Updated June 02, 2022

A Texas Tax Power of Attorney (Form 85-113) must be filled out to designate someone to represent you in tax matters that concern you before the Texas Comptroller of Public Accounts. This power of attorney grants the person you appoint the power to see your tax information and make filings and decisions on your behalf. Once this document has been submitted, approved, then placed in effect the person you name as your representative will be able to carry out the functions expected of him or her so long as they have been clearly authorized in this paperwork. Naturally, it will be imperative that any agent given authority in such matters should be one who is both qualified and reliable to act in this capacity.

How to Write

1 – Download And Fill Out The Tax Power Delegation Paperwork On This Page

The template you can use to delegate Tax Powers in Texas is supplied through the buttons on this page. You may save a copy by clicking on one of the three buttons under the image.

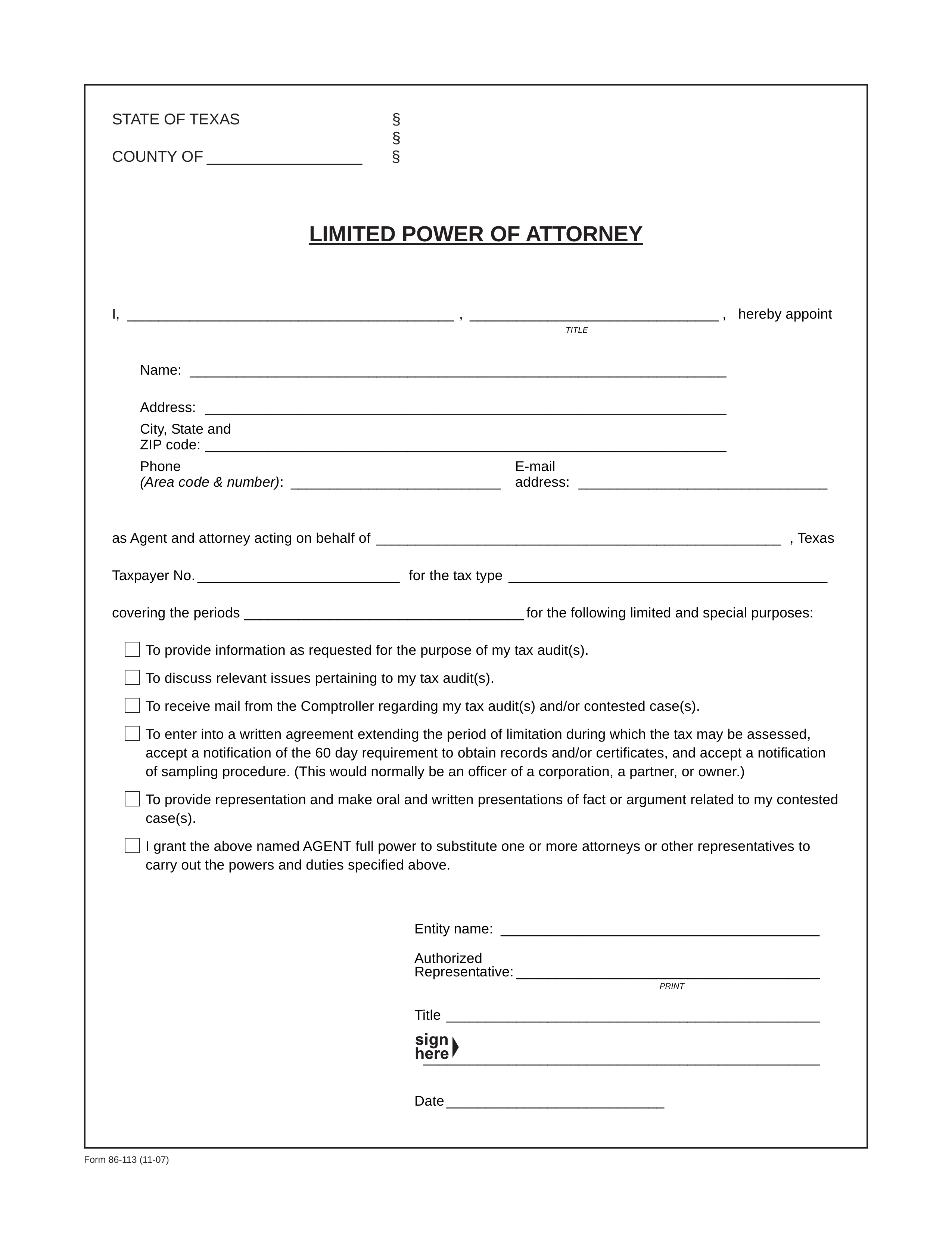

2 – Satisfy The Requirements To Complete The Principal’s Statement

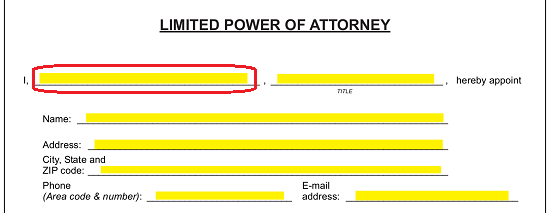

The first requirement of this document will be to solidify where it is being executed. Report the County where this document will be executed and apply on the blank line at the top of the page labeled “County Of”  The Signature Party’s Name is the first piece of information required in the Principal’s statement at the beginning of this template. Use the first blank line after the word “I” to document his or her Full Legal Name. The Signature Party of this document is either the Principal delegating his or her Authority or an Authorized Representative of Business (Principal).

