Updated August 28, 2023

A lien release allows an entity or individual that owns property to waive any debt that was owed on their behalf and was attached to their property. A lien can affect the sale or lease of real estate as a title company will most likely request that the payment be secured before any transaction.

After the payment has been made, the lien may be cleared with the County Registry of Deeds.

Types

Contractor’s (Mechanic’s) Lien Release – This lien would be used when mechanic has repaired a vehicle of any type and is now awaiting payment. Once full payment has been secured by the mechanic, this form would be completed to release the motor vehicle back to the owner.

IRS Lien Release (Form 12277) – For the purpose of formally asking the Internal Revenue Service to relinquish a debt that has been filed on a property.

Mortgage Lien Release – If a lien has been filed by a mortgagee and the balance has been paid then a release may be requested and filed.

Partial Release of Lien – Is a waiver and release of lien upon progress during a work contract, usually for construction, that is met upon payment by the owner of the company.

What is a Lien Release?

A Lien Release (also considered a Lien Cancellation or Release of Lien) is a legally binding document that is sent by the current lien holder, the individual who has leased the property or provided payment to secure the property, that informs any debt in relation to that property has been fulfilled and they relinquish the property in question to the appropriate party. Until the Lien Release, or loan satisfaction document has been sent, the Lien Holder is the true owner of the property.

How to Get a Lien Release (3 steps)

