Updated August 03, 2023

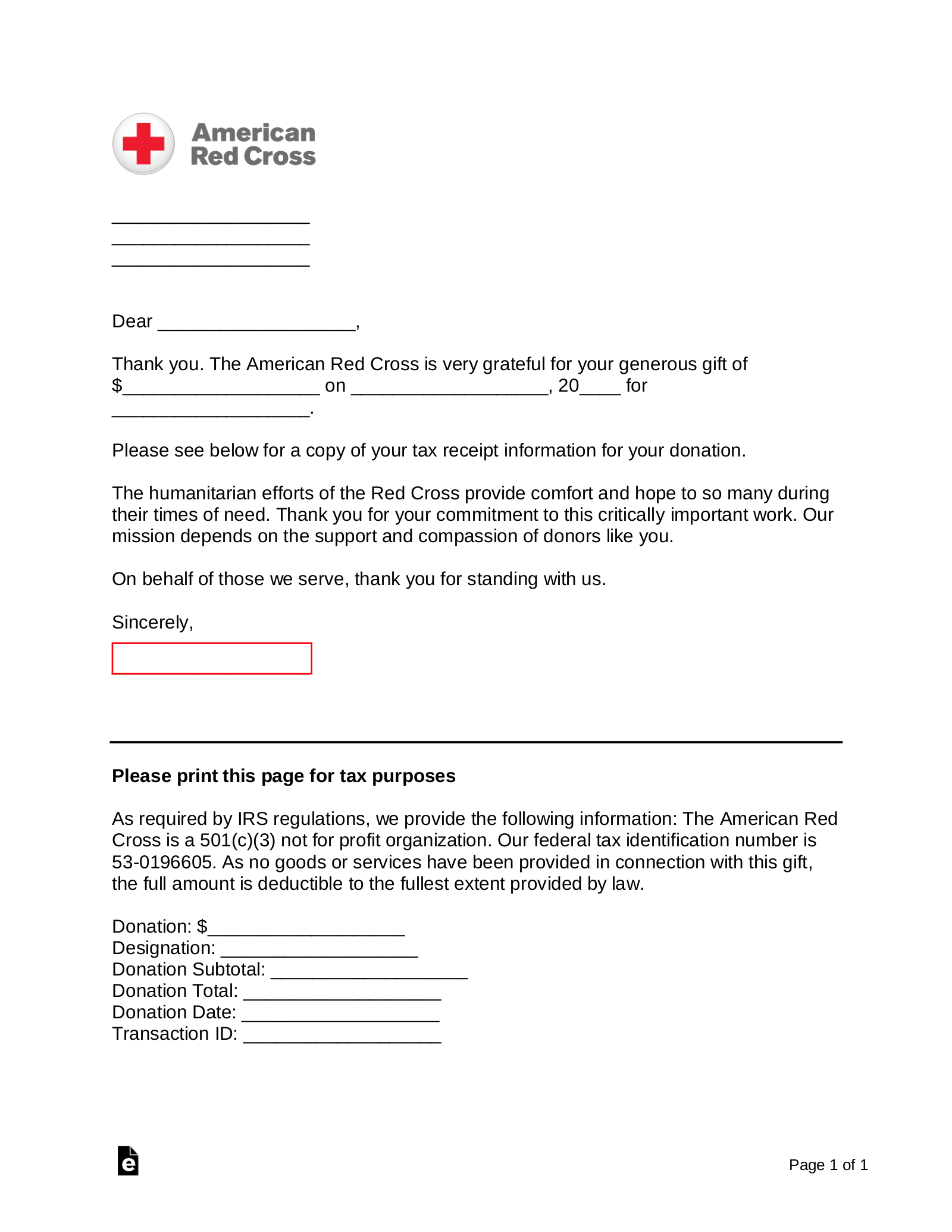

An American Red Cross donation receipt is given to any donor for a payment made for their internal tax records. In accordance with Internal Revenue Code (IRS) regulations, any donation made over $250 must have a receipt from the organization confirming such amount was received. As a general rule, the donor should hold the receipt for a period of three (3) years.

Tax ID Number (EIN) – 53-0196605

Request a Donation Receipt (Online) – Use this link to make an inquiry and obtain a donation receipt.

Donation Methods

Donate Online – $10 is the minimum amount and may be paid one-time or monthly by credit card or PayPal.

Donate by Mail – Attach a check payable to the “American Red Cross” and send to: American Red Cross, PO Box 37839, Boone, Iowa 50037-0839.

Donate by Phone – 1-800-HELP NOW (1-800-435-7669)