Updated June 02, 2022

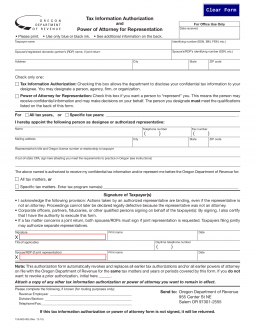

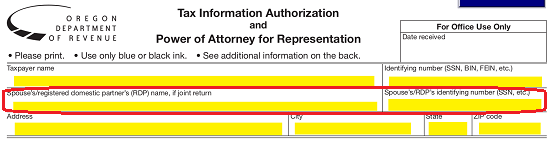

An Oregon tax power of attorney (Form 150-800-005) is the document you must use to appoint an agent with the principal authority to represent you before the Oregon Department of Revenue. Titled as “Tax Information Authorization and Power of Attorney for Representation,” the focus will be kept on your Taxes therefore, your agent will only be able to perform actions in relation to this area of your life. Typically, such authority is appointed to a CPA or Attorney. It will be up to you as to which matters, and tax years the agent will have principal authority in. Naturally, you may revoke such power at any time of your choosing for whatever reason you have by either granting another agent (at a later Date) principal powers that conflict with this document or if you issue a written revocation to the agent and notify the relevant tax entity. It should be noted; this paperwork will automatically terminate a previously issued power if the concerned paperwork involves the same matters or years. If you wish to keep a previous appointment, then make sure to indicate this clearly using this document.

How to Write

1 – The Tax Form Required To Grant Representational Power Should Be Downloaded

Open the form using one of the buttons under the image. Make sure you have all the information required regarding the Principal Taxpayer, Representative Attorney-in-Fact, and the Powers being delivered. All requested information must be accurate and accounted for by the time of the Principal’s Signing

