Updated August 03, 2023

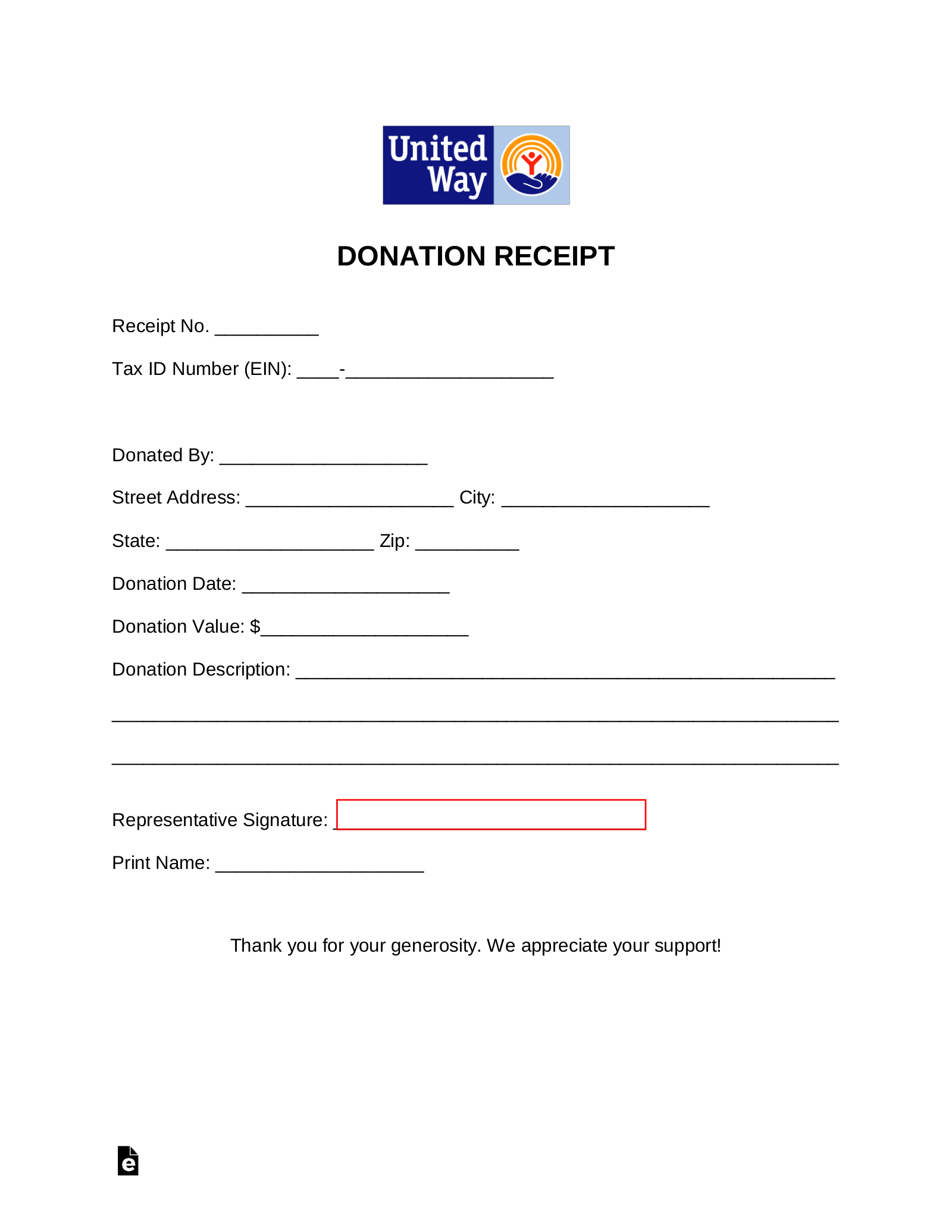

A United Way donation receipt is used as proof when reporting to the IRS for a tax deduction from a contribution to UWW. United Way is recognized as a 501(c)(3) public charity. Goods or services provided in exchange for a contribution are not eligible for tax credits.

Tax ID Number (EIN) – 13-1635294

Donation Methods

United Way focuses primarily on education, financial stability and health which creates many ways to make a contribution towards their many causes. Use the links below to donate.

Donate Online – Their primary way in which people can donate cash via credit card or with a PayPal account.

Donate Stock – United Way will provide you with their brokerage firm’s name including the DTC number, account name and number, and phone number. In order to avoid capital gains taxation, stock should be transferred to United Way’s account prior to being sold.

Donate Bitcoin – Donate Bitcoin or Bitcoin Cash via BitPay.

Planned Giving – From IRAs to life insurance policies that have outlasted their purpose.