Updated June 02, 2022

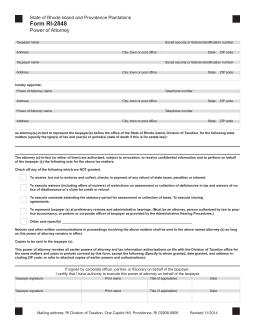

A Rhode Island Tax Power of Attorney (Form RI-2848) should be filled out and submitted when you wish to appoint another party (i.e. attorney, tax specialist, etc.) to represent your interests with the Rhode Island Division of Taxation. Your representative will be able to obtain your tax information and make filings on your behalf, however, in addition to your approval, this paperwork must be approved by the R.I. Division of Taxation. You will need to set aside some time and make sure your reference material is up-to-date and accurate before filling out this paperwork. You may also have a preparer provide the information requested. All parties involved with the submission of this document will need to supply a valid signature.

How to Write

1 – The Rhode Island Tax Document used

The Tax Form available through the PDF button on this page will enable a Taxpayer to delegate his or her Authority to a Representative/Attorney-in-Fact. Be prepared to supply the information requested accurately. Download and open this form when you are ready to proceed.

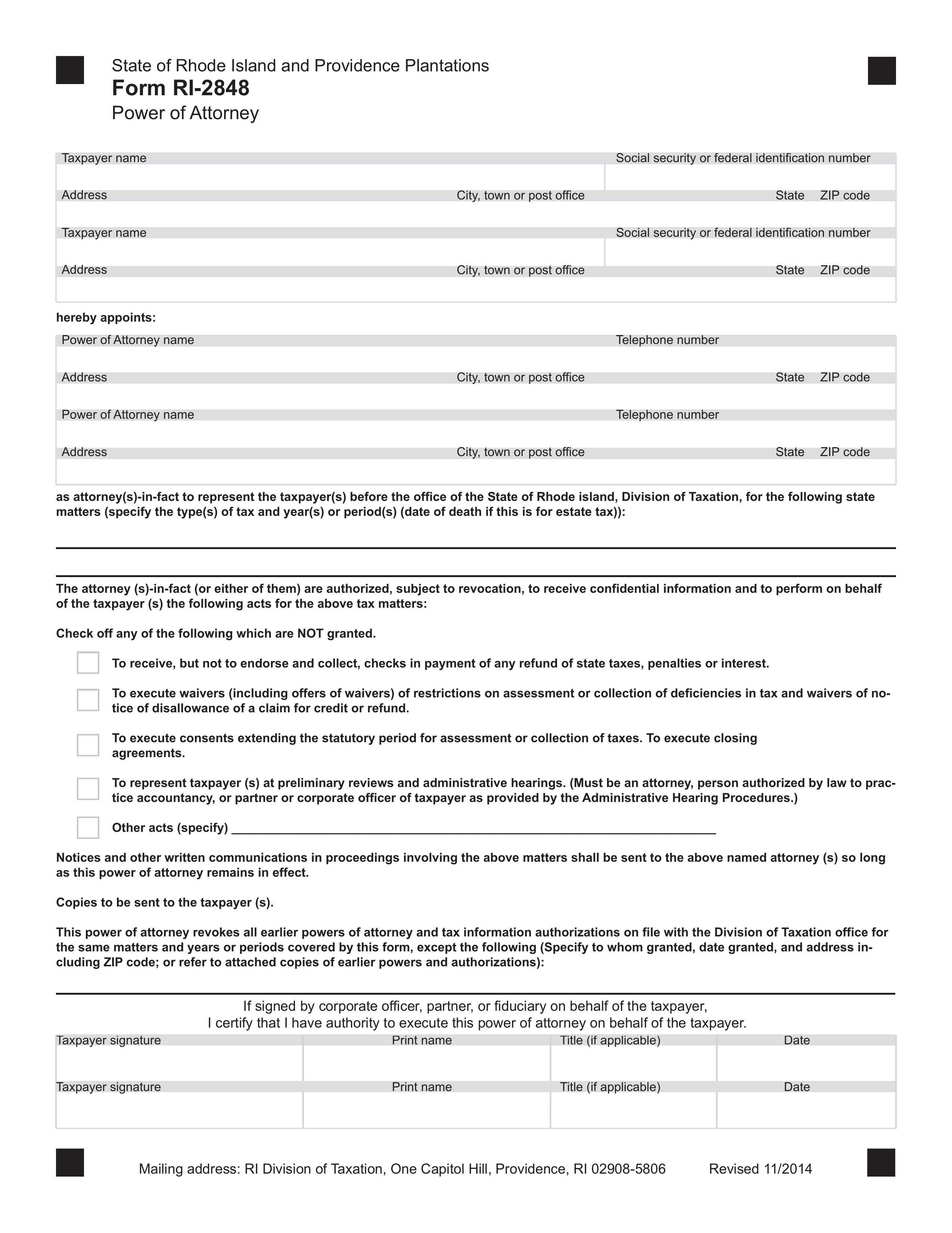

2 – Every Tax Payer Involved In These Tax Matters Must Be Documented

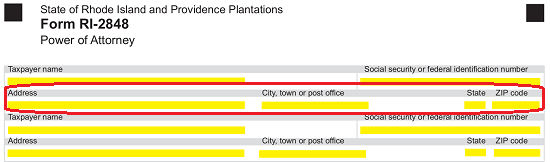

