Updated August 03, 2023

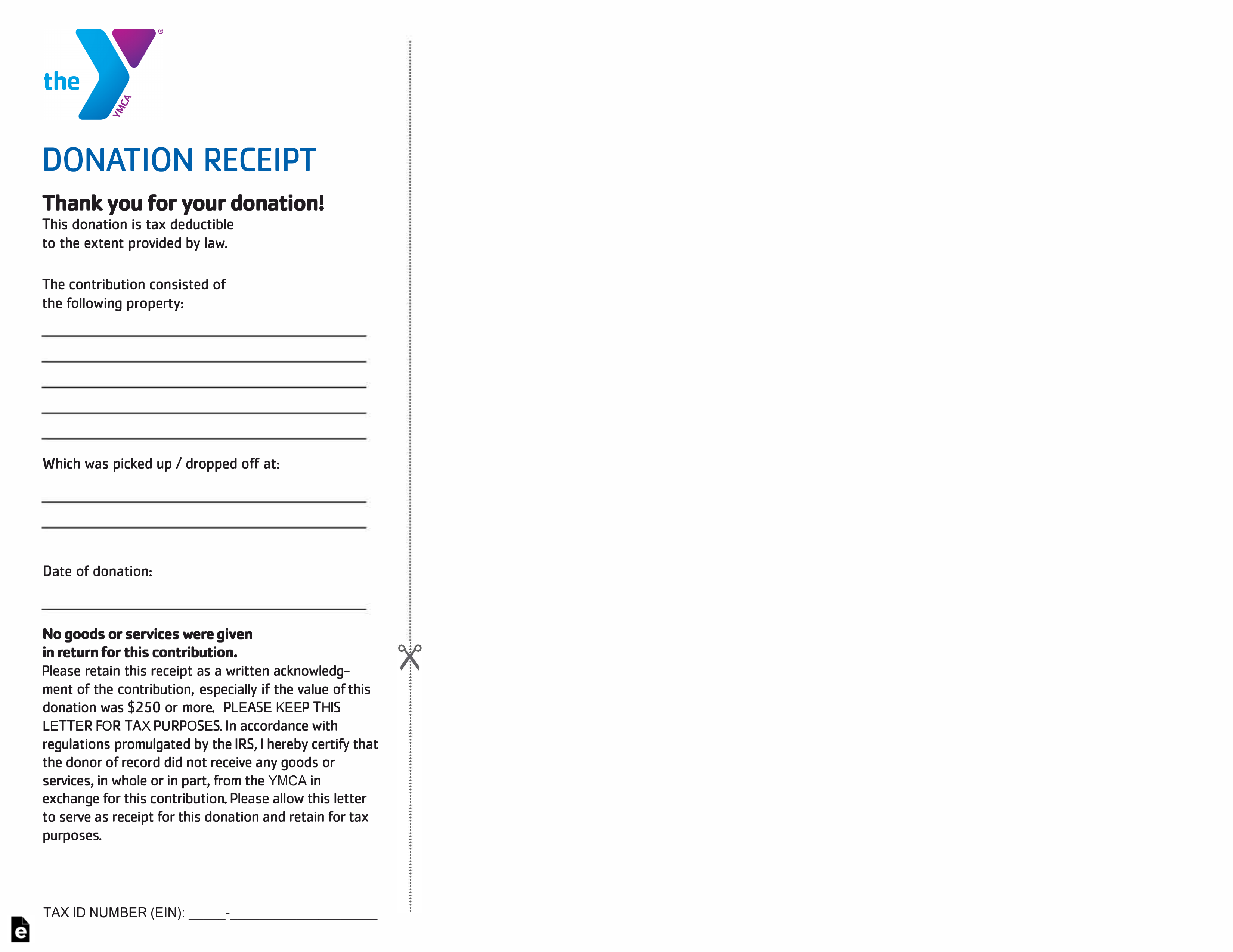

A YMCA donation receipt template is used to show the IRS that a contribution was given. The YMCA is recognized as a 501(c)(3) not-for-profit corporation which allows all gifts to be tax deductible to the fullest extent allowed by law. The Y’s primary mission is youth development in neighborhoods all around the United States.

Tax ID Number (EIN) – 21-0635051

Donation Methods

Donate Online – Give a minimum of $10 to any one of the dozen programs by making payment via credit card.

Donate by Mail – Make payments payable to The Community YMCA. Send to: Annual Support Campaign 170 Patterson Avenue Shrewsbury, NJ 07702

Email – To make gifts of securities, trusts, life insurance or bequests, send an email to giving@cymca.org or call 732-671-5505, ext. 131.

YMCA Locations – Find one of the 2,700 locations nationwide by entering a city and State.