Updated April 14, 2023

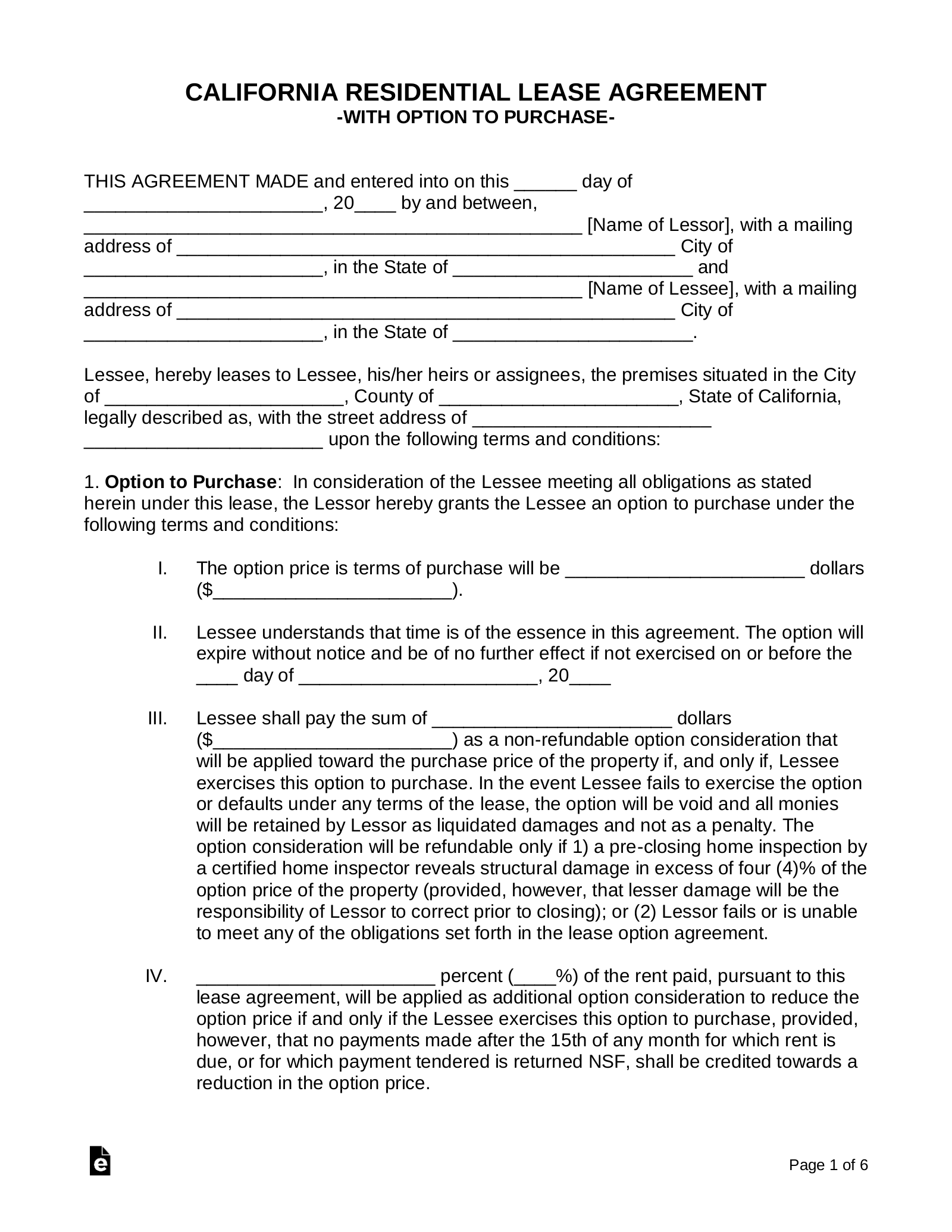

A California rent-to-own lease agreement is a binding contract between a landlord and tenant for the renting of property. The form also includes language that allows the tenant to buy the property for an agreed-upon price. The tenant will usually have to undergo the same screening process as a standard lease and must follow all State-required laws.

If the tenant decides to buy the property, the lease should be converted to a purchase contract.

Rental Application – Use as a landlord to collect a fee and obtain the personal information of a prospective tenant.