Updated August 23, 2023

A business purchase agreement (BPA) is a legal document between a buyer to acquire the full ownership of an entity from a seller for a sales price. All assets and liabilities held by the business will be transferred from the seller to the buyer on the closing date.

A business purchase agreement can be set up as an asset purchase or a stock purchase.

What Does It Include?

- Tangible or intangible Assets;

- Shares of stock;

- Due diligence period;

- Liabilities;

- Non-compete; and

- Leasehold interests.

Table of Contents |

Do I Need a Business Purchase Agreement?

Oftentimes, a transaction will involve the purchase of an asset and not the business in its entirety. To know whether to use a business purchase agreement, the answer must be “yes” to each question in the 3-point test.

3-Point Test

1. Will all aspects of the business continue normally after the sale?

2. Will the business continue to be incorporated under the same governing law?

3. Will all liabilities (such as debts and leasehold interests) be transferred to the buyer?

An Asset Purchase Agreement is recommended if the answer is no to any of the 3 questions. For example, if a website business is being purchased, the buyer buys the website’s assets, not the entire business entity.

If the answer is “yes” to all 3 questions, but only a percentage of the business is being purchased, a Stock Purchase Agreement is recommended. For example, only 1 partner in a 50/50 partnership decides to sell their shares.

How to Buy a Business (5 steps)

1. Conduct Due Diligence

The buyer should gather all necessary documents of the business, including:

- A list of all tangible and intangible assets;

- The liabilities, including property leases and debts;

- All internal documents and government records;

- Current payables and receivables;

- Tax records for the past 3 years; and

- Profit and loss statements.

After obtaining such information from the seller, a financial value can be placed on the business.

2. Get an Appraisal

Hiring a business broker or appraisal company can be useful to get the value of a business. Depending on the industry, the business will commonly trade at a multiple of its profit or revenue.

- Finding a Local Broker

A business is commonly sold on a local level. Therefore, it is recommended to contact a local business broker listed with the International Business Broker Association (IBBA).

3. Make an Offer

The buyer should structure a business purchase agreement that encourages the owner to sell.

This should include:

- A “good faith” deposit. This can be non-refundable based on any outstanding contingencies.

- Purchase price. The total amount paid to the seller for the business entity.

- Closing date. Usually, within 30 days when the purchase price is paid to the seller and the business is transferred to the buyer.

- Confidentiality. Both parties cannot share the agreement’s details with a 3rd party.

- Non-compete. Requires that the seller cannot open a similar business within the same market for a specified period of time.

Common Terms (5)

Counter-offer. When the buyer or seller wants to make a change to the other party’s offer. The counter-offer will then be sent to the other party for acceptance.

Deposit. The initial payment is made towards the final sales price of the business.

Non-compete. The seller can be prohibited from engaging in the same business after the sale of the business.

Non-operating costs. Expenses not directly related to the costs of the business such as interest on debt, moving costs, payments to settle lawsuits, etc.

Operating costs. Expenses that are directly related to providing goods or services to customers. This includes costs related to materials, labor, transportation, etc.

Frequently Asked Questions (FAQs)

What are Tangible Assets?

Tangible assets are physical items that you can “touch and feel.” Examples include equipment, vehicles, hardware, etc.

What are Intangible Assets?

Intangible assets are non-physical items that hold value. Examples include trademarks, copyrights,

What is EBITDA?

EBITDA means earnings before interest, taxes, depreciation, and amortization and is a metric used to determine the value of a business.

Sample

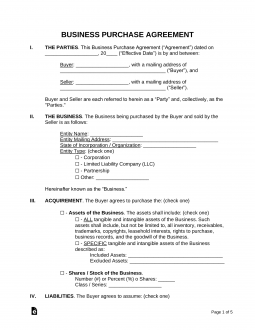

BUSINESS PURCHASE AGREEMENT

I. THE PARTIES. This Business Purchase Agreement (“Agreement”) dated on [DATE] (“Effective Date”) is by and between:

Buyer: [BUYER’S NAME] with a mailing address of [BUYER’S MAILING ADDRESS] (“Buyer”), and

Seller: [SELLER’S NAME] with a mailing address of [SELLER’S MAILING ADDRESS] (“Seller”).

