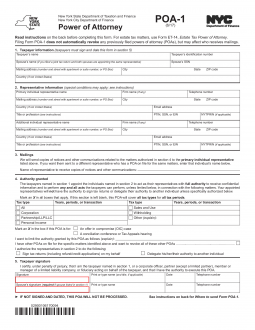

Updated August 09, 2023

A New York tax power of attorney (Form POA-1) allows a principal to appoint another party to represent them to file State taxes or handle any other matters related to the New York State Department of Taxation and Finance. Often, a principal will have an accountant, attorney or some other tax professional be their representative to handle filings, obtain information, or otherwise deal with issues that come up relating to the taxes.

How to Write

Download: PDF

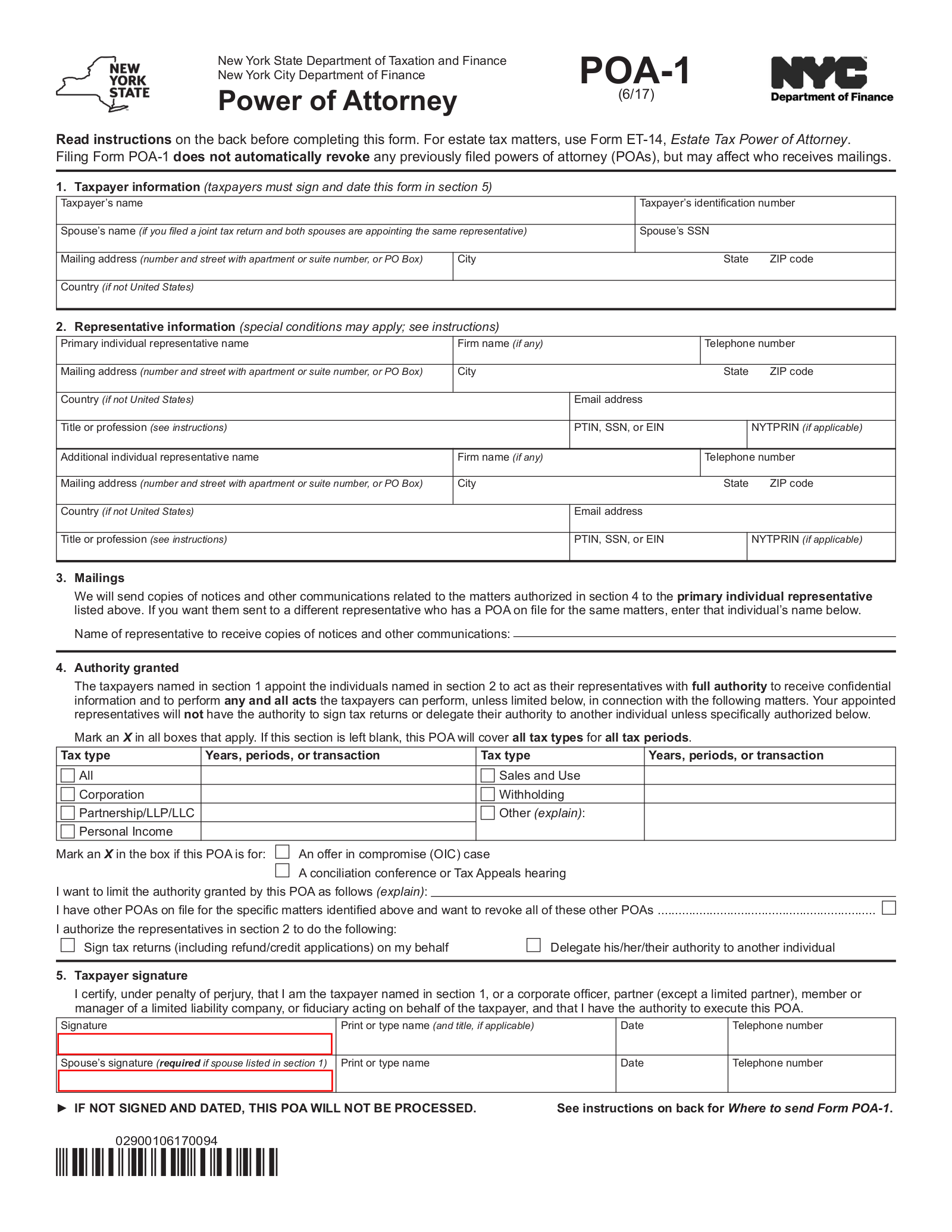

Section 1. Taxpayer Information

(1) Taxpayer’s Name. The full name of the New York Taxpayer must be recorded in the first section. This will be the Party who intends to authorize another Party or Entity to access and engage in allowable tax functions on his or her behalf.

(2) Taxpayer’s Identification Number. The Taxpayer’s Government I.D. Number is required to further identify him or her to the I.R.S office receiving this document. It is strongly recommended to enter the Taxpayer’s social security number to this box if he or she has been issued one.

