Updated June 02, 2022

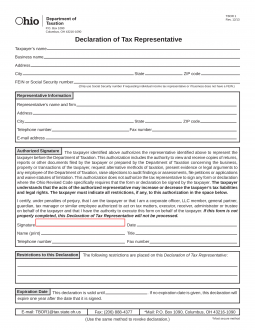

An Ohio tax power of attorney form, or ‘Form TBOR 1’, is a document you can fill out to appoint an agent to represent you before the Department of Taxation. The principal taxpayer will be responsible for naming the representational powers the agent can wield in this paperwork. Such powers can range from the authority to view and receive copies of returns, to file the paperwork when necessary to represent the taxpayer in appeals. The principal taxpayer and representative agents will need to agree on the authority and responsibilities being delivered as both parties must provide an executing signature.

How to Write

1 – This Declaration Should Be Accessed And Obtained On This Page

The form required to declare an individual the Principal Representative Powers when dealing with Tax Entities should be downloaded here on this page. Locate the buttons (PDF, Word, ODT) then select the file you prefer.

2 – Taxpayer And Representative Information Must Be Recorded Accurately

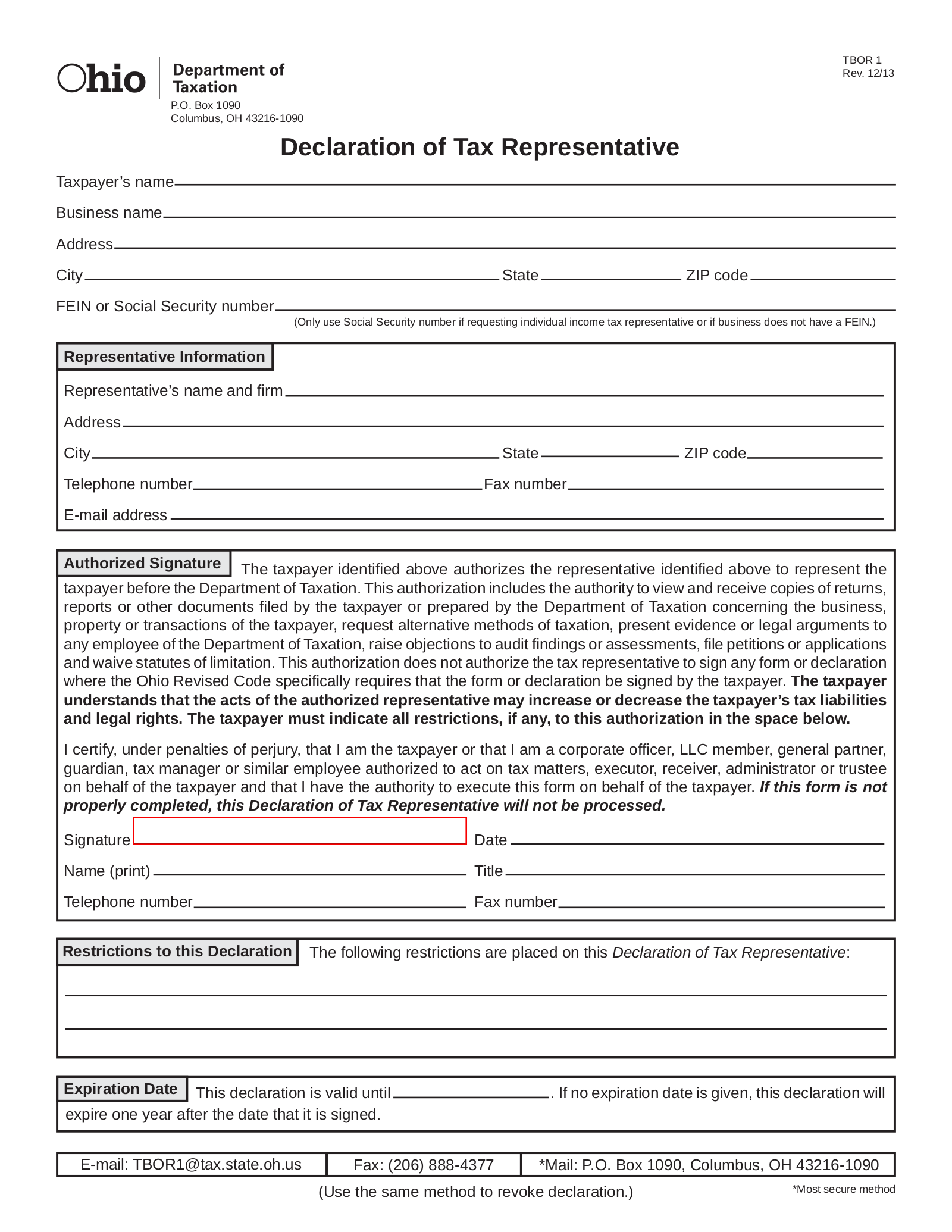

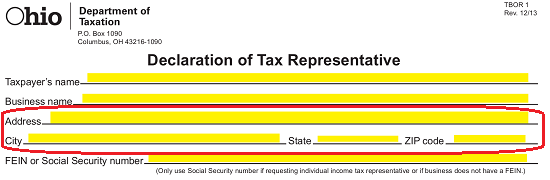

Several labeled lines are presented at the beginning of this form. Each one of these lines will refer to the Principal and must be supplied with the requested information. To begin, report the Taxpayer’s Legal Name (as recorded on his or her Tax documents) on the first blank line.  If the Taxpayer is a Business Entity, fill in the Name of this entity (including any suffix considered part of its Legal Name) on the second blank line. If the Taxpayer is an individual and not a Business Entity, then leave this line blank.