Buyer and Seller are each referred to herein as a “Party” and, collectively, as the “Parties.”

II. THE BUSINESS. The Business being purchased by the Buyer and sold by the Seller is as follows:

Entity Name: [ENTITY NAME]

Entity Mailing Address: [ENTITY MAILING ADDRESS]

State of Incorporation / Organization: [STATE]

Entity Type: ☐ Corporation ☐ Limited Liability Company (LLC) ☐ Partnership ☐ Other: [OTHER]Hereinafter known as the “Business.”

III. ACQUIREMENT. The Buyer agrees to purchase the: (check one)

☐ – Assets of the Business. The assets shall include: (check one)

☐ – ALL tangible and intangible assets of the Business. Such assets shall include, but not be limited to, all inventory, receivables, trademarks, copyrights, leasehold interests, rights to purchase, business records, and the goodwill of the Business.

☐ – SPECIFIC tangible and intangible assets of the Business described as:

Included Assets: [INCLUDED ASSETS]

Excluded Assets: [EXCLUDED ASSETS]

☐ – Shares / Stock of the Business.

Number (#) or Percent (%) o Shares: [# OR %]

Class / Series: [CLASS OR SERIES]

IV. LIABILITIES. The Buyer agrees to assume: (check one)

☐ – No Liability(ies). The Buyer agrees to assume no more liability than is obligated and specifically mentioned under the terms of this Agreement.

☐ – Some Liability(ies). The Buyer agrees to assume the following liability(ies) in accordance with the terms of this agreement: (check all that apply)

☐ – Accounts payable.

☐ – Past and current business expenses.

☐ – Contractual obligations.

☐ – Leasehold interests.

☐ – Legal liabilities.

☐ – Past and current taxes owed by the Business.

☐ – Payroll related to past and current employees, independent contractors, agents, and any other owed individuals.

☐ – Other. [OTHER]

☐ – Other. [OTHER]

☐ – Other. [OTHER]V. PURCHASE PRICE. The Buyer agrees to purchase the Business under the type of acquirement mentioned in Section III for $[AMOUNT] (“Purchase Price”).

The Purchase Price represents the total sum of money that is agreed to by the Parties for the transaction mentioned in this Agreement.

VI. PAYMENT. Payment of the Purchase Price shall be made: (check one)

☐ – In a Lump Sum. The Purchase Price shall be made on the Closing Date.

☐ – With Multiple Payments. The 1st payment is due on [DATE], and shall continue on the [DAY] of each ☐ week ☐ month ☐ quarter with the last payment made on [DATE].

☐ – Other. [OTHER].

VII. PAYMENT METHODS. The Buyer may deliver the full amount of the Purchase Price in any of the following methods: (check all that apply)

☐ – Bank Wire

☐ – Cash

☐ – Cashier’s Check

☐ – Other: [OTHER].VIII. DEPOSIT. As part of this Agreement, the Seller: (check one)

☐ – Requires a Deposit. The Seller requires an initial payment in the amount of $[AMOUNT] (“Deposit”). The Deposit must be paid within [#] Calendar Days from the Effective Date of this Agreement.

☐ – Does not require a Deposit. The Buyer’s consideration shall be their full-faith commitment to purchase the Business under the terms of this Agreement.

IX. CLOSING DATE. The closing shall occur on or before [DATE], (“Closing Date”) at a time and location agreeable by the Parties.

X. DUE DILIGENCE PERIOD. The Buyer: (check one)

☐ – Requires a Due Diligence Period. The Buyer requires a due diligence period to inspect the finances and agreements of the Business. The decision as to whether the Business is suitable for its intended purpose shall be the sole decision of Buyer, determined in the absolute discretion of Buyer, with Buyer’s decision being final and binding upon the Parties. Buyer shall have until [DATE], at [TIME] ☐ AM ☐ PM to notify Seller of its termination of this Agreement (“Due Diligence Period”). If the Buyer decides to terminate this Agreement during the Due Diligence Period, any Deposit made shall be returned to the Buyer.