This document will open with a table at its onset. This table will be divided into several labeled boxes where you can record the Taxpayer Information. Begin with the first row by filling in the First, Middle, and Last Name under the label “Taxpayer Name” then, present his or her Identification Number under the words “Social Security Or Federal Identification Number.” If the Taxpayer is a human being, this second box will require his or her Social Security Number whereas if the Taxpayer is a Business Entity then its Federal Entity Identification Number must be placed here.

![]() The next row will focus on the Taxpayer’s Address. Use the area labeled “Address” to report the Building Number, Street Name, and Unit Number (if applicable). Next to this, record the Taxpayer’s “City, Town, or Post Office),” the “State,” and the “ZIP Code” of the Principal’s Address on the remainder of this line.

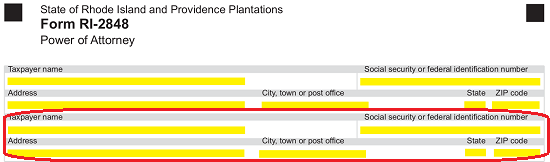

The next row will focus on the Taxpayer’s Address. Use the area labeled “Address” to report the Building Number, Street Name, and Unit Number (if applicable). Next to this, record the Taxpayer’s “City, Town, or Post Office),” the “State,” and the “ZIP Code” of the Principal’s Address on the remainder of this line. You will notice the next two rows bear the same labels as the ones above them (“Taxpayer Name,” “Social Security Or Federal Identification Number,” “Address,” “City, Town Or Post Office,” and “ZIP Code”). If the Taxpayer filed jointly with another Taxpayer for the Tax Matters the Representative/Attorney-in-Fact will be delegated Principal Authority over, then this additional Principal Taxpayer entity (i.e. Spouse). will need to be reported in this section.

