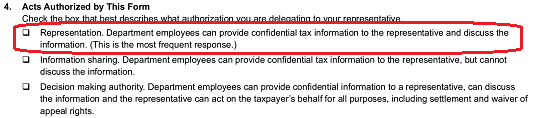

Three statements with check boxes are provided in the fourth article so that you may indicate the Actions of Principal Authority being delegated to the Appointed Representative. Mark the box corresponding to the statement describing why the Principal is granting Power. The Principal should review these statements carefully before one is selected.

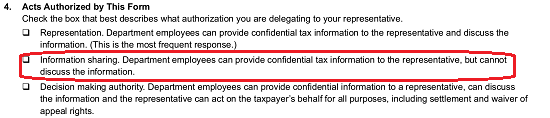

Mark the check box corresponding to the first statement if the reason this paperwork is being executed is for Principal “Representation.” Select the second check box to issue this Authority for “Information Sharing.”

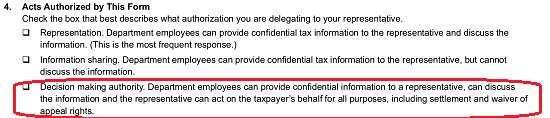

Select the second check box to issue this Authority for “Information Sharing.” If this paperwork is being issued for granting “Decision Making Authority,” select the third statement.

If this paperwork is being issued for granting “Decision Making Authority,” select the third statement.

6 – Address The Durability Of Previously Issued Authorities

If there are any previous Power Documents granting Authority in existence, by default, they will be automatically revoked with this form’s execution. You may prevent this automatic revocation by simply marking the check box at the end of the paragraph item in the fifth article, then attaching a copy of the previously issued Power Document that should not be revoked.![]()

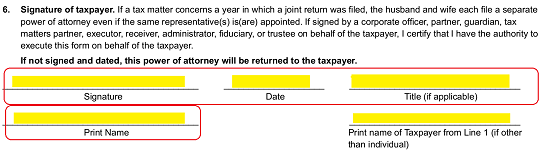

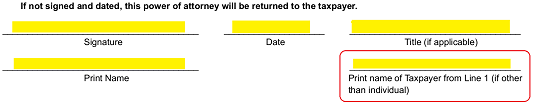

7 – Direct Principal Attention Is Required To Execute This Paperwork

The sixth article will provide an instrument to execute this document. The Principal should sign his or her Name on the Signature line, enter the Date of Signature on the adjacent blank line, and fill in any applicable Title on the blank line labeled “Title (if applicable).” Finally, on the line labeled “Print Name,” the Principal must present his or her printed Name.  If the Signature Party is not the same party reported in the first article, then he or she must Print the Name of the Taxpayer in the first article on the blank space labeled “Print Name Of Taxpayer From Line 1 (If Other Than Individual).”

If the Signature Party is not the same party reported in the first article, then he or she must Print the Name of the Taxpayer in the first article on the blank space labeled “Print Name Of Taxpayer From Line 1 (If Other Than Individual).”

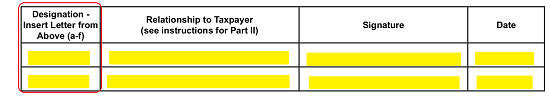

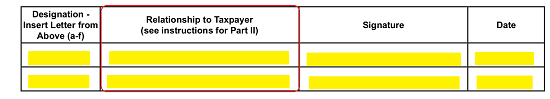

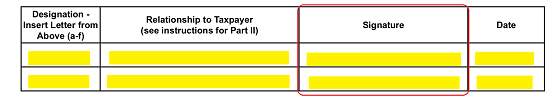

8 – The Attorney-in-Fact Must Self-Report And Verify Acknowledgment By Signature

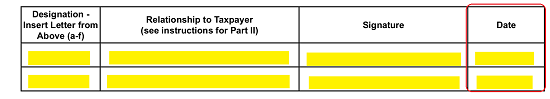

Part II will have a bulleted list each Appointed Representative should read. The second bulleted item will be composed of a list of statements labeled “A” through “E.” The Appointed Representative will need to make a note of which one best describes his or her role. The table below will require the Appointed Representative to enter the letter for the list item that best defines the Appointed Representative’s role in the first column (“Designation – Insert Letter From Above (a-f).”  The second column, “Relationship To Taxpayer,” requires the relationship the Appointed Representative holds with the Principal entered.

The second column, “Relationship To Taxpayer,” requires the relationship the Appointed Representative holds with the Principal entered.  The Appointed Representative must sign his or her Name in the column labeled “Signature.”

The Appointed Representative must sign his or her Name in the column labeled “Signature.” Finally, the Appointed Representative must enter the Date he or she is signing this form.

Finally, the Appointed Representative must enter the Date he or she is signing this form.

Once this form has been completed, you may:

Mail To:

Montana Department Of Revenue

Legal Services, Disclosure Office

125 N Roberts

P.O. Box 7701

Helena, MT 59604-7701

Or Fax To:

(406) 444-4375