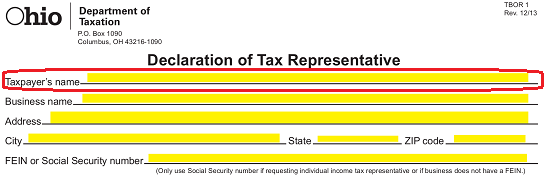

If the Taxpayer is a Business Entity, fill in the Name of this entity (including any suffix considered part of its Legal Name) on the second blank line. If the Taxpayer is an individual and not a Business Entity, then leave this line blank.  Now, use the blank lines bearing the labels “Address,” “City,” “State,” and “Zip Code” to fully document the Legal Address of the Taxpayer (regardless of whether the Taxpayer is an individual or Business Entity).

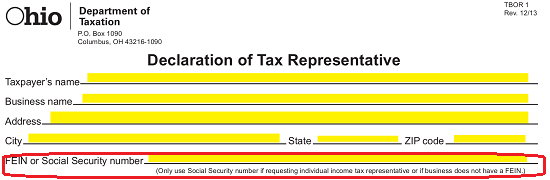

Now, use the blank lines bearing the labels “Address,” “City,” “State,” and “Zip Code” to fully document the Legal Address of the Taxpayer (regardless of whether the Taxpayer is an individual or Business Entity).  This Taxpayer report concludes with the line labeled “FEIN Or Social Security Number.” If the Taxpayer is a Business Entity, then report its Federal Entity Identification Number on this line. If the Taxpayer is an individual or the Business Entity does not have a FEIN, then record the Taxpayer’s Social Security Number on this line.

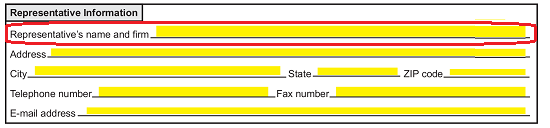

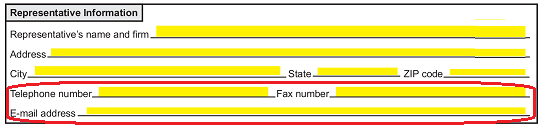

This Taxpayer report concludes with the line labeled “FEIN Or Social Security Number.” If the Taxpayer is a Business Entity, then report its Federal Entity Identification Number on this line. If the Taxpayer is an individual or the Business Entity does not have a FEIN, then record the Taxpayer’s Social Security Number on this line.  The next task will be to document the Taxpayer Representative’s Name and Contact Information. This will be handled in the box labeled “Representative Information.” Begin by entering the Taxpayer Representative’s Legal Name on the “Representative’s Name And Firm.” Make sure that, if the Representative is a Firm, to include any appropriate suffixes. If the Representative is a professional make sure that you include any title (i.e. C.P.A.) that may be used to identify his or her trade.

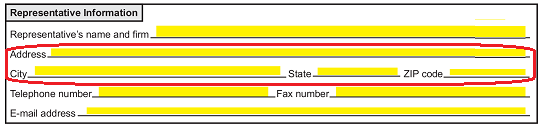

The next task will be to document the Taxpayer Representative’s Name and Contact Information. This will be handled in the box labeled “Representative Information.” Begin by entering the Taxpayer Representative’s Legal Name on the “Representative’s Name And Firm.” Make sure that, if the Representative is a Firm, to include any appropriate suffixes. If the Representative is a professional make sure that you include any title (i.e. C.P.A.) that may be used to identify his or her trade.  The next three lines “Address,” “City,” “State,” and “Zip Code” have been presented so an accurate disclosure of the Taxpayer’s Representative’s Address may be made. Make sure this Address is transcribed precisely as it appears on the Taxpayer Representative’s Identification Documents (i.e. Professional License)

The next three lines “Address,” “City,” “State,” and “Zip Code” have been presented so an accurate disclosure of the Taxpayer’s Representative’s Address may be made. Make sure this Address is transcribed precisely as it appears on the Taxpayer Representative’s Identification Documents (i.e. Professional License) The final task in this section will furnish distinct areas where the Taxpayer Representative’s Contact Information can be documented. Use the lines bearing the labels “Telephone Number,” “Fax Number,” and “E-Mail Address” to record a well-maintained Daytime Telephone Number (and/or Cell Phone Number), Fax Number, and E-Mail Address of the Taxpayer Representative

