Updated August 24, 2023

A vehicle donation receipt is a formal record that documents the charitable gift of an automobile (also known as a “vehicle donation bill of sale”). It is essential paperwork that should be given to all donors upon the acceptance of a vehicle donation. Donors seeking to deduct the value of a donated vehicle from their income tax will require the donation receipt to prove the validity of the donation. After a receipt has been issued, it should be retained by the donor until needed for itemization on their tax return.

Table of Contents |

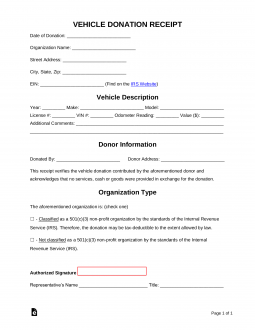

What Should be Included?

Like any charitable receipt, the vehicle donation receipt should indicate:

- The name of the donor and contact information, including the address and phone number;

- The name and contact information of the organization receiving the donation;

- The tax identification number of the organization;

- The date of the donation;

- The vehicle make and model;

- The approximate value of the vehicle; and

- The signature of an authorized agent of the charitable organization.

The receipt may also describe the vehicle condition and include other details like the vehicle identification number (VIN).

How to Donate a Vehicle (5 steps)

- Select a Charity to Donate the Vehicle

- Ensure the Donation is Tax Deductible

- Lookup/Determine the Value of the Vehicle

- Meet with the Charity and Give Title

- Obtain the Receipt for Record-Keeping

Donating a motor vehicle is one of the best ways to obtain a tax benefit rather than selling on a conventional basis. Sometimes it’s better to donate a vehicle when finding it hard to sell. To donate, it’s as simple as contacting an eligible charity, scheduling a pickup, and getting a receipt. If the vehicle’s worth is more than $500, then it will need to have a professional appraisal letter from a local car dealership verifying its value.

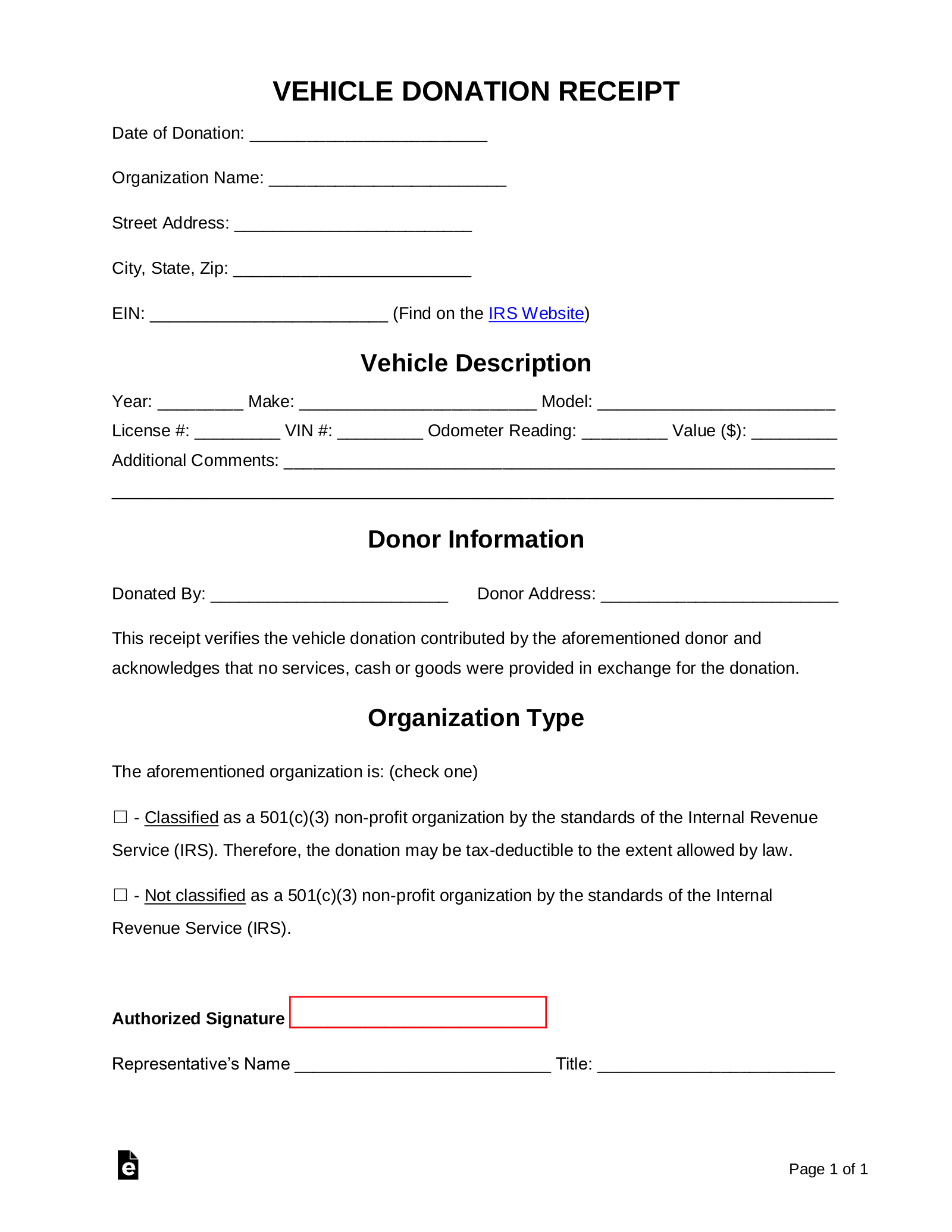

1. Select a Charity to Donate the Vehicle

There are many charities, for great causes, that make the vehicle donation process easy by coming to your place of residence or work to pick-up the vehicle and take care of most the paperwork involved. If the vehicle is worth more than $500 then a full description of the vehicle is required.