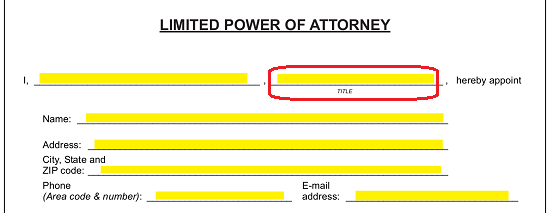

The Signature Party’s Name is the first piece of information required in the Principal’s statement at the beginning of this template. Use the first blank line after the word “I” to document his or her Full Legal Name. The Signature Party of this document is either the Principal delegating his or her Authority or an Authorized Representative of Business (Principal).  If the Principal has a Title, then fill in the second blank line with his or her Title. This is useful in the event the Principal is a business entity and an Authorized Representative must deliver Principal Powers.

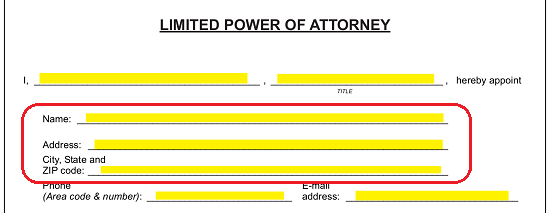

If the Principal has a Title, then fill in the second blank line with his or her Title. This is useful in the event the Principal is a business entity and an Authorized Representative must deliver Principal Powers.  The next task is to fully define the Attorney-in-Fact or Principal Agent who the Principal intends to grant his or her Tax Authority to. Several blank areas have been supplied for this purpose. Use the first three lines (labeled “Name,” “Address,” and “City, State And Zip Code”) to list the Agent’s Legal Name followed by his or her Full Address.

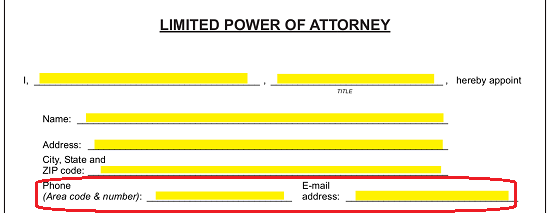

The next task is to fully define the Attorney-in-Fact or Principal Agent who the Principal intends to grant his or her Tax Authority to. Several blank areas have been supplied for this purpose. Use the first three lines (labeled “Name,” “Address,” and “City, State And Zip Code”) to list the Agent’s Legal Name followed by his or her Full Address.  The Phone Number and E-Mail Address of the Principal Agent must be disclosed on the spaces labeled “Phone (Area Code & Number)” and “E-Mail Address”

The Phone Number and E-Mail Address of the Principal Agent must be disclosed on the spaces labeled “Phone (Area Code & Number)” and “E-Mail Address”

3 – The Principal Must Determine The Tax Powers He Or She Will Grant The Attorney-in-Fact

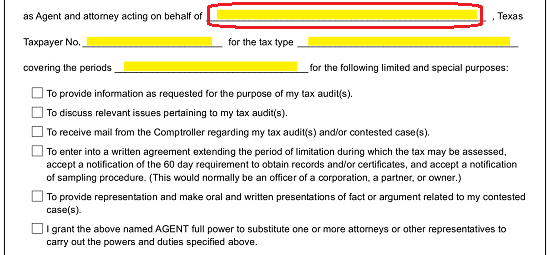

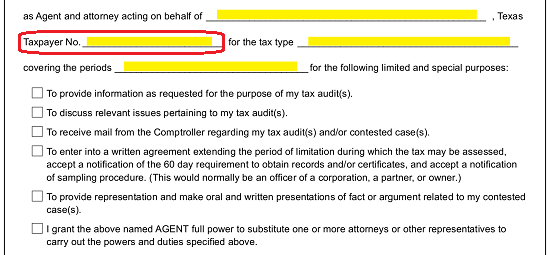

Some rather specific wording will be required for the completion of this statement concerning Principal Powers. Enter the Full Name of the Principal whose Authority is being delivered to an Attorney-in-Fact through this document.  The Principal report will continue by reporting the “Taxpayer No.” assigned by the Dept. of Revenue. For individuals, this is a Social Security Number. If the Principal is a Business Entity, then his or her Federal Entity Identification Number should be presented here.