The final task in this section will furnish distinct areas where the Taxpayer Representative’s Contact Information can be documented. Use the lines bearing the labels “Telephone Number,” “Fax Number,” and “E-Mail Address” to record a well-maintained Daytime Telephone Number (and/or Cell Phone Number), Fax Number, and E-Mail Address of the Taxpayer Representative

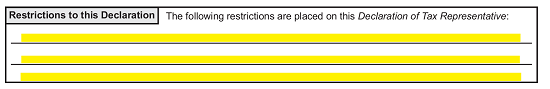

3 – Record Any Restrictions On Powers Or This Delegation’s Lifespan

If the Taxpayer wishes to impose any Restrictions upon the Principal Powers the Taxpayer Representative may use when dealing with a Tax Entity on his or her behalf, they should be well-documented before he or she signs this document. If any restrictions or limitations need to apply, then record them below the Signature Area using the blank lines provided in the “Restrictions To This Declaration.” By Default, the Principal Powers delivered here will automatically terminate One Year from the Taxpayer’s reported Signature Date. If the Taxpayer wishes these Powers to Terminate on a different Date, this should be declared in the box labeled “Expiration Date.” A blank space has been provided in this section for this purpose.

By Default, the Principal Powers delivered here will automatically terminate One Year from the Taxpayer’s reported Signature Date. If the Taxpayer wishes these Powers to Terminate on a different Date, this should be declared in the box labeled “Expiration Date.” A blank space has been provided in this section for this purpose.![]()

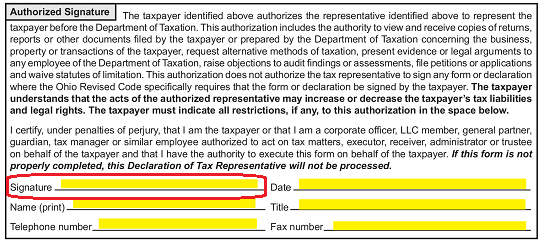

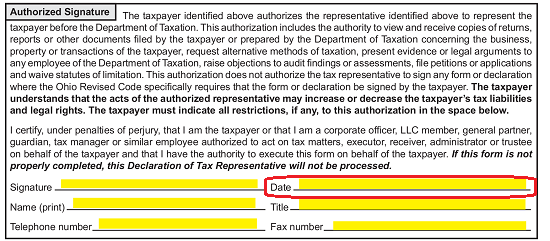

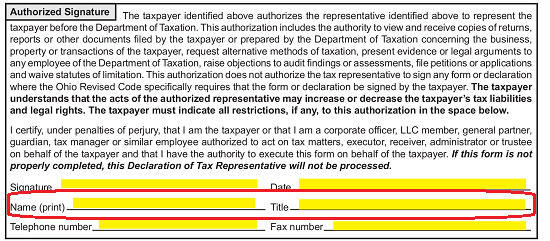

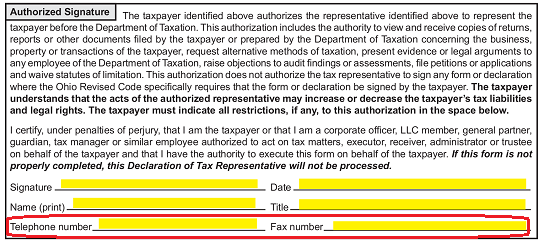

4 – The Taxpayer Must Sign This Form For Its Execution To Be Effective

If this form has been completed and the information has been presented to the satisfaction of the Taxpayer, then it may be Executed at the Taxpayer’s discretion. Several blank lines have been supplied in the box labeled “Authorized Signature” to satisfy this requirement.

The Taxpayer will formally delegate Principal Power to the Representative when he or she signs the “Signature” line in this section. If this is a Business Entity, then an Authorized Representative of that Entity must sign his or her Name to make this declaration on its behalf.  The Taxpayer must declare the Date of Signature by entering the Current Date immediately after signing his or her name.

The Taxpayer must declare the Date of Signature by entering the Current Date immediately after signing his or her name.  Directly below the Taxpayer Signature and Signature Date, the Principal must Print his or her Name on the blank line labeled “Name (Print).” If he or she has a Title, the blank line “Title” has been supplied so it can be recorded.

Directly below the Taxpayer Signature and Signature Date, the Principal must Print his or her Name on the blank line labeled “Name (Print).” If he or she has a Title, the blank line “Title” has been supplied so it can be recorded.  Finally, The Taxpayer must supply his or her current Daytime Telephone Number on the blank line labeled “Telephone Number.” If the Taxpayer has a Fax Number, this should be disclosed on the “Fax Number” line.

Finally, The Taxpayer must supply his or her current Daytime Telephone Number on the blank line labeled “Telephone Number.” If the Taxpayer has a Fax Number, this should be disclosed on the “Fax Number” line.

Deliver this document by:

Email:

TBOR1@tax.state.oh.us

Fax:

(206) 888-4377

Mail:

Ohio Dept. Of Taxation

P.O. Box 1090

Columbus, OH 43216-1090

If this Power is revoked in the future, the Revocation must be issued by the same method of delivery used to submit this form.