If the vehicle is worth more than $5,000 then a “qualified appraisal” must be completed to verify its value. Many charities will have an appraiser provide the paperwork needed to make an easy and smooth process for the donor.

2. Ensure the Donation is Tax Deductible

To ensure that a vehicle donation is tax-deductible, you need to make certain that the charity is a qualified organization. The IRS offers a 501(c)(3) Verification Tool for donors to ensure organizations are deemed charities

There are two (2) ways to verify a charity which are listed below. Do note – certain organizations are not required to file exemption applications and yearly returns, these include churches, mosques, synagogues, and temples. Therefore, these organizations may not be listed in the organization search database.

- Verify a charity using the IRS Tax Exempt Organization Search.

- Verify by calling the IRS Customer Account Services division and ask for Tax Exempt and Government Entities at (877) 829-5500.

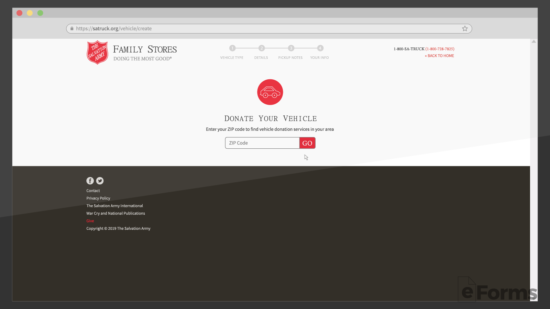

3. Lookup/Determine the Value of the Vehicle

The most well-known way to search the value of a vehicle is by using the online resource Kelly Blue Book. This will give vehicle owners a realistic price, although not an official appraisal, as to what their vehicle is worth. When donating, the value of the vehicle is determined by how the charity uses it.

There are mainly two scenarios that will determine the value of a vehicle when donated.

- If the charity sells the donated vehicle, the donor’s tax deduction is based on the gross proceeds from the sale which is detailed in the written acknowledgment/receipt from the charity.

- If the charity plans to make significant use of the vehicle (not sell), the donor is eligible to deduct the vehicle’s fair market value. A written appraisal from a qualified appraiser is required if the deduction is over $5,000 dollars. The appraisal must be made within 60 days prior to donating a vehicle.

4. Meet with the Charity and Give Title

The only document needed to donate a vehicle is the Title, which details the vehicle’s current legal owner. Only the current legal owner has the legal authority to donate the vehicle. When meeting with the charity to donate the vehicle, the owner should remove the license plate to avoid liability after the vehicle is transferred.

5. Obtain the Receipt for Record-Keeping

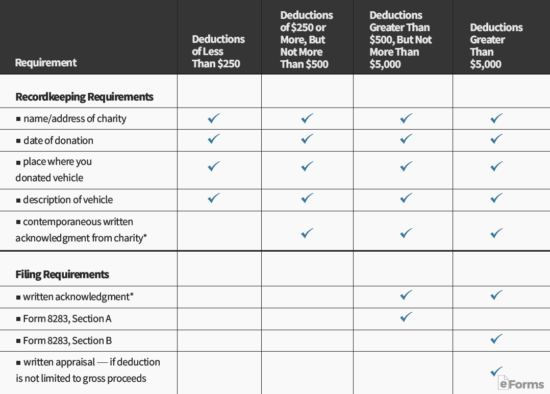

When making a donation, it’s legally required by the charity to return a written acknowledgment (receipt). If the deduction exceeds by more than $500 dollars, it’s required by donors that give vehicles to keep the following records:

- Name/address of charity;

- Date of donation;

- Place where you donated the vehicle (the location where the vehicle was dropped off or picked-up;

- Description of the vehicle; and

- A statement that no goods or services were provided in return for the donation.

Vehicle Donation Receipt – Sample

Donor information: Bill Smith, 57 Main Street, Townville, MO, 12345 Phone: 555-555-5555

Organization information: Veterans Alliance, P.O. Box 0429, Townville, MO, 12345 Phone: 777-777-7777

EIN: 09-1203928

Date: June 1, 2017

Vehicle Make/Model: 2004 Subaru Impreza

Description: Silver 4 door hatchback. 150xxx miles.

VIN: 1234XXX123XXX92019

Value: $750.00.*

This receipt serves as official documentation of the donation of the 2004 Subaru Impreza described above by Bill Smith to Veterans Alliance on June 1, 2017 .

No cash, goods, or services were provided in exchange for this vehicle.

The donor was released from any liability associated with this vehicle at the time of donation.

Signature: ______________________

*Note that the value indicated above is as stated by the donor and does not necessarily reflect the vehicle’s fair market value or its ultimate resale price.