Updated August 24, 2023

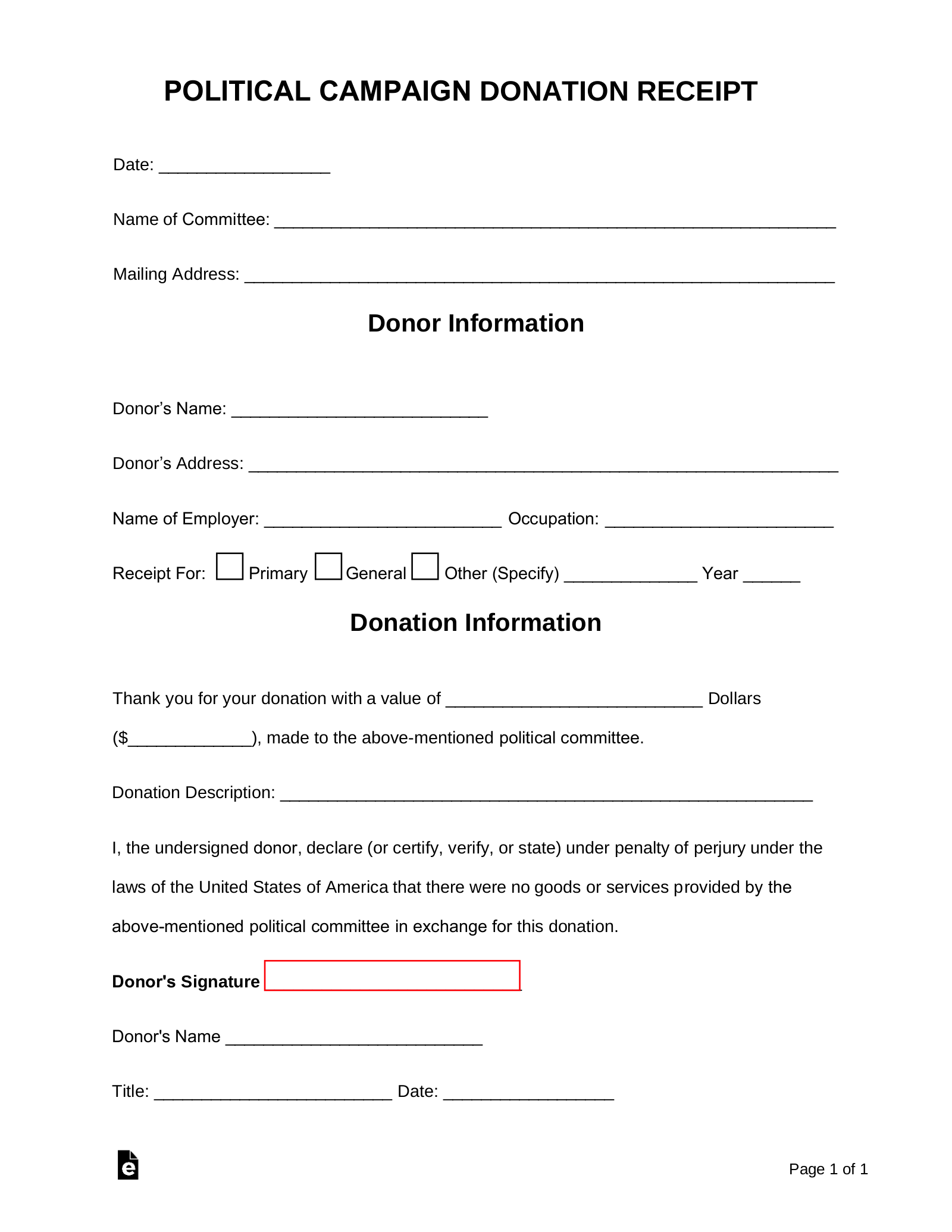

A political campaign donation receipt is written documentation provided to a donor for a contribution made to a political organization. Donors can contribute to a political organization by donating money or goods/services (in-kind donation). Although a political donation is non-deductible according to the IRS, it is still wise to keep a record of all receipts.

What to Include?

The following may be included in a Political Campaign Donation Receipt:

- The name address and contact information of the political organization.

- The name of the donor or the entity making a donation.

- Description of the donation.

- The total value or dollar amount of the donation.

- The date the donation was made.

- A statement advising that the organization did not provide any services or goods in exchange for the donation.

How to Make a Political Donation (4 steps)

1. Distinguish the Donor Type

2. Know Maximum Donation Limits

Are Political Donations Tax-Deductible?

The short answer is no. In accordance with the Internal Revenue Code 501(c)(3) only donations to valid non-profit entities are tax-deductible.

Which Agency Monitors Political Campaign Donations?

The Federal Election Commission (FEC) administers and enforces the regulations in association with campaign donations. They enforce the Federal Election Campaign Act (FECA) which indicates the maximum amounts of contributions that can be made.

Individual Contributions vs Corporate Contributions

In accordance with US law, individuals are allowed to make financial donations in contribution to a political campaign. There are limits each year regarding the maximum amount that can be donated per individual. However, in accordance with varying state laws, some corporations are explicitly prohibited from making any contributions to a political party or campaign. With that in mind, there are states that allow corporations to donate an unlimited amount of money to state campaigns. Any individual or corporation interested in making a donation to a State or Federal committee should contact the Federal Election Committee to understand the preset limits and to ensure they are contributing to a campaign in a lawful way.