Updated August 03, 2023

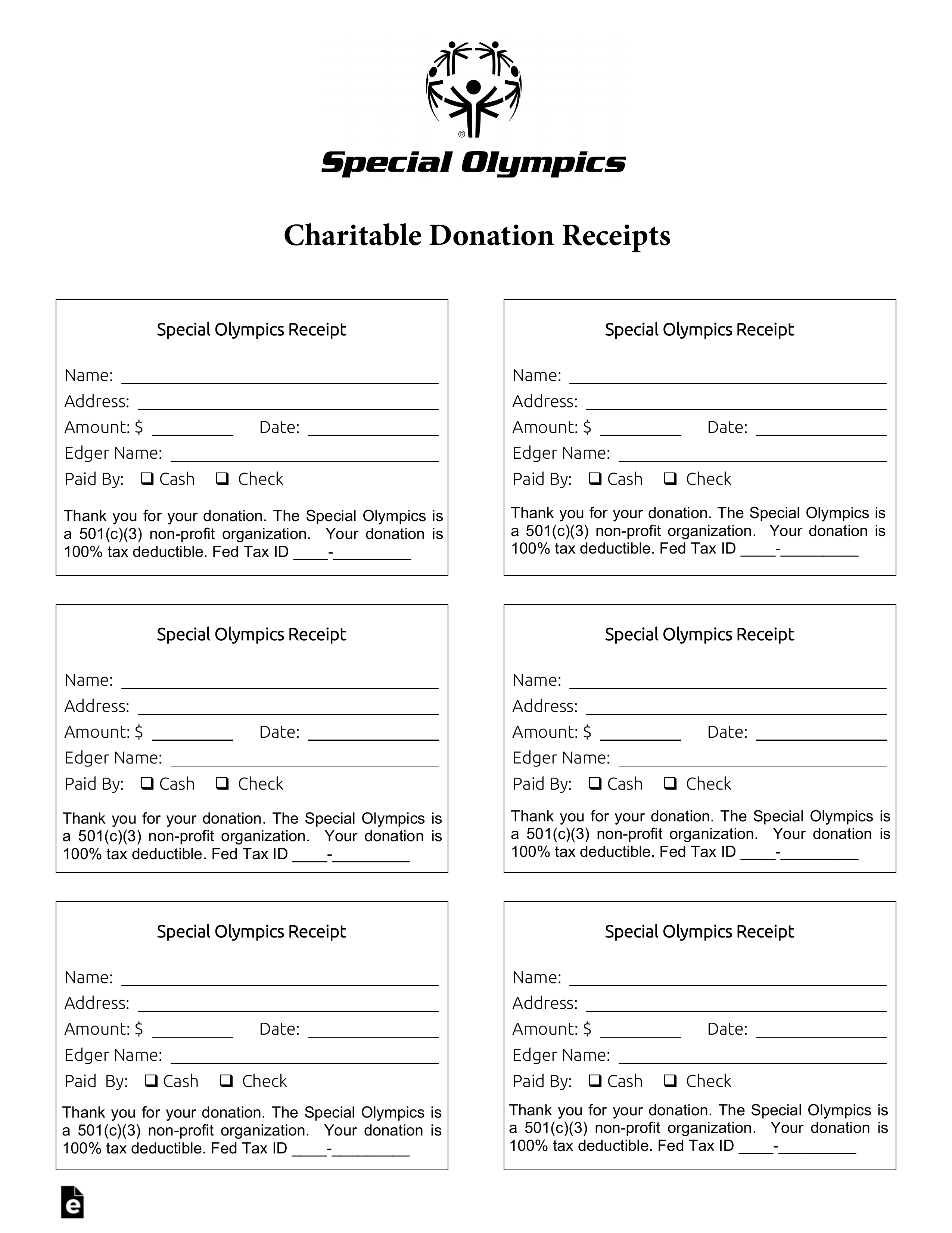

A Special Olympics donation receipt is a document confirming that a contribution has been given in the form of a donation which can be tax deductible as the Special Olympics, Inc. is recognized as tax-exempt under section 501(c)(3) of the Internal Revenue Code. Donations may not be tax deductible if made outside the United States.

Tax ID Number (EIN) – Designated by State-specific organization.

Donation Methods

Donate by Phone or Email – 1 (800) 380-3071 | donorservices@specialolympics.org

Donate Online – Make a one-time or recurring contribution via credit card.

Donate by Mail – When sending by mail, expect a confirmation letter/receipt to be returned in 2-3 weeks time. Attach a check or enter credit card information and send to:

Special Olympics

Attn: Web Gifts

1133 19th Street NW, 12th Floor

Washington, DC 20036‐3604

Gift of Stock – If giving securities to the Special Olympics. Complete and e-mail to DonorServices@SpecialOlympics.org or send to:

Nicholas Morgan

Gift Services Specialist Special Olympics

1133 19th Street, NW

Washington, DC 20036