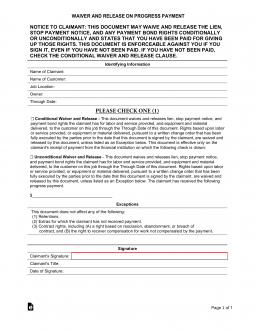

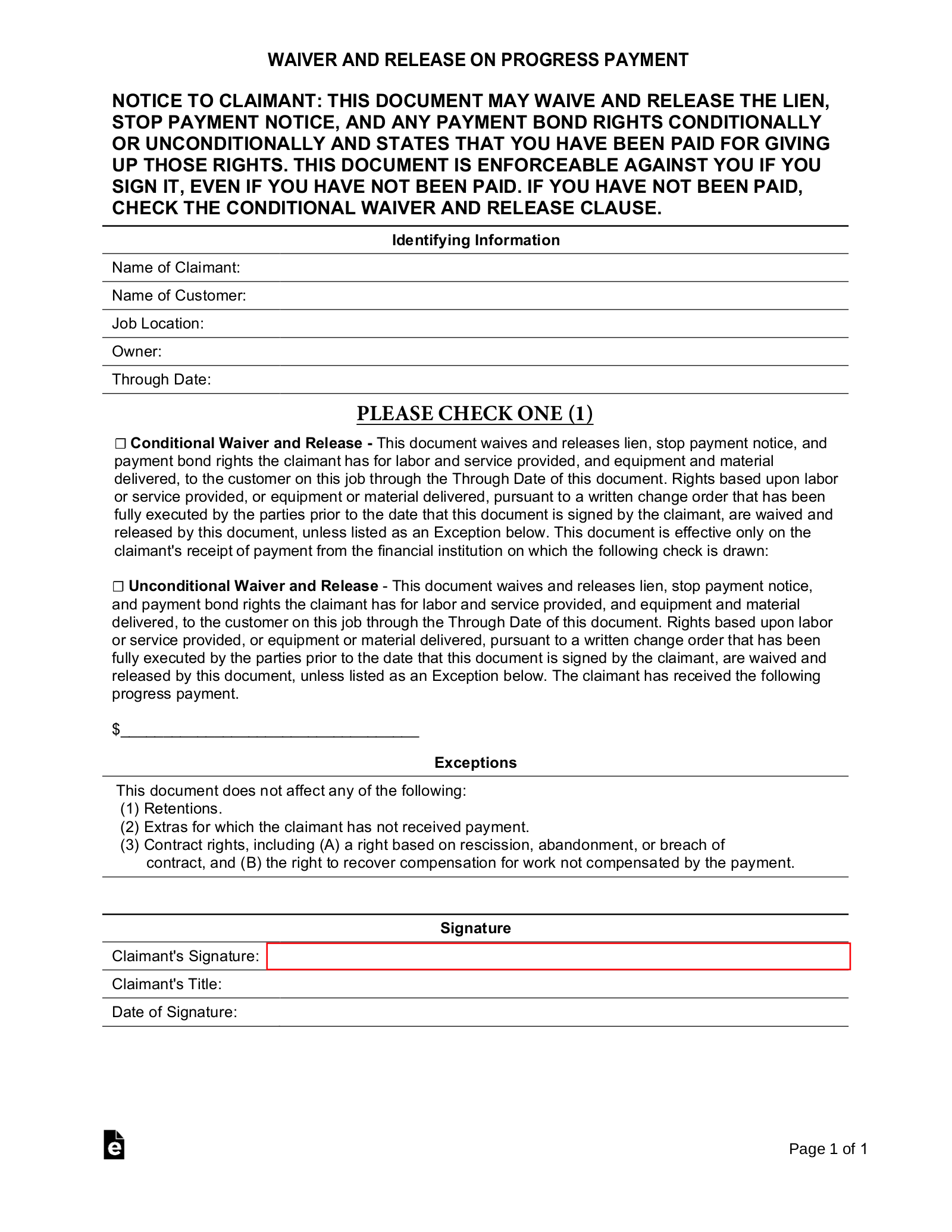

1. Download the Form

Download the appropriate form and review. A Lien Release should be filed immediately upon final payment clearing the financial institution and dependent on state law may be required to be filed within a particular time frame from satisfaction or it can be subject to penalties and legal consequence. The form may need the following filled out and acknowledged:

- Claimant Name

- Customer Name

- Location of Job, if applicable

- Property in question

- Owner

- Total Amount paid and date paid, if applicable

- Review document for any exceptions, exclusions or limitations.

2. Conditional vs. Unconditional

A Conditional Waiver and Release should be utilized when the claimant will release the property in order to induce a progress payment, when the claimant has not yet been paid. The Conditional Waiver and Release is only binding if payments are actually being paid by a financial institution to the claimant but is not inclusive of the final payment. This differs from an Unconditional Waiver and Release in that, in order for the waiver and release to occur, the claimant has in fact received a progress payment from a financial institution, which is not inclusive of final payment. Exceptions may be associated with Conditional and Unconditional Waiver and Release and should be reviewed.

3. Obtain Signature(s)

Appropriate signatures will need to be documented for the form to become valid.

- Signature of the claimant

- Title in question

- Date of signature

Once the document is signed by vested parties the document should be notarized to ensure its validity. Dependent on local state law, once signature is obtained the document should be filed through the county recorder’s office to have records updated.

What is the Purpose of a Lien?

A lien is considered a legally recorded claim against a particular piece of property (i.e., car, house, boat). The lien provides notice that the financial institution has a vested interest in the stated property. The purpose of the Lien is to ensure the financial institution received full payment before it is transferred or sold.

Ways to Avoid a Lien

There are many ways to avoid a lien and the most common ones are listed below:

- Ensure all vendors and contractors sign of on a lien waiver.

- Pay home/auto vendor contracts timely.

- Negotiate outstanding balance with lien holder.

- Avoid lawsuits.

- Ensure property is taken care of (homeowners associations or environmental control boards have a vested interest).

- Pay outstanding parking violations or tickets.

- Research property prior to making a purchase (liens transfer from seller to buyer). Purchasing property with a lien will make you solely responsible for fulfilling the lien.

- Pay taxes timely and in full, this is inclusive of personal and property taxes.

- Avoid a federal tax lien by owing less than $25,000 on taxes.

- Pay credit card debt timely.