Updated August 08, 2023

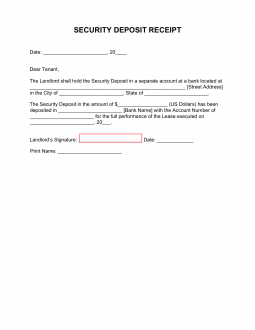

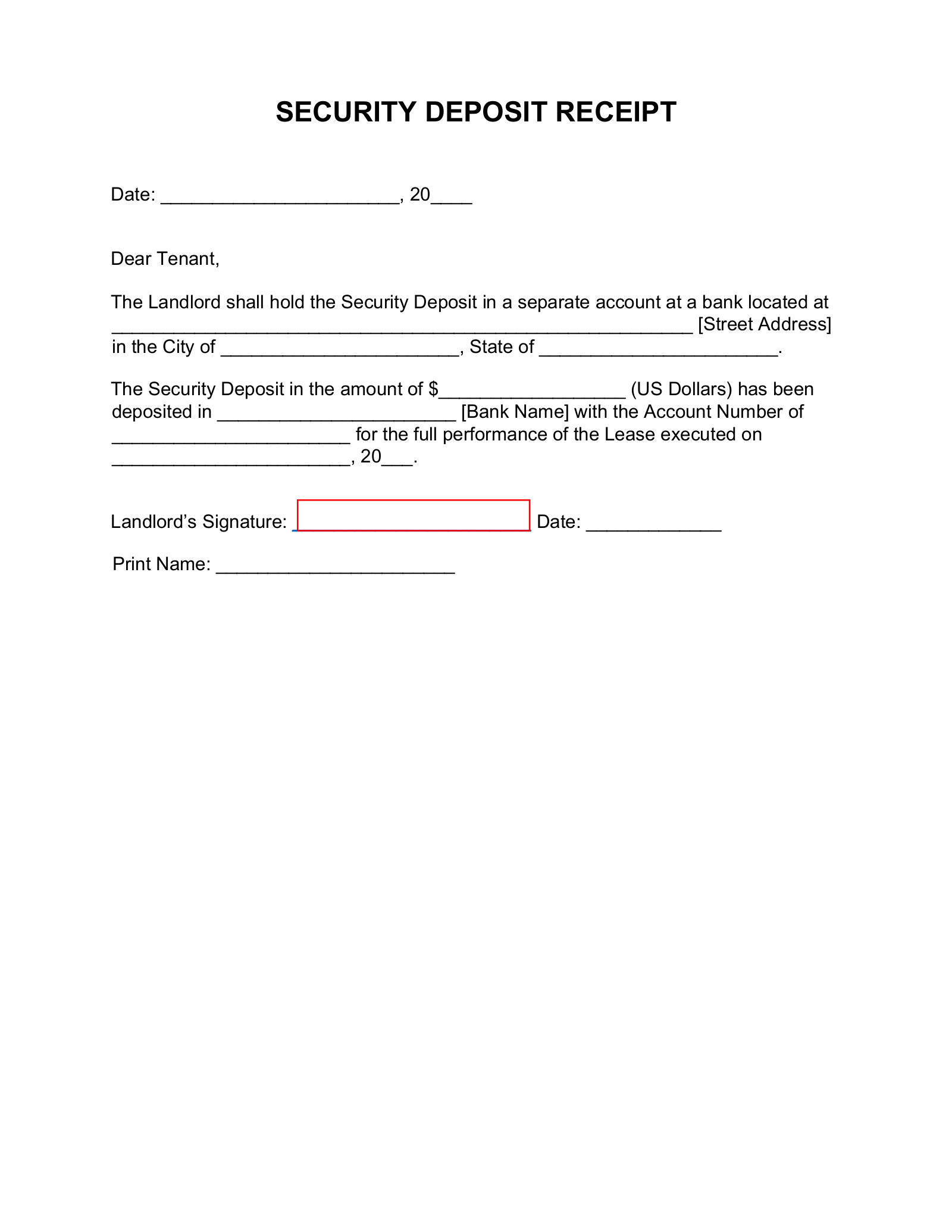

A security deposit receipt is provided by a landlord to a tenant after receiving payment for the security deposit. This amount is placed in the landlord’s bank account for the security of the lease. Per State laws, this amount will be returned to the tenant at the end of the tenancy.

Required States (10)

A security deposit receipt is required to be issued if a deposit is accepted in the following States:

- Florida – § 83.49

- Kentucky – § 383.580(1)

- Maryland – § 8–203

- Massachusetts – Chapter 186, Section 15B(2)(c)

- Michigan – § 554.603

- New Hampshire – RSA 540-A:6(I)(b)

- New York – § 7-103

- North Carolina – § 42-50

- *Maine (*city of Portland only) – § 30.01.087(B)(1)

- Washington – § 59.18.270

- Washington D.C. – § 14-306

Maximum Amounts ($)

Use this table to find out the maximum security deposit amounts allowed under the respective State laws.