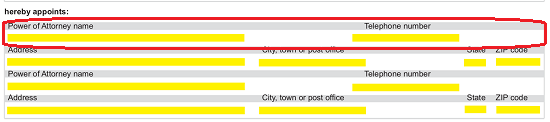

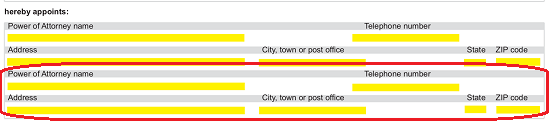

You will notice the next two rows bear the same labels as the ones above them (“Taxpayer Name,” “Social Security Or Federal Identification Number,” “Address,” “City, Town Or Post Office,” and “ZIP Code”). If the Taxpayer filed jointly with another Taxpayer for the Tax Matters the Representative/Attorney-in-Fact will be delegated Principal Authority over, then this additional Principal Taxpayer entity (i.e. Spouse). will need to be reported in this section. The next table, under the words “Hereby Appoints,” will need similar information regarding the Attorney-in-Fact. You may designate up to two Attorneys-in-Fact using this table. The first row will accept the Attorney-in-Fact’s Name under the label “Power of Attorney Name” and his or her current Phone Number in the area labeled “Telephone Number.”

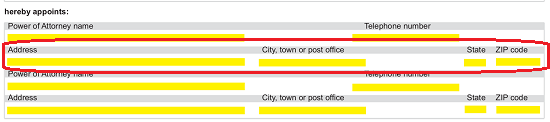

The next table, under the words “Hereby Appoints,” will need similar information regarding the Attorney-in-Fact. You may designate up to two Attorneys-in-Fact using this table. The first row will accept the Attorney-in-Fact’s Name under the label “Power of Attorney Name” and his or her current Phone Number in the area labeled “Telephone Number.” The second row will accept the Attorney-in-Fact’s “Address,” “City, Town Or Post Office,” “State,” and “ZIP Code.”

The second row will accept the Attorney-in-Fact’s “Address,” “City, Town Or Post Office,” “State,” and “ZIP Code.” The next two rows have been reserved in case a second Attorney-in-Fact must be named. If so, supply this entity’s Name, Telephone Number, and Address using this area. If there will be more than two Attorneys-in-Fact being designated with Principal Power, then you may continue this report on the Attorney-in-Fact identity on a separate attachment.

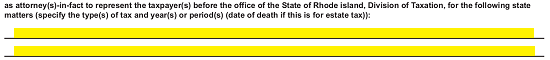

The next two rows have been reserved in case a second Attorney-in-Fact must be named. If so, supply this entity’s Name, Telephone Number, and Address using this area. If there will be more than two Attorneys-in-Fact being designated with Principal Power, then you may continue this report on the Attorney-in-Fact identity on a separate attachment. The bold statement below these tables will formally declare what Tax Matters the Attorney-in-Fact can wield Principal Power with. You will need to provide a list of each Tax Matter and that Tax Matter’s Year the Attorney-in-Fact can wield Principal Power over using the blank lines beneath the statement “…As Attorney(s)-in-Fact To Represent The Taxpayer(s) Before The Office Of The State Of Rhode Island.”

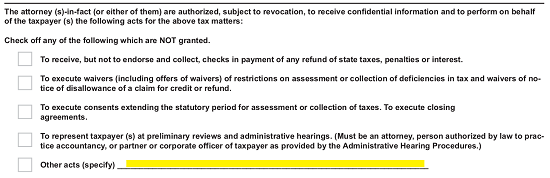

The bold statement below these tables will formally declare what Tax Matters the Attorney-in-Fact can wield Principal Power with. You will need to provide a list of each Tax Matter and that Tax Matter’s Year the Attorney-in-Fact can wield Principal Power over using the blank lines beneath the statement “…As Attorney(s)-in-Fact To Represent The Taxpayer(s) Before The Office Of The State Of Rhode Island.” The next area contains several checkbox statements. These statements will each describe the actions a Representative/Attorney-in-Fact can take on behalf of the Principal pertaining to the Tax Matters listed above. Each statement the Principal Taxpayer wishes included in the Representative/Attorney-in-Fact’s Principal Powers should be marked or check marked. Any statement left unmarked will not be applied to the Attorney-in-Fact’s Principal Powers. In this way the Principal Taxpayer may easily assign the Authority to Receive (not endorse) payments regarding the above Tax Matters, Execute Waivers, Execute Consents, Represent the Taxpayer at Preliminary Reviews/Administrative Hearings (must be a qualified professional), and/or “Other Acts” the Principal intend to assign the Representative/Attorney-in-Fact the Authority to engage in. Note: If you mark the box marked “Other Acts,” you must define the Authorized Powers being delivered.