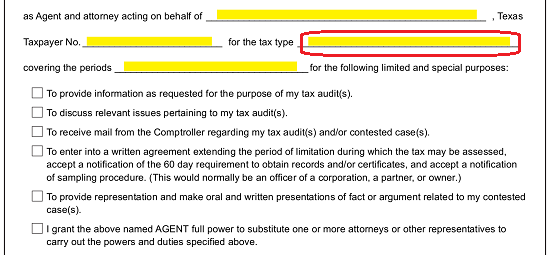

The Principal report will continue by reporting the “Taxpayer No.” assigned by the Dept. of Revenue. For individuals, this is a Social Security Number. If the Principal is a Business Entity, then his or her Federal Entity Identification Number should be presented here.  The subject matter the Attorney-in-Fact may represent the Principal with (using Principal Authority) should be documented on the blank line after the words “…For The Tax Type.” Examples of Tax Types include Income Tax, Sales/Use Tax, etc.

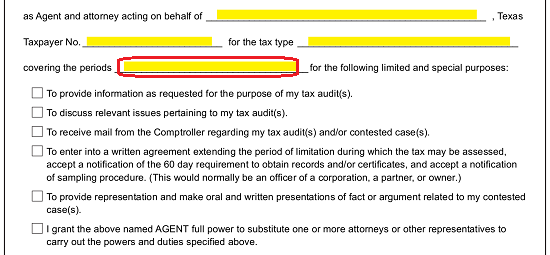

The subject matter the Attorney-in-Fact may represent the Principal with (using Principal Authority) should be documented on the blank line after the words “…For The Tax Type.” Examples of Tax Types include Income Tax, Sales/Use Tax, etc.  The Periods of Time where the Attorney-in-Fact can wield Powers over the Principal’s Tax Types should be recorded on the next blank space.

The Periods of Time where the Attorney-in-Fact can wield Powers over the Principal’s Tax Types should be recorded on the next blank space.  The next task will take place with a checklist. The Principal will need to review the list of checkbox statements supplied below the statement. If the Principal intends for the Agent to possess the Principal Power to conduct the actions defined in a statement, the corresponding checkbox must be check marked.

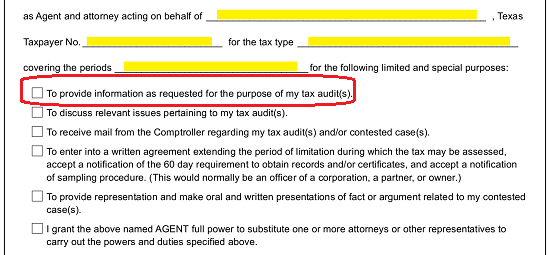

The next task will take place with a checklist. The Principal will need to review the list of checkbox statements supplied below the statement. If the Principal intends for the Agent to possess the Principal Power to conduct the actions defined in a statement, the corresponding checkbox must be check marked.

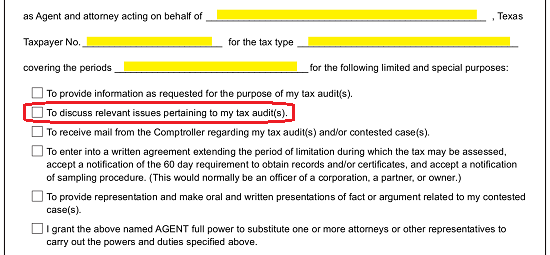

If the Attorney-in-Fact should have the Principal Power to supply Principal Information to satisfy a Tax Audit, then mark the first checkbox.  The Principal can approve the Attorney-in-Fact’s ability to discuss Tax Audit issues on behalf of the Principal when the second box is checked marked.

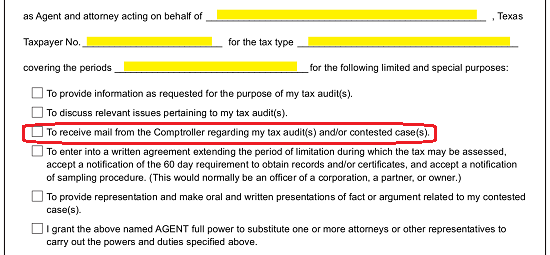

The Principal can approve the Attorney-in-Fact’s ability to discuss Tax Audit issues on behalf of the Principal when the second box is checked marked.  The Attorney-in-Fact will have the Principal Power to receive Comptroller Mail to the Principal regarding any cases currently open or any Tax Audits currently being performed once the third checkbox statement is marked.

