Updated June 02, 2022

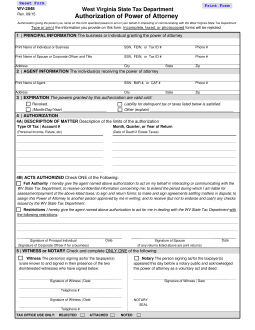

A West Virginia Tax Power of Attorney (Form WV-2848) is a required submission when a taxpayer wants to gain approval from the West Virginia State Tax Department for their delegation of principal authority to an agent. The agent appointed here will potentially be able to represent the principal taxpayer regarding his or her tax matters by deciding upon and acting in the principal’s name. The principal will have to use this form to document precisely what he or she intends and allows the agent to do in his or her name. Usually, the agent will be a professional (i.e. C.P.A.) who will be expected to engage in filings, queries, appeals, etc. on behalf of the principal taxpayer. This document will require several signatures when it is executed before it can be submitted for approval with the West Virginia State Tax Department.

How to Write

1 – Acquire The West Virginia Form Required To Assign Authority Over Principal Taxes

This page allows access to the West Virginia Tax Form that must be submitted when a Principal designates an Attorney-in-Fact with the Principal Powers to act as a Principal Representative. Download this form using the PDF button or by clicking on the preview image

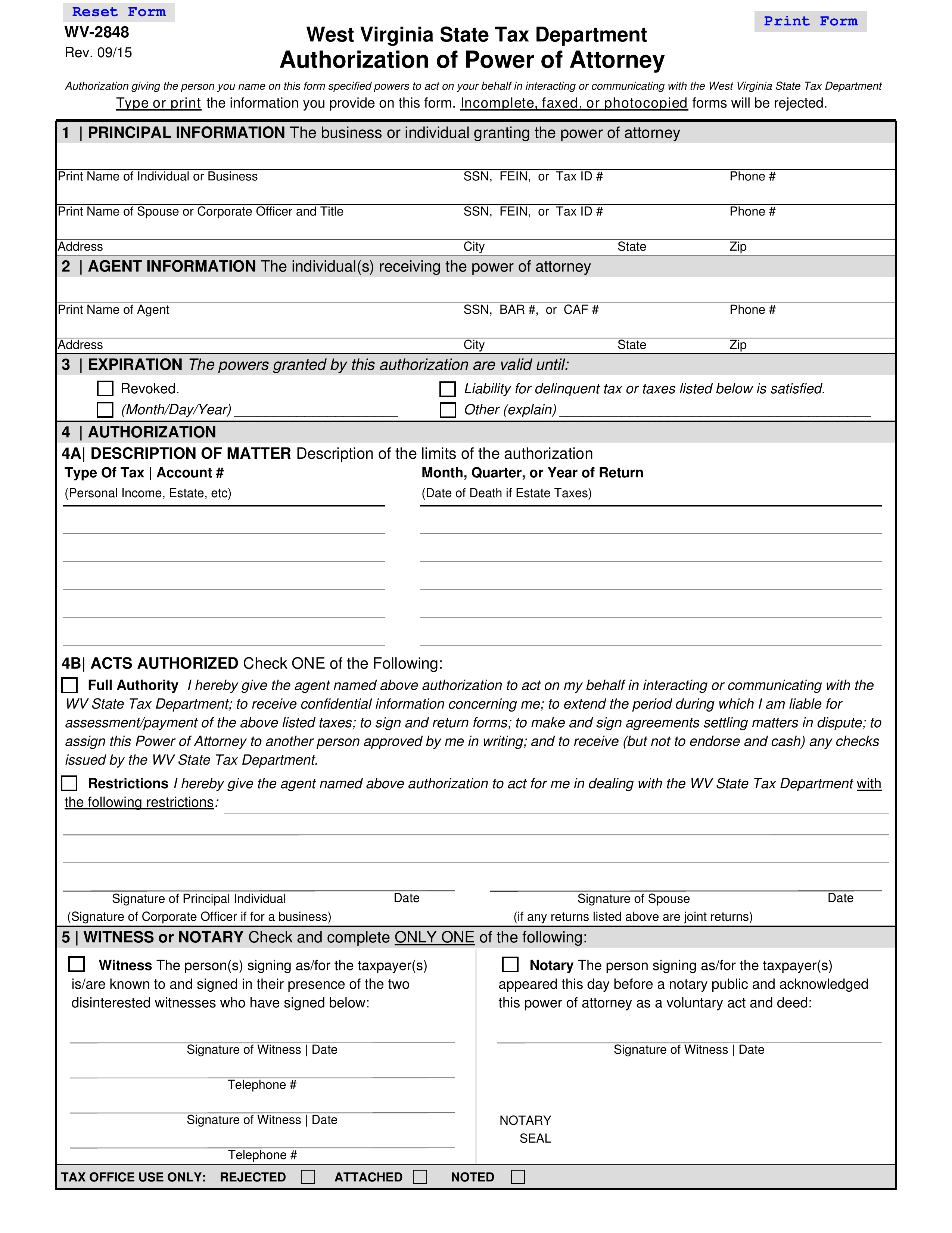

2 – The Principal And Agent Will Each Have A Separate Section To Accept Information