(3) Spouse’s Name. If the Taxpayer is married (in any state) record the full name of his or her Married Partner or Spouse.

(4) Spouse’s SSN. Record the social security number of the New York Taxpayer’s Spouse.

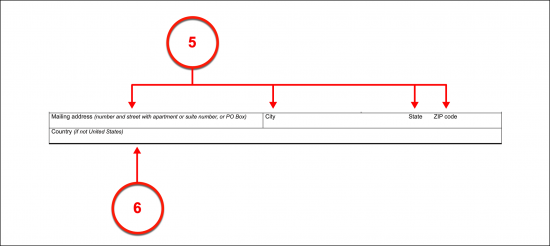

(5) Mailing Address. Produce the New York Taxpayer’s mailing address making sure to produce the “City,” “State,” and “Zip Code” portion of the address where they are requested.

(6) Country Of Residence. If the New York Taxpayer does not live in the United States, record his or her country of residence.

Section 2. Representative Information

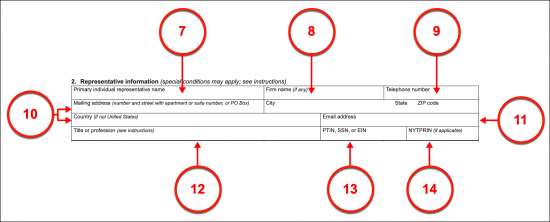

(7) Primary Individual Representative Name. The Primary Individual Representative will be your first choice for the New York Tax Attorney-in-Fact appointment being made. This is the Party that will carry the principal power you deliver through this instrument to represent you in certain matters of taxation. Report the full name of this Person in the first area of the second section. Do not report the name of a Firm or other Business Entity in this box.

(8) Firm Name. If the Primary Individual Representative you named above is acting in the name of a Business Entity such as an Accounting or Law Firm, then produce the full name of this Business Entity where it is requested. If the New York Tax Attorney-in-Fact (Primary Individual Representative) is acting independently then this box may be left blank.

(9) Primary Individual Representative Phone Number.

(10) Mailing Address And Country. The address where the Primary Individual Representative must be presented in full as a street address, city, state, and zip code

(11) Email Address. The current e-mail address where the Primary Individual Representative can be reached should be recorded.

(12) Title Or Profession. If the Primary Individual Representative is part of a Firm or Business Entity representing the New York Taxpayer or Principal, then his or her formal job title or position should be documented. If the Primary Individual Representative is an Independent Party, then, report his or her profession.

(13) PTIN, SSN, Or EIN. If the Internal Revenue Service has issued a Preparer Tax Identification Number (PTIN) and/or Entity Identification Number to your Primary Individual Representative then produce this information where requested. If the Primary Individual Representative has not been identified in this manner by the IRS, then document his or her social security number.

(14) NYTPRN. If the Primary Individual Representative has received a New York Tax Preparer Registration Number.

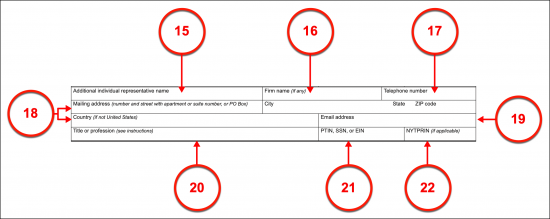

(15) Additional Individual Representative Name. If the New York Taxpayer (Principal) wishes to name an Additional Individual Representative, then identify this Party in the next section. It should be mentioned that if this document is revoked or if one of the New York Tax Attorneys-in-Fact denies this appointment, then neither Attorney-in-Fact will retain the power to represent the New York Taxpayer since such action will terminate this form as a whole.

(16) Firm Name. If the Additional Representative is working for a Business Entity that is formally representing the New York Taxpayer, then the entire name of this Entity must be documented.

(17) Additional Individual Representative Phone Number.

(18) Mailing Address And County. The complete address where the Additional Representative or the Firm representing the New York Taxpayer can be reached by mail must be recorded with this Party’s identity.

(19) Additional Individual Representative E-Mail Address.

(20) Title Or Profession. The Additional Representative’s profession should be documented. If a Business Entity or Firm is acting on your behalf, then deliver the Additional Representee’s official job title or position with this Entity.

(21) PTIN, SSN, Or EIN. The IRS may have issued the Additional Representative a Preparer Tax Identification Number or an Entity Identification Number. Distribute this information if it has been assigned to the Additional Representative or the Entity he or she works for. If Additional Representative works independently, he or she may not have been issued either ID number and this area will require his or her social security number entered instead.

(22) NYTPRN. Make sure to report the Additional Individual Representative’s New York Tax Preparer Registration Number if he or she has been issued one from the I.R.S.

