Updated August 27, 2023

A donation request letter is a written solicitation by a non-profit for money or in-kind contributions to potential donors. It acts as a request or appeal to request money to fund the operations and services of a charity.

Table of Contents |

Who Can Ask for Donations?

A group or organization may request and receive donations.

However, for the contribution to be tax-deductible for the donor, the organization receiving the donation must be tax-exempt under Section 501(c)(3) of the Internal Revenue Code.[1]

Tax-Exempt Organizations

Tax-exempt organizations typically operate exclusively for charitable, religious, educational, scientific, literary, or other specified purposes under Section 501(c)(3).

Samples[2]

- Social welfare organizations and charities

- Nonprofits related to the arts, education, or science

- Churches, synagogues, or other religious entities

- Medical research organizations

- Public school district programs

- Private family foundations

- Museums, animal shelters, and more

Verify a Tax-Exempt Organization (IRS): https://apps.irs.gov/app/eos/

Types of Donations (4 types)

1. Cash Donations

Monetary contributions are the most commonly sought-out form of donation. It can be a one-time gift, or supporters may commit to a recurring monthly, quarterly, or annual donation. For any donation over $250, the receiving organization must provide the donor with a written acknowledgment to submit to the IRS for a tax write-off.[3]

2. In-Kind Donations

In-kind donations are non-monetary contributions gifted to an organization, such as goods or services. Requested donations may include clothes, electronics, appliances, or other items in new or fair condition, depending on the type of organization. Bigger donations in this category may include cars, boats, jewelry, real estate, and other high-value items that the organization can use in its operations, auction off, or liquidate for cash.

A person may donate professional services the organization may otherwise have to pay for, such as web design, accounting, and legal services.

What to Include (4 clauses)

1. Facts and Organization

2. Mission Statement

- What does it do? (primary function); and

- Who does it primarily serve?

If the letter is to request donations for a particular campaign or event, be sure to provide the corresponding details. It’s helpful to inform the potential donor with information about exactly where their contribution will go and how it will be used.

3. Requested Donations

Donations can range from one-time or recurring cash contributions to household items, clothes, and more. Specify the exact types of donations the organization is requesting.It can be helpful to provide an incentive for the potential donor by providing additional information related to tax benefits.

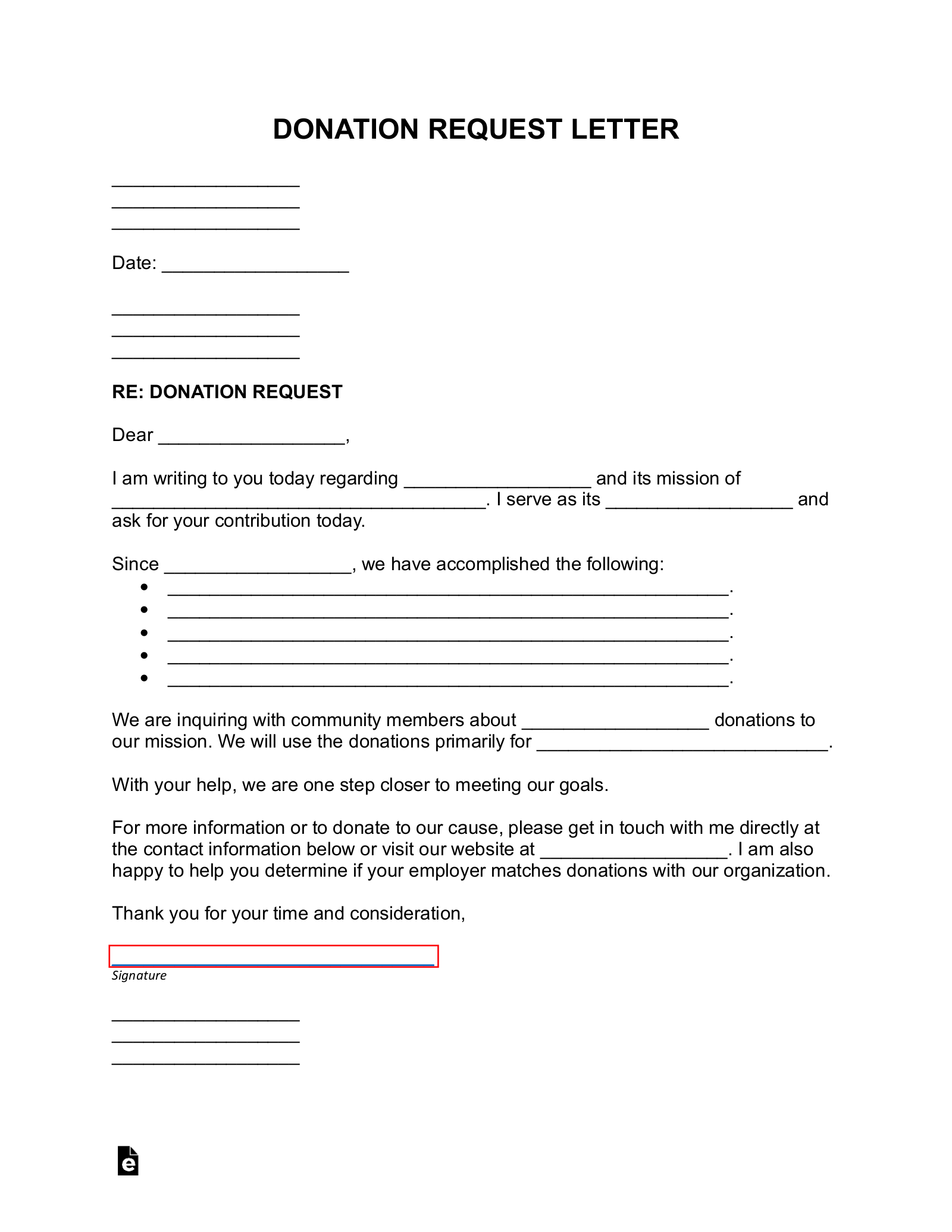

Sample

Download: PDF, MS Word, OpenDocument

DONATION REQUEST LETTER

[SENDER’S NAME]

[SENDER’S STREET ADDRESS]

[SENDER’S CITY, STATE, ZIP CODE]

Date: [DATE]

[RECIPIENT’S NAME]

[RECIPIENT’S STREET ADDRESS]

[RECIPIENT’S CITY, STATE, ZIP CODE]

RE: REQUEST FOR A DONATION

Dear [RECIPIENT’S NAME],

I am writing to you today regarding [ORGANIZATION’S NAME] and its mission of [MISSION STATEMENT]. I serve as its [TITLE/ROLE] and ask for your contribution today.

Since [YEAR], we have accomplished the following:

- [ACCOMPLISHMENT #1]

- [ACCOMPLISHMENT #2]

- [ACCOMPLISHMENT #3]

- [ACCOMPLISHMENT #4]

- [ACCOMPLISHMENT #5]

We are inquiring with community members about [TYPES OF DONATIONS] donations to our mission. We will use the donations primarily for [PRIMARY USE OF DONATIONS].

With your help, we are one step closer to meeting our goals.

For more information or to donate to our cause, please get in touch with me directly at the contact information below or visit our website at [URL]. I am also happy to help you determine if your employer matches donations with our organization.

Thank you for your time and consideration,

_______________________________

Signature

[SENDER’S NAME]

[SENDER’S PHONE NUMBER]

[SENDER’S E-MAIL]