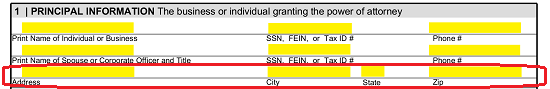

Locate the area bearing the label “1 | Principal Information.” This area should be utilized to fully identify the person or entity that intends to designate an Attorney-in-Fact with Principal Power. The first blank line will be divided by a few labels: “Print Name Of Individual Or Business,” “SSN, FEIN OR TAX ID#,” and “Phone #.” These items of information refer to the Principal. Supply the Principal’s Full Name, ID # (Social Security Number or Federal Entity Identification Number), and Daytime Telephone Number in these areas. If the Principal filed with a Spouse (jointly) on the Tax Matters or Time Periods the Attorney-in-Fact will have Principal Power over, then use the second blank line to supply the Spouse’s Name, ID#, and Daytime Telephone Number.

The next line shall require the Principal’s Full Street “Address,” “City,” “State,” and “Zip” Code of the Principal supplied to it. In the next section, titled “2 | Agent Information,” the Attorney-in-Fact’s Identity will be placed in our focus. The first line of this table calls for the Attorney-in-Fact’s Name, ID Number (i.e. Social Security Number, Bar Number, or Centralized Authorization File Number), and Daytime Phone Number in the areas labeled “Print Name Of Agent,” “SSN, BAR#, Or CAF#,” and “Phone #”

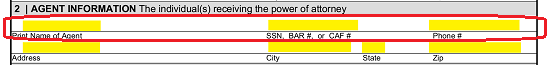

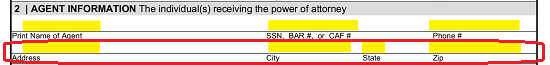

In the next section, titled “2 | Agent Information,” the Attorney-in-Fact’s Identity will be placed in our focus. The first line of this table calls for the Attorney-in-Fact’s Name, ID Number (i.e. Social Security Number, Bar Number, or Centralized Authorization File Number), and Daytime Phone Number in the areas labeled “Print Name Of Agent,” “SSN, BAR#, Or CAF#,” and “Phone #”  The second blank line will have three defined areas where you may record the Full Address of the Attorney-in-Fact by supplying his or her Street Address, City, State, and Zip in the appropriate areas.

The second blank line will have three defined areas where you may record the Full Address of the Attorney-in-Fact by supplying his or her Street Address, City, State, and Zip in the appropriate areas.

3 – Report How The Principal Powers Will Terminate and The Type Of Powers Being Granted

Now that we have clearly presented the Principal and the Attorney-in-Fact he or she is granting Authority to, we must define how the Attorney-in-Fact’s Principal Power will end. This can be done by marking one of the checkboxes in “3 | Expiration.”

If the Principal Powers will remain in Effect until the Principal revokes them, then mark the first checkbox ![]() If these Principal Powers will terminate immediately upon the completion of the Attorney-in-Fact’s Principal Responsibilities have been satisfied, then mark the second checkbox.

If these Principal Powers will terminate immediately upon the completion of the Attorney-in-Fact’s Principal Responsibilities have been satisfied, then mark the second checkbox. ![]() If the Principal has a specific Date when these Powers should terminate, then record this Date in the Month/Day/Year format on the blank line after the third checkbox and place a mark in it.

If the Principal has a specific Date when these Powers should terminate, then record this Date in the Month/Day/Year format on the blank line after the third checkbox and place a mark in it. ![]() If there is another method or catalyst that shall terminate these Powers then, mark the box labeled “Other” and detail the method of Termination on the blank line after this word.

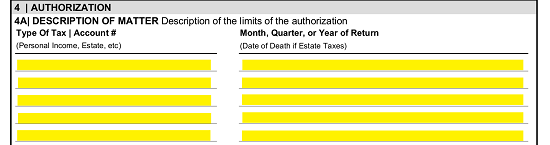

If there is another method or catalyst that shall terminate these Powers then, mark the box labeled “Other” and detail the method of Termination on the blank line after this word. ![]() Next, we will use the two sections in part “4 | Authorization” to furnish a report on the definition and extent of the Attorney-in-Fact’s Principal Powers. First, we will tend to “4A | Description Of Matter.” Two columns have been produced in this section so that each “Type Of Tax | Account #” the Principal will grant the Attorney-in-Fact in and its applicable “Month, Quarter, Or Year Of Return” of activity may be reported. Make sure each Time Frame is reported in the same row as the Tax Matter it relates to.

