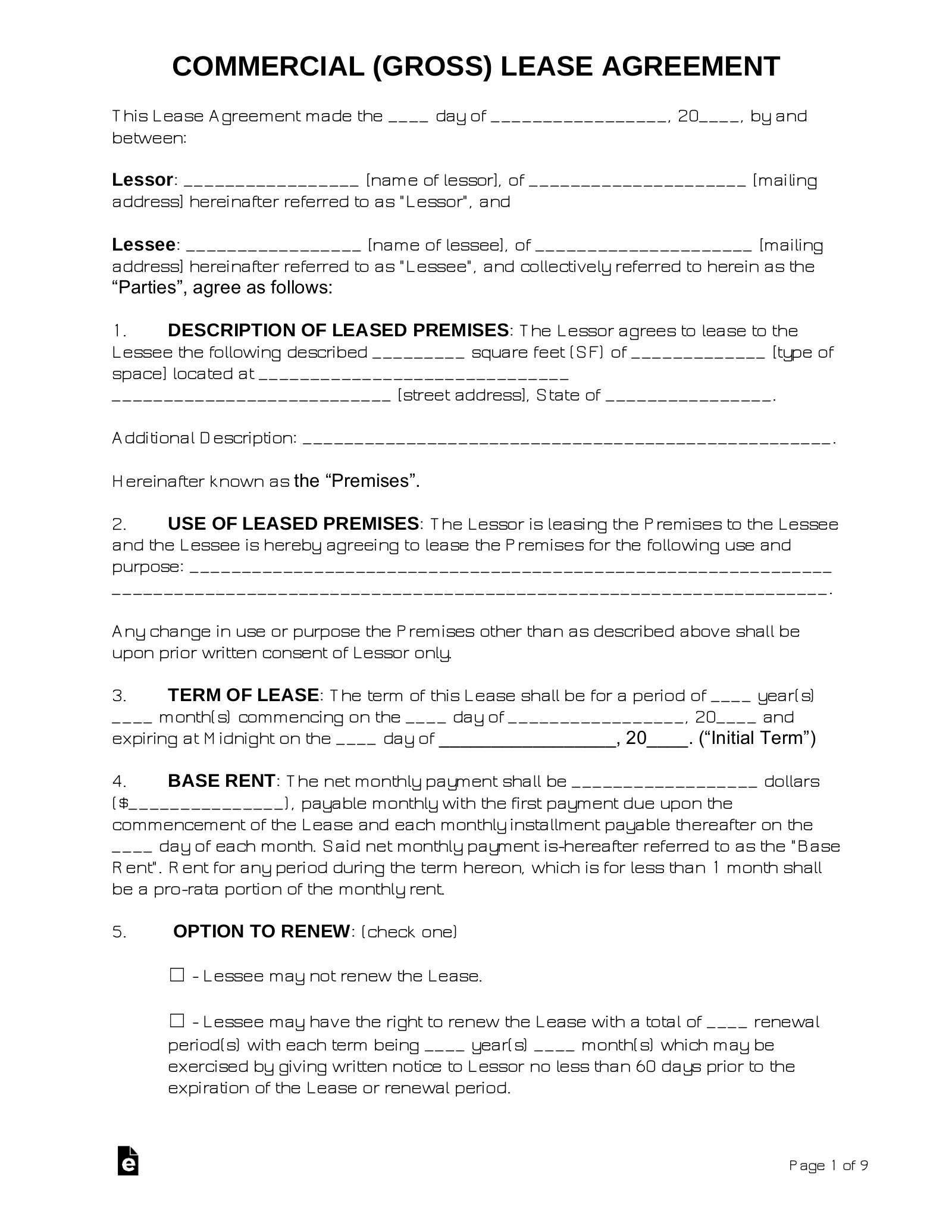

Updated April 14, 2023

A commercial gross lease agreement is between a tenant required to only pay the monthly rent and the landlord is responsible for all expenses related to the property. The expenses are commonly real estate taxes, property insurance, and common area maintenance (CAM’s). The tenant will be responsible for their own services and other expenses related to their usage of utilities (ex. electricity, internet, water, etc.).

What is a Gross Lease?

A gross lease is a type of commercial agreement that requires a tenant to pay only the monthly rent and, in some cases, their usage of utilities. The landlord is responsible for the payment of taxes, property insurance, and common area maintenance (CAM’s).

Full Service Gross Lease

A full service gross lease requires the landlord to pay, in addition to the property expenses, all utilities and services. This includes electricity, water/sewer, internet, oil/gas, HVAC, and other uses by the tenant.

The tenant is only required to pay the monthly rent. This is common when it is not possible to calculate the tenant’s usage of utilities such as a co-working space.

When is a Gross Lease used?

A gross lease is used commonly with office space or any shared property that is difficult to calculate the property expenses for each tenant. The landlord will usually charge a higher amount in the monthly rent to account for the payment of property expenditures.