The next area contains several checkbox statements. These statements will each describe the actions a Representative/Attorney-in-Fact can take on behalf of the Principal pertaining to the Tax Matters listed above. Each statement the Principal Taxpayer wishes included in the Representative/Attorney-in-Fact’s Principal Powers should be marked or check marked. Any statement left unmarked will not be applied to the Attorney-in-Fact’s Principal Powers. In this way the Principal Taxpayer may easily assign the Authority to Receive (not endorse) payments regarding the above Tax Matters, Execute Waivers, Execute Consents, Represent the Taxpayer at Preliminary Reviews/Administrative Hearings (must be a qualified professional), and/or “Other Acts” the Principal intend to assign the Representative/Attorney-in-Fact the Authority to engage in. Note: If you mark the box marked “Other Acts,” you must define the Authorized Powers being delivered. If there are any other previously issued Powers of Attorney that apply to the Tax Matters or Tax Years listed above, they will automatically be revoked once this document is executed. If the Principal Taxpayer wishes such previously issued Principal Powers to remain in effect, then locate the bold statement beginning with the words “This Power Of Attorney Revokes All Earlier Powers Of Attorney…” Then report the Name of the Attorney-in-Fact who must retain Principal Power, the Start Effective Date, and the Attorney-in-Fact’s Complete Address then, attach a copy of the previously issued Power document to this form.

If there are any other previously issued Powers of Attorney that apply to the Tax Matters or Tax Years listed above, they will automatically be revoked once this document is executed. If the Principal Taxpayer wishes such previously issued Principal Powers to remain in effect, then locate the bold statement beginning with the words “This Power Of Attorney Revokes All Earlier Powers Of Attorney…” Then report the Name of the Attorney-in-Fact who must retain Principal Power, the Start Effective Date, and the Attorney-in-Fact’s Complete Address then, attach a copy of the previously issued Power document to this form.![]()

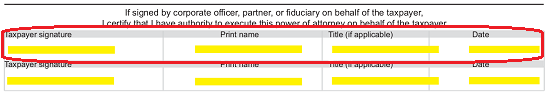

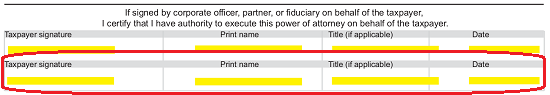

3 – Every Principal Taxpayer Named In The First Table Must Sign This Form

Once the appropriate information has been supplied in the requested areas accurately, it will be time for the Principal to execute this document for submission. The Principal Taxpayer named in the first row of this page should locate the label “Taxpayer Signature” at the bottom of this page then, sign the area below it. Adjacent to this, the Principal Taxpayer must furnish his or her Printed Name under the label “Print Name.” The remaining two boxes on this row will require the Signature Taxpayer’s “Title (If Applicable)” and the “Date” he or she signed this form. If the Principal Taxpayer is a Business Entity, the Signature Party must be an Authorized Representative of the Company and must supply the role/relationship he or she holds with the Business Entity in the “Title (If Applicable)” area. The next row will be organized in a similar manner as the one above. It has been presented so that any additional Taxpayer the Principal Taxpayer filed jointly with can satisfy the Signature Requirement this document places on him or her by the second-row labels “Taxpayer Signature,” “Print Name,” “Title (If Applicable),” and “Date”