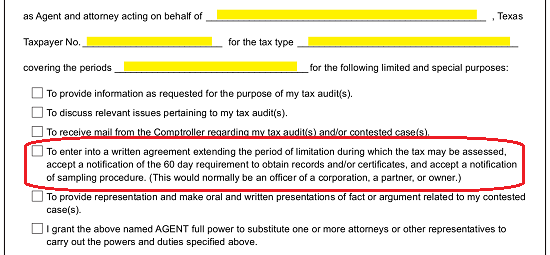

The Attorney-in-Fact will have the Principal Power to receive Comptroller Mail to the Principal regarding any cases currently open or any Tax Audits currently being performed once the third checkbox statement is marked.  The wording in the fourth statement allows the Attorney-in-Fact to extend periods of limitation for assessment and accept notifications to obtain records/certificates, and sampling procedure on behalf of the Principal. Mark the checkbox corresponding the fourth statement to grant the Attorney-in-Fact with these Powers.

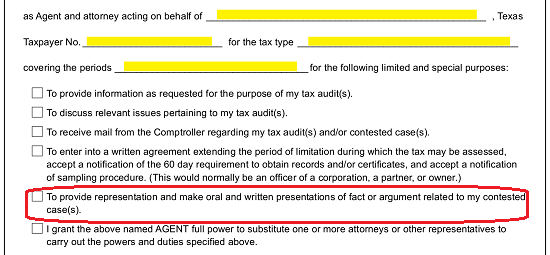

The wording in the fourth statement allows the Attorney-in-Fact to extend periods of limitation for assessment and accept notifications to obtain records/certificates, and sampling procedure on behalf of the Principal. Mark the checkbox corresponding the fourth statement to grant the Attorney-in-Fact with these Powers.  If the Principal wants the Attorney-in-Fact to represent the Principal (orally or on paper) in contested cases, the fifth checkbox must be marked.

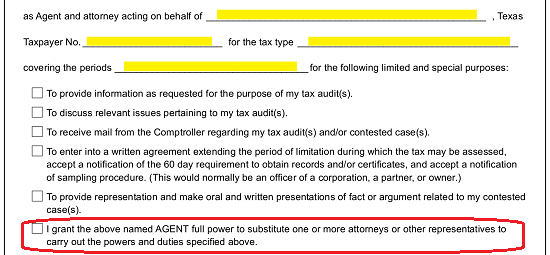

If the Principal wants the Attorney-in-Fact to represent the Principal (orally or on paper) in contested cases, the fifth checkbox must be marked.  The Principal can delegate the Attorney-in-Fact with the Principal Power to designate additional Agents to carry out the Principal Powers delivered here by marking the last checkbox.

The Principal can delegate the Attorney-in-Fact with the Principal Power to designate additional Agents to carry out the Principal Powers delivered here by marking the last checkbox.

4 – An Official Signature From The Principal Is Required

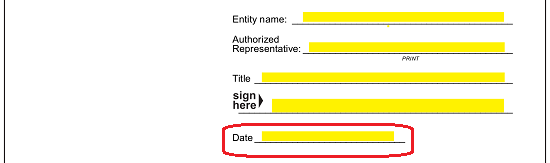

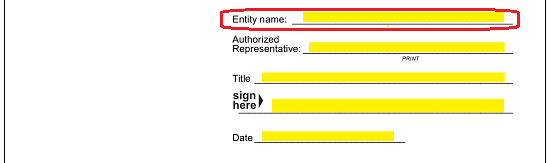

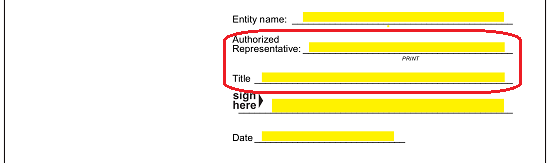

Once this document has been completed and reviewed by the Principal, he or she must sign it. If the Principal is an entity, then enter the Entity’s Legal Name on the blank space labeled “Entity Name” The Authorized Representative selected by the Principal to sign this document on its behalf must Print his or her Name on the line labeled “Authorized Representative” then, his or her “Title” must be recorded on the next blank space.

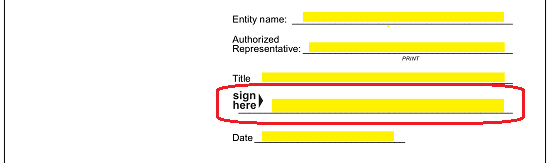

The Authorized Representative selected by the Principal to sign this document on its behalf must Print his or her Name on the line labeled “Authorized Representative” then, his or her “Title” must be recorded on the next blank space.  The Principal or Signature Party must sign his or her Name on the blank line labeled “Sign Here.”

The Principal or Signature Party must sign his or her Name on the blank line labeled “Sign Here.” Below this, a Signature Date is required. Only the Principal may enter this Date, and this should be documented at the time of signing.

Below this, a Signature Date is required. Only the Principal may enter this Date, and this should be documented at the time of signing.