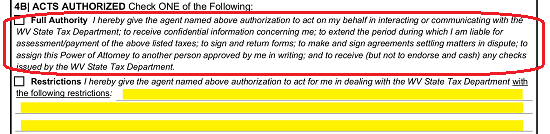

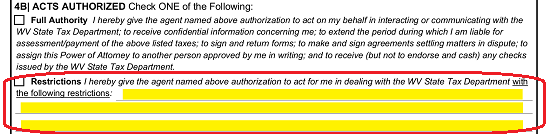

Next, we will use the two sections in part “4 | Authorization” to furnish a report on the definition and extent of the Attorney-in-Fact’s Principal Powers. First, we will tend to “4A | Description Of Matter.” Two columns have been produced in this section so that each “Type Of Tax | Account #” the Principal will grant the Attorney-in-Fact in and its applicable “Month, Quarter, Or Year Of Return” of activity may be reported. Make sure each Time Frame is reported in the same row as the Tax Matter it relates to.  Once we have defined these Tax Matters, we will need to declare exactly how much Principal Power is being designated to the Attorney-in-Fact. The section labeled “4B | Acts Authorized” shall call for one of two checkboxes to be marked. The one that is marked will define the extent of Principal Power being delivered. If the Attorney-in-Fact should have the “Full Authority” he or she may wield then mark the first checkbox.

Once we have defined these Tax Matters, we will need to declare exactly how much Principal Power is being designated to the Attorney-in-Fact. The section labeled “4B | Acts Authorized” shall call for one of two checkboxes to be marked. The one that is marked will define the extent of Principal Power being delivered. If the Attorney-in-Fact should have the “Full Authority” he or she may wield then mark the first checkbox.  The Principal also has the option to place Restrictions on the Principal Actions the Attorney-in-Fact may take on the Principal’s behalf by reporting them on the blank line provided in the second choice and marking the checkbox labeled “Restrictions.”

The Principal also has the option to place Restrictions on the Principal Actions the Attorney-in-Fact may take on the Principal’s behalf by reporting them on the blank line provided in the second choice and marking the checkbox labeled “Restrictions.”

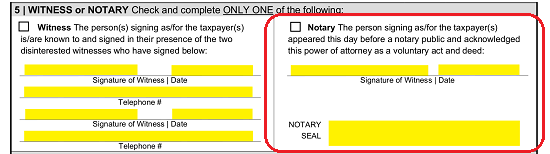

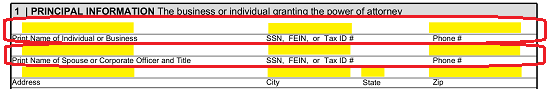

4 – The Principal Must Execute This Document Through A Witnessed Or Notarized Signature

Two blank lines have supplied to the end of the fourth part. The Principal, named int he first section, must sign his or her Name just above the words “Signature Of Principal Individual” then document the current Calendar Date above the word “Date.” If the Principal is a Business Entity, then a Corporate Officer authorized to sign on its behalf must sign this line. ![]() If a Spouse’s information was reported in the first part of this paperwork, then he or she must also sign and date this form. A second signature line “Signature Of Spouse” is placed in this area to accept this signature. If there is no Spouse, then it may be left blank.

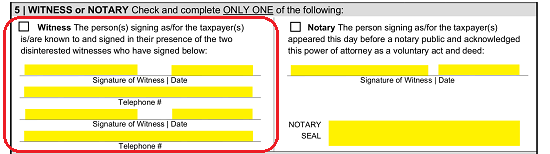

If a Spouse’s information was reported in the first part of this paperwork, then he or she must also sign and date this form. A second signature line “Signature Of Spouse” is placed in this area to accept this signature. If there is no Spouse, then it may be left blank. ![]() The Principal’s Signature will need to be substantiated in some way. The fifth part of this form (“5 | Witness Or Notary”) will address this need nicely. Here, one of two areas will need to be satisfied by the party who will verify the authenticity of the Principal Signature because of observing it personally. If this verification comes from two Witnesses, the first area’s checkbox (“Witness”) must be marked and each Witness must use the space provided to produce a Signature, Date, and Daytime Telephone Number.

The Principal’s Signature will need to be substantiated in some way. The fifth part of this form (“5 | Witness Or Notary”) will address this need nicely. Here, one of two areas will need to be satisfied by the party who will verify the authenticity of the Principal Signature because of observing it personally. If this verification comes from two Witnesses, the first area’s checkbox (“Witness”) must be marked and each Witness must use the space provided to produce a Signature, Date, and Daytime Telephone Number.  If the verifying party is a Notary Public, then mark the Notary Box. The Notary Public will then Sign, Date, and Stamp this area.

If the verifying party is a Notary Public, then mark the Notary Box. The Notary Public will then Sign, Date, and Stamp this area.