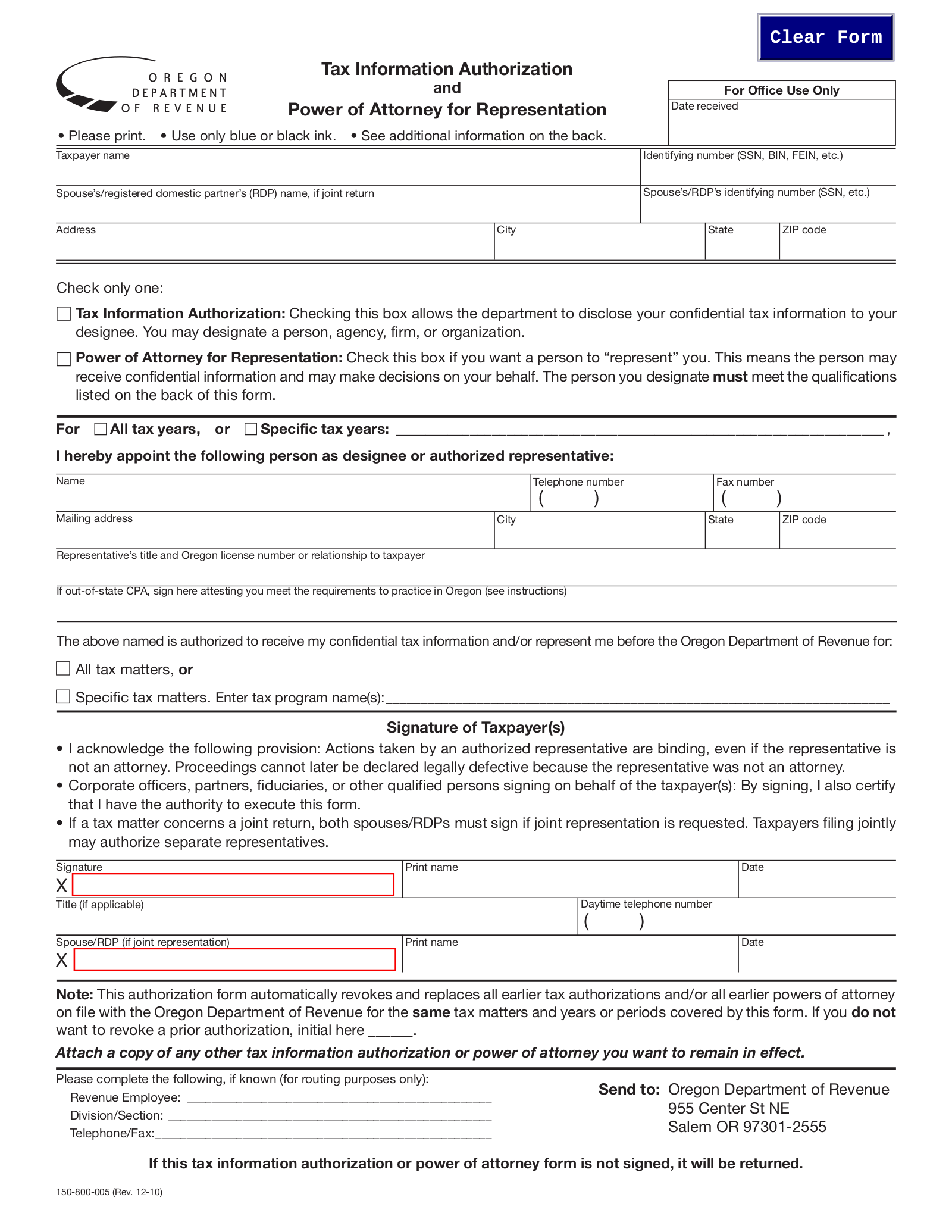

2 – Supply A The Principal Taxpayer’s Details

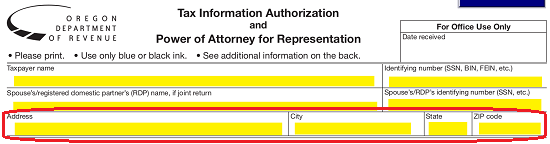

The table at the start of this form will seek a presentation of the Principal Taxpayer’s identifying information. The first row will seek the Principal Taxpayer’s Full Name as it appears in the records and the Principal Taxpayer’s “Identifying Number.” That is, if the Principal Taxpayer is a business entity, record its Federal Entity Identification Number. If he or she is a human being, supply the Principal Taxpayer’s Social Security Number. Use the first box for the “Taxpayer Name” and the second box for the “Identifying Number (SSN, BIN, FEIN, Etc.).”  If the Principal Taxpayer filed jointly on any of the matters he or she is delivering Principal Power over, the Name and Identifying Number of that spouse must be supplied to the second row of this table.

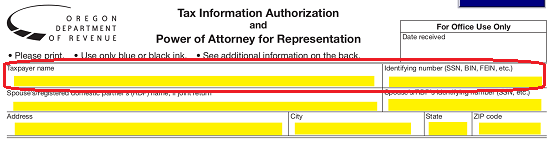

If the Principal Taxpayer filed jointly on any of the matters he or she is delivering Principal Power over, the Name and Identifying Number of that spouse must be supplied to the second row of this table. Record the Principal Taxpayer’s Address on the last row in this table. The third row will break up the Address so that each component may be reported in its own designated area (“Address,” “City,” “State,” and “Zip Code”).

Record the Principal Taxpayer’s Address on the last row in this table. The third row will break up the Address so that each component may be reported in its own designated area (“Address,” “City,” “State,” and “Zip Code”).

3 – Summarize The Matters The Attorney-in-Fact May Wield Principal Powers With

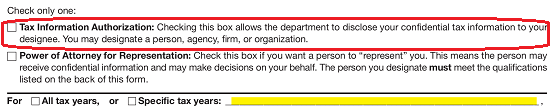

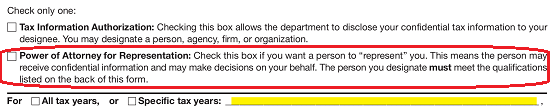

Next, it will be time to solidify what the Principal Taxpayer is authorizing another party to do on his or her behalf. If the Principal only wishes to grant an individual with the right to receive information on his or her behalf, then mark the first checkbox. Marking this option will not grant Principal Powers to the Representative Attorney-in-Fact.  If the Principal Taxpayer intends to designate another party with the Principal Powers so the Representative Attorney-in-Fact can receive information, make decisions, and act on behalf of the Principal regarding Tax Matters, then mark the second checkbox. This option will grant Principal Authority to the Representative Attorney-in-Fact.

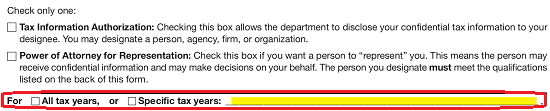

If the Principal Taxpayer intends to designate another party with the Principal Powers so the Representative Attorney-in-Fact can receive information, make decisions, and act on behalf of the Principal regarding Tax Matters, then mark the second checkbox. This option will grant Principal Authority to the Representative Attorney-in-Fact. Next, the time period of the Tax Matters the Representative Attorney-in-Fact must be solidified. If the Principal Taxpayer intends the Representative Attorney-in-Fact to wield Principal Powers regarding “All Tax Year” then, mark the first checkbox after the bold word “For.” If the Representative Attorney-in-Fact can only wield Principal Powers regarding “Specific Tax Years” mark the second checkbox, then enter those Years on the blank line following this choice.

Next, the time period of the Tax Matters the Representative Attorney-in-Fact must be solidified. If the Principal Taxpayer intends the Representative Attorney-in-Fact to wield Principal Powers regarding “All Tax Year” then, mark the first checkbox after the bold word “For.” If the Representative Attorney-in-Fact can only wield Principal Powers regarding “Specific Tax Years” mark the second checkbox, then enter those Years on the blank line following this choice.

4 – Record The Representative Attorney-in-Fact Information

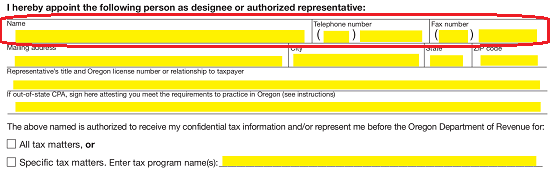

Now, find the bold words “I Hereby Appoint The Following Person As Designee…” Use the table below these words to display the Attorney-in-Fact’s information. The first row should have the Representative Attorney-in-Fact’s “Name,” “Telephone Number,” and “Fax Number” in the boxes bearing these labels.  Use the second row to enter the Representative Attorney-in-Fact’s “Mailing Address” (Building Number/Street/Unit Number), “City,” “State,” and “Zip Code

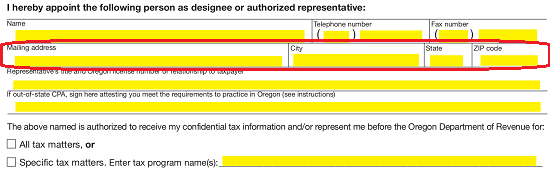

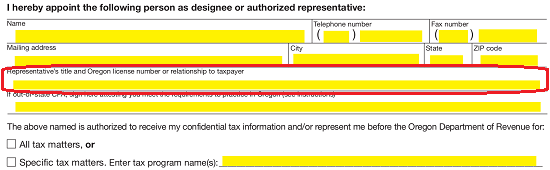

Use the second row to enter the Representative Attorney-in-Fact’s “Mailing Address” (Building Number/Street/Unit Number), “City,” “State,” and “Zip Code Use the third row to document the “Representative’s Title And Oregon License Number Or Relationship To Taxpayer.” If the Attorney-in-Fact’s credentials are from another state, they should be reported here.

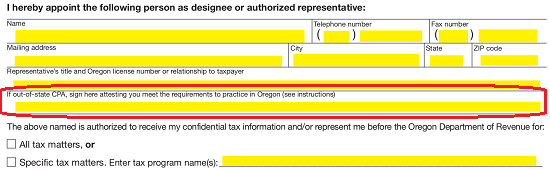

Use the third row to document the “Representative’s Title And Oregon License Number Or Relationship To Taxpayer.” If the Attorney-in-Fact’s credentials are from another state, they should be reported here. In the event the Representative Attorney-in-Fact is an out of state Certified Public Accountant, he or she must sign the next row to testify that he or she meets the requirements to practice his or her profession in the state of Oregon.

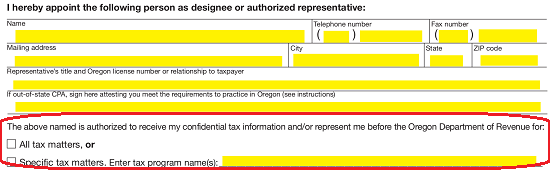

In the event the Representative Attorney-in-Fact is an out of state Certified Public Accountant, he or she must sign the next row to testify that he or she meets the requirements to practice his or her profession in the state of Oregon. Find the statement beginning with “The Above Named Is Authorized To Receive My Taxpayer Information…” then indicate if the Representative Attorney-in-Fact may act with Principal Power in “All Tax Matters” by marking the first checkbox or if the Representative may only wield Principal Powers regarding “Specific Tax Matters” by marking the second checkbox and documenting the “Tax Program Names” in the available space.

Find the statement beginning with “The Above Named Is Authorized To Receive My Taxpayer Information…” then indicate if the Representative Attorney-in-Fact may act with Principal Power in “All Tax Matters” by marking the first checkbox or if the Representative may only wield Principal Powers regarding “Specific Tax Matters” by marking the second checkbox and documenting the “Tax Program Names” in the available space.

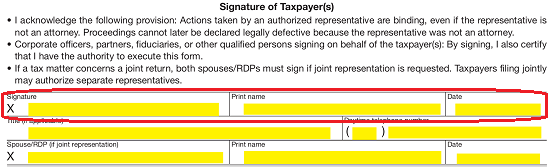

5 – The Principal Taxpayer’s Executing SIgnature Must Be Produced

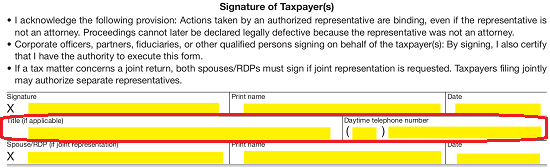

The area under the heading “Signature Of Taxpayer(s)” will supply a few bulleted statements the Principal needs to by signing this form. In the first row, the Principal Taxpayer must sign his or her Name next to the bold “X,” print his or her Name in the second box and enter the current “Date” in the third box.  The first box of the second row will accept an account of any “Title” the Principal Taxpayer holds. This may be left blank if he or she holds no title. Next to this box, the Taxpayer’s “Daytime Telephone Number” must be entered.

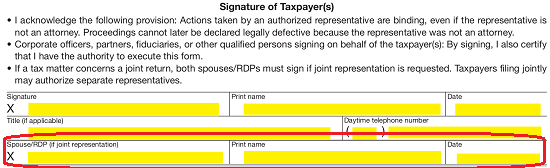

The first box of the second row will accept an account of any “Title” the Principal Taxpayer holds. This may be left blank if he or she holds no title. Next to this box, the Taxpayer’s “Daytime Telephone Number” must be entered. The third row of this table will allow for the mandatory Signature of any “Spouse/RDP” involved along with this party’s printed name and signature date.

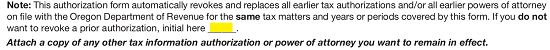

The third row of this table will allow for the mandatory Signature of any “Spouse/RDP” involved along with this party’s printed name and signature date. If there are any other Power documents presently in Effect and should remain in effect after this execution, the Principal Taxpayer will need to initial the blank line in the “Note” paragraph then attach a copy of that Power Document. If no such Power document exists or if all other Power Documents should be revoked the Principal should not initial this line.

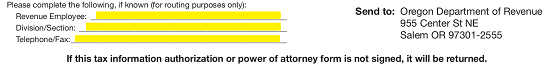

If there are any other Power documents presently in Effect and should remain in effect after this execution, the Principal Taxpayer will need to initial the blank line in the “Note” paragraph then attach a copy of that Power Document. If no such Power document exists or if all other Power Documents should be revoked the Principal should not initial this line. Enter the Name of the “Revenue Employee” receiving this information along with his or her “Division/Section,” and his or her “Telephone/Fax” on the blank lines at the bottom of this page. IF this information is unknown, these lines may be left blank. When ready, mail this form to:

Enter the Name of the “Revenue Employee” receiving this information along with his or her “Division/Section,” and his or her “Telephone/Fax” on the blank lines at the bottom of this page. IF this information is unknown, these lines may be left blank. When ready, mail this form to:

Oregon Department Of Revenue

955 Center St. NE

Salem, OR 97301-2555