Part 3. Mailings

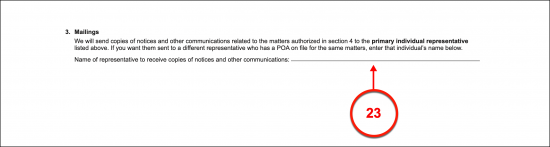

(23) Name Of Notice Recipient. The Primary Individual Representative will be considered the Primary Recipient of notices and communications sent by I.R.S. The New York Tax Payer can name an additional Recipient who will be sent copies of such correspondence originating from the IRS.

Part 4. Authority Granted

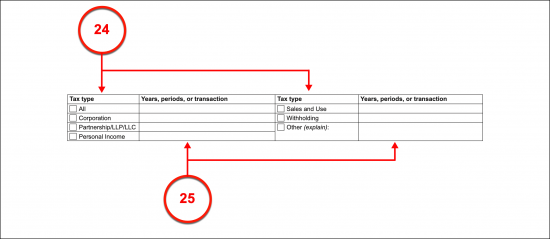

(24) Tax Type. The authority to represent the New York Tax Payer must be targeted to the tax matters he or she approves. This requires that a record of the type of tax matters the Primary (and Additional) Individual Representative will have the principal power to act in on behalf of the New York Tax Payer. A table listing tax types enables a quick assignment of these matters to the concerned Agents or Representatives. Check each box corresponding to a Tax Type the New York Tax Payer authorizes his or her Representative to engage in on his or her behalf. He or she can be given the ability to represent the New York Tax Payers in “All” matters or only for topics concerning Corporations, Partnerships including LLP’s and LLC’s, the Tax Payer’s (Personal) Income, sales taxes and use taxes, withholding taxes, and “Other” matters not previously listed by selecting (only) every box that should be placed in the Primary and Additional Individual Representative’s principal powers.

(25) Years, Periods, Or Transaction. For each selection of “Tax Type” made, the time frame (i.e., years or periods) and/or transaction types that your Individual Representative or Tax Attorney(s)-in-Fact may access and engage in on your behalf must be listed. Make sure to correspond each description of power you provide to the correct tax matter on its left. Be advised that if you selected “All” or “Other” you must record any relevant information (i.e., a case number, an assessment ID Number, forms the Representative may work with).

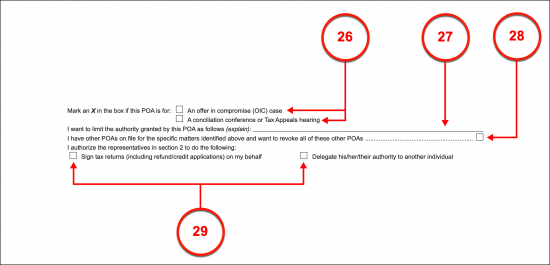

(26) Purpose. If the reason for this appointment of power is to allow the Primary (and Additional) Individual Representative to offer a compromise or engage in a conciliation conference (or Tax Appeals) on behalf of the New York Tax Payer, then this should be indicated. Two statements defining such purpose have been supplied.

(27) Limitations. You can limit the access to information, the power to make certain decisions, and/or how he or she behaves with your tax matters or communications in general or with each other in any way that is legal and desired, but such limitations must be documented in this appointment. If relevant, document all limitations to be placed on your Individual Representative’s use of the principal authority he or she can wield as a result of this document’s submission.

(28) Other Powers Of Attorney Status. If there are any other powers of attorney that deal with matters of taxation in the State of New York, then they must be revoked with the execution of this document. This requires the direct approval that can be supplied by filling in the checkbox corresponding to this declaration.

(29) Authorized Actions. If the New York Tax Payer wishes to authorize the named Representative(s) to sign his or her tax returns, then select the statement authorizing this action. Similarly, the Individual Representative can also be approved to delegate the powers granted here to other parties by locating and selecting this statement. Either or both of these statements may be selected as desired. Be aware that some of the actions associated with these powers may require additional paperwork submitted.

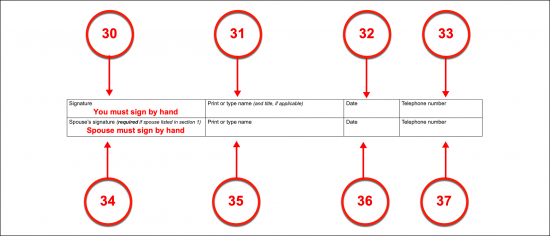

Part 5. Taxpayer Signature

(30) New York Tax Payer Signature. The New York Tax Payer must sign this form once it is completed, and all additional information attached.

(31) Printed Name.

(32) Signature Date. As soon as the New York Tax Payer signs his or her name to this form, he or she should report the current date.

(33) New York Taxpayer Telephone Number.

(34) Spouse’s Signature. If the New York Tax Payer has listed a Spouse, then his or her Spouse must also sign this form.

(35) Printed Name Of Spouse.

(36) Spouse’s Signature Date.

(37) Phone Number Of New York Taxpayer’s Spouse.