☐ – Does NOT Require a Due Diligence Period. The Buyer does not require a Due Diligence Period to review the finances, agreements, or any other information of the Business.

XI. NON-COMPETE. As part of this Agreement, there shall be: (check)

☐ – Non-Compete Restrictions. The Purchase Price, for the Business mentioned in this Agreement, shall act as consideration towards a non-compete covenant that the Seller shall be legally bound. It is understood by all parties that the Seller is knowledgeable of proprietary information, including trade secrets, which could be harmful to the success and continuation of the business after the sale. Therefore, in order to protect the fiduciary interests of the Buyer, the Seller agrees not to compete under the following terms:

Scope of work. For the specific business or practice of: [SCOPE OF WORK].

Term. For a period of [TERM] after the sale of the Business.

Geographical areas. Strictly for the areas of: [GEOGRAPHICAL AREAS].☐ – No Non-Compete Restrictions. The Seller shall not be restricted, in any manner, from engaging in the same or similar business purpose as the Business in this Agreement.

XII. DELIVERY. The delivery of the Business, along with any stock certificates, shall be transferred to the Buyer at the Closing Date upon the funds being received by the Seller.

XIII. AUTHORITY OF SELLER. The Seller hereby represents and warrants to Buyer, and covenants with Buyer, as follows:

a.) Capacity. The Seller has all requisite power, authority, and capacity to enter into this Agreement. The execution, delivery, and performance of this Agreement by the Seller does not, and the consummation of the transaction contemplated hereby will not result in a breach of or default under any agreement to which the Seller is a party by which the Seller is bound.

b.) Binding Agreement. This Agreement has been duly and validly executed and delivered by the Seller and constitutes the Seller’s valid and binding agreement, enforceable against the Seller in accordance with and subject to its terms.

c.) Title (Ownership) to Business. The Seller is the lawful record and beneficial owner of the Business, free and clear of any liens, claims, agreements, charges, security interests, and encumbrances unless otherwise mentioned in this Agreement. The sale, conveyance, assignment, and transfer of the Business in accordance with the terms of this Agreement transfers to the Buyer legal and valid title to the Business, free and clear of all liens, security interests, or pledges.

XIV. AUTHORITY OF BUYER. The Buyer represents and warrants to the Seller as follows:

a.) Capacity. The Buyer has all requisite power, authority, and capacity to enter into this Agreement. The execution, delivery, and performance of this Agreement by the Buyer does not, and the consummation of the transaction contemplated hereby will not result in a breach of or a default under any agreement to which the Buyer is a party or by which Buyer is bound.

b.) Disclosure. The Buyer is aware of the risks involved in purchasing the Business and accepts that its value can change rapidly and unpredictably.

XV. DATE AND TIME. Time is of the essence.

a.) Calendar Days. Calendar days shall represent all days of the year except Saturdays, Sundays, and Federal Holidays (“Calendar Days”).

b.) Effective Date. The effective date of this Agreement shall be the day the Parties authorize this Agreement and acceptance has been given.

XVI. GOVERNING LAW. This Agreement shall be construed, interpreted, and enforced in accordance with, and shall be governed by, the laws in the State of [GOVERNING LAW] without reference to, and regardless of, any applicable choice or conflicts of laws principals.

XVII. SEVERABILITY. In the event any provision or part of this Agreement is found to be invalid or unenforceable, only that particular provision or part so found, and not the entire Agreement, will be inoperative.

XVIII. COUNTERPARTS. This Agreement may be executed in any number of counterparts and by the several parties hereto in separate counterparts, each of which shall be deemed to be an original, and all of which together shall constitute one and the same Agreement.

XIX. ADDITIONAL TERMS & CONDITIONS. [ADDITIONAL TERMS & CONDITIONS]

XX. ENTIRE AGREEMENT. This Agreement constitutes the entire understanding and agreement of the Parties relating to the subject matter hereof and supersedes any and all prior understandings, agreements, negotiations, and discussions, both written and oral, between the Parties hereto with respect to the subject matter hereof.

Buyer Signature: _____________________________ Date: ______________

Print Name: _____________________________

Seller Signature: _____________________________ Date: ______________

Print Name: _____________________________