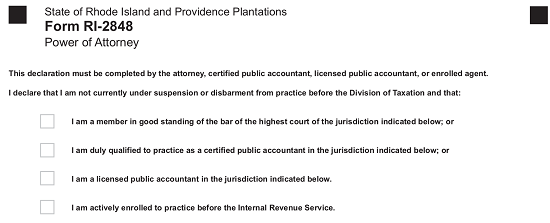

The next row will be organized in a similar manner as the one above. It has been presented so that any additional Taxpayer the Principal Taxpayer filed jointly with can satisfy the Signature Requirement this document places on him or her by the second-row labels “Taxpayer Signature,” “Print Name,” “Title (If Applicable),” and “Date” This template form will also require a signed testimony from the Representative/Attorney-in-Fact. He or she should read the statement following the Principal Taxpayer(s) Signature. Additionally, the Representative/Attorney-in-Fact must self-identify as a Member of the Bar, C.P.A., Public Accountant, or qualifies to practice before the I.R.S by marking the checkbox corresponding to the appropriate statement from the list presented below the Testimonial.

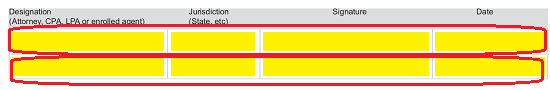

This template form will also require a signed testimony from the Representative/Attorney-in-Fact. He or she should read the statement following the Principal Taxpayer(s) Signature. Additionally, the Representative/Attorney-in-Fact must self-identify as a Member of the Bar, C.P.A., Public Accountant, or qualifies to practice before the I.R.S by marking the checkbox corresponding to the appropriate statement from the list presented below the Testimonial. Next a table with the column headings “Designation (Attorney, CPA, Or Enrolled Agent),” “Jurisdiction (State, Etc.),” “Signature,” and “Date.” Each Representative/Attorney-in-Fact named in this document must use these columns to produce his or her Status Designation, where he or she may practice legally, his or her Signature, and the Date of that Signature.

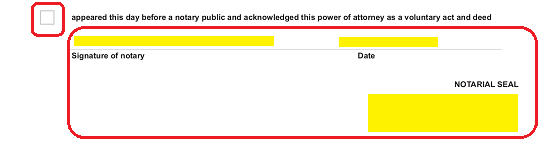

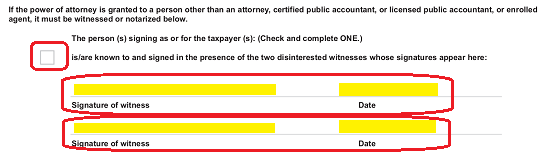

Next a table with the column headings “Designation (Attorney, CPA, Or Enrolled Agent),” “Jurisdiction (State, Etc.),” “Signature,” and “Date.” Each Representative/Attorney-in-Fact named in this document must use these columns to produce his or her Status Designation, where he or she may practice legally, his or her Signature, and the Date of that Signature. The final step in this document’s signing will be left up to one of two outside parties. The Principal’s Signature must be verified either through a Witness Testimony or through the notarization process. Hence, two separate areas are presented. You will need to mark the checkbox corresponding to the area that will be used. If this signing will be verified through the Signatures of two Witnesses testifying they have seen the Principal Taxpayer, then mark the first checkbox below the statement “The Person(s) Signing As Or For…” and present this form to the Witnesses. Each one must sign his or her name on a unique “Signature Of Witness” line then record the Signature Date on the “Date” line.

The final step in this document’s signing will be left up to one of two outside parties. The Principal’s Signature must be verified either through a Witness Testimony or through the notarization process. Hence, two separate areas are presented. You will need to mark the checkbox corresponding to the area that will be used. If this signing will be verified through the Signatures of two Witnesses testifying they have seen the Principal Taxpayer, then mark the first checkbox below the statement “The Person(s) Signing As Or For…” and present this form to the Witnesses. Each one must sign his or her name on a unique “Signature Of Witness” line then record the Signature Date on the “Date” line. If the Principal Signing will be notarized, mark the second check box presented then turn this paperwork over to the Notary Public who will notarize this signing.

If the Principal Signing will be notarized, mark the second check box presented then turn this paperwork over to the Notary